Property Tax Calculator East Delhi

Property tax rate is being calculated with the help of a method named annual value method in Delhi. Cell Tower Permission.

How To Calculate Pay Mcd Property Tax In Delhi Online Complete Guide

How To Calculate Pay Mcd Property Tax In Delhi Online Complete Guide

Property tax Annual Value Rate of Tax.

Property tax calculator east delhi. North East South Delhi MCD Property Tax 2020-21 Online Payment at mcdpropertytaxin Delhi property owners are obligate to pay their tax to the Delhi municipality body. Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year. To compute the annual value you may use the following formula.

Here is the formula for the calculation of property tax in Delhi. MCD calculates the property tax in Delhi based on the Unit Area System. In the Unit Area System the Annual Value is calculated by multiplying the Annual Value with the Rate Of Tax Picture Credit.

Calculate Property tax Annual Value of your property in Delhi for the year 2018-19 in just few clicks based on its location year of construction structure type use type occupancy type and its build up area. The MCD offers rebates on some property tax payments. SDMC Property Tax from year 2020-21 and onwards can be filed online through new application from below link.

Portal of Delhi Government is a single window access to information and services being provided by the various department of Govt. The values attached to all these factors can be found at MCDs Multiplicative Factors. Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes.

The Amdavad Municipal Corporation AMC calculates property tax payable on a property based on its capital valueThe formula for manual calculation of property tax is as follows. After this the calculated tax is then payable to one of the three municipal corporations of the Delhi that is North MCD South MCD or East MCD. The municipal corporation of Delhi MCD is responsible for correcting and maintaining the state.

Annual Value Value of the unit area sq. Property or house tax is calculated based on the annual value of a property multiplied with the rate of tax. Delhi Govt Portal Home Taxes Finance.

Property Tax Annual Value. And the notable thing is that the property tax rate on commercial industrial institutional residential property vary. Online Property Tax Municipal Corporation of Delhi.

Annual Value Unit Area Value Age Factor Use Factor Structure Factor Flat factor Occupancy Factor. Delhi Government enables citizens to retrieve Records of Rights RoR by District Subdivision Village Khata Khasra Name More Pay property tax online in North Delhi Municipal Corporation Delhi. Property Tax Annual Value Rate of Tax.

Municipal Corporation Of Delhi How to pay property tax online. Computing the MCD property tax Formula The Property tax can be computed as Annual Value Tax Rate. Net property tax Rs 3600.

You can pay your property taxes online as Delhi municipality is one of the very few in the country that allows this facility. Property Tax ChequesDDsPOs must in favour of Commissioner East Delhi Municipal Corporation for properties falling under East Delhi Municipal Corporation Employee Email Login MCD Employee Email Logingovin Swachh Bharat Mission SBM School Information. Metre total property area age of the property usage type of the property structure of the property Occupancy type Flat aspect.

For Category A 12 tax on residential property 20 for commercial and 15 for industrial property. Rebates on property tax in Delhi. The Unit Area System of property tax calculation takes into account multiple factors like built-up area age and location of the property as well as the type of property commercialresidential.

SBR_3188_27_06_2020httpsyoutubehRgNiN2hP0U 13 MinutesPayment of Property Tax FY 2020-21 Tax Calculation - North Delhi East Delhi South Delhi. Property tax Annual Value Rate of Tax. Property Tax Calculator Delhi.

Property Tax from year 2020-21 and onwards can be filed online through new application from below link. The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. Where Annual Value Unit Area Value Age Factor Use Factor Structure Factor Flat factor Occupancy Factor.

After this the calculated tax is then payable to one of the three municipal corporations of the Delhi that is North MCD South MCD or East MCD. Property tax Area x Rate x f1 x f2 x f3 x f4 x fn. Property tax rate is being calculated with the help of a method named annual value method in Delhi.

Property tax Annual value x Rate of tax as mentioned above in category B tax rate 30000 x 12 Rs 3600.

