Disabled Property Tax Exemption New York

The Disabled Homeowners Exemption DHE provides a reduction of 5 to 50 on New York Citys real property tax to low-income homeowners with disabilities. An applicant must have a physical or mental impairment not due to current use of alcohol or illegal drug use that substantially limits that persons ability to engage in one or more major life activities such as.

Https Www Nassaucountyny Gov Documentcenter View 16287

14400 for Classes 2 and 4.

Disabled property tax exemption new york. Maximum of 1920 for Class 1. It does not apply to special district taxes. DHE reduces property tax between five and fifty percent.

The City of New York offers tax exemptions and abatements for seniors veterans clergy members people with disabilities and other homeowners. You can request to have the following exemptions removed due to changes in primary residence or the death of a property owner. Maximum of 2880 for Class 1.

Local governments and school districts in New York State can opt to grant a reduction on the amount of property taxes paid by qualifying persons with disabilities. Served in a combat zone Additional 10. STAR Basic or Enhanced Veterans DisabledSenior Citizen Homeowners Exemption DHE or SCHE Crime VictimGood Samaritan CondoCooperative Abatement or Clergy.

There are three different property tax exemptions available to Veterans who have served in the United States Armed Forces. If you are married the income of your spouse must be included in the total unless your spouse is absent from the residence due to a legal separation or abandonment. Documents on this page are provided in pdf format.

People with disabilities who own one to three homes condos or coop apartments can get property tax on their primary residence lowered through DHE. Reduction of propertys assessed value. You cannot receive the exemption for persons with disabilities if the income of the owner or the combined income of all the owners exceeds the maximum income limit set by the locality.

Veterans can receive one of the three following exemptions. Some properties such as those owned by religious organizations or governments are completely exempt from paying property taxes. Apply online by March 15th for benefits to begin on July 1.

These benefits can lower your property tax bill. Tax Breaks for People Who Are Totally Disabled New York State residents can take advantage of the State School Tax Relief Program or STAR homestead property exemption to lower the amount of. New York Property Tax Exemptions New York veterans may be eligible for one of three property tax exemptions for a veteran-owned primary residence.

The exemption is equal to 15 of your assessment for service during wartime and an additional 10 for service in a combat area or for having received an Expeditionary Medal. Whichever exemption you choose it will apply only to county city town and village taxes. Thanks to changes in city and state law the DHE and SCHE Senior Citizen Homeowners Exemption tax breaks are now available to homeowners with a combined annual income of 58399 or less.

21600 for Classes 2 and 4. Others are partially exempt such as veterans who qualify for an exemption on part of their homes and homeowners who are eligible for the School Tax Relief. Exemption for Persons with Disabilities - Disability requirements.

The property tax reduction depends on how much the family earns. Though all property is assessed not all of it is taxable. Disabled Homeowners Exemption DHE A property tax break for disabled New Yorkers who own one- two- or three-family homes condominiums or cooperative apartments.

To be eligible for DHE you must have a disability earn no more than 58399 for the last calendar. Maximum exemption amount by tax class. Caring for ones self.

Served during a specified period of conflict listed above 15. See Publication 1093 Veterans Exemption Questions Answers Partial Exemption from Property Taxes in New York State for more information. Most of the exemptions are not specifically aimed at disabled veterans but additional discounts or considerations apply for those with VA-rated disabilities.

Exemptions may apply to school district taxes. To qualify persons with disabilities generally must have certain documented evidence of their disability and meet certain income limitations and other requirements. Eligible applicants will receive an exemption from county and town taxes but not from special district or school taxes.

The exemption applies to county city town and village taxes.

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

Https Keeganlaw Us Wp Content Uploads 2013 02 Property Tax Exemptions Pdf

Https Www Lockportny Gov Wp Content Uploads 2018 06 Exemptions 6518 Pdf

New York The Official Army Benefits Website

New York The Official Army Benefits Website

Https Keeganlaw Us Wp Content Uploads 2013 02 Property Tax Exemptions Pdf

Https Www Nassaucountyny Gov Documentcenter View 11881

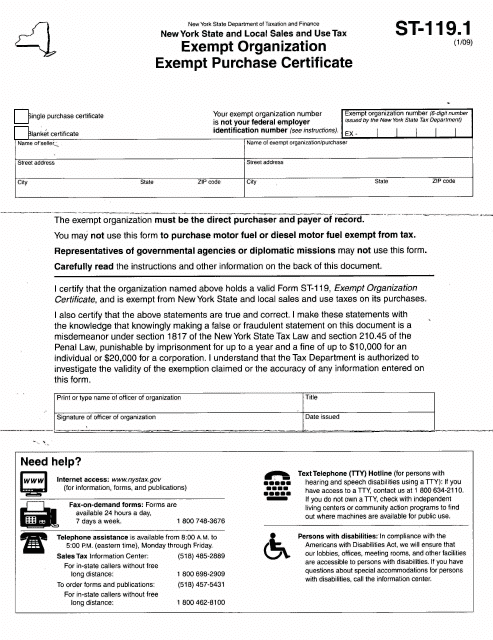

Form St 119 1 Download Fillable Pdf Or Fill Online New York State And Local Sales And Use Tax Exempt Organization Exempt Purchase Certificate New York Templateroller

Form St 119 1 Download Fillable Pdf Or Fill Online New York State And Local Sales And Use Tax Exempt Organization Exempt Purchase Certificate New York Templateroller

Https Www Brookhavenny Gov Documentcenter View 15370 Rp 467 Partial 2021 22

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem Real Estate New Homeowner Estate Tax

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem Real Estate New Homeowner Estate Tax

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Property Tax Exemption Who Is Exempt From Paying Property Taxes

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Disabled Homeowners Exemption Dhe

Disabled Homeowners Exemption Dhe

Https Keeganlaw Us Wp Content Uploads 2013 02 Property Tax Exemptions Pdf

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Exemptions Columbia County Real Property Tax

Exemptions Columbia County Real Property Tax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home