Maricopa County House Tax Records

301 W Jefferson Street. The Maricopa County Treasurers Office is to provide billing collection investment and disbursement of public monies to special taxing districts the county and school districts for the taxpayers of Maricopa County so the taxpayer can be confident in the accuracy and accountability of their tax dollars.

Call the Maricopa County Treasurers Office.

Maricopa county house tax records. Your mailing address as of mid-August with the Treasurers Office should reflect where you will be in September as that is when the Treasurers Office will mail your tax bill whose first half will be due by October 1st. If it is determined that you are entitled to an exemption the taxable amounts paid may refunded or abated. Your Parcel Number Examples.

Eddie Cook Maricopa County Assessors Office. The Maricopa County Treasurer sends out the property tax bills for local jurisdictions this includes the county cities school districts special taxing districts and the state not just Maricopa County based on the assessed values and the calculated rates. PO Box 52133 Phoenix AZ 85072-2133 Account.

First half taxes are due Thursday October 1 2020 and delinquent after Monday November 2 2020If you miss the first half payment date you may pay the full year amount by December 31 without incurring interest. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. 33-1902 an owner of a residential rental property in Maricopa County must register certain information relating to the property and its ownership with the Maricopa County AssessorALL owners of residential rental properties must register their.

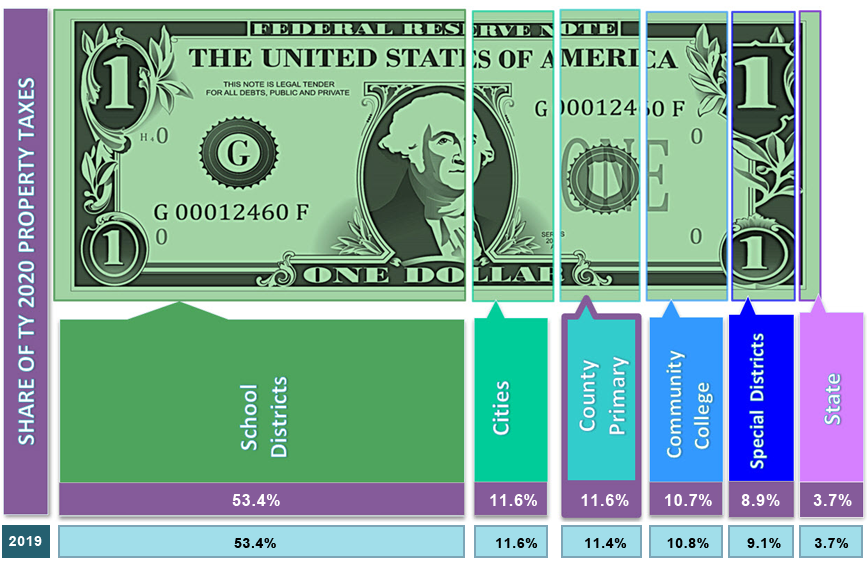

Maricopa County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Maricopa County Arizona. Median property values for single-family residential homes in Maricopa County rose for the ninth consecutive year and most property types increased for the 2022 tax year. The Maricopa County Supervisors only control a small portion of the property tax bill.

E-Check payments will be accepted for current taxes only. Please make payments with the following payee information. The Maricopa County Assessors Office is open to serve you by phone email and by appointment only at this time.

Please allow 5-7 business days for the payment to post to the Treasurers database. Pay the taxes owed. According to the Office of the Maricopa County Assessor this is the physical location of the property being represented by this bill.

It may take 8-12 weeks for a decision to be rendered after the release of the tax bills for the current tax year. Please note that the mailing address you have with the Assessors Office may not be the same as the mailing address for your tax bill maintained by the Treasurers Office. The number is composed of the book map and parcel number as defined by the Maricopa County Assessors Office.

These records can include Maricopa County property tax assessments and assessment challenges appraisals and income taxes. The Maricopa County Assessors Office is open to serve you by phone email and by appointment only at this time. In-depth Maricopa County AZ Property Tax Information.

Visit the Maricopa County Treasurers Office website type in your Assessors Parcel Number APN and click on your tax bill to find districts or jurisdictions taxing your property with. 301 W Jefferson Street. Maricopa County Treasurer Address.

The Assessor annually notices and administers over 18 million real and personal property parcelsaccounts with full. 301 West Jefferson St Suite 100 Phoenix Arizona 85003 602 506-8511 TTD 711 602 506-1102 Disclaimer. Second half taxes are due Monday March 1 2021 and delinquent after Monday May 3 2021.

Apartments saw the largest increase of 154 while commercial property increased the least by 21.

How Do I Search Maricopa County Assessor S Office

How Do I Search Maricopa County Assessor S Office

State Of Georgia Website Georgia Business People People

State Of Georgia Website Georgia Business People People

Examples Web Design Agency Web Development Agency City

Examples Web Design Agency Web Development Agency City

Keyglee Franchising Real Estate Investing Investing Real Estate

Keyglee Franchising Real Estate Investing Investing Real Estate

Taxes Maricopa County Assessor S Office

Taxes Maricopa County Assessor S Office

Joseph Bonanno Sr Tucson Police Investigate A Bombing At The Home Of Joe Bonanno In Tucson In 1968 Two Sticks Of D Joseph Bonanno Al Capone Organized Crime

Joseph Bonanno Sr Tucson Police Investigate A Bombing At The Home Of Joe Bonanno In Tucson In 1968 Two Sticks Of D Joseph Bonanno Al Capone Organized Crime

The Future Of Housing Rises In Phoenix Residential Real Estate House Flippers Vacation Home

The Future Of Housing Rises In Phoenix Residential Real Estate House Flippers Vacation Home

Maricopa County Assessor S Office

Maricopa County Assessor S Office

5315 N Wilkinson Road Paradise Valley 85253 Paradise Valley Mansions Valley

5315 N Wilkinson Road Paradise Valley 85253 Paradise Valley Mansions Valley

Arizona 1945 Joe Bonanno And His Son Salvatore Bill Bonanno Mafia Gangster Gangster Crime Family

Arizona 1945 Joe Bonanno And His Son Salvatore Bill Bonanno Mafia Gangster Gangster Crime Family

Real Property Records Placer County List Of Jobs Job Hunting

Real Property Records Placer County List Of Jobs Job Hunting

Clyde Dinnell Was An Involved In Land And Securities Fraud Clyde Was Sentenced To 18 Months In Prison And Fined Organized Crime Superior Court Maricopa County

Clyde Dinnell Was An Involved In Land And Securities Fraud Clyde Was Sentenced To 18 Months In Prison And Fined Organized Crime Superior Court Maricopa County

Maricopa County Assessor S Office

Maricopa County Assessor S Office

Real Estate Contract Real Estate Contract Real Estate Buying Selling Real Estate

Real Estate Contract Real Estate Contract Real Estate Buying Selling Real Estate

Property Tax Costs Official Website Surprise Arizona

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home