Mcd Property Tax Payment Online Mcd Property Tax Delhi 2019 20

Mcd Property Tax Payment Online Mcd Property Tax Delhi 2019 20

Property Tax Online In Delhi Step By Step Guide

Property Tax Online In Delhi Step By Step Guide

Property Tax Payment In Delhi Some Simple And Helpful Steps

Property Tax Payment In Delhi Some Simple And Helpful Steps

Property Tax Payment In Delhi Some Simple And Helpful Steps

Property Tax Payment In Delhi Some Simple And Helpful Steps

Property Tax Online In Delhi Step By Step Guide

Property Tax Online In Delhi Step By Step Guide

Filling Mcd Property Tax Online

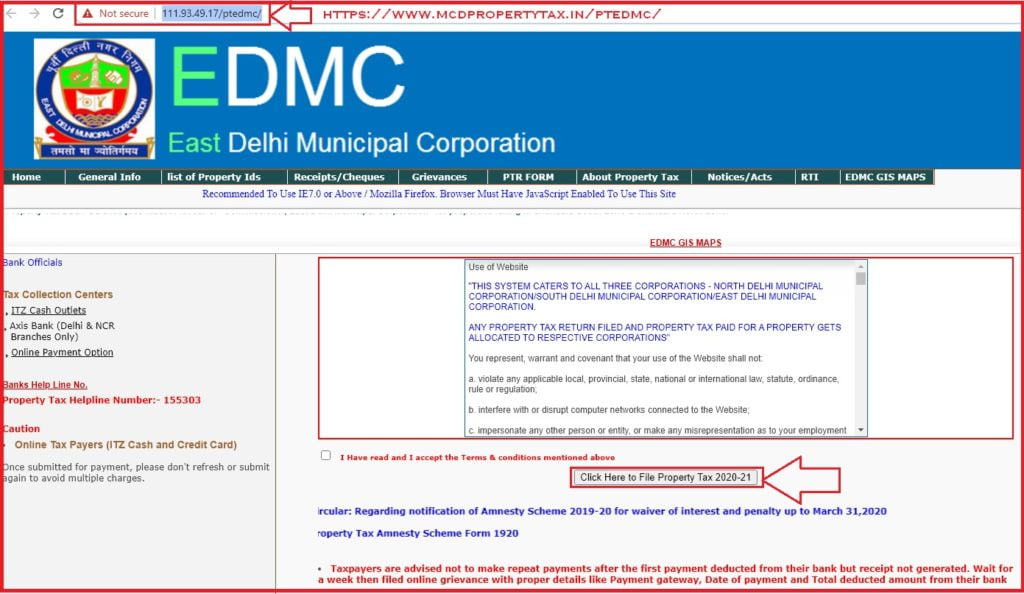

Edmc Property Tax Online Payment 2021 At Mcdpropertytax In Ptedmc

Edmc Property Tax Online Payment 2021 At Mcdpropertytax In Ptedmc

How To Calculate Pay Mcd Property Tax In Delhi Online Complete Guide

How To Calculate Pay Mcd Property Tax In Delhi Online Complete Guide

How To Calculate Pay Mcd Property Tax In Delhi Online Complete Guide

How To Calculate Pay Mcd Property Tax In Delhi Online Complete Guide

Filling Mcd Property Tax Online

How To Calculate Pay Mcd Property Tax In Delhi Online Complete Guide

How To Calculate Pay Mcd Property Tax In Delhi Online Complete Guide

How To Calculate And Pay Commercial Property Tax For Delhi Ncr Properties Zricks Com

How To Calculate And Pay Commercial Property Tax For Delhi Ncr Properties Zricks Com

How To Calculate Pay Mcd Property Tax In Delhi Online Complete Guide

How To Calculate Pay Mcd Property Tax In Delhi Online Complete Guide

Property Tax Payment In Delhi Some Simple And Helpful Steps

Property Tax Payment In Delhi Some Simple And Helpful Steps

Filling Mcd Property Tax Online

Property Tax Online In Delhi Step By Step Guide

Property Tax Online In Delhi Step By Step Guide

Mcd Property Tax Online Payment In Delhi Hindi Youtube

Mcd Property Tax Online Payment In Delhi Hindi Youtube

Property Tax Online In Delhi Step By Step Guide

Property Tax Online In Delhi Step By Step Guide

Property Tax Calculation Unit Area System Hindi Youtube

Property Tax Calculation Unit Area System Hindi Youtube

Labels: calculator, delhi, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home