Brown County Ohio Property Tax Records

Assessor Auditor Brown County Auditor Brown County Administration Building Suite 181 800 Mt. OR2015-16025 and on the advice of counsel the Brown County Appraisal District is no longer able to provide preliminary information regarding mineral.

Telephone - 937 378-6705 or toll free 800 229-6177.

Brown county ohio property tax records. Please contact the Brown County 9-1-1 Coordinator at 325-643-1985 to verify that the property address is correct before establishing utility or mail service. The next Six Year Re-evaluationactual site viewing of all property by our appraisers for Brown County will be 2024 payable 2025. The Brown County Engineers Office makes no warranty or guarantee of any kind implied or expressed as to the completeness sequence accuracy timeliness or content of the data provided herein.

Dear Taxpayer As County Auditor it is my job to see that the funds of Brown County are spent legally and that the tax revenues are distributed properly. Brown County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Brown County Ohio. Please contact the Recorders Office at 937-378-6478 with any questions or issues.

The Brown County Recorders Office is here to assist you in land records requests. Get Property Records from 1 Treasurer Tax Collector Office in Brown County OH Brown County