How Do I Change My Name On My Property Tax Bill

You can ask for the credits to be applied to other tax periods or you can request a refund by completing a Property Refund Request form. Property Tax Bill Frequently Asked Questions FAQs I have a question about my property tax bill ie.

/getty-moneyhouse_1500_157590565-56a7269c5f9b58b7d0e757e3.jpg) Taking Advantage Of Property Tax Abatement Programs

Taking Advantage Of Property Tax Abatement Programs

Request tax deferral for seniors military.

How do i change my name on my property tax bill. Pay Online for Free. Fill out form 2525 bRP Request to Correct Name or Address on a Real Property Account on our website at FORMS POPULAR FORMS and send it to the address in the upper left of the form. Change your property title.

Fill out and submit a Address and Name Correction Form. The IRS based your third stimulus check on your 2019 taxes and youre owed money for your 2020 AGI or dependents. You may be a nonfiler who needs to file a 2020 tax.

This deed is then filed and a new deed is then filed back to you using just your current name. Property Tax Lookup Online Payments. The Travis Central Appraisal District TCAD records ownership and address information in person and by mail.

Depending upon your question you should contact one of three county departments involved in the property bill process. Use your bank account to pay your property taxes with no fee. Assessed value tax bill and payments tax rates.

To request a change in the mailing address for your property tax bill please send the following information by email to. Complete the Name or Address Correction form and submit it to TCAD. Youre responsible for making sure your property.

You may send the same letter to both offices. To search for tax information you may search by the 10 digit parcel number OR last name of property owner OR site address. Search your property tax history.

If lawyer has not sent in the ownership change paperwork then new owner can submit them. Who should I contact. You can not change a deed to a property through the Assessment office.

Formerly Known As If you are the sole owner of the property and want to change your name on the deed in some states you file a quitclaim deed to your new name using the formerly known as FKA with your prior name. Send Mail to a Different Address. A change in mailing address may only be requested by the property owner or an authorized representative.

Change your tax deferment address. 2 Get NOC from society for the purpose of milkat change. If a notice has already been mailed or if it is about to be mailed the change will take effect on the next notice.

Address Change Tax and Utility. When searching choose ONLY ONE of the listed criteria. If you do nothing it will be automatically applied to your next tax bill.

We encourage consultation with appropriate legal authorities. There is a fee for an ownership change. To remove a deceased owner from the accounts please send in the death certificate with written request.

To get property information duplicate tax bill or to pay your taxes click on the green Property Lookup Payments box. If you wish to change your name or remove a name on your property record due to marriage divorce death of an owner etc a new deed must be filed with the local Land Records office where the property is located. Use interactive maps.

Have your property tax bill sent to a different address. Here if your name is XXXXX XXXXX on the property tax bill I would be willing to bet that it has been removed from the title of the property. Property address name of new owner closing date.

Only you can surmise why she would have done that but suffice it to say that if your name is XXXXX XXXXX the title to the property you no longer have ownership rights to the property. Once you make a change with their office TCAD sends the updated information in about 30 days to the tax office. If you have deferred your property taxes and have an open account you can change your tax deferment address by phone.

If the Department does not have a record of the Full Payment Certificate from your closing you may be required to provide us with a copy of the deed closing statement and or. Use the second link below to look up your notice online. Use the first link below to change the mailing address for your Property Tax Bill and other Property Tax notices.

How to Change a Name on a Tax Bill If you would like the property tax records to reflect a change of name you may need to record documentation with the Register of Deeds office. The paper work will include. Some credits are treated differently.

Receive your bill by email. Change your name and mailing address. If you are not the listed property owner please attach the document that states you are an authorized.

Good luck to you. More Ways to Pay. For PMC property tax name change 1 Pay the property tax for entire year get NOC from PMC website itself.

Any overpaid property tax will be credited to your account. Update Property and Billing Information. Death of a Spouse If you are requesting that a name be removed due to the death of a spouse you must record either a.

