What Is The Property Tax Rate For Maricopa County

The median property tax also known as real estate tax in Maricopa County is 141800 per year based on a median home value of 23860000 and a median. Primary and secondary property taxes would then be paid on every 100 of this AV amount 11642 100 11642 Multiply 11642 by the property tax rate to reach the primary and secondary property taxes paid.

Maricopa County Assessor S Office

Maricopa County Assessor S Office

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Maricopa County Tax Appraisers office.

What is the property tax rate for maricopa county. The Maricopa County Treasurers Office hereby disclaims liability for any damages direct or indirect arising from use of or reliance upon this information. Property tax rates in Pima County are the second highest of any county in Arizona. The median property tax in Maricopa County Arizona is 1418 per year for a home worth the median value of 238600.

Computing Arizonas Property Tax Say that the current tax rate on homes in Maricopa County is 13 of full cash value or 13 of assessed value. The Maricopa County Supervisors only control a small portion of the property tax bill. The LPV of 116424 would be multiplied by 10 to reach the AV of 11642.

Rates vary by city and school district though. The median property tax on a 23860000. 301 West Jefferson Street Phoenix Arizona 85003 Main Line.

If the taxes are not paid in full within 13 months an advertising fee of 5 or 500 whichever is greater is assessed and during the sixteenth month the Treasurers Office offers a tax lien ON THE PROPERTY for sale. 10039107 5150233 4713325 4485414 3338330. The Maricopa County Treasurers Office is to provide billing collection investment and disbursement of public monies to special taxing districts the county and school districts for the taxpayers of Maricopa County so the taxpayer can be confident in the accuracy.

The property owner may appeal this decision within 30 days to the Maricopa County Board of Supervisors. The Maricopa County Board of Supervisors only control a small. Relationship Between Property Values Taxes.

Starting in Tax Year 2015 Proposition 117 and ARS. MARICOPA COUNTY ARIZONA 2020 TAX LEVY TABLE OF CONTENTS Note. The number is composed of the book map and parcel number as defined by the Maricopa County Assessors Office.

The largest county in Arizona Maricopa County is home to the city of Phoenix and surrounding cities like Mesa Chandler and Glendale. This includes the county city school districts special taxing districts and the state not just Maricopa County based on the assessed values and the calculated rates. To calculate property taxes paid.

Recommended Settings Adobe Reader available free of charge from Adobe Systems is required to view some content on this site. Maricopa County provides a variety of full and partial exemptions like exemption for property of widows widowers and disabled persons that are subtracted from the assessed value giving the propertys taxable value. The Maricopa County Treasurer sends out the property tax bills for local jurisdictions.

