Tennessee Nonprofit Property Tax Exemption

67-6-322 provides a sales and use tax exemption to exempt organizations for the purchase of tangible personal property or services. The exemption may be used to buy free of sales tax goods and services that the nonprofit will use or give away.

An essential condition for consideration for exemption status is the property must be actively used for religious scientific educational charitable and non-profit organization purposes.

Tennessee nonprofit property tax exemption. Tennessee Tax Exemption Resources. Used by religious charitable scientificor non-profiteducational organizations1 Tax exempt properties are removed from a countys tax roll. Skip to main content An official website of the United States Government.

REC-14 - Realty Adjustment Due to Divorce Exempt from Transfer Tax. Farming personal residence in LLCs or LPs. Tax Relief is not an exemption.

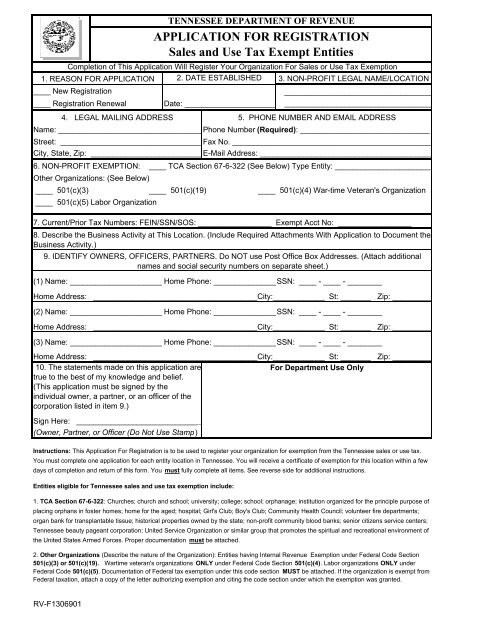

Purchases by government entities and non-profit organizations are also exempt. You will need to complete an application for non-profit sales and use tax exemption and submit it and all required documentation copies of articles bylaws IRS determinationto the Tennessee Department of Revenue. REC-10 - Credit Unions Exempt from Recordation Tax.

With few exceptions the exemption does not apply when the nonprofit resells goods for profit. The phrase intend to solicit and receive was deleted effective July 1 2019. 1 hour agoIf any other entity organized as a nonprofit sought an exemption and began providing for-profit services on its property they could be stripped of their tax exemption and required to pay.

Please visit the Filing and State Tax section of our website for more information on this process. In order to qualify for exemption the sale must be made directly to the exempt organization meaning the purchased item must be paid for with the exempt organizations funds. Tennessee Department of Revenue Andrew.

The application is available on the Departments website. Tennessee recognizes resale certificates issued by other states to make tax-exempt purchases in Tennessee for resale outside of Tennessee to end users located outside of Tennessee. With limited exception no organization is automatically exempt from the payment of property taxes but rather must apply to and be approved by the Tennessee State Board of.

New Exemption Certificates Issued. Exemption Request Form SS-6042 for the State of Tennessee You should complete and file the Form SS - 6042 to the Tennessee Department of State. SBSE Business Filing.

REC-13 - Oath Not Required for Tax Exempt Realty Transfer. However Tennessee State law requires churches scientific educational charitable and qualifying non-profit organizationsgroups file for property-tax exemption for each piece of property they acquire. To avoid sales and use tax nonprofit organizations must apply for an exemption certificate from the Tennessee Department of Revenue.

Taxpayers may only file paper forms if the electronic filing requirement creates a hardship upon the taxpayer. REC-11 - Transfer Tax - Responsible Party for Paying and Collecting. If you are interested in receiving a property tax exemption for your personal residence please call the office of Erica S.

Gilmore Metro Trustee at 615-862-6330. Federal and state credit unions. Masonic lodges and similar lodges.

This means that the owners of these properties do not pay property taxes. The use of the property determines the exemption. Certain Tennessee non-profits are eligible to be exempt from Tennessee state and local sales tax.