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

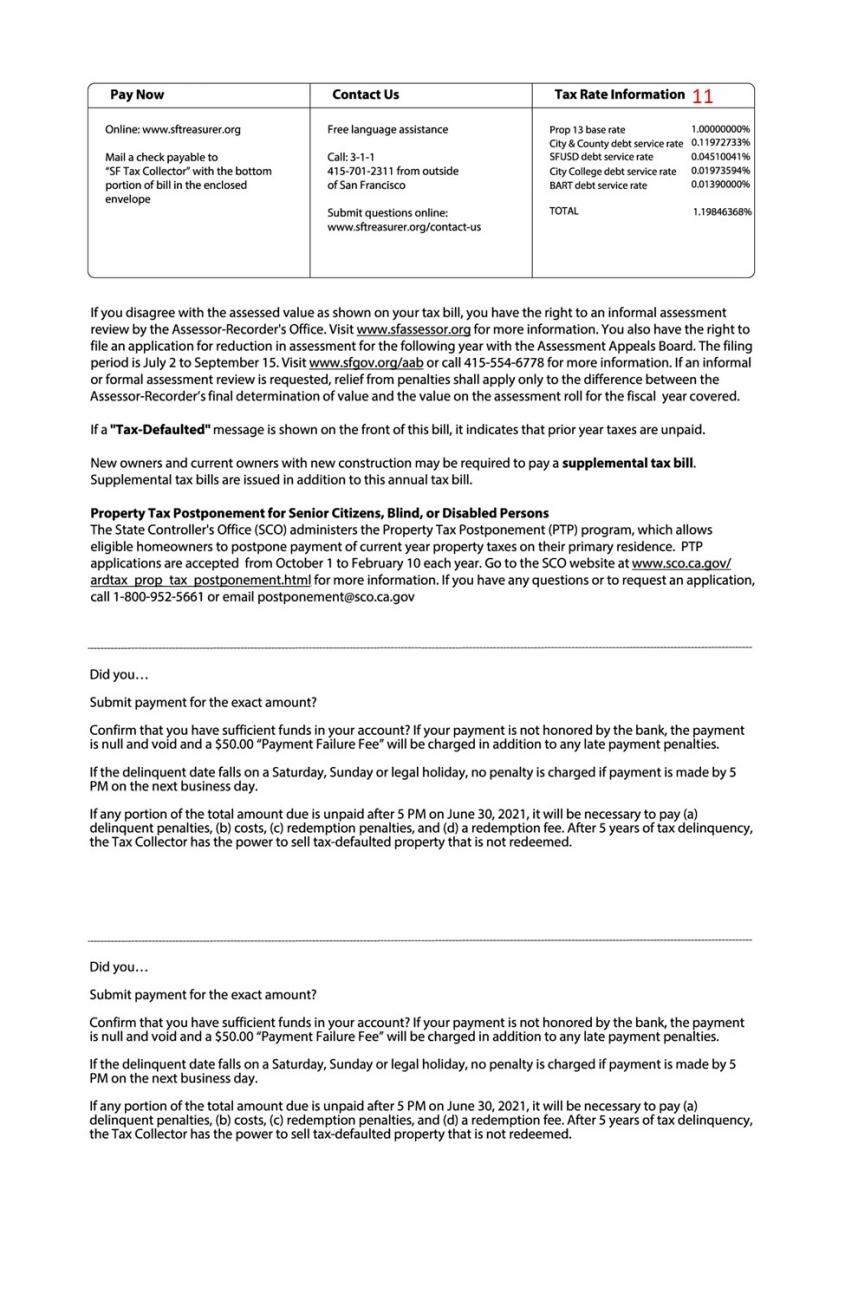

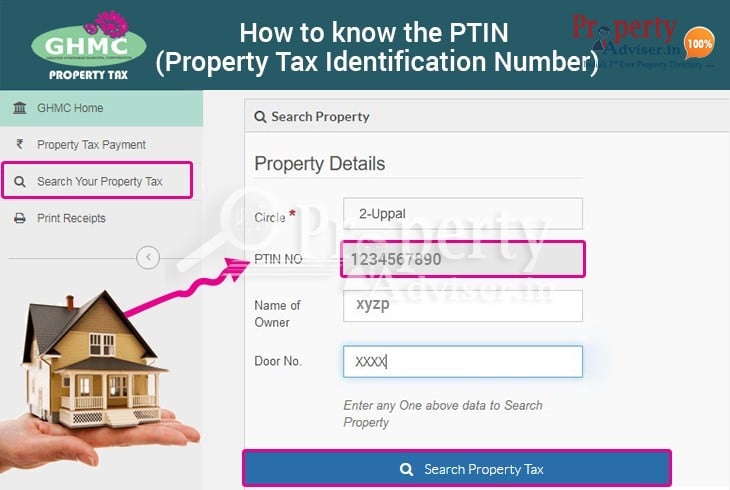

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Property Tax Information Lake County Il