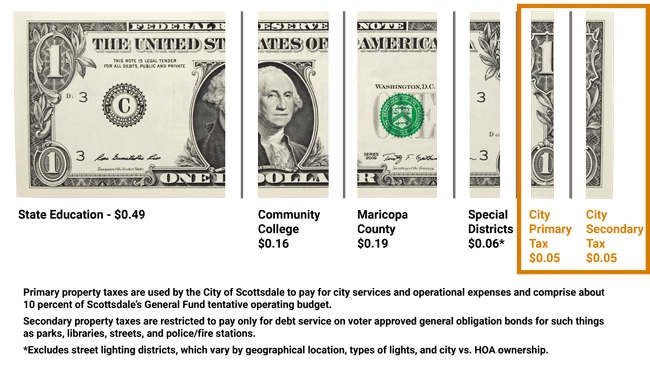

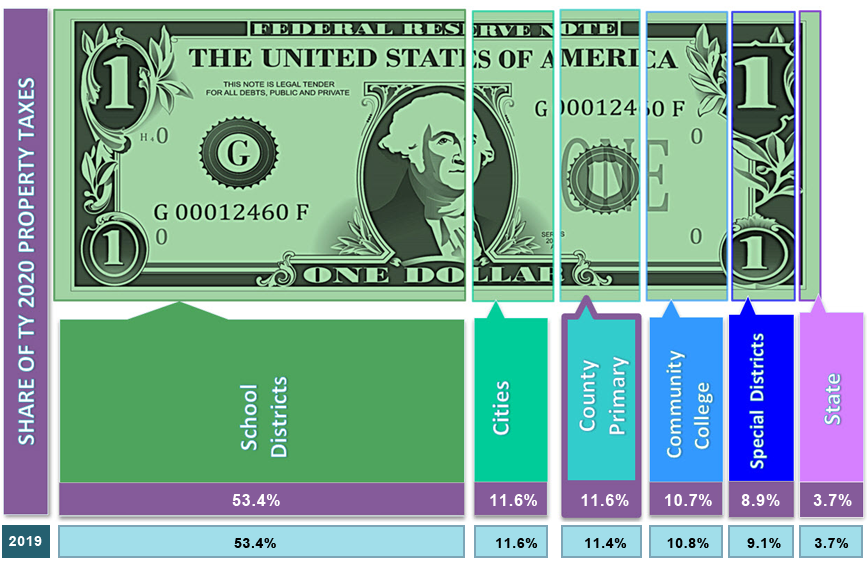

Maricopa County collects on average 059 of a propertys assessed fair market value as property tax. No School No School. County Controlled Property Taxes make up only 11 of Total Property Taxes.

Interest is assessed BY STATE LAW at 16 per annum prorated monthly. According to the Office of the Maricopa County Assessor this is the physical location of the property being represented by this bill. So if your home is assessed with a Full Cash Value of 200000 and your property tax rate was 13 then youd.

The School District taxes are the largest portion of the property taxes followed by cities the community college districts special districts and the State. Property tax is calculated by adding the primary and the secondary tax amounts which result from multiplying the taxable value to the coresponding dollar per 100 of assessed. The median property tax on a 23860000 house is 140774 in Maricopa County.

Arizona is ranked 874th of the 3143 counties in the United States in order of the median amount of property taxes collected. The average effective tax rate in the county is just 061. About Maricopa County Maricopa County is the nations 4th largest county in terms of population.

42-11001 Subsection 7b now requires using the Limited Property Value Net Assessed Value in determining and levying primary and secondary property taxes. In addition we notify the Maricopa County Treasurers Office which will assess a civil penalty against the property owner that is equal to the amount of the State Aid to Education Property Tax Credit given to the property in the prior year.

