When Will I Receive My Property Tax Bill For 2020

The stimulus bill exempts the first 10200 of unemployment income from federal tax if your AGI is under 150000 or 20400 for couples with a combined AGI. By law the first installment property tax bill is exactly 55 percent of the previous years total tax amount.

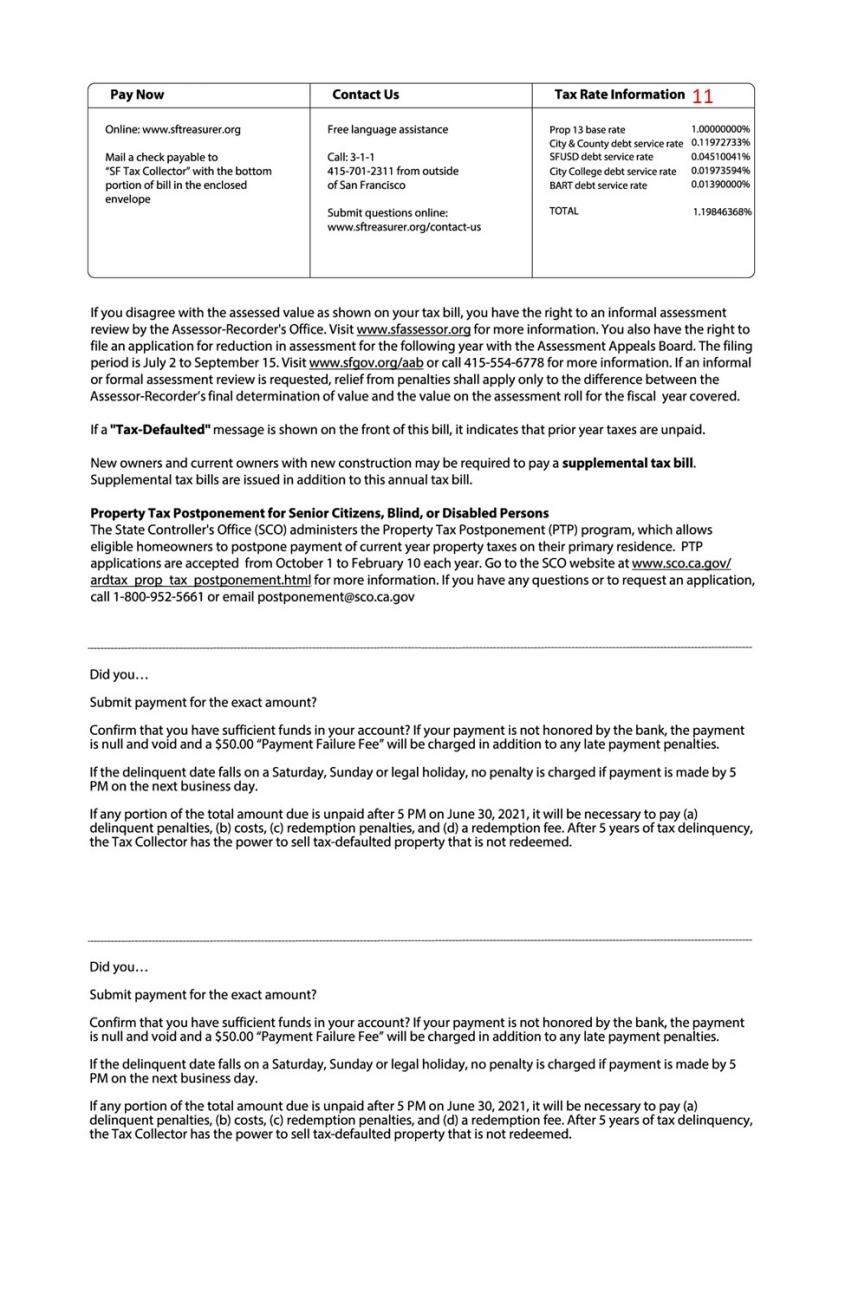

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

If you do nothing it will be automatically applied to your next tax bill.

When will i receive my property tax bill for 2020. You can ask for the credits to be applied to other tax periods or you can request a refund by completing a Property Refund Request form. Sign up to receive future property tax bills by email. Any overpaid property tax will be credited to your account.

If you pay your taxes online or by phone a convenience fee is charged in addition to the property tax amount paid. If you do not receive the original bill by November 1 contact the County Tax Collector or Assessor for a duplicate bill. Where Your Taxes Go.

You will receive a transaction number when you finish see disclaimer. Property Tax Bill Frequently Asked Questions FAQs I have a question about my property tax bill ie. You are still responsible for payment of your property taxes even if you have not received a copy of your property tax statements.

Change your mailing address for property tax bills. Your first installment is due at the beginning of March. Access property tax forms.

Depending upon your question you should contact one of three county departments involved in the property bill process. Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the taxpayer. The Lake County Clerks office maintains a list of the local taxing districts.

