Wi Property Tax Credit Veterans

Wisconsin Veterans Property Tax Credit 2135 Rimrock Road PO. Wisconsin Department of Revenue.

Wi Veterans And Surviving Spouses Credit

Wi Veterans And Surviving Spouses Credit

Not available if you or your spouse claims the veterans and surviving spouses property credit.

Wi property tax credit veterans. To elect this credit go to the WI 1B screen. You deducted the 3000 as a federal itemized deduction on your 2020 federal Schedule A. 2 certified death certificate if the veteran is deceased.

Requester Name Print Date of Birth Address Social Security Number. Wisconsin Department of Veterans Affairs. School Levy Tax Credit.

Individuals Press Releases Tax Pro. 1 DD Form 214 Certificate of Release or Discharge from Active Duty. There is also an override field that allows you to directly enter the amount for the credit.

Applicable Laws and Rules This document provides statements or interpretations of the following laws and regulations enacted as of January 20 2021. Additional Tax Credits Available. Sections 71076e and 7303 Wis.

Available if you paid rent during 2020 for living quarters that was used as your primary residence OR you paid property taxes on your home. Box 7843 Madison WI 53707-7843. 1 the Wisconsin Disabled Veterans and Unremarried Surviving Spouses Property Tax Credit program provides a refundable property tax credit for the primary residence instate and up to one acre of land via the state income tax form for eligible veterans as certified by the Wisconsin Department of Veterans Affairs.

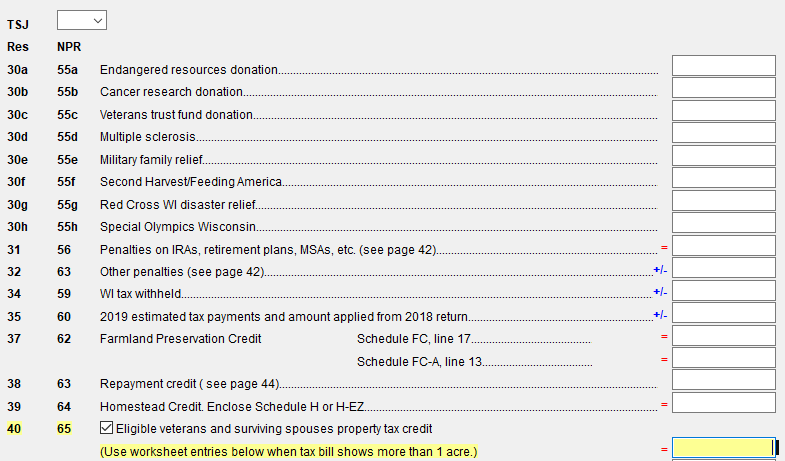

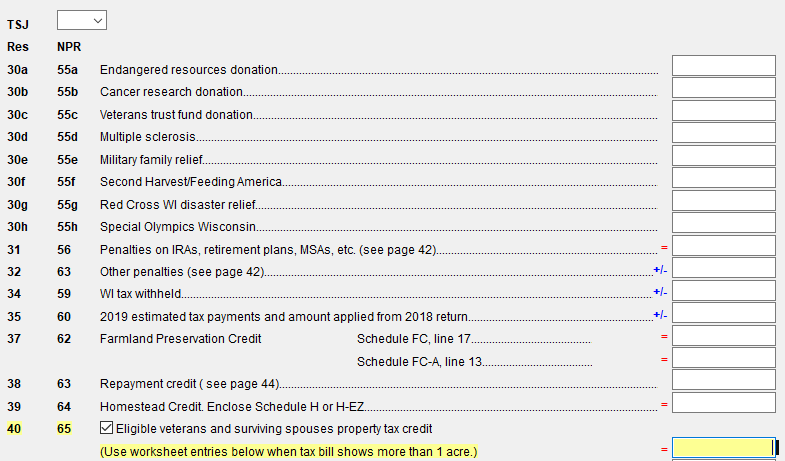

You claimed the veterans and surviving spouses property tax credit of 3000 which was refunded to you when you filed your Wisconsin income tax return in 2021. If you paid 3000 in property taxes for the year you would be able to claim 2000 of property taxes for the veterans and surviving spouses property tax credit. There is a checkbox on line 40 or line 65 for NPR returns to allow the credit.

For more information on property tax credits listed on the property tax bill contact us at. Eligible Veteran means a veteran. Property Tax Credit for Veterans and Surviving Spouses.

The Wisconsin Veterans Surviving Spouses Property Tax Credit provides eligible veterans and unremarried surviving spouses a refundable property tax credit for their primary in-state residence and up to one acre of land. All taxable real property in Wisconsin qualifies for the School Levy Tax Credit. All those requesting certification for veterans property tax credit must complete this form in full and attach required documentation as follows.

