Wisconsin Property Tax Disabled Veterans

The Wisconsin Veterans and Surviving Spouses Property Tax Credit provides eligible Veterans and un-remarried Surviving Spouses a. VA-rated 100 disabled veterans or their surviving spouses in the State of Wisconsin may qualify for property tax credits on a primary residence.

Experienced Attorneys Who Care About Your Case Estate Lawyer Attorneys Estate Planning Attorney

Experienced Attorneys Who Care About Your Case Estate Lawyer Attorneys Estate Planning Attorney

Added to the SCD due to individual unemployability such that the VA rates the veteran 100 disabled.

Wisconsin property tax disabled veterans. The exemption amount varies. Wisconsin Property Tax Credit certification that shows the veterans combined schedular rating of 100. Veterans with 70 or greater service-.

The Wisconsin Property Tax Credit is extended to include the unremarried surviving spouse of an eligible veteran who. PROPERTY TAX CREDIT - Wisconsin Veterans and Surviving Spouses The Racine County Treasurer would like to remind qualified disabled veterans and surviving spouses about the recent expansion of the refundable property tax credit via the State Income Tax form. A disabled veteran in Wisconsin may receive a property tax exemption on hisher primary residence if the veteran is 100 percent disabled as a result of service.

Before claiming the credit the veteran or surviving spouse must obtain verification of his or her eligibility for the credit from the Wisconsin Department of. The veterans and surviving spouses property tax credit is a credit equal to the amount of property taxes paid during the year on an eligible veterans or surviving spouses principal dwelling. The Wisconsin Property Tax Credit is extended to include the unremarried surviving spouse of an eligible veteran who following the veterans death began to receive and continues to receive Dependency and Indemnity Compensation DIC from the Federal VA.

This benefit is given in recognition of veterans sacrifices for our country. Surviving spouses of qualifying veterans and service members while serving qualifying Primary Family Caregivers of permanently and totally disabled veterans Up to 150000 of market value is excluded from property taxes for. The credit is claimed on the Wisconsin income tax return.

Your total itemized deductions were 14100. Wisconsin Veterans and Surviving Spouses Property Tax Credit. 34 rows A disabled veteran or their surviving spouse in Wisconsin may receive a property tax.

The veteran must have been a state resident upon entry into military service or for. CODES Just Now Wisconsin Property Tax Exemption. The Wisconsin Veterans Surviving Spouses Property Tax Credit gives eligible veterans and unremarried surviving spouses a property tax credit for their primary residence.

You deducted the 3000 as a federal itemized deduction on your 2020 federal Schedule A. Under the proposal if a veteran is 70 disabled or more the tax credit that veteran can claim is equal to his or her disability percentage. For example a veteran with.

You claimed the veterans and surviving spouses property tax credit of 3000 which was refunded to you when you filed your Wisconsin income tax return in 2021. O A federal VA basic service-connected disability rating notification letter that shows the veterans combined schedular rating of 100 for the first year the property tax credit will be claimed AND in each year in which credit is claimed. Effective for taxable years beginning on or after January 1 2014.

Effective for taxable years beginning on or after January 1 2014. Disabled Veterans Property Tax Exemptions by State. VA-rated 100 disabled veterans or their surviving spouses in the State of Wisconsin may qualify for property tax credits on a primary residence.

Those rated 10 percent disabled will receive at least 14005 a month depending on their marital and dependent status while 100 percent disabled veterans get up to 305713 monthly if. The veteran must have been a state resident upon entry into military service or for a five-year period after beginning military service.

Long Term Care Benefits For Veterans And Surviving Spouses

Long Term Care Benefits For Veterans And Surviving Spouses

How Many Real Vietnam Vets Are Alive Today Vietnam Vets Vietnam Vietnam War Photos

How Many Real Vietnam Vets Are Alive Today Vietnam Vets Vietnam Vietnam War Photos

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

Va Benefits For Spouses Of Disabled Veterans Cck Law

Va Benefits For Spouses Of Disabled Veterans Cck Law

Should You Hire A Attorney To File A Va Disability Claim Attorneys Va Disability Estate Planning

Should You Hire A Attorney To File A Va Disability Claim Attorneys Va Disability Estate Planning

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Fair Housing Month Michigan Gov Real Estate Professionals Private Lender

Fair Housing Month Michigan Gov Real Estate Professionals Private Lender

Did You Know You Can Use Your Tax Refund To Purchase A Home Realize The Dream Of Homeownership With Unmb Home Ownership Home Financing Tax Refund

Did You Know You Can Use Your Tax Refund To Purchase A Home Realize The Dream Of Homeownership With Unmb Home Ownership Home Financing Tax Refund

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Should You Hire A Veteran S Attorney For Filing A Va Disability Claim Va Disability Attorneys Disability

Should You Hire A Veteran S Attorney For Filing A Va Disability Claim Va Disability Attorneys Disability

Wisconsin Offers More Veteran Benefits Than Any Other State Think Make Happen In Wisconsin

Wisconsin Offers More Veteran Benefits Than Any Other State Think Make Happen In Wisconsin

Hidden Secrets Of The Va S Vocational Rehabilitation Program Rehabilitation The Secret Hide

Hidden Secrets Of The Va S Vocational Rehabilitation Program Rehabilitation The Secret Hide

The Colorado Housing Finance Authority Chfa Provides Access To Affordable Homes For Those With Qualifying Military S Home Loans 30 Year Mortgage Fha Mortgage

The Colorado Housing Finance Authority Chfa Provides Access To Affordable Homes For Those With Qualifying Military S Home Loans 30 Year Mortgage Fha Mortgage