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

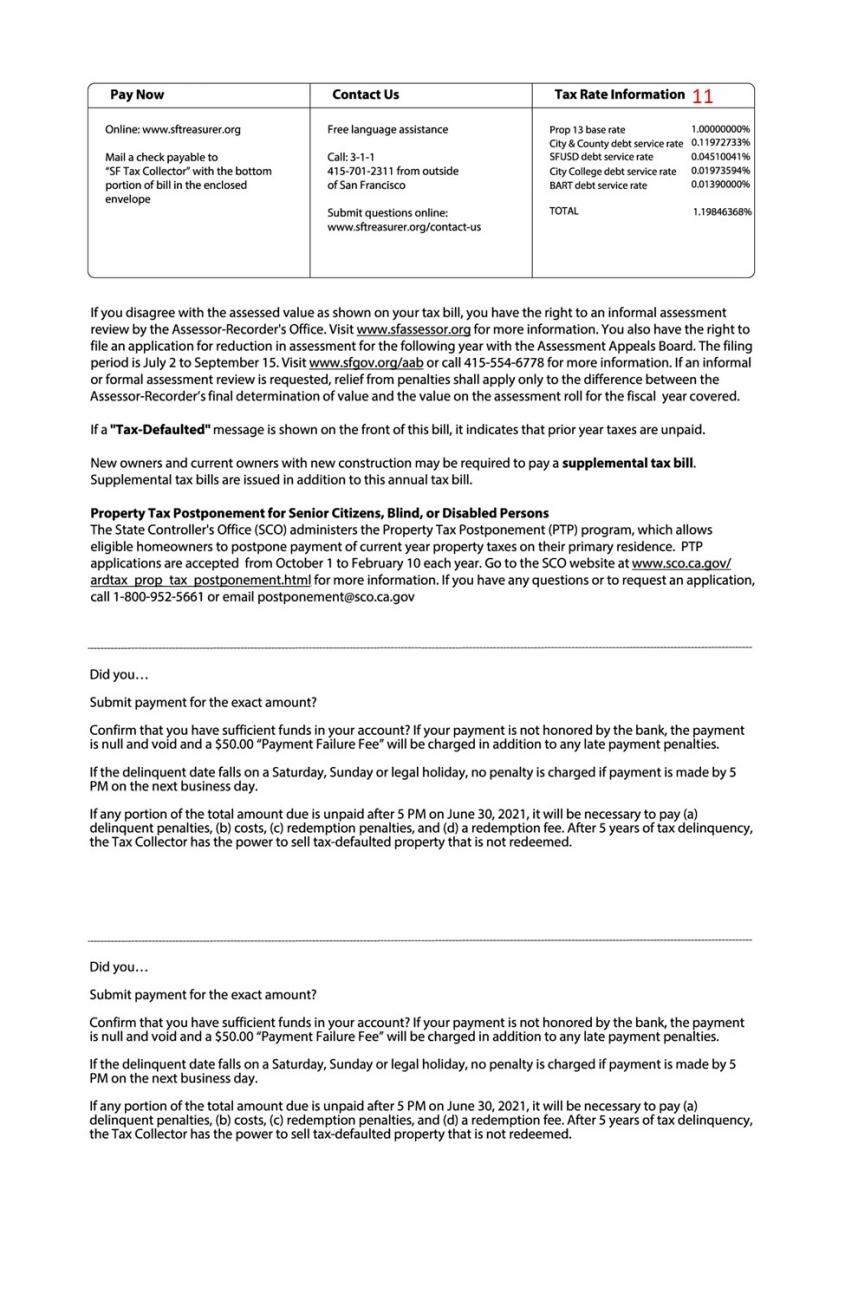

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

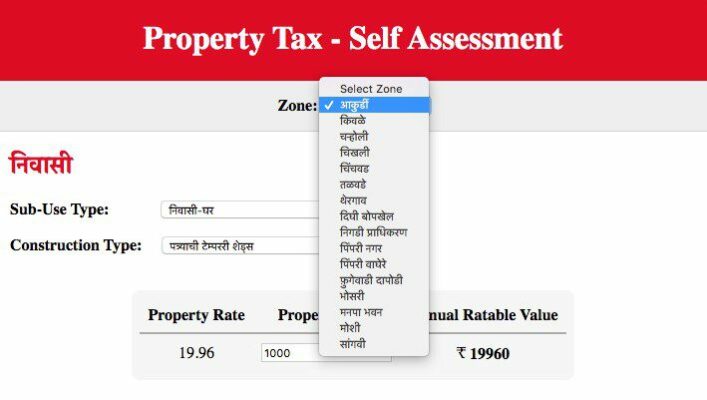

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Current Payment Status Lake County Il

The Official Website Of The Township Of North Bergen Nj Tax Collector

The Official Website Of The Township Of North Bergen Nj Tax Collector

What Are Real Estate Taxes Real Estate Tax Basics Millionacres

What Are Real Estate Taxes Real Estate Tax Basics Millionacres

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home