Property Brothers Renovation Costs Realistic

The contractor half of the Property Brothers revealed during a Facebook Live that the duo does indeed foot the bill for their renovation projects including the bad news costs they rack. The Scotts dont necessarily have a fee but youll need a 90000 renovation and design budget to make it on TV.

Property Brothers Home Improvement Live Q A

Property Brothers Home Improvement Live Q A

Can they convince these hesitant homebuyers to take a radical risk.

Property brothers renovation costs realistic. That does not include the cost of the house itself. According to 2019 casting documents HGTV requires P roperty Brothers show prospects to have at least 90000 to spend on a renovation. With a beige sofa few decorations and empty walls the space.

If you want Drew and Jonathan to overhaul your space youll need to apply to an upcoming season of Property Brothers. And can they complete their ambitious project on time and. Those without the sizable 90000 required budget on hand can get the Property Brothers experience via Casaza a shopping platform created by the Scott brothers that they described to Vox as an inspiration hub for people in the home space.

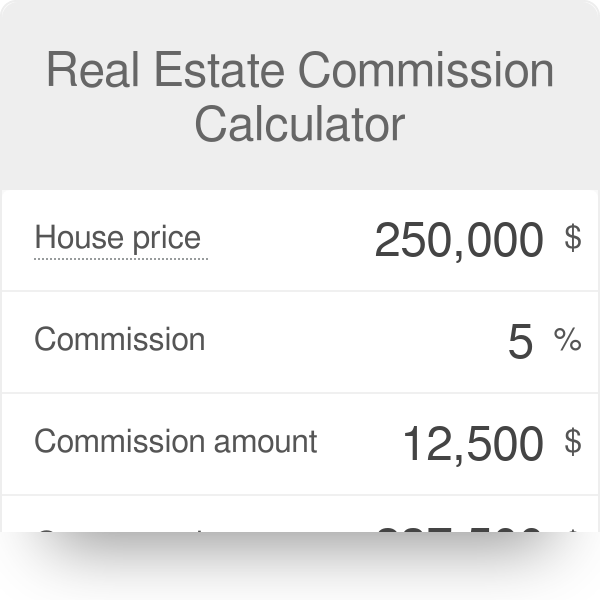

How realistic is a show like Property Brothers in terms of the cost to renovate a home. The professional shows like Property Brothers on HGTV buy the families 20k-25k in furnishings. With more than a dozen seasons under its work belt it.

The brothers love making a living room feel warm and welcoming but in one renovation they left a sitting room feeling a bit stark. Have a renovation and design budget of at least 70000 The budget can vary based on the area Be able to move out of your home for the renovation around six to eight weeks Be prepared for the renovation to start within a specified time frame. How much do Drew and Jonathan charge.

So in other words if the Brothers quote you a 100000 renovation you actually need to put 120000 to the side in case they open a wall and discover there are issues that require more expensive. But on Property Brothers what you see is what you get. So all the expensive fixtures and furniture that give the rooms.

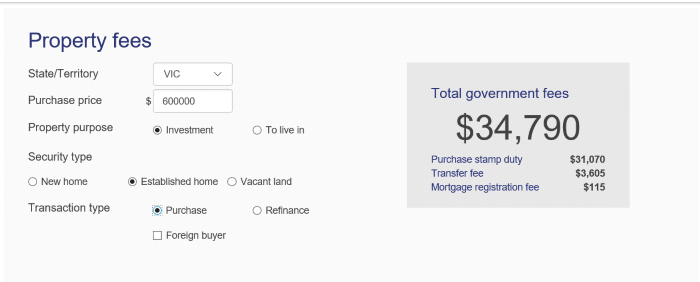

A lawsuit against the owners of the show and the contractors featured in the Property Brothers episode has revealed just how much it costs to get on the show. For the uninitiated Property Brothers features the twin brothers meeting a couple helping them search for and buy a fixer upper then renovate it. According to MSN homebuyers must walk in with at least 65000 for renovations and a 25 contingency fee in case things go wrong.

Be available for around eight days of filming staggered over six to eight weeks. The contractor half of the Property Brothers revealed during a Facebook Live that the duo does indeed foot the bill for their renovation projects including the bad news costs they rack. As Jonathan told the Star Tribune in 2016 their average budget for remodeling three.

The Property Brothers are determined to help couples find buy and transform extreme fixer-uppers into the ultimate forever home and since its hard to see beyond a dated propertys shortcomings theyre using state-of-the-art CGI to reveal their vision of the future. Ive been watching Property Brothers and have noticed that the renovation costs of most properties seem to be significantly less than what youd pay for comparable work within the open market.

Read more »Labels: costs, property, realistic, renovation