How To Find Property Tax In Maricopa County

Property taxes are paid to the county treasurers office. E-Check payments will be accepted for current taxes only.

Making Sense Of Maricopa County Property Taxes And Valuations

Annually the tax rate is calculated based on the tax levy for each taxing authority and.

How to find property tax in maricopa county. Welcome to Maricopa County Planning and Development Departments Geographic Information Systems GIS homepage. PO Box 52133 Phoenix AZ 85072-2133 Account. Please make payments with the following payee information.

33-1902 an owner of a residential rental property in Maricopa County must register certain information relating to the property and its ownership with the Maricopa County AssessorALL owners of residential rental properties must register their. See what the tax bill is for any Maricopa County AZ property by simply typing its address into a search bar. You can use the Arizona property tax map to the left to compare Maricopa Countys property tax to other counties in Arizona.

Then multiply that amount by the tax rate. The taxes can be figured by dividing the limited net assessed value by 100. See Maricopa County AZ tax rates tax exemptions for any property the tax assessment history for the past years and more.

You can fill out the Real Property Update Mailing Address PDF DocuSign Version or Mobile Home Mailing Address Update PDF. Your Parcel Number Examples. Visit the Maricopa County Treasurers Office website type in your Assessors Parcel Number APN and click on your tax bill to find districts or jurisdictions taxing your property with a comparison to last years taxation.

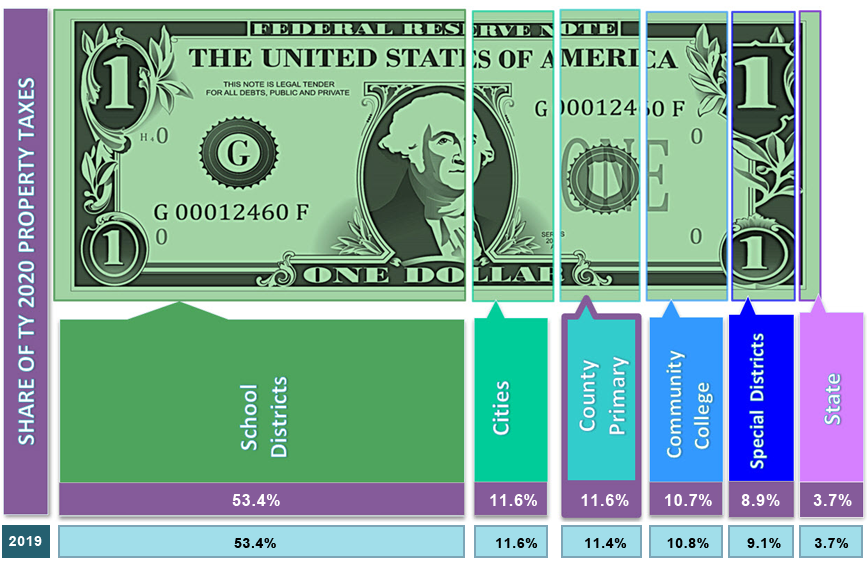

You can see that Maricopa County takes a cut as do local school districts and colleges the library and the fire department. To get an idea of where your property tax money might go take a look at the breakdown of property taxes in Avondale Arizona. Enter the address or street intersection to search for and then click on Go.

You can allocate 85 136000 160000 of the purchase price to the house and 15 24000 160000 of the purchase price to the land. The latest real estate tax assessment on the property was based on an assessed value of 160000 of which 136000 was for the house and 24000 was for the land. Maricopa County Treasurer Address.

Property in Arizona is valued and classified in each individual county by the county assessor with the exception of centrally valued properties such as airlines railroads and mines. This represents the difference between the current year assessment and the prior year assessment as defined in the form of a percentage. Please allow 5-7 business days for the payment to post to the Treasurers database.

Your areas property tax levy can be found on your local tax assessor or municipality website and its typically represented as a percentagelike 4. Enter the Assessor Parcel Number APN to search for and then click on Go. Maricopa County AZ Property Tax information.

This site was created to help you more quickly and easily locate the various services data ordinances and maps developed and administered by the. Enter the property owner to search for and then click on Go. Annually cities school districts special taxing districts and Maricopa County establish their own tax levy or the amount of taxes that will be billed.

