Vehicle Property Tax Virginia Calculator

North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred. Given the complexity in determining vehicle registration fees its best to use an online calculator or what some states refer to as a Fee Estimator.

Free Home Mortgage Calculator For Excel Mortgage Payoff Calculator Calculat Mortgage Loan Calculator Mortgage Amortization Calculator Mortgage Amortization

Free Home Mortgage Calculator For Excel Mortgage Payoff Calculator Calculat Mortgage Loan Calculator Mortgage Amortization Calculator Mortgage Amortization

Counties cities school districts and other special tax districts can levy property taxes.

Vehicle property tax virginia calculator. The tax rate is 400 per hundred dollars of the assessed value. If a vehicle has situs for taxation in Loudoun the county computes the tax by dividing the assessment by 100 and multiplying the result by the appropriate tax rate. Virginia Fiduciary and Unified Nonresident Automatic Extension Payment 502ADJ.

Motor Vehicle Sales and Use Tax. So if your car costs you 25000 you multiply that by 3 to get your tax amount of 75000 With this PDF you can determine all the other taxes and fees that you will incur while purchasing your car. Personal Property Tax Relief PPTR Calculator.

Code 581-2402 Virginia levies a 415 Motor Vehicle Sales and Use SUT Tax based on the vehicles gross sales price or 75 whichever is greater. Visit the DMVs website for reporting filing and payment requirements. For the purposes of the Motor Vehicle Sales and Use Tax collection gross sales price includes the dealer processing fee.

Vehicle Tax Rate Vehicle Personal Property Tax The tax rate for most vehicles is 457 per 100 of assessed value. The Department of Motor Vehicles DMV administers the tax effective July 1 2013. The County Boards set tax rate for 2020 the tax rate has been set at 500 per 100 of assessed value.

Not ALL STATES offer a tax and tags calculator. Virginia law makes vehicles with an active Virginia registration taxable in the municipality where the vehicle is registered - even if the vehicle is garaged or parked in another state. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Virginia local counties cities and special taxation districts.

Pass-Through Entity Schedule of Adjustments CU-7 and Instructions. West Virginia Property Tax Rates. Division of Motor Vehicles collects as defined by law on behalf of counties Revenue from the highway-use tax goes to the North.

Assessed value of 19300 19300 x036 69480 for 12 months. Virginia has a 43 statewide sales tax rate but also has 177 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1249 on top of the state tax. The total tax rate for an individual property is the sum of those rates which are expressed as cents per 100 in assessed value.

This means that depending on your location within Virginia the total tax you pay can be significantly higher than the 43 state sales tax. Personal Property Relief Act 1998 PPTRA Under Virginia law the Commonwealth of Virginia subsidizes a percentage of the tax on the first 20000 of assessed value for vehicles. Use this calculator to compute your 2021 personal property tax bill for a qualified vehicle.

Anytime you are shopping around for a new vehicle and are beginning to make a budget its important to. Once you have the tax rate multiply it with the vehicles purchase price. Personal property tax applies to any vehicle normally garaged or parked in Prince William County - even if the vehicle is registered in another state or county.

See below for states that do and dont offer these services In addition CarMax offers a free tax and tag calculator for some states only. The current tax rate for most all vehicles is 420 per 100 of assessed value. This calculator can help you estimate the taxes required when purchasing a new or used vehicle.

Vehicles are also subject to property taxes which the NC. You can do this on your own or use an online tax calculator. The Wholesale Sales Tax is a 21 tax on fuels sold in the Northern Virginia area and the Hampton Roads Planning District Commission area.

Please input the value of the vehicle the number of months that you owned it during the tax year and click the Calculate button to compute the tax. 134 rows Richmond is the capital of Virginia and the place where Virginias property tax laws were. The Commissioner of Revenues Personal Property Tax Division assesses all Arlington vehicle personal property taxes based on.

2000 x 5 100. For properties included in a special subclass the tax rate is. Effective July 1 2016 unless exempted under Va.