Your Property Tax Distribution. Almost all property tax bills are due on receipt. Assessment appeals filed in 2019 are applicable for tax bills paid in 2020.

Some credits are treated differently. When filing your taxes for 2020 input the amount of money you were legally entitled to but didnt receive from the two stimulus checks in 2020 the 1200 and 600 checks on your tax return. To claim a property tax credit you must file your claim or extension request by April 15 2020.

The 2020 property taxes are due January 31 2021. Annual property tax bills are mailed every year in October to the owner of record as of January 1 of that year. For instance 2019 taxes are billed and due in 2020.

When searching for Unsecured taxes use the ASSESSMENT NUMBER. You received unemployment in 2020. Provide input at a local budget hearing.

The pandemic in 2020 caused the IRS to extend the 2019 tax filing deadline from April 15 2020 to July 15 2020. Pay your property tax bill. Taxpayers were also able to defer federal income tax payments due on April 15 2020 to July 15 2020 without penalties and interest regardless of the amount owed.

This may mean youre eligible for a Recovery Rebate Credit when filing for your 2020 tax return. For a copy of the original Secured Property Tax Bill please email us at infottclacountygov be sure to list your AIN and use the phrase Duplicate Bill in the subject line or call us at 8888072111 or 2139742111 press 1 2 and then press 9 to reach an agent Monday Friday 800am. Tax payments for current tax bills are posted according to their postmark.

Where can I find property tax increment amounts for Redevelopment Agencies or Successor Agencies. All property taxes become due November 1st must be paid no later than March 31st and become delinquent if not paid before April 1st Discounts are applied to tax bills paid in full between November 1st and February 28th November 4. This applies to dependents under 17 as well.

Property Taxes Home Brenna Haggar 2020-09-17T072357-0500 Would you like to. Assessed value tax bill and payments tax rates. How will my property taxes change when I sell my property.

Lenders have two different ways of working with buyers of new construction when it comes to their property taxes. View your property tax account details. Your bill will only have the due date of August 31.

Once you receive your assessment notice. How is the Countywide 1 property tax. Property tax bills are mailed twice a year by the Cook County Treasurer.

Or better yet have your tax advisor handle this for you. Why is the due date on my bill August 31 2020 when the 2020 2021 taxes are not due until September 30 2020. Understandably that will mean a higher property tax bill.

Form 140PTC provides a tax credit of up to 502. Who should I contact. Convenience fees are paid to the service provider not San Joaquin County.

Tax Code Section 3101g provides that failure to send or receive the tax bill does not affect the validity of the tax penalty interest the due date the creation of a tax lien or any procedure instituted to collect a tax. If your AGI for 201819 is higher than your AGI in 2020 you can claim the additional amount owed when you file your 2020 taxes in 2021. Note the original bill may still have the prior owners name on it the first year.

They may have you pay the assumed rate on your improved property meaning youll set aside more than youll actually owe for the year into escrow and will either get. Then if necessary file an assessment appeal. What are the phone numbers for the departments related to property taxes.

When can I expect to receive a corrected tax bill.

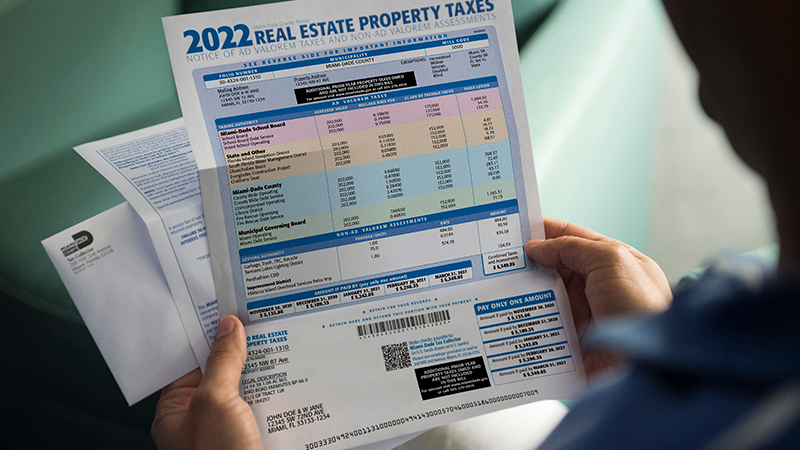

Understanding Property Tax In California Property Tax Tax Understanding

Understanding Property Tax In California Property Tax Tax Understanding

Https Www Atlantaga Gov Home Showdocument Id 18844

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Understanding Your Property Tax Refund In 2020 Tax Refund Property Tax Tax

Understanding Your Property Tax Refund In 2020 Tax Refund Property Tax Tax

Current Payment Status Lake County Il

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Pin On How To Save Money Ideas

Pin On How To Save Money Ideas

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Pay Your Property Tax Bill Online

Pay Your Property Tax Bill Online

Labels: receive

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home