Manitoba Education Property Tax Credit (rent Paid)

Under the Review tab if the following Warning appears. On your income taxes you can claim the Manitoba Education Property Tax Credit Rent Paid credit.

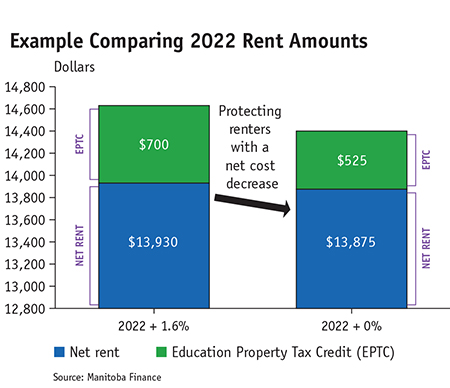

Education Property Tax Credit Whether you own or rent your home you could be eligible to save up to 700 with the Manitoba governments Education Property Tax Credit EPTC.

Manitoba education property tax credit (rent paid). There you can select Education Property Tax Credit Rent Paid or Property Taxes Paid. This bulletin provides information on what the Department of Finance will accept as eligible rental payments for purposes of the Education Property Tax Credit. The Credit is equal to the lesser of a 700 or b 20 of total rental payments paid in the year exceeding 250.

You paid rent or property tax on your home in Manitoba during the year. Seniors Education Property Tax Credit. For the education property tax credit a principal residence is a residential dwelling unit located in Manitoba that you or you and your spouse or common-law partner either owned or rented and usually lived in during 2020.

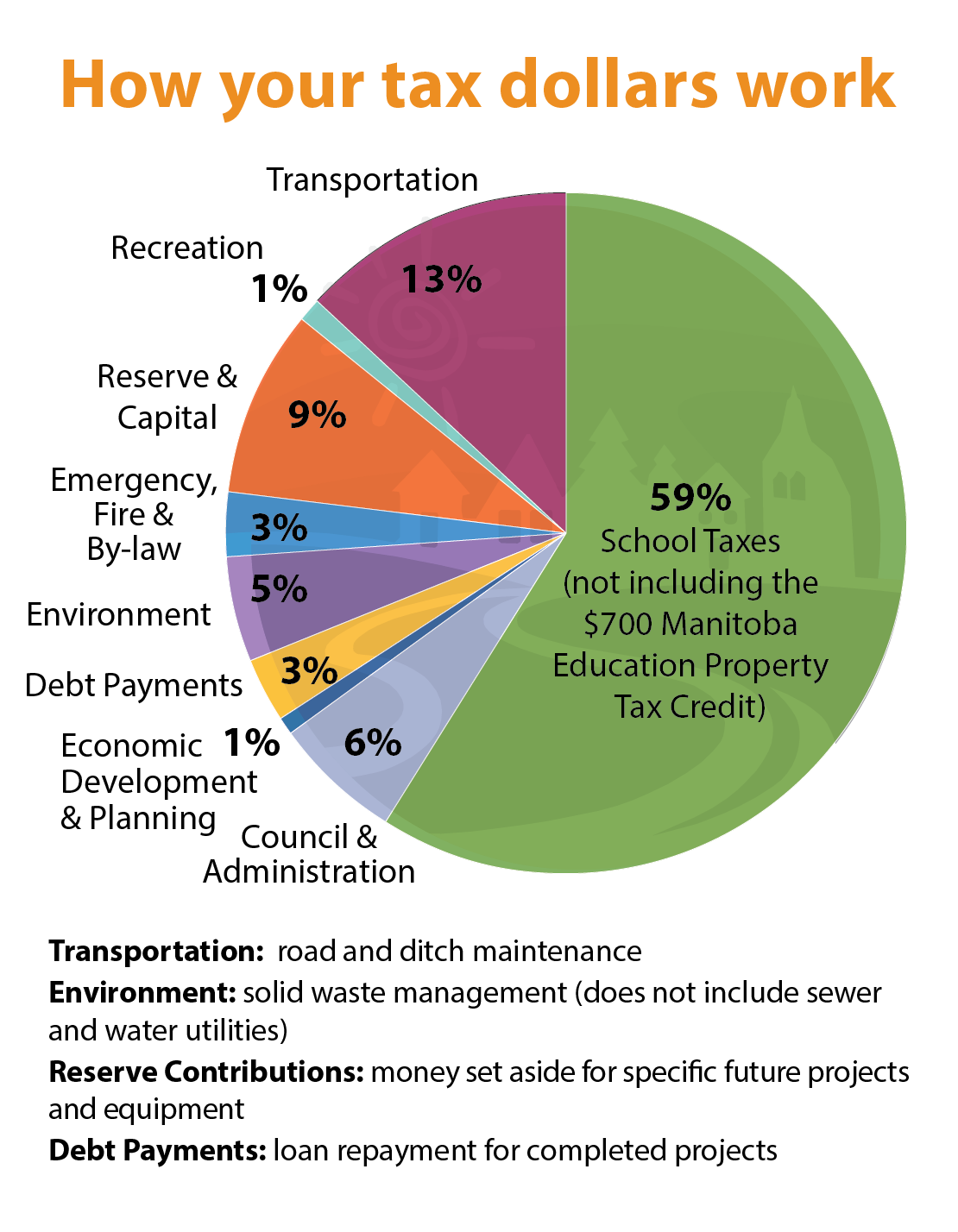

Up to 400 Minus 10 of family net income. Manitoba Education Property Tax Credit As a Manitoba resident part of your rent or property tax is put towards funding schools. CRA Information for Residents of Manitoba.

