What Is The Manitoba Education Property Tax Credit

This is the first time there seems to be a glitch with the School Tax Credit. Learn more on how to claim this provincial credit on your taxes in this CRA link.

700 Hit To Homeowners Winnipeg Free Press

700 Hit To Homeowners Winnipeg Free Press

Manitoba Education Property tax credit advance received refers to any amount already deducted from your property tax statement or received by you after you applied for it.

What is the manitoba education property tax credit. Up to 353 Minus 15 on family net income over 40000. Up to 400 Minus 10 of family net income. I entered the total Manitoba Property Taxes in the ReceiptsProperty screen.

Education Property Tax Credit and Advance. With the Manitoba education property tax credit EPTC you might be able to claim up to 700 either on your municipal property tax statement or through your income tax return for your contribution to the school system. The Education Property Tax Credit Advance can.

With the Manitoba education property tax credit EPTC you might be able to claim up to 700 either on your municipal property tax statement or through your income tax return for your contribution to the school system. Primary Caregiver Tax Credit. Manitoba Education Property Tax Credit As a Manitoba resident part of your rent or property tax is put towards funding schools.

Renters and homeowners may qualify for a maximum of 700 in tax savings under this credit intended to offset property taxes. This credit is available to renters or homeowners who were resident in Manitoba and age 16 or older on December 31 of the tax year. Manitoba Education Property Tax Credit As a Manitoba resident part of your rent or property tax is put towards funding schools.

You can claim this credit if you were a resident of Manitoba at. Who can claim the credit and how do you claim it. Education Property Tax Credit Whether you own or rent your home you could be eligible to save up to 700 with the Manitoba governments Education Property Tax Credit EPTC.

Claims for most Manitoba credit amounts must be made within three years of the end of the tax year they relate to. This credit is meant to give Manitobans a bit of a break on their taxes. Manitoba Education Property Tax Credit.

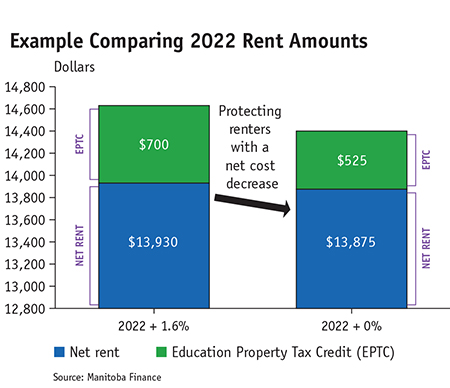

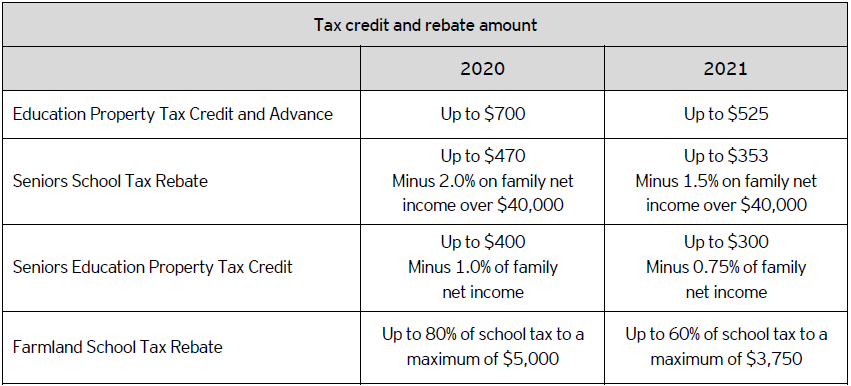

2 days agoThe rebate will also mean a proportionate 25 per cent cut in Manitobas existing school tax offsets in 2021 and that includes the current farmland school tax rebate as well as the education property tax credit and advance seniors school tax rebate and seniors education property tax credit. As a Manitoba resident part of your rent or property tax is put towards funding schools. The Credit is equal to the lesser of a 700 or b 20 of total rental payments paid in the year exceeding 250.

Up to 300 Minus 075 of family net income. This bulletin provides information on what the Department of Finance will accept as eligible rental payments for purposes of the Education Property Tax Credit. The Advance is the Education Property Tax Credit applied directly.

Manitoba Education Property Tax Credit. Did you receive Manitoba Education Property Tax Credit. The education property tax credit is a refundable tax credit which is claimed on form MB479 of the personal tax return.

So you dont need to calculate it you just need to check your property tax statement or any notice sent if you received an amount separately. When it comes to entering the Resident Homeowner tax assistance received. The Education Property Tax Credit EPTC is a Provincial Tax Credit for homeowners and tenants to offset the occupancy costs of property tax for homeowners and 20 of rent for tenants - payable in Manitoba.

In the past Hutchings would pay roughly 250 each year in municipal and school taxes after the 700 education property tax credit was applied. Manitobans who act as the primary caregiver for a family member. I have been using Turbo Tax for many years.

The Manitoba Education Property Tax Credit is designed to cover school taxes or a portion of your rent either on your municipal property tax statement or through your income tax return. The Education Property Tax Credit is a credit for homeowners and tenants offsetting occupancy costs - property tax for homeowners and 20 of rent for tenants payable in Manitoba. The Seniors Education Property Tax Credit would also.

The credit is provided by the province of Manitoba to help cover the school taxes you pay or a portion of your rent either directly on your municipal property tax statement or through your income tax return. Residential tenants are eligible to claim the Manitoba Education Property Tax Credit through the income tax return. Up to 470 Minus 20 on family net income over 40000.

With the Manitoba education property tax credit EPTC you might be able to claim up to 700 either on your municipal property tax statement or through your income tax return for your contribution to the school system. Seniors School Tax Rebate. The Education Property Tax Credit Advance is where the EPTC is applied directly to the municipal property tax statement for homeowners.

Seniors Education Property Tax Credit. Education Property Tax Credit Whether you own or rent your home you could be eligible to save up to 700 with the Manitoba governments Education Property Tax Credit EPTC. Education Property Tax Credit Budget 2018 announced that effective for 2019 the calculation of the Manitoba Education Property Tax Credit will be based on school taxes and the 250 deductible will be eliminated.

The credit previously covered all. Even if you do not have to pay tax you may be entitled to the primary caregiver tax credit the personal tax credit the education property tax credit the seniors school tax rebate and the school tax credit for homeowners. The credit can only be claimed once per dwelling.

Read more »