Vehicle sales and use tax is 3 of the sale price. For an estimate of the tax on your vehicle contact the Personal Property Division of the Commissioners office. Example of a personal use vehicle with an assessed value of 20000 or less.

Form Instructions for Virginia Consumers Use Tax Return for Individuals Use for purchases ending before July 1 2013 502V. Tax rates in West Virginia apply to assessed value. The assessed value of a vehicle is based on the loan value from the January National Auto Dealers Association NADA book.

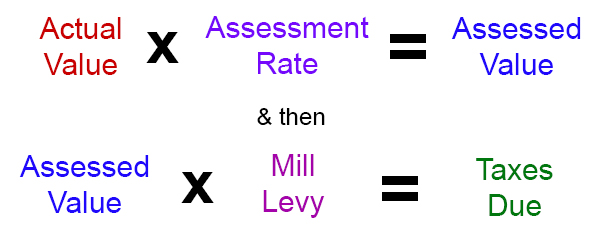

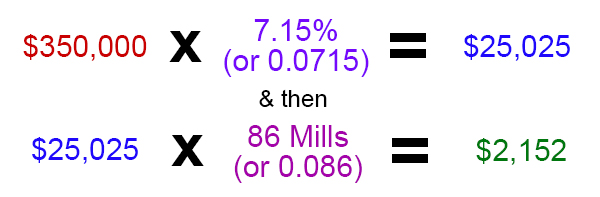

Property Tax Calculation Boulder County

Property Tax Calculation Boulder County

Virginia Property Tax Calculator Smartasset

Virginia Property Tax Calculator Smartasset

Loan Calculator For Personal Loans Personal Loan Payments Calculator Personalloans Debt Personal Loans Loan Calculator Loan

Loan Calculator For Personal Loans Personal Loan Payments Calculator Personalloans Debt Personal Loans Loan Calculator Loan

W2 Forms Google Search Tax Forms W2 Forms Tax Time

W2 Forms Google Search Tax Forms W2 Forms Tax Time

5 Stage Of The Home Buying Process Sell My House Fast We Buy Houses Home Buying Process

5 Stage Of The Home Buying Process Sell My House Fast We Buy Houses Home Buying Process

Home Affordability Calculator How Much House Can You Afford Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Amortization Calculator

Home Affordability Calculator How Much House Can You Afford Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Amortization Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Pin By Amber Decker Udall On Mortgage Infographic How To Raise Money Infographic Layout

Pin By Amber Decker Udall On Mortgage Infographic How To Raise Money Infographic Layout

Handy Home Blog Calculating How Much You Can Afford To Spend On A Mortgage Payment Buying First Home Home Buying Home Buying Tips

Handy Home Blog Calculating How Much You Can Afford To Spend On A Mortgage Payment Buying First Home Home Buying Home Buying Tips

Auto Loan Calculator Brought To You By Iq Wealth Calculators Car Loan Calculator Wealth Calculator Loan Calculator

Auto Loan Calculator Brought To You By Iq Wealth Calculators Car Loan Calculator Wealth Calculator Loan Calculator

2208 E Crestwood Drive Real Estate Real Estate Professionals Real Estate Listings

2208 E Crestwood Drive Real Estate Real Estate Professionals Real Estate Listings

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Mortgage Approval

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Mortgage Approval

Pin By Amber Decker Udall On Mortgage Fha Loans Fha Mortgage Mortgage Loans

Pin By Amber Decker Udall On Mortgage Fha Loans Fha Mortgage Mortgage Loans

Va Loan Pros And Cons Va Mortgage Loans Va Loan Loan Rates

Va Loan Pros And Cons Va Mortgage Loans Va Loan Loan Rates

House For Sale Sign With Calculator On Wood Background For Property Taxes And M Ad Calculator Wood For Sale Sign Typography Poster Design Sale House

House For Sale Sign With Calculator On Wood Background For Property Taxes And M Ad Calculator Wood For Sale Sign Typography Poster Design Sale House

Property Tax Calculation Boulder County

Property Tax Calculation Boulder County

Labels: calculator, vehicle, virginia

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home