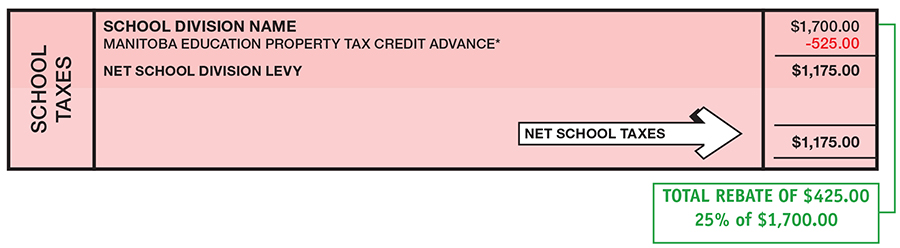

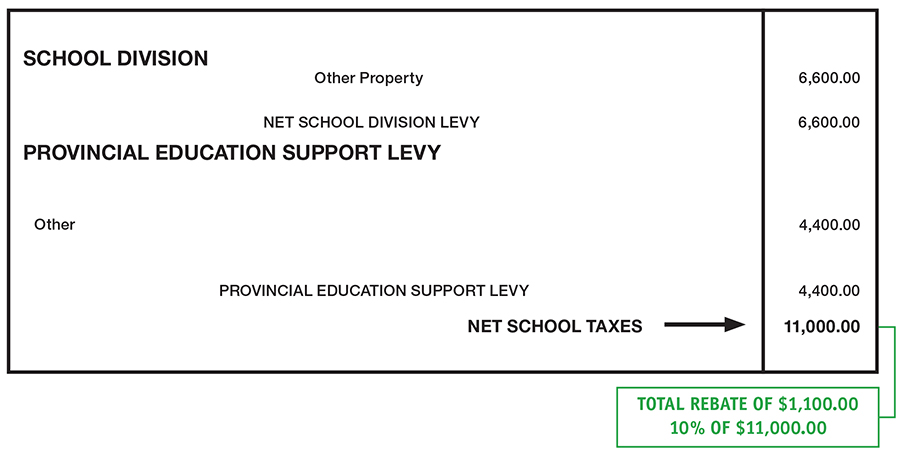

Manitobas Education Property Tax Credit. The credit is provided by the province of Manitoba to help cover the school taxes you pay or a portion of your rent either directly on your municipal property tax statement or through your income tax return. With the Manitoba education property tax credit EPTC you might be able to claim up to 700 either on your municipal property tax statement or through your income tax return for your contribution to the school system.

Up to 353 Minus 15 on family net income over 40000. Education Property Tax Credit and Advance. Seniors School Tax Rebate.

You paid more than 250 in property taxes or rent. Manitoba Education Property Tax Credit. If you rent you can claim 20 of your rent over 250 up to a maximum of 700.

You can only claim an education property tax credit on. For more information on Manitobas Education Property Tax Credit see the following links. The Education Property Tax Credit EPTC is a Provincial Tax Credit for homeowners and tenants to offset the occupancy costs of property tax for homeowners and 20 of rent for tenants - payable in Manitoba.

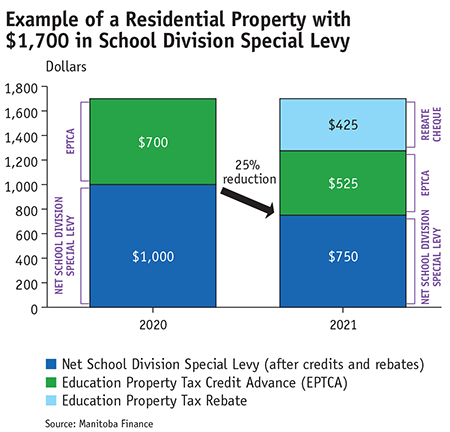

The Education Property Tax Credit Advance is where the EPTC is applied directly to the municipal property tax statement for homeowners. Province of Manitoba Personal Tax Credits. You were at least 16 years old at the end of the year.

If youre a homeowner you need to pay the first 250 of property taxes. With the Manitoba education property tax credit EPTC you might be able to claim up to 700 either on your municipal property tax statement or through your income tax return for your contribution to the school system. Anything higher is eligible for the credit up to a maximum of 700.

Otherwise you cannot currently NETFILE your return. Residential tenants are eligible to claim the Manitoba Education Property Tax Credit through the income tax return. The Education Property Tax Credit is a credit for homeowners and tenants offsetting occupancy costs - property tax for homeowners and 20 of rent for tenants payable in Manitoba.

Learn more on how to claim. Up to 300 Minus 075 of family net income. This credit is available to renters or homeowners who were resident in Manitoba and age 16 or older on December 31 of the tax year.

The education property tax credit is a refundable tax credit which is claimed on form MB479 of the personal tax return. Renters and homeowners may qualify for a maximum of 700 in tax savings under this credit intended to offset property taxes. Up to 470 Minus 20 on family net income over 40000.

Education Property Tax Credit Whether you own or rent your home you could be eligible to save up to 700 with the Manitoba governments Education Property Tax Credit EPTC. The credit can only be claimed once per dwelling. Under the Provincial tab select Provincial Tax Credit Profile.

You entered an amount for either rent paid or property tax paid but did not make an entry for the Manitoba education property tax credit received you must enter a value on the first line of the Manitoba property and school tax credit for tenantsowners page. Manitoba Education Property Tax Credit As a Manitoba resident part of your rent or property tax is put towards funding schools. Residents of Manitoba who pay rent may be able to receive a credit of up to 20 of rent payments or 700 whichever is less.

The Advance is the Education Property Tax Credit applied directly.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home