Maricopa County Public Real Estate Records

The Judicial Branch of Arizona in Maricopa County is dedicated to providing a safe fair and impartial forum for resolving disputes enhancing access to our services and providing innovative evidence based programs that improve the safety of our community and ensure the publics trust and confidence in. 5 rows NETR Online Maricopa Maricopa Public Records Search Maricopa Records Maricopa.

These records can include Maricopa County property tax assessments and assessment challenges appraisals and income taxes.

Maricopa county public real estate records. Non-Commercial Purpose Public Records Request. The use of public records for personal information not for profit. The filing date or year filed.

Maricopa County Public Records are any documents that are available for public inspection and retrieval in Maricopa County AZ. Maricopa County Planning and Development has no records of easements on individual lots that are not part of a recorded subdivision. The Assessor annually notices and administers over 18 million real and personal property parcelsaccounts with full cash value of more than 6075 billion in 2020.

The use of public records for sale or resale including. Arizona Maricopa County 111 S 3rd Ave Phoenix AZ 85003 Number. Recorded subdivisions may have easement information listed as part of the recorded plat.

Stephen Richer is the 30th Recorder of Maricopa County. The specific documents you want to receive. Many Public Records are available at local Maricopa County Clerks Recorders and Assessors Offices.

The Clerks Office can provide public access to the records of the actions of Superior Court. The Maricopa County Recorder of Deeds located in Phoenix Arizona is a centralized office where public records are recorded indexed and stored in Maricopa County AZ. The Maricopa County Assessors Office now offers electronic notices eNotices for your Notice of Valuation.

He was elected in November 2020 and took office January 2021. Welcome to Maricopa County the 4th populous county in the nation with over 13000 employees working together to continually improve residents quality of air environment public health human services animal shelters roads planning development elections courts parks and more. To obtain copies of public records by phone please call 602 37-CLERK or 602 372-5375.

Maricopa County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Maricopa County Arizona. Prior to his election as Recorder Stephen worked as a lawyer and business person. We would like to show you a description here but the site wont allow us.

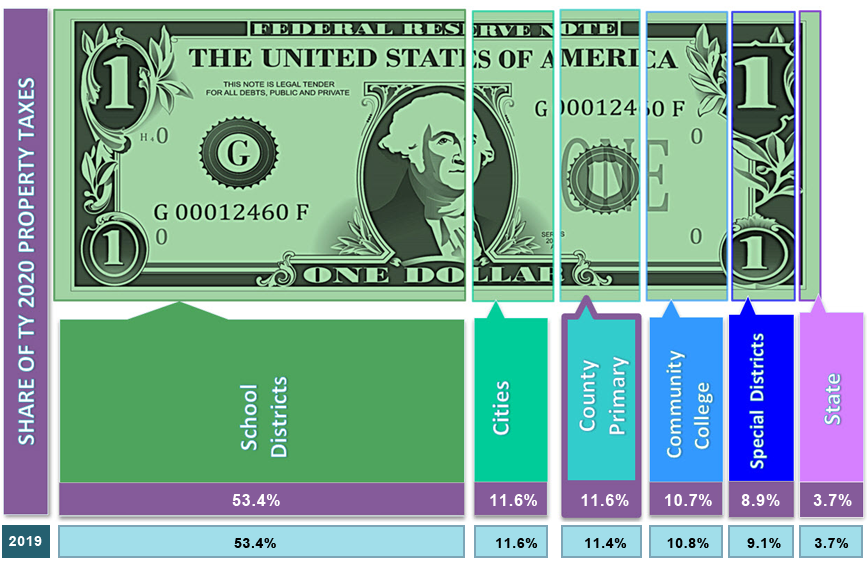

The Maricopa County Supervisors only control a small portion of the property tax bill. Arizona law defines records into two types. Please have the following information available with your request.

A surveyor real estate attorney or a schedule B from a title company may be able to assist you with the location of easements. There are many different types of records including Maricopa County birth records criminal records and business records. The primary responsibilities of the Clerk of the Superior Court include keeping and maintaining dockets recording each Superior Court session and preserving official court documents.

The Maricopa County Treasurer sends out the property tax bills for local jurisdictions this includes the county cities school districts special taxing districts and the state not just Maricopa County based on the assessed values and the calculated rates. These records can include land deeds mortgages land grants and other important property-related documents. Maricopa County Land Records are real estate documents that contain information related to property in Maricopa County Arizona.

The names of the parties at the time the case was filed. Commercial Purpose Public Records Request. The purpose of the Recorder of Deeds is to ensure the accuracy of Maricopa County property.

He was elected in November 2020 and took office January 2021. Records Maintained by External Agencies Maricopa County 602-372-5375 Search the Maricopa County Directory to find records including Marriage Licenses Divorce Decrees Passports Superior Court Records Property Assessor Assessors Parcel Numbers APN Property Tax Information Voter Registration and Cards Recorded Documents etc.

Read more »