Veterans Property Tax Exemption South Dakota

Paraplegic veterans can qualify for an up to 100 exemption as. Permanently and totally disabled veterans as well as veterans with the loss or loss of use of both lower extremities are exempt from property tax.

Greenville S C Total Population 872 463share Of Population Age 45 To 64 26 3 Retired Cost Of Living 2 6 Aerial Images Real Estate Development Great Places

Greenville S C Total Population 872 463share Of Population Age 45 To 64 26 3 Retired Cost Of Living 2 6 Aerial Images Real Estate Development Great Places

SDCL 10-4-2410 states that dwellings or parts of multiple family dwellings which are specifically designed for use by paraplegics as wheelchair homes and which are owned and occupied by veterans with the loss or loss of use of both lower extremities or by the unremarried widow or widower of such veteran are exempt from.

Veterans property tax exemption south dakota. South Dakota State Property Tax Exemption for Totally Disabled Veterans Veterans who are disabled may qualify for exemption from property tax for up to 100000 of the full and true value for their dwelling. Spouses of those who would qualify are also eligible if the veteran passes away. The Disabled Veterans program provides a market value exclusion for property tax purposes for the homestead property of an honorably discharged veteran who has a service-connected disability rating of 70 percent or higher as determined by the United States Department of.

In South Dakota there are exemptions available for both fully disabled and paraplegic veterans. Pt 46c - application for disabled veteran. However property exempt from the general property tax may be required to pay for special assessments and services or pay a portion of the income from the property instead of the general property tax.

Check out some states that dont charge property tax to disabled veterans in the list below. South Dakota A disabled veteran in South Dakota may receive a property tax exemption of up to 100000 of hisher primary residence if the veteran is 100 percent disabled as a result of service. PIERRE SD The Nov.

South Dakota Property Tax Exemptions. Equalization Department - Property Tax Reductions Exemptions. Certain conditions may need to be fulfilled so its best to check with your state and county.

Property Tax Exemption for Veterans and their Widow or Widower. Property tax exemptions sdcl 10-4-40 10-4-41 personal information. This is an exemption of up to a 4000 reduction in the taxable value of a Veterans primary residence for county property taxation purposes.

Since taxation is the rule and exemption is the. Personal Property Tax Exemption Disabled Veterans Property Tax Credit Enacted in 2009 by the North Dakota State Legislature the disabled veterans credit is a property tax credit that is available to veterans of the United States armed forces with a disability of 50 or greater. VA-rated disabled veteran who are South Dakota residents may qualify for property tax exemptions of up to 100000 on a primary residence.

You can check out our articles covering the details of veterans tax exemptions. See all South Dakota Veterans Benefits. Veterans 65 years or older are qualified for 50 exemption on property taxes on the first 200000 of value assessed on their property.

Paraplegic veterans qualify for a full property tax exemption. The most popular state benefit available to New Mexicos 154000 Veterans according to the New Mexico Department of Veterans Services is the Veterans State Property Tax Exemption. South Dakota Property Tax Exemption for Disabled Veterans.

In order to qualify for this benefit dwellings must meet the following criteria. The veteran must be 100 disabled as the result of military service. The South Dakota Department of Revenues Disabled Veterans Program exempts the first 150000 of valuation on an eligible applicants property.

Owner-occupied classification historical moratorium paraplegic reduction of taxes paraplegic and disabled veteran exemption and the various exemptions for religious organizations. Learn more about South Dakota Property Tax Exemption for Paraplegic Veterans and Their Surviving Spouse. Owned and occupied for one full calendar year.

Under Minnesota law all property except tribal lands is taxable. 1 2020 deadline for eligible disabled veterans to apply for property tax relief is approaching. Property Tax Exemption.

The Equalization Department is also responsible for administering various tax reduction or tax exemptions specified in South Dakota law.