71076e1 the Wisconsin Veterans and Surviving Spouses Property Tax Credit program provides a refundable property tax credit for the primary residence instate via the state income tax form for eligible veterans as certified by the Wisconsin Department of Veterans Affairs. This credit amount is listed on the property tax bill below the Net Assessed Value Rate box. Wisconsin Department of Veterans Affairs Eligibility Under s.

Maximum credit is 300 per qualified taxpayer. Special conditions may apply. 30 W Mifflin Street.

School Property Tax Credit. The Wisconsin Veterans Surviving Spouses Property Tax Credit gives eligible veterans and unremarried surviving spouses a property tax credit for their primary residence. How do I get the Veterans and Surviving Spouses Property Tax Credit for Wisconsin.

Your total itemized deductions were 14100. State Grant Programs Funded by the Coronavirus Relief Fund That Are Excluded From Wisconsin Income.

Over The Years Hometown Equity Mortgage Has Proven To Be One Of Missouris Best Va Home L Home Improvement Financing Home Renovation Loan Home Improvement Loans

Over The Years Hometown Equity Mortgage Has Proven To Be One Of Missouris Best Va Home L Home Improvement Financing Home Renovation Loan Home Improvement Loans

Https Tax Iowa Gov Sites Default Files 2021 01 Bftc 20evaluation 20study 202020 Pdf

Https Lib Dr Iastate Edu Cgi Viewcontent Cgi Article 17518 Context Rtd

Track Medical Bills With The Medical Expenses Spreadsheet Squawkfox Medical Expense Tracker Medical Billing Medical

Track Medical Bills With The Medical Expenses Spreadsheet Squawkfox Medical Expense Tracker Medical Billing Medical

Pin By Julia Melatis Author On End Of Life Info In 2020 Funeral Planning Checklist Funeral Planning Estate Planning Checklist

Pin By Julia Melatis Author On End Of Life Info In 2020 Funeral Planning Checklist Funeral Planning Estate Planning Checklist

Seller Safety Tips Selling Your House Things To Sell Selling House

Seller Safety Tips Selling Your House Things To Sell Selling House

2017 Update On The Homestead Tax Credit And Wisconsin Renter S And Homeowner S School Property Tax Credit Steve Brown Apartments

2017 Update On The Homestead Tax Credit And Wisconsin Renter S And Homeowner S School Property Tax Credit Steve Brown Apartments

Explore Our Image Of Cover Letter Template For Security Job Letter Templates Cover Letter Template Cover Letter

Explore Our Image Of Cover Letter Template For Security Job Letter Templates Cover Letter Template Cover Letter

7 Qualities The Army Instilled In Me That Helped Me Launch A Business Army Soldier Us Army Soldier Army

7 Qualities The Army Instilled In Me That Helped Me Launch A Business Army Soldier Us Army Soldier Army

We See The Whole Picture We See The Whole Picture When It Comes To Body Corporate Reporting On Insurance Valuations Insura Pictures Wholeness Insurance Claim

We See The Whole Picture We See The Whole Picture When It Comes To Body Corporate Reporting On Insurance Valuations Insura Pictures Wholeness Insurance Claim

Motel 6 San Diego San Diego Community Development Affordable Housing

Motel 6 San Diego San Diego Community Development Affordable Housing

10 Options To Avoid Foreclosure Avoid Foreclosure Foreclosures Janesville Wisconsin

10 Options To Avoid Foreclosure Avoid Foreclosure Foreclosures Janesville Wisconsin

1887 Queen Anne Newton Ks 169 900 Old House Dreams Queen Anne Old House Dreams Victorian Homes

1887 Queen Anne Newton Ks 169 900 Old House Dreams Queen Anne Old House Dreams Victorian Homes

Retirement Account Transfer Rollover Conversion Chart Investing For Retirement Conversion Chart Traditional Ira

Retirement Account Transfer Rollover Conversion Chart Investing For Retirement Conversion Chart Traditional Ira

Directv Offer Legal Directv How To Plan Words

Directv Offer Legal Directv How To Plan Words

410 Lincoln St For Sale Mauston Wi Trulia Home And Family Trulia Home

410 Lincoln St For Sale Mauston Wi Trulia Home And Family Trulia Home

Http Www Legis Nd Gov Assembly 61 2009 Docs Pdf 19216 Pdf

Invest In Institutional Quality Real Estate With Technology Driven Insight Investing Commercial Real Estate Investing Real Estate Investing

Invest In Institutional Quality Real Estate With Technology Driven Insight Investing Commercial Real Estate Investing Real Estate Investing

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home