Property Damage Portion Of Your Claim

In Texas the minimum amount for property damage liability coverage is 25000. It includes not only the damage to your automobile but also your property in your vehicle that was damaged.

Pin By The Red Coupe Blog On Auto Vehicle Repair Compare Car Insurance Car Insurance Car Insurance Online

Pin By The Red Coupe Blog On Auto Vehicle Repair Compare Car Insurance Car Insurance Car Insurance Online

A property damage claim is the portion of your claim to repair or replace your vehicle.

Property damage portion of your claim. According to the Insurance Information Institute III windhail damage is the highest property claim type in terms of loss frequency. A limit is the maximum amount your policy will pay for a covered claim. Like good taste or bad wine negligence can be easy to recognize but hard to.

A policy owner also plays another role. Under Ohio law there are essentially two claims to any car accident against the at-fault drivers insurance company. Property damage is defined as some harm that is inflicted upon someones property as the result of another persons negligence willful destruction of that persons property or by an act of nature.

Property damage claims related to auto accidents come in many shapes and sizes and different states have different laws governing claims. Most of the property damage claims are often the result of faulty work claims derived from the homeowners complaints regarding how you performed the work on their home or business. Step 7 Repair or replace everything to pre-loss condition.

Real property claims These involve insurance claims for damages to real estate and structural property eg your house business establishment land crops covered by your insurance. A property damage claim is a report or evidence that you submit to an insurance company in the event your property has been damaged. Find more in depth information here about total loss property damage claims.

Please answer a few questions to help us match. Negligent Property Damage in Small Claims. In the world of public adjustment common property damage claims are a daily occurrence.

Property Damage Cases in Small Claims Court Learn the rules about bringing a claim and how to calculate your damages. Property damage cases often end up in small claims court. A casualty doesnt include normal wear and tear or progressive deterioration.

The policyholder will often assume that its in their best interest but we assure you thats further from the. Your part in property damage insurance involves money. It requires that you pay your premiums to have this protection in place.

You can choose your liability coverage limits when you buy car insurance or adjust them later with the help of your agent. If you have personal property that has sustained damageor has been completely destroyedby any of the following four categories of events you may be able to deduct a portion of your. In Nevada its 10000.

You have these options for filing a claim when someone else caused the. Your client might also claim that your work did not meet industry standards or was not of the quality outlined in the contract. Property insurance policies typically cover damage due to natural causes vandalism accidents and acts of.

The second claim is the personal injury claim. If you have a 100000 policy for example and a fire caused 150000 of damage to your property then your insurer will pay 100000 while you pay the remaining 50000 out of pocket. Reducing exposure to damages that may occur.

After filing your claim your insurance provider will choose an adjuster to oversee your case. When your property has been damaged by the negligent or intentional act of someone else in most instances you have the right to recover the amount of money it would take to fix the. Lack of documentation could threaten a property damage insurance claim.

First is the property damage claim which involves damage to your vehicle. Property damage cases can be fairly straightforward. Water damagefreezing comes in second on this not so great list.

With this in mind I would like to give you a few tips to prepare your property for the upcoming winter months so that you can minimize your chances of being a part of these statistics. As long as premiums are paid by the policy owner the policy will pay the benefits promised in the insurance contract. In Georgia all motorists are required to have a minimum of 25000 in property damage liability insurance coverage to pay for property damage they cause in a wreck.

A claim to have your vehicle fixed or repaired after a car accident is the property damage portion of your claim. You might not notice a part of the home that requires maintenance like a leaky roof or broken shingles You might be significantly underinsured based on the value of your home and possessions You might have no evidence proving ownership or value of many items in your home. In Georgia all drivers are required to purchase 25000 in property damage liability coverage to pay for damages they cause to vehicles and other property in an accident.

Flooding caused by a hurricane is an example of property damage caused by an act of nature. You can settle the property damage claim and it will have no adverse affect on your injury claim. A casualty loss can result from the damage destruction or loss of your property from any sudden unexpected or unusual event such as a flood hurricane tornado fire earthquake or volcanic eruption.

6 Strange Things Your Home Insurance Policy Covers Home Insurance Renters Insurance Homeowners Insurance

6 Strange Things Your Home Insurance Policy Covers Home Insurance Renters Insurance Homeowners Insurance

Know What Your Homeowners Insurance Covers When Winter Storms Strike Insurance Com Homeowners Insurance Coverage Homeowners Insurance Homeowner

Know What Your Homeowners Insurance Covers When Winter Storms Strike Insurance Com Homeowners Insurance Coverage Homeowners Insurance Homeowner