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

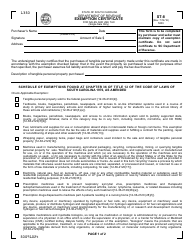

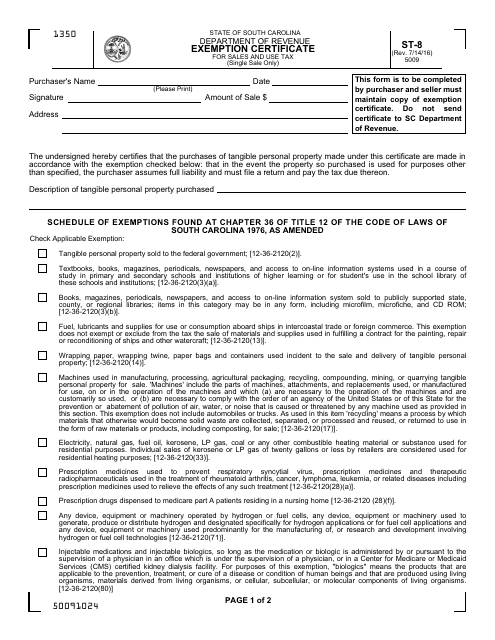

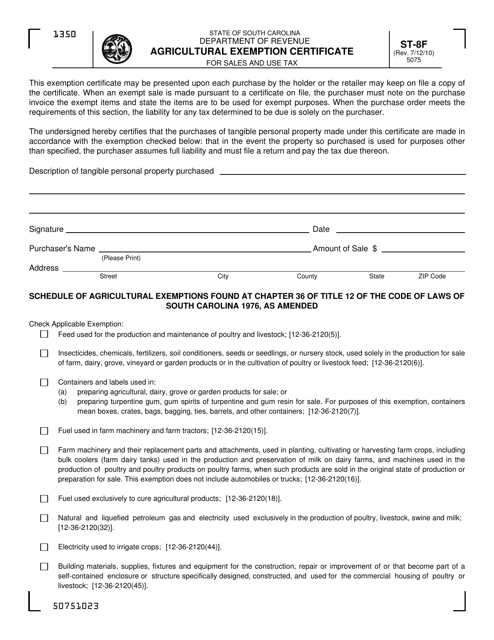

Form St 8 Download Fillable Pdf Or Fill Online Exemption Certificate For Sales And Use Tax South Carolina Templateroller

Form St 8 Download Fillable Pdf Or Fill Online Exemption Certificate For Sales And Use Tax South Carolina Templateroller

Veteran Disability Exemptions By State Va Hlc

Veteran Disability Exemptions By State Va Hlc

Form St 8 Download Fillable Pdf Or Fill Online Exemption Certificate For Sales And Use Tax South Carolina Templateroller

Form St 8 Download Fillable Pdf Or Fill Online Exemption Certificate For Sales And Use Tax South Carolina Templateroller

South Dakota Military And Veterans Benefits The Official Army Benefits Website

South Dakota Military And Veterans Benefits The Official Army Benefits Website

Form St 8 Download Fillable Pdf Or Fill Online Exemption Certificate For Sales And Use Tax South Carolina Templateroller

Form St 8 Download Fillable Pdf Or Fill Online Exemption Certificate For Sales And Use Tax South Carolina Templateroller