You can get to this parcel summary from our website by clicking the ViewPay Tax Bill button on the parcel information you see on the Assessors Office website. The Maricopa County Treasurers Office collects and distributes property taxes. Perform a free Maricopa County AZ public tax records search including assessor treasurer tax office and collector records tax lookups tax departments property and real estate taxes.

Do not include city or apartmentsuite numbers. Contact the county treasurer where the property is located for payment options and online services. Annually the Maricopa County Assessor determines the Full Cash and Limited Property values used to determine the assessed values on the tax bill calculations.

The assessed value is divided by 100 and multiplied by the tax rate set on the third Monday in August annually determines the property tax billed in September. Pima County collects the highest property tax in Arizona levying an average of 161400 081 of median home value yearly in property taxes while Greenlee County has the lowest property tax in the state collecting an average tax of 30300 046 of median home value per year. Free Maricopa County Property Tax Records Search.

Taxes Maricopa County Assessor S Office

Taxes Maricopa County Assessor S Office

Real Estate Contract Real Estate Contract Real Estate Buying Selling Real Estate

Real Estate Contract Real Estate Contract Real Estate Buying Selling Real Estate

First Time Home Buyers Tips And Advice In 2020 In 2020 First Time Home Buyers Real Estate Marketing Fixed Rate Mortgage

First Time Home Buyers Tips And Advice In 2020 In 2020 First Time Home Buyers Real Estate Marketing Fixed Rate Mortgage

A Lot Of People Will Wait To Get A Tax Refund And Then Use That For A Down Payment On A New Home Which Is A Great Strategy And Not Tax

A Lot Of People Will Wait To Get A Tax Refund And Then Use That For A Down Payment On A New Home Which Is A Great Strategy And Not Tax

5943 E Calle Del Norte Phoenix Az 85018 Redfin Del Norte Sale House Norte

5943 E Calle Del Norte Phoenix Az 85018 Redfin Del Norte Sale House Norte

Right Now Its A Vacation Spot Soon It Ll Be Home I M Coming For You Arizona I Have Fallen For You Sun City Arizona Vacation Spots Best Places To Retire

Right Now Its A Vacation Spot Soon It Ll Be Home I M Coming For You Arizona I Have Fallen For You Sun City Arizona Vacation Spots Best Places To Retire

Carnation Dairy 1950s Phoenix Az Central And Indian School We Went Here With Mom And Grandma For Black Walnut I Arizona Cross Country Road Trip Willis Tower

Carnation Dairy 1950s Phoenix Az Central And Indian School We Went Here With Mom And Grandma For Black Walnut I Arizona Cross Country Road Trip Willis Tower

The Future Of Housing Rises In Phoenix Residential Real Estate House Flippers Vacation Home

The Future Of Housing Rises In Phoenix Residential Real Estate House Flippers Vacation Home

Installment Payment Plan Agreement Template Inspirational Partial Payment Installment Agreement Form Contract Template Payment Agreement Letter Templates

Installment Payment Plan Agreement Template Inspirational Partial Payment Installment Agreement Form Contract Template Payment Agreement Letter Templates

The U S Homeless Population Mapped Vivid Maps Homeless People People In The Us Homeless

The U S Homeless Population Mapped Vivid Maps Homeless People People In The Us Homeless

Are You A Number Cruncher Free Mortgage Calculator Number Cruncher Mortgage Calculator

Are You A Number Cruncher Free Mortgage Calculator Number Cruncher Mortgage Calculator

Strawberry Az Payson Az Arizona Travel Northern Arizona

Strawberry Az Payson Az Arizona Travel Northern Arizona

Knock Homeswap Sell Your Az Home House Swap Arizona House Glendale Arizona

Knock Homeswap Sell Your Az Home House Swap Arizona House Glendale Arizona

State By State Guide To Taxes On Retirees Texas Retirement States Guide

State By State Guide To Taxes On Retirees Texas Retirement States Guide

Taxes Maricopa County Assessor S Office

Taxes Maricopa County Assessor S Office

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home