Property Tax Calculator Raleigh Nc

Furthermore the typical homeowner in North Carolina pays about 1493 annually in property taxes good for just. The Raleigh sales tax rate is.

5416 Beardall Street Raleigh Nc 27616 Mls 2255187 Huge Master Bedroom Entry Foyer House Styles

5416 Beardall Street Raleigh Nc 27616 Mls 2255187 Huge Master Bedroom Entry Foyer House Styles

The 2016 county tax rate for Wake county was set by July 1 2016 at 615.

Property tax calculator raleigh nc. Wake Countys property tax rate is 534 cents per 100 of assessed. This is the total of state county and city sales tax rates. The countys average effective rate is just 088.

Property that was to be listed as of January 1 2016 would be subject to this tax rate. As a way to measure the quality of schools we analyzed the math and readinglanguage arts proficiencies for every school district in the country. Contact your county tax department for more information.

County Property Tax Rates and Reappraisal Schedules County Property Tax Rates for the Last Five Years County and Municipal Property Tax Rates and Year of Most Recent Reappraisal County and Municipal. Mortgage Calculator Raleigh NC. If you own a home in Wake County North Carolina paying property taxes isnt something you can avoid.

This means property will be appraised at 6150 cents per 100 value. The North Carolina sales tax rate is currently. Many counties in North Carolina collect property taxes at an effective rate taxes paid as a percentage of home value of less than 1 making the state average effective property tax rate 077 which is below the national average.

If you need help or assistance with the purchase process please dont hesitate to reach out to us here at Raleigh Realty. In comparison to other major North Carolina counties the average property tax rates in Wake County are relatively low. This calculator is designed to estimate the county vehicle property tax for your vehicle.

Tax Administration Hours MondayFriday 830 am5. First we used the number of households median home value and average property tax rate to calculate a per capita property tax collected for each county. Overview of Wake County NC Taxes.

How 2021 Sales taxes are calculated in Raleigh. Individual income tax refund inquiries. Multiply the applicable county and municipaldistrict combined tax rate to the county tax appraisal of the property.

2021 Cost of Living Calculator. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and Taxes with details on state and local sales income property and automobile taxes - Includes the cost of Child Care for toddlers or infants at a day. There is no city sale tax for Raleigh.

Learn about listing and appraisal methods appeals and tax relief. The Raleigh North Carolina general sales tax rate is 475The sales tax rate is always 725 Every 2021 combined rates mentioned above are the results of North Carolina state rate 475 the county rate 2 and in some case special rate 05. Fortunately North Carolinas property taxes are generally fairly low.

The County sales tax rate is. A salary of 140000 in Raleigh North Carolina could decrease to 121964 in San Antonio Texas assumptions include Homeowner. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to North Carolina local counties cities and special taxation districts.

Your county vehicle property tax due may be higher or lower depending on other factors. Residents of Wake County have an average effective property tax rate of 088 and the median annual property tax payment is 2327. The act went into full effect in 2014 but before then North Carolina had a three-bracket progressive income tax system with rates ranging from 6 to 775.

Our North Carolina Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in North Carolina and across the entire United States. Search real estate and property tax bills. The minimum combined 2021 sales tax rate for Raleigh North Carolina is.

If youre buying a home youll want to know how much house you can afford. Pay tax bills online file business listings and gross receipts sales. Counties in North Carolina collect an average of 078 of a propertys assesed fair market value as property tax per year.

In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes. The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000. North Carolina has one of the lowest median property tax rates in the United States with only fourteen states collecting a lower median property tax than.

In the city of Raleigh the total rate for 2020 was 03552 which is on top of the county rate of 060. The calculator should not be used to determine your actual tax bill. Use that figure in our example 1500 and multiply it by both Wake Countys property tax rate and Raleighs property tax rate.

Raleigh North Carolina vs San Antonio Texas Change Places. Physical Location 301 S. Our Premium Calculator Includes.

3800 Raleigh NC 27601. Below is our easy to use mortgage calculator that will help you in determining a comfortable price range. Child care and Taxes with details on state and local sales income.