Tennessee state filing information for tax-exempt organizations. Property tax exemptions are addressed in the Tennessee Code in. Effective July 1 2019 the Tennessee Code Annotated has been amended raising the charitable exemption level from thirty thousand dollars 30000 to fifty thousand dollars 50000.

Some exemptions are based on who the purchaser is or what the purchaser does. An out-of-state 501c3 organization may use its federal authorization to make tax-free purchases in Tennessee. Exemption from property tax is available to religious charitable scientific or nonprofit educational institutions who apply while the property currently is used exclusively to carry out one or more of the purposes for which the.

For example qualified farmers and qualified manufacturers can make purchases of certain items tax free or at a discounted tax rate. You still receive your tax bill s and are responsible for paying your property taxes each year. REC-12 - How to Determine Fair Market Value of Property.

Seventeen different types of entities are exempt from the franchise and excise taxes. Online Filing - All sales tax returns must be filed and paid electronically. State Filing Requirements for Political Organizations.

State Nonprofit Corporation Filings. Acting on constitutional authority the Tennessee General Assembly authorized certain property tax exemptions for Tennessees religious charitable scientific literary and nonprofit educational organizations. Regulated Investment Companies owning 75 in United States Tennessee or local bonds.

Typical organizations receiving property tax exemption are schools churches cemeteries hospitals social service agencies character building organizations nursing homes homes for the aging museums performing arts. A nonprofit entity must apply for and receive the Sales and Use Tax Certificate of Exemption from the Department of Revenue before making tax-exempt purchases. Tax relief is payment by the State of Tennessee to reimburse homeowners meeting certain eligibility requirements for a part or all of paid property taxes.

If your organization is exempt from registration because your gross contributions from the public are less than 30000 you have to complete this form. Lifecycle of an Exempt Organization.

Real Doctors Note For Work Doctors Note Pack Of 5 Premium Printable Templates Doctors Note Template Doctors Note Notes Template

Real Doctors Note For Work Doctors Note Pack Of 5 Premium Printable Templates Doctors Note Template Doctors Note Notes Template

Start A Nonprofit In Montana Fast Online Filings

Camp Ho Mita Koda Foundation Names Ian Roberts As New Executive Director Send2press Newswire Executive Director Director Foundation

Camp Ho Mita Koda Foundation Names Ian Roberts As New Executive Director Send2press Newswire Executive Director Director Foundation

Start A Nonprofit In Nevada Fast Online Filings

Setting Up Non Profits And Service Organizations In Tennessee Dodson Parker Behm Capparella Pc

Setting Up Non Profits And Service Organizations In Tennessee Dodson Parker Behm Capparella Pc

Sample Nonprofit Articles Of Incorporation Template For 501c3

Sample Nonprofit Articles Of Incorporation Template For 501c3

Application For Registration California Limited Partnership Application

Application For Registration California Limited Partnership Application

Nonprofit Limited Liability Company Nonprofit Law Blog

Nonprofit Limited Liability Company Nonprofit Law Blog

Https Www Tn Gov Content Dam Tn Revenue Documents Notices Sales Sales15 16 Pdf

Tennessee Non Profit Sales Tax Exemption Certificate

Tennessee Non Profit Sales Tax Exemption Certificate

Start A Nonprofit In Alaska Fast Online Filings

How To Keep Your Tennessee Nonprofit Compliant How To Start An Llc

How To Keep Your Tennessee Nonprofit Compliant How To Start An Llc

Https Tn Gov Content Dam Tn Revenue Documents Rulings Sales 11 51 Pdf

Application To Register Name Of Farm Ranch Estate Or Villa California Planner Printables Free Names

Application To Register Name Of Farm Ranch Estate Or Villa California Planner Printables Free Names

Certificate Of Dissolution Stock California Certificate Corporate

Certificate Of Dissolution Stock California Certificate Corporate

Short Form Certificate Of Dissolution California Form Short Form

Short Form Certificate Of Dissolution California Form Short Form

Acknowledgment Of Receipt And Review Of Npm Reserve Fund Statute Legal Forms California Clerk Of Courts

Acknowledgment Of Receipt And Review Of Npm Reserve Fund Statute Legal Forms California Clerk Of Courts

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home