Property Tax Marion County Fl

Marion County collects on average 086 of a propertys assessed fair market value as property tax. Property Taxes in Marion County Property tax is a tax on real estate mobile homes and business personal property.

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

Property Taxes Mortgage 82434800.

Property tax marion county fl. This 2940 square foot house sits on a 483 acre lot and features 3 bedrooms and 3 bathrooms. CUSTODIAN OF PUBLIC RECORDS. 000 Lowest in US.

Marion County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Property Taxes No Mortgage 69433500. 3834 Marion County Rd is a house in WEIRSDALE FL 32195.

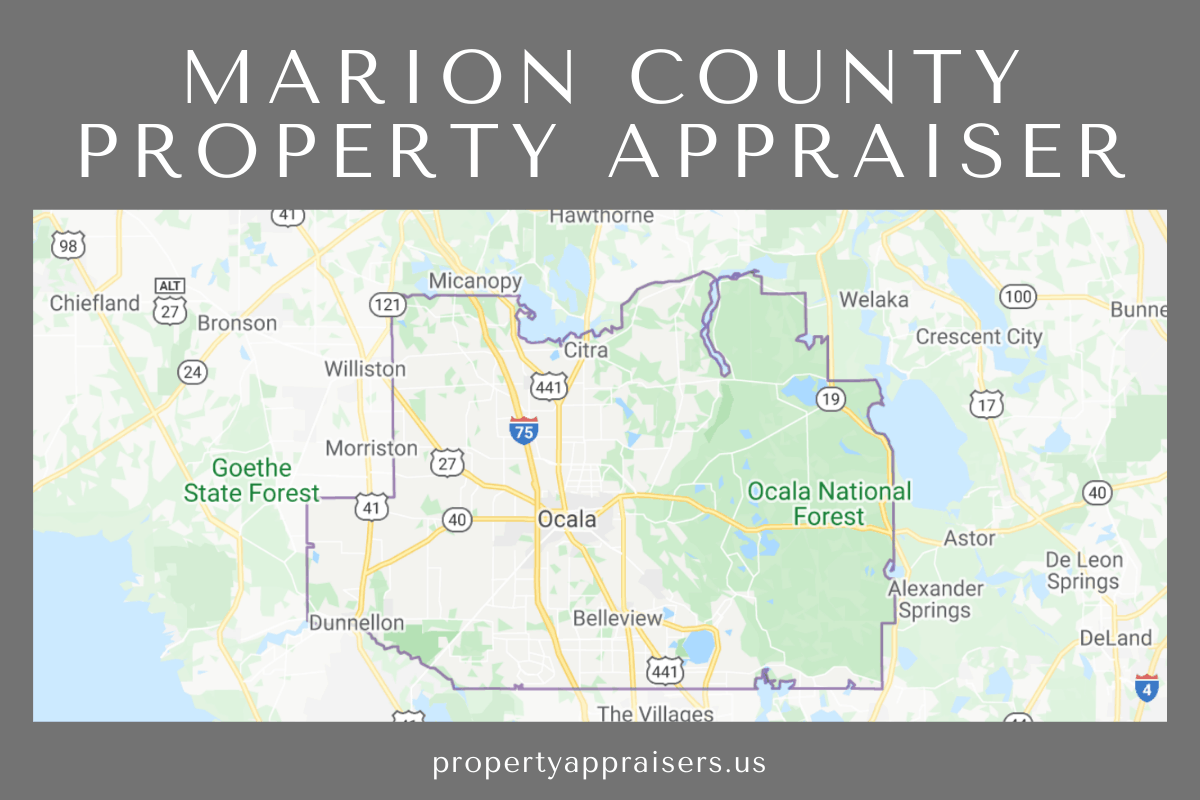

View details map and photos of this lotsland property with 0 bedrooms and 0 total baths. The Real Estate and Tangible Personal Property Tax Rolls are written by the Property Appraiser. Marion County Property Tax Collections Total Marion County Florida.

In-depth Marion County FL Property Tax Information. Tax planning strategies will differ depending on depending on where you live. This house has been listed on Redfin since April 14 2021 and is currently priced at 1200000.

Stay up to date on the latest county news regarding COVID-19. Exemptions for Homestead Disability Widows etc and Agricultural Classifications are determined by the Property Appraisers. Ocala Florida 34471 Phone.

Text FLCOVID19 to 888777 To Receive COVID-19 Updates from the State of Florida Reply to the text message you receive with your ZIP code for local updates. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. 3834 Marion County Rd was built in 2020 and last sold on April 12 2019 for 82500.

Marion County Property Tax Collections Total Marion County Florida. In accordance with 2017-21 Laws of Florida 119 Florida Statutes. Use this section of the website to pay your property taxes and to learn about property tax rates deductions and exemptions how property taxes are used and other frequently asked questions.

Marion County Assessment Rolls httpswwwpamarionflusPropertySearchaspx Search Marion County property assessments by tax roll parcel number property owner address and taxable value. After 90 days any person or governmental unit may purchase the land for the opening bid plus omitted years taxes as cited in Florida Administrative Code 12D-130643. Yearly median tax in Marion County.

The Property Appraiser determines the ownership mailing address of the property owner legal description and determines the values of all Real Estate and Tangible Personal Property in Marion County for Ad Valorem Tax purposes. The median property tax on a 15070000 house is 146179. The median property tax on a 15070000 house is 129602 in Marion County.

For Sale - 0 Marion Oaks Golf Way Ocala FL - 32900. The renewed sales tax will generate an estimated 196M in county revenue. Marion County Assessors Website httpswwwpamarionflus Visit the Marion County Assessors website for contact information office hours tax payments and bills parcel and GIS maps assessments and other property.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Marion County Tax Appraisers office. The median property tax also known as real estate tax in Marion County is 129900 per year based on a median home value of 15070000 and a median effective property tax rate of 086 of property value. The median property tax in Marion County Florida is 1299 per year for a home worth the median value of 150700.