Veterans Property Tax Exemption By State Pro Tips

Veterans Property Tax Exemption By State Pro Tips

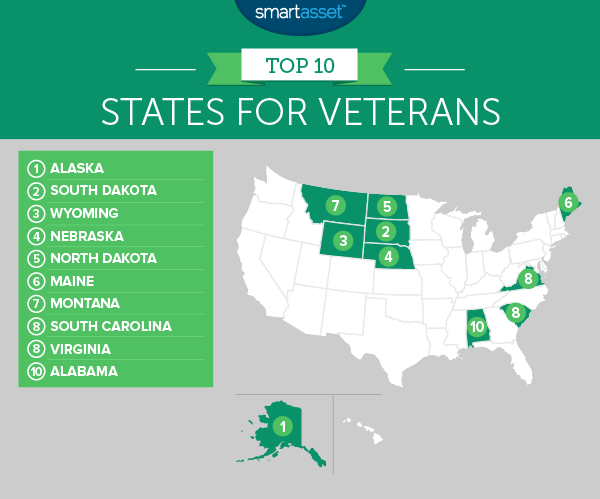

The Best States For Veterans Smartasset

The Best States For Veterans Smartasset

Veteran Disability Exemptions By State Va Hlc

Veteran Disability Exemptions By State Va Hlc

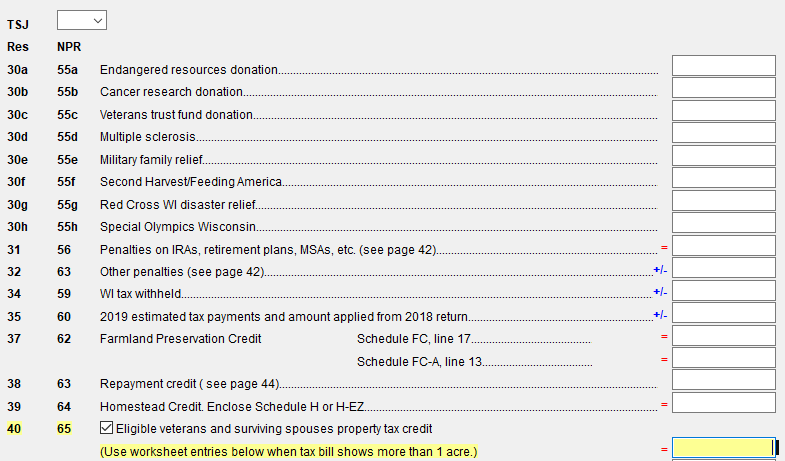

Wi Veterans And Surviving Spouses Credit

Wi Veterans And Surviving Spouses Credit

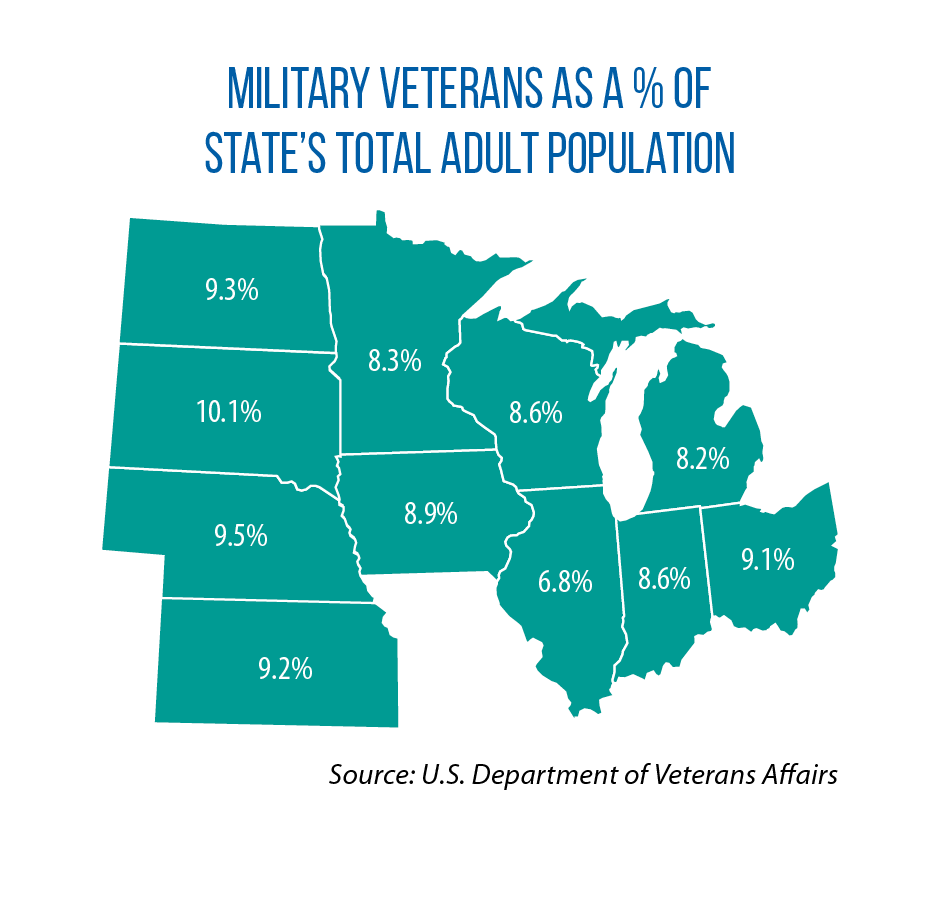

January February 2020 Question Of The Month Help For Veterans Csg Midwest

January February 2020 Question Of The Month Help For Veterans Csg Midwest

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home