Pin By Richard Callahan Realtor On Raleigh N C Startup Funding Startup Growth Female Entrepreneur

Pin By Richard Callahan Realtor On Raleigh N C Startup Funding Startup Growth Female Entrepreneur

Accounting Audit Business Taxtime Incometaxseason Taxreturn Taxseason Incometaxes Incometax Income Tax Return Tax Extension Income Tax

Accounting Audit Business Taxtime Incometaxseason Taxreturn Taxseason Incometaxes Incometax Income Tax Return Tax Extension Income Tax

Post Office Rd Plan 2020 Post Office Recurring Deposit Post Office Rd Interest Rate 2020 Youtube Post Office How To Plan Educational Videos

Post Office Rd Plan 2020 Post Office Recurring Deposit Post Office Rd Interest Rate 2020 Youtube Post Office How To Plan Educational Videos

Shopping For A Commercial Property This Holiday Season Consult This Handy Calculation To Find Out I Commercial Property How To Find Out Commercial Real Estate

Shopping For A Commercial Property This Holiday Season Consult This Handy Calculation To Find Out I Commercial Property How To Find Out Commercial Real Estate

726 Gaston St Raleigh Nc 2 Baths Real Estate Values Real Estate Sales Sale House

726 Gaston St Raleigh Nc 2 Baths Real Estate Values Real Estate Sales Sale House

Section 179 Write Off Increases For 2018 The Equipnet Blog Tax Deductions Deduction Tax

Section 179 Write Off Increases For 2018 The Equipnet Blog Tax Deductions Deduction Tax

Time Is Almost Up To Apply For 335 Extra Credit Grant For North Carolina Families With Children Abc11 Raleigh Durham

Time Is Almost Up To Apply For 335 Extra Credit Grant For North Carolina Families With Children Abc11 Raleigh Durham

Wake County Nc Property Tax Calculator Smartasset

Wake County Nc Property Tax Calculator Smartasset

We Buy Your House In Raleigh North Carolina Raleigh North Carolina Wake County Raleigh

We Buy Your House In Raleigh North Carolina Raleigh North Carolina Wake County Raleigh

Spotlight Raleigh Nc Think Realty A Real Estate Of Mind

Spotlight Raleigh Nc Think Realty A Real Estate Of Mind

Taxes 646512 1280 Irs Taxes Tax Services Tax Attorney

Taxes 646512 1280 Irs Taxes Tax Services Tax Attorney

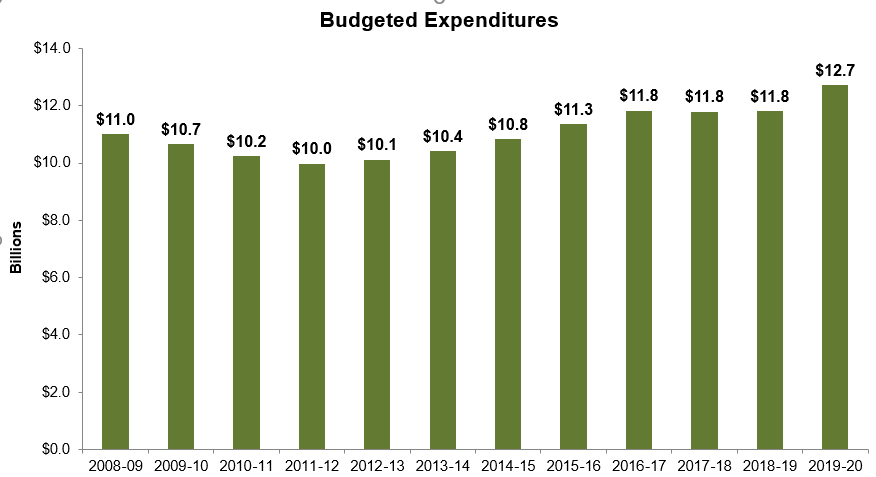

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Active Listing In Macgregor West 975 000 Http 302chalondrive C21 Com Charming Victorian H In 2021 Victorian Homes Century 21 Real Estate North Carolina Homes

Active Listing In Macgregor West 975 000 Http 302chalondrive C21 Com Charming Victorian H In 2021 Victorian Homes Century 21 Real Estate North Carolina Homes

Taxes Wake County Economic Development

Taxes Wake County Economic Development

If You Are Divorced Or Separated There Is A Possible Exception To This Rule May Apply If You Are The Custodial Pa Child Support Laws Child Support Supportive

If You Are Divorced Or Separated There Is A Possible Exception To This Rule May Apply If You Are The Custodial Pa Child Support Laws Child Support Supportive

The Best Worst Metros For Dating 2020 Rentonomics Richmond College Fun Dating Girls

The Best Worst Metros For Dating 2020 Rentonomics Richmond College Fun Dating Girls

Jim Mcalear On Twitter First Time Home Buyers Real Estate Infographic How To Plan

Jim Mcalear On Twitter First Time Home Buyers Real Estate Infographic How To Plan

Labels: calculator, raleigh

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home