Florida is ranked 1029th of the 3143 counties in the United States in order of the median amount of property taxes collected. In the Marion County area tax planning is often included with other services like asset management estate planning and retirement planning. The list of Land Available for Taxes are properties which were offered but not purchased at a Tax Deed Sale.

Property Taxes Mortgage 82434800. 274 22nd Lowest in US Florida Individual Income Tax. Property Taxes No Mortgage 69433500.

Office of the Marion County Tax Collector PO BOX 63 Ocala Florida 34478-0063.

Florida Property Tax Records Florida Property Taxes Fl

Florida Property Tax Records Florida Property Taxes Fl

Florida Property Tax Millage Rates County Rating Walls

0 Turkey Town Ln Hilliard Fl 32046 Mls 1075497 Zillow Vacant Land Hilliard Us Real Estate

0 Turkey Town Ln Hilliard Fl 32046 Mls 1075497 Zillow Vacant Land Hilliard Us Real Estate

Http Www Marioncountyfl Org Home Showdocument Id 7990

Florida Property Tax H R Block

Florida Property Tax H R Block

Marion County Property Appraiser How To Check Your Property S Value

Marion County Property Appraiser How To Check Your Property S Value

Http Www Marioncountyfl Org Home Showdocument Id 7990

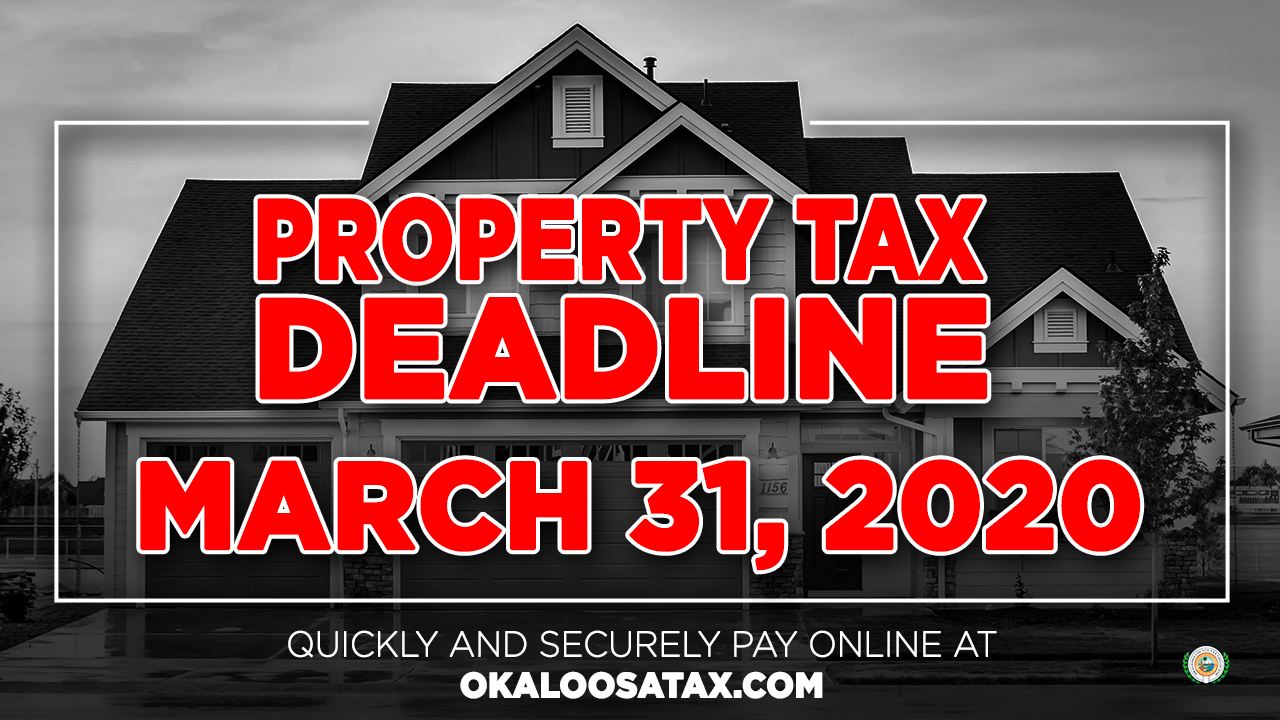

March 27 2020 Coronavirus Notebook Local Closings And Related Information News Ocala Com Ocala Fl

March 27 2020 Coronavirus Notebook Local Closings And Related Information News Ocala Com Ocala Fl

Marion County Florida Property Tax Records Property Walls

Http Www Marioncountyfl Org Home Showdocument Id 7990

Florida Property Tax Records Florida Property Taxes Fl

Florida Property Tax Records Florida Property Taxes Fl

Property Taxes In Ocala Marion County Florida Area Explained

Property Taxes In Ocala Marion County Florida Area Explained

Https Www Marioncountyfl Org Home Showpublisheddocument Id 11901

Https Www Marioncountyfl Org Home Showdocument Id 18865

Robin St Elkton Fl 32033 Mls 181093 Zillow Elkton Zillow Us Real Estate

Robin St Elkton Fl 32033 Mls 181093 Zillow Elkton Zillow Us Real Estate

Fort Mccoy Marion County Fl Land For Sale Property Id 334496089 Landwatch Land For Sale Marion County Window Unit

Fort Mccoy Marion County Fl Land For Sale Property Id 334496089 Landwatch Land For Sale Marion County Window Unit

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home