The Impaired Property Exclusion Expert Commentary Irmi Com

The Impaired Property Exclusion Expert Commentary Irmi Com

Property Damage Liability What Is Property Damage Insurance

Property Damage Liability What Is Property Damage Insurance

16 Most Important Car Insurance Terms Infographic Car Insurance Tips Car Insurance Renew Car Insurance

16 Most Important Car Insurance Terms Infographic Car Insurance Tips Car Insurance Renew Car Insurance

Homeowners Insurance For Burst Pipes And Water Leaks Forbes Advisor

Homeowners Insurance For Burst Pipes And Water Leaks Forbes Advisor

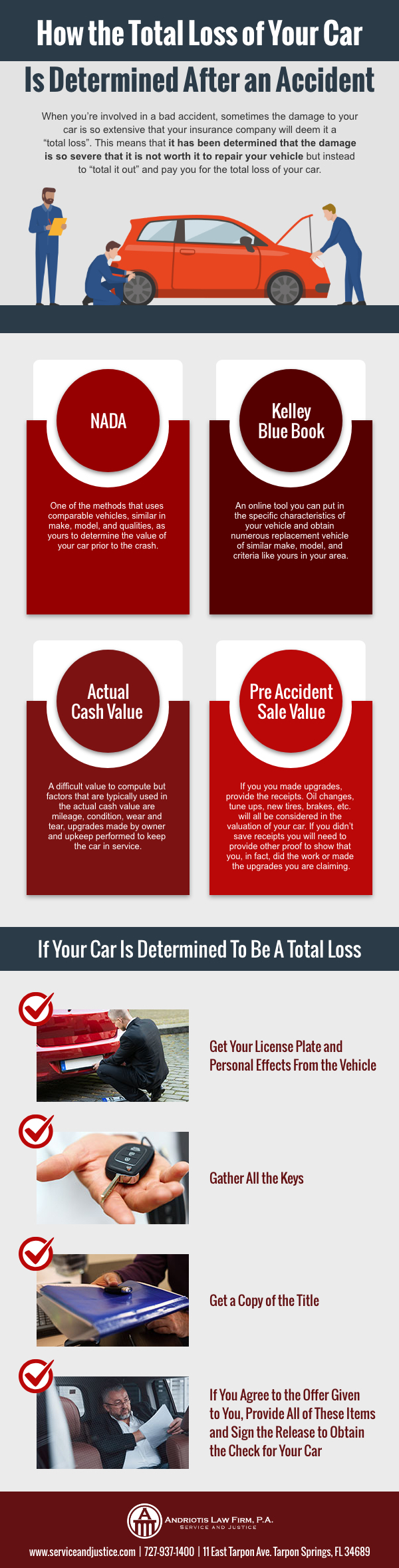

Property Damage How The Total Loss Of Your Car Is Determined After An Accident

Property Damage How The Total Loss Of Your Car Is Determined After An Accident

Loss Of Use As Property Damage Expert Commentary Irmi Com

Loss Of Use As Property Damage Expert Commentary Irmi Com

How To Lower Your Car Insurance Bankrate Life Insurance Facts Insurance Humor Best Cheap Car Insurance

How To Lower Your Car Insurance Bankrate Life Insurance Facts Insurance Humor Best Cheap Car Insurance

Download The Public D O Liability Claims Infographic And Know The Top Types Of D O Cases And The Industries With The Mo Infographic Public Commercial Insurance

Download The Public D O Liability Claims Infographic And Know The Top Types Of D O Cases And The Industries With The Mo Infographic Public Commercial Insurance

What Is My Auto Accident Case Worth Dyer Garofalo Mann And Shultz

What Is My Auto Accident Case Worth Dyer Garofalo Mann And Shultz

38 Unique Insurance Banner Ideas Renew Car Insurance Best Car Insurance Car Insurance

38 Unique Insurance Banner Ideas Renew Car Insurance Best Car Insurance Car Insurance

Home Insurance Myths Busted Homeowners Insurance Home Insurance Personal Insurance

Home Insurance Myths Busted Homeowners Insurance Home Insurance Personal Insurance

Fire Damage Insurance Claims Fire Damage Business Continuity Damaged

Fire Damage Insurance Claims Fire Damage Business Continuity Damaged

Infographic Types Of Automatic Coverage Some Types Of Automatic Content Insurance Homeowners Insurance Car Insurance

Infographic Types Of Automatic Coverage Some Types Of Automatic Content Insurance Homeowners Insurance Car Insurance

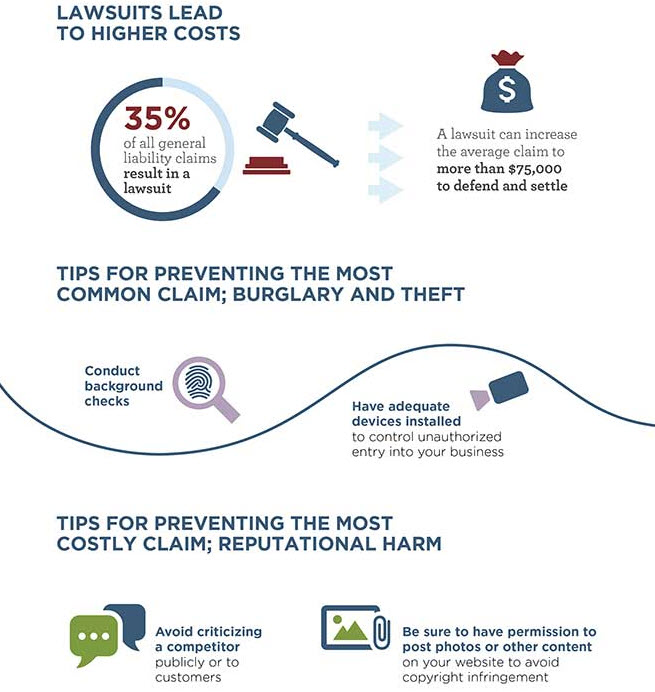

How Much Does General Liability Insurance Cost The Hartford

How Much Does General Liability Insurance Cost The Hartford

Property Damage Liability What Is Property Damage Insurance

Property Damage Liability What Is Property Damage Insurance

Auntie Karen Says That When You Are At A Stop Light Or Sign Wait An Extra Few Seconds To Sure No One Is Going Run Th Car Insurance Tips Car Insurance

Auntie Karen Says That When You Are At A Stop Light Or Sign Wait An Extra Few Seconds To Sure No One Is Going Run Th Car Insurance Tips Car Insurance

How To Choose Liability Bodily Injury And Property Damage Coverages

How To Choose Liability Bodily Injury And Property Damage Coverages

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home