Maricopa County Assessor S Office

Maricopa County Assessor S Office

Maricopa County Assessor S Office

Maricopa County Assessor S Office

Countywide Property Tax Rates Approved News Pinalcentral Com

Countywide Property Tax Rates Approved News Pinalcentral Com

Taxes Maricopa County Assessor S Office

Taxes Maricopa County Assessor S Office

Property Tax Rate Changes In Maricopa County Greater Phoenix Arizona

Property Tax Rate Changes In Maricopa County Greater Phoenix Arizona

Maricopa County Assessor S Office

Maricopa County Assessor S Office

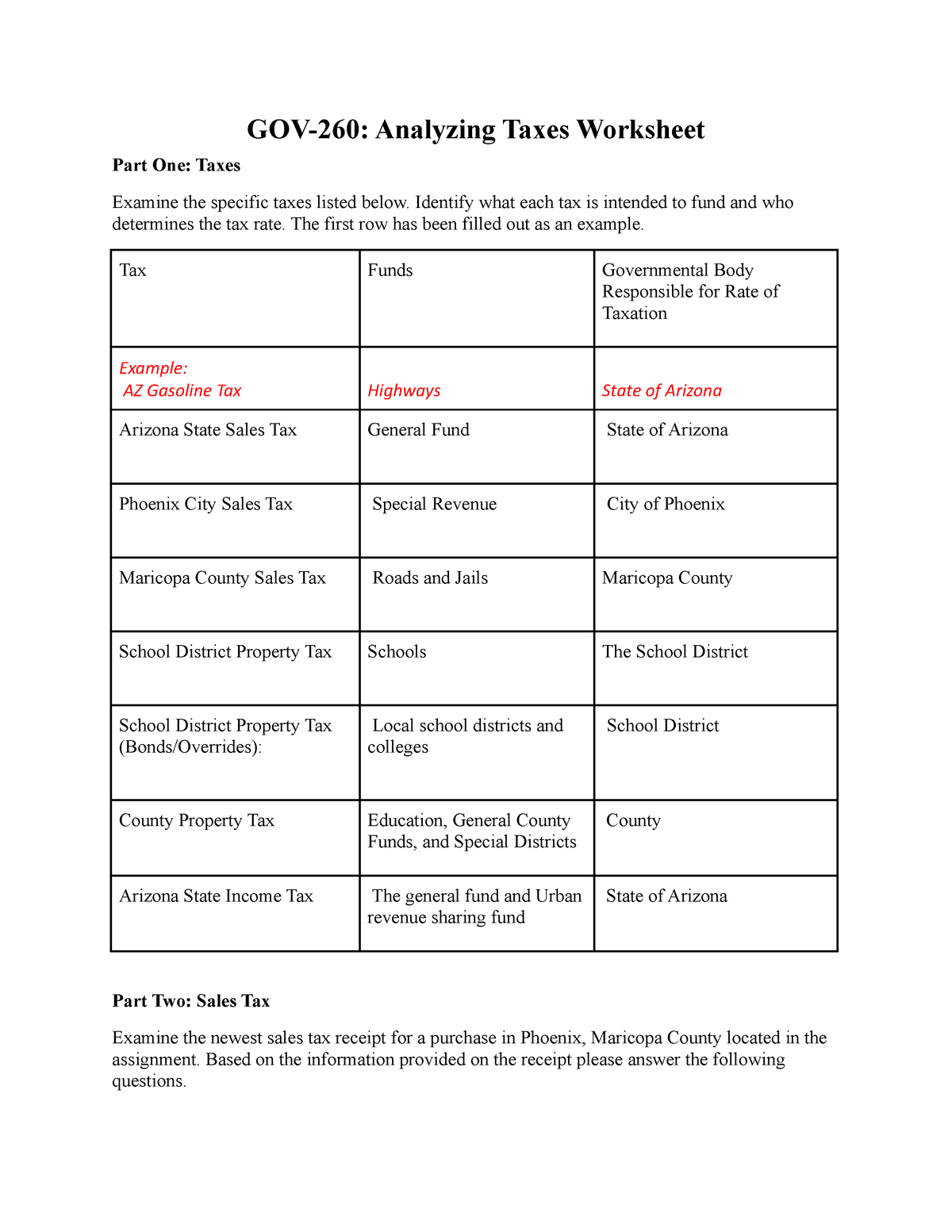

Analyzing Tax Worksheet 1 Gcu Studocu

Analyzing Tax Worksheet 1 Gcu Studocu

Maricopa County Assessor S Office

Maricopa County Assessor S Office

Maricopa County Assessor S Office

Maricopa County Assessor S Office

Https Www Maricopa Gov Documentcenter View 52906 Tax Levy 2019 Pdf

Https Www Maricopa Gov Documentcenter View 53249 Tax Rate 2019 Pdf

Rodney Glassman S Op Ed Shows He Doesn T Understand Assessor S Role

Rodney Glassman S Op Ed Shows He Doesn T Understand Assessor S Role

City Of Scottsdale Truth In Taxation Notice

City Of Scottsdale Truth In Taxation Notice

Making Sense Of Maricopa County Property Taxes And Valuations

Maricopa County Assessor S Office

Maricopa County Assessor S Office

Making Sense Of Maricopa County Property Taxes And Valuations

Making Sense Of Maricopa County Property Taxes And Valuations

Fountain Hills Property Tax Information Fountain Hills Az Official Website

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home