Property Tax Assessor Maricopa County Az

Our focus remains to provide property owners and residents of Maricopa County with fair and equitable valuations. 301 W Jefferson Street Phoenix AZ 85003.

Annually the Maricopa County Assessor determines the Full Cash and Limited Property values used to determine the assessed values on the tax bill calculations.

Property tax assessor maricopa county az. Statement From Assessor Eddie Cook. Ready for your site-built or. The Maricopa County Assessors Office is open to serve you by phone email and by appointment only at this time.

Form 140PTC provides a tax credit of up to 502. Staff members are proud to serve the community and work with individuals in Maricopa County. There are no fees for submitting your property tax filings.

55690 W IVORY Rd 65 Maricopa AZ 85139 49500 MLS 6223653 Great property with 33 acres. For property located in Maricopa County only. The Maricopa County Assessors Office is open to serve you by phone email and by appointment only at this time.

301 West Jefferson Street Phoenix Arizona 85003 Main Line. Senior Value protection offers citizens the opportunity to freeze their property value for a period of time primarily based on income age and residency. To freeze application year Limited Property Value of a Primary Residence owned by seniors based on income age and residency.

The Senior Value Protection Program is part of the Assessors Valuation Relief Programs Division. Second half taxes are due Monday March 1 2021 and delinquent after Monday May 3 2021. To claim a property tax credit.

The Maricopa County Assessors Office is open to serve you by phone email and by appointment only at this time. The Maricopa County Assessors Office is open to serve you by phone email and by appointment only at this time. 301 W Jefferson Street Phoenix AZ 85003.

It is important to note that this program does not freeze your property TAXES it freezes the taxable portion of your property VALUE. The Maricopa County Assessors Office is open to serve you by phone email and by appointment only at this time. Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the taxpayer.

Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the taxpayer. Residential rental property is defined as property that is used solely as leased or rented property for residential purposes ARS. 301 W Jefferson Street Phoenix AZ 85003.

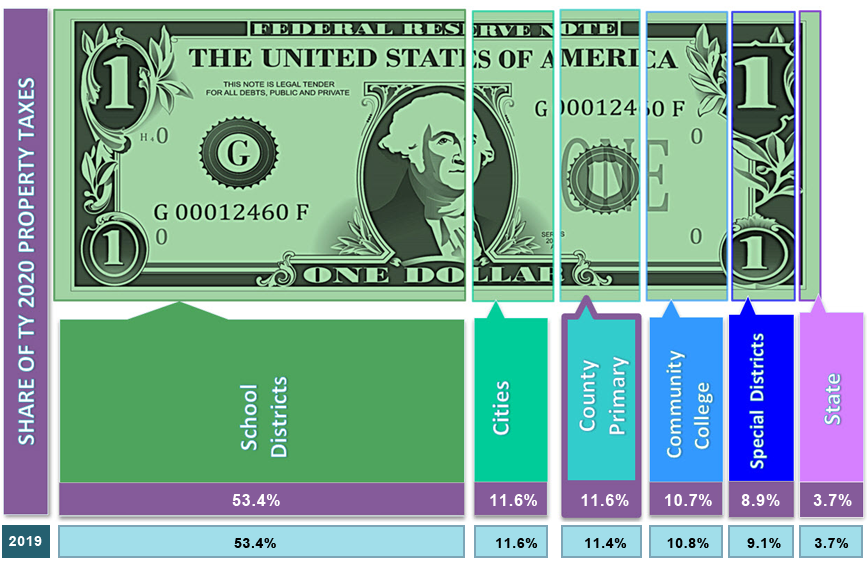

Annually cities school districts special taxing districts and Maricopa County establish their own tax levy or the amount of taxes that will be billed. Annually the tax rate is calculated based on the tax levy for each taxing. I vow that our team at the Maricopa County Assessors Office will continue to handle adversity with integrity and respect.

33-1901Residential rental property must be registered with the County Assessor according to Arizona law ARS. Interest on delinquent property tax is set by Arizona law at 16 percent simple and accrues on the first day of each month including weekends and holidays and cannot be waived. 301 W Jefferson Street Phoenix AZ 85003.

301 W Jefferson Street Phoenix AZ 85003. 33-1902The intent of this law is to maintain an accurate record of rental properties so that towns cities and the county can enforce laws. Maricopa County Assessor Purpose.

According to the Office of the Maricopa County Assessor this is the physical location of the property being represented by this bill.

How Do I Pay My Taxes Maricopa County Assessor S Office

How Do I Pay My Taxes Maricopa County Assessor S Office

Making Sense Of Maricopa County Property Taxes And Valuations

Making Sense Of Maricopa County Property Taxes And Valuations

How Do I Search Maricopa County Assessor S Office

How Do I Search Maricopa County Assessor S Office

Maricopa County Assessor Denies 70 Year Old Veteran Senior Valuation Benefit Arizona Daily Independent

Maricopa County Assessor Denies 70 Year Old Veteran Senior Valuation Benefit Arizona Daily Independent

Taxes Maricopa County Assessor S Office

Taxes Maricopa County Assessor S Office

Maricopa County Assessor S Office Mcassessor Twitter

Maricopa County Assessor S Office Mcassessor Twitter

Taxes Maricopa County Assessor S Office

Taxes Maricopa County Assessor S Office

Maricopa County Treasurer Flora Resigns In Disgust With Board Of Supervisors Arizona Daily Independent

Maricopa County Treasurer Flora Resigns In Disgust With Board Of Supervisors Arizona Daily Independent

Making Sense Of Maricopa County Property Taxes And Valuations

Maricopa County Assessor S Office

Maricopa County Assessor S Office

Who Is Maricopa County Assessor Paul Petersen Adoption Fraud Investigation Azfamily Com

Who Is Maricopa County Assessor Paul Petersen Adoption Fraud Investigation Azfamily Com

Maricopa County Assessor S Office

Maricopa County Assessor S Office

Maricopa County Assessor S Office

Maricopa County Assessor S Office

Maricopa County Assessor Pay Property Tax Property Walls

Maricopa County Assessor Pay Property Tax Property Walls

Maricopa County Assessor S Office

Maricopa County Assessor S Office

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home