South Dakota Military And Veterans Benefits The Official Army Benefits Website

South Dakota Military And Veterans Benefits The Official Army Benefits Website

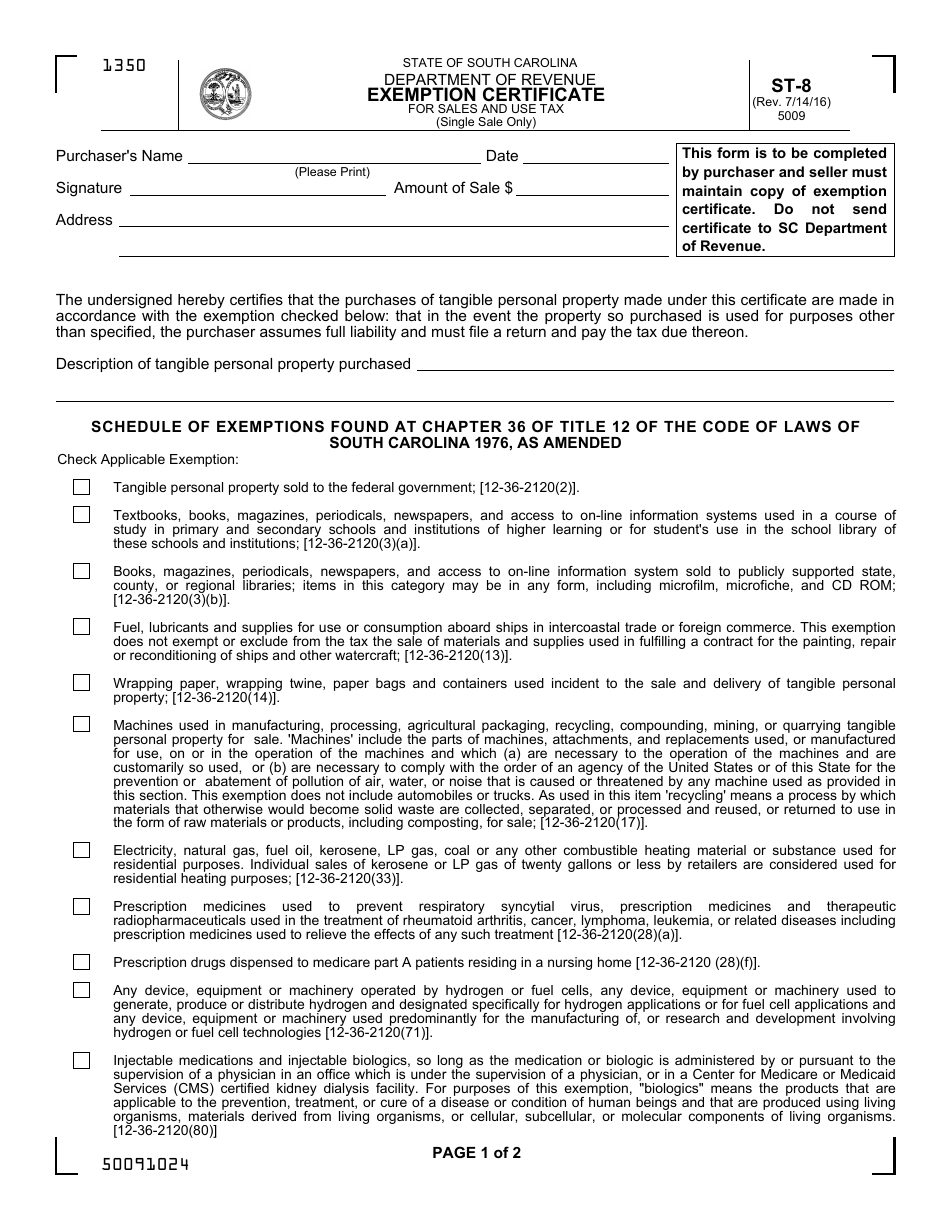

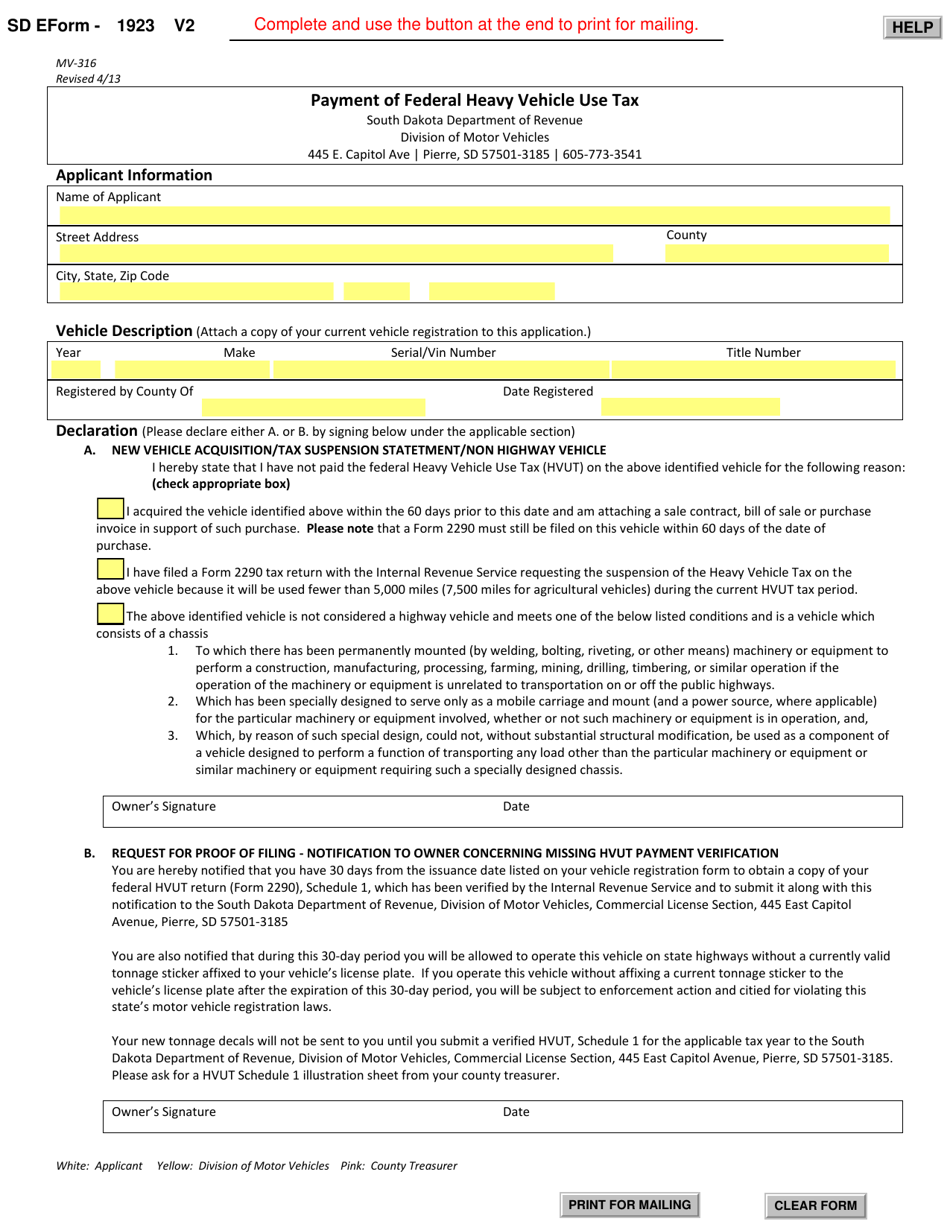

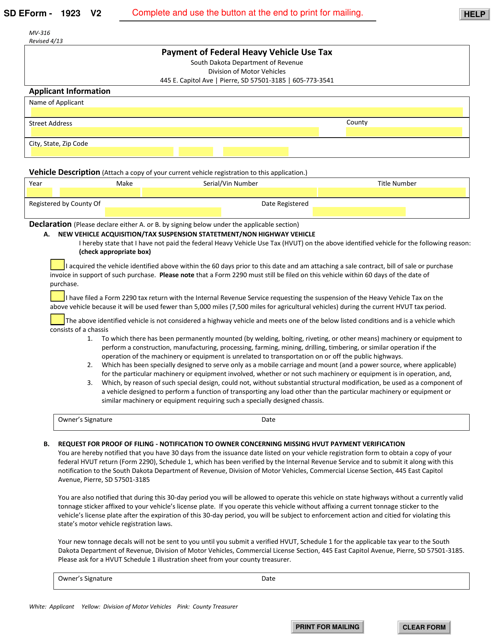

Sd Form 1923 Mv 316 Download Fillable Pdf Or Fill Online Payment Of Federal Heavy Vehicle Use Tax South Dakota Templateroller

Sd Form 1923 Mv 316 Download Fillable Pdf Or Fill Online Payment Of Federal Heavy Vehicle Use Tax South Dakota Templateroller

Sd Form 1923 Mv 316 Download Fillable Pdf Or Fill Online Payment Of Federal Heavy Vehicle Use Tax South Dakota Templateroller

Sd Form 1923 Mv 316 Download Fillable Pdf Or Fill Online Payment Of Federal Heavy Vehicle Use Tax South Dakota Templateroller

Military Retirees Retirement Military Retirement Military

Military Retirees Retirement Military Retirement Military

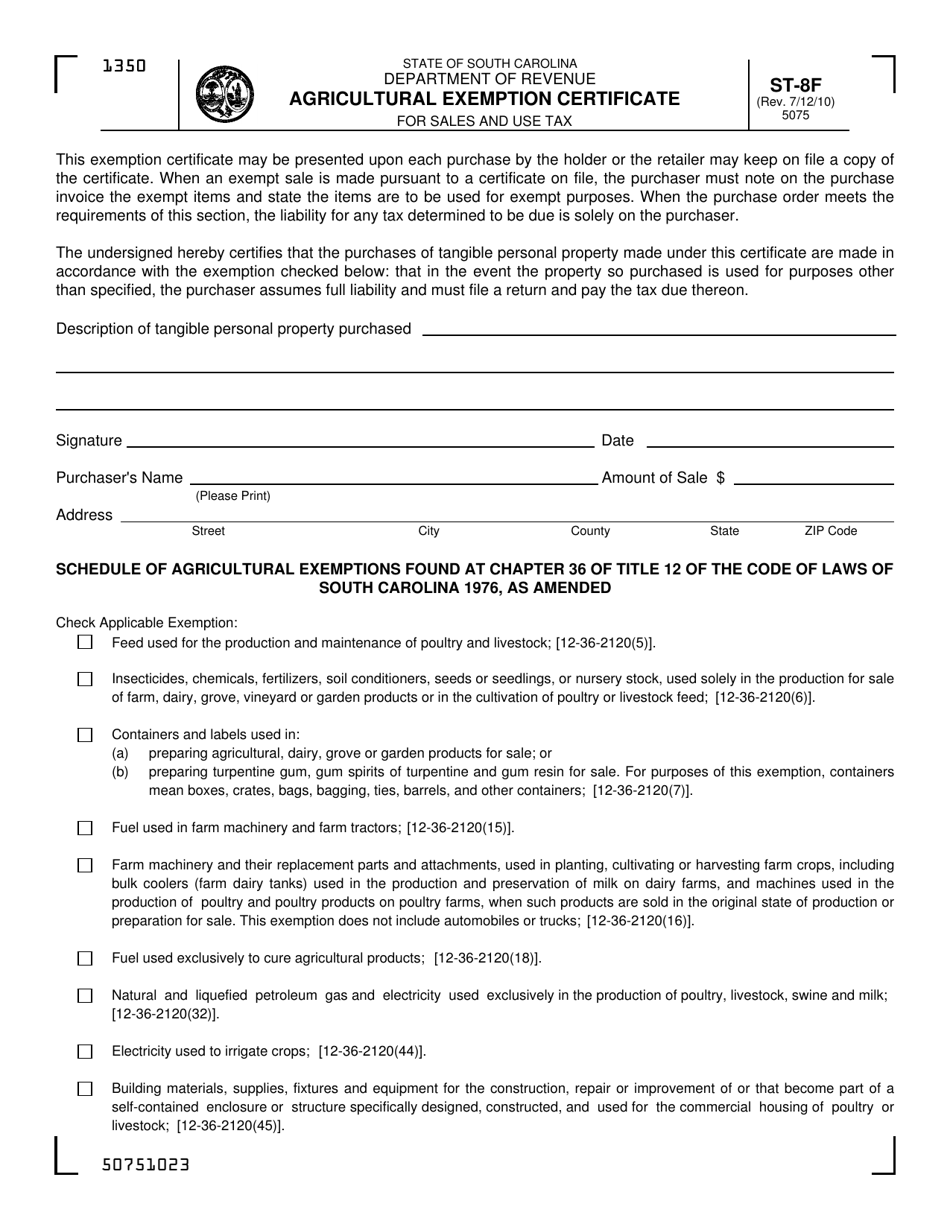

Download Instructions For Form St 8f Agricultural Exemption Certificate For Sales And Use Tax Pdf Templateroller

Download Instructions For Form St 8f Agricultural Exemption Certificate For Sales And Use Tax Pdf Templateroller

Relief Programs South Dakota Department Of Revenue

Relief Programs South Dakota Department Of Revenue

Download Instructions For Form St 8f Agricultural Exemption Certificate For Sales And Use Tax Pdf Templateroller

Download Instructions For Form St 8f Agricultural Exemption Certificate For Sales And Use Tax Pdf Templateroller

States That Don T Tax Military Retirement Pay Military Benefits Military Retirement Pay Military Retirement Military Benefits

States That Don T Tax Military Retirement Pay Military Benefits Military Retirement Pay Military Retirement Military Benefits

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home