Wisconsin Property Tax For Disabled Veterans

Those rated 10 percent disabled will receive at least 14005 a month depending on their marital and dependent status while 100 percent disabled veterans get. Property Tax Credit Veteran Employment Benefits.

Local Military Veterans Discounts Military Benefits

Local Military Veterans Discounts Military Benefits

34 rows A disabled veteran or their surviving spouse in Wisconsin may receive a property tax credit.

Wisconsin property tax for disabled veterans. Eligible Veteran means a veteran who is verified by the Wisconsin Department of Veterans Affairs as meeting all of the following conditions. The credit is claimed on the Wisconsin income tax return. The Wisconsin Department of Veterans Affairs verifies the Veterans eligibility for the program.

You claimed the veterans and surviving spouses property tax credit of 3000 which was refunded to you when you filed your Wisconsin income tax return in 2021. Wisconsin Veterans and Surviving Spouses Property Tax Credit. The Wisconsin Property Tax Credit is extended to include the unremarried surviving spouse of an eligible veteran who following the veterans death began to receive and continues to receive Dependency and Indemnity Compensation DIC from the Federal VA.

Hunting Fishing Licenses for Wisconsin Veterans Wisconsin disabled veterans with a combined service-connected disability rating by the US. 1 the Wisconsin Disabled Veterans and Unremarried Surviving Spouses Property Tax Credit program provides a refundable property tax credit for the primary residence instate and up to one acre of land via the state income tax form for eligible veterans as certified by the Wisconsin Department of Veterans Affairs. VA-rated 100 disabled veterans or their surviving spouses in the State of Wisconsin may qualify for property tax credits on a primary residence.

Military service that limits or impairs the ability to walk. Effective for taxable years beginning on or after January 1 2014. The State of Wisconsin offers a property tax credit to qualifying veterans and un-remarried surviving military spouses for primary residences and up to an acre of land.

Added to the SCD due to individual unemployability such that the VA rates the veteran 100 disabled. The Wisconsin Property Tax Credit is extended to include the unremarried surviving spouse of an eligible veteran who. Disabled person must provide written acknowledgment by Social Security or Veterans Administration or Proof of Disability Affidavit.

Cannot walk 200 feet or more without stopping to rest. Completion of Application for Senior Citizen and Disabled Persons Exemption from Real Property Taxes. The Wisconsin Veterans Surviving Spouses Property Tax Credit gives eligible veterans and unremarried surviving spouses a property tax credit for their primary residence.

Veterans and Surviving Spouses Property Tax Credit program provides a refundable property tax credit for the primary residence instate via the state income tax form for eligible veterans as certified by the Wisconsin Department of Veterans Affairs. Your total itemized deductions were 14100. Qualifying veterans must be a Wisconsin resident for five consecutive years after entering military service Active Duty or who was a Wisconsin resident upon entering military service.

Effective for taxable years beginning on or after January 1 2014. The Wisconsin Veterans and Surviving Spouses Property Tax Credit provides eligible Veterans and un-remarried Surviving Spouses a refundable property tax credit for their primary in-state residence and up to one acre of land. Eligible Veteran means a veteran.

For example a veteran with an. You deducted the 3000 as a federal itemized deduction on your 2020 federal Schedule A. Under the proposal if a veteran is 70 disabled or more the tax credit that veteran can claim is equal to his or her disability percentage.

The veterans and surviving spouses property tax credit is a credit equal to the amount of property taxes paid during the year on an eligible veterans or surviving spouses principal dwelling. Department of Veterans Affairs VA of 70 or greater are eligible for a disabled veteran. Disabled veteran parking license plates are available to any Wisconsin motorist who is a veteran with a permanent disability incurred while in active US.

Renewal required at least once every six. By legal definition this includes any person who. The veteran must have been a state resident upon entry into military service or for a five-year period after beginning military service.

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

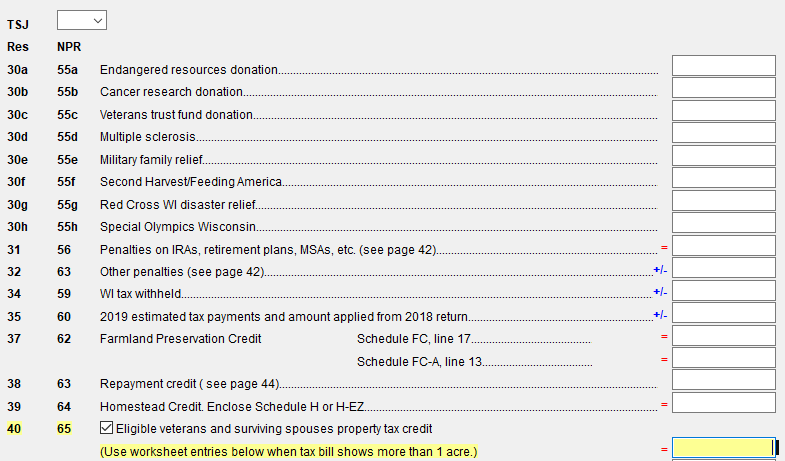

Wi Veterans And Surviving Spouses Credit

Wi Veterans And Surviving Spouses Credit

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

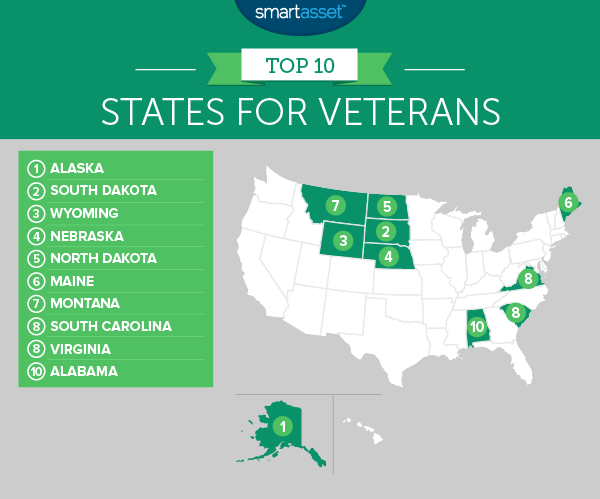

The Best States For Veterans Smartasset

The Best States For Veterans Smartasset

Did You Know You Can Use Your Tax Refund To Purchase A Home Realize The Dream Of Homeownership With Unmb Home Ownership Home Financing Tax Refund

Did You Know You Can Use Your Tax Refund To Purchase A Home Realize The Dream Of Homeownership With Unmb Home Ownership Home Financing Tax Refund

Wisconsin Offers More Veteran Benefits Than Any Other State Think Make Happen In Wisconsin

Wisconsin Offers More Veteran Benefits Than Any Other State Think Make Happen In Wisconsin

The Colorado Housing Finance Authority Chfa Provides Access To Affordable Homes For Those With Qualifying Military S Home Loans 30 Year Mortgage Fha Mortgage

The Colorado Housing Finance Authority Chfa Provides Access To Affordable Homes For Those With Qualifying Military S Home Loans 30 Year Mortgage Fha Mortgage

Hidden Secrets Of The Va S Vocational Rehabilitation Program Rehabilitation The Secret Hide

Hidden Secrets Of The Va S Vocational Rehabilitation Program Rehabilitation The Secret Hide

Veterans Property Tax Exemption By State Pro Tips

Veterans Property Tax Exemption By State Pro Tips

Va Identification Cards Portage County Wi

Fair Housing Month Michigan Gov Real Estate Professionals Private Lender

Fair Housing Month Michigan Gov Real Estate Professionals Private Lender

Should You Hire A Attorney To File A Va Disability Claim Attorneys Va Disability Estate Planning

Should You Hire A Attorney To File A Va Disability Claim Attorneys Va Disability Estate Planning

Va Benefits For Spouses Of Disabled Veterans Cck Law

Va Benefits For Spouses Of Disabled Veterans Cck Law

Should You Hire A Veteran S Attorney For Filing A Va Disability Claim Va Disability Attorneys Disability

Should You Hire A Veteran S Attorney For Filing A Va Disability Claim Va Disability Attorneys Disability

Experienced Attorneys Who Care About Your Case Estate Lawyer Attorneys Estate Planning Attorney

Experienced Attorneys Who Care About Your Case Estate Lawyer Attorneys Estate Planning Attorney

Veteran Disability Exemptions By State Va Hlc

Veteran Disability Exemptions By State Va Hlc

How Many Real Vietnam Vets Are Alive Today Vietnam Vets Vietnam Vietnam War Photos

How Many Real Vietnam Vets Are Alive Today Vietnam Vets Vietnam Vietnam War Photos

Long Term Care Benefits For Veterans And Surviving Spouses

Long Term Care Benefits For Veterans And Surviving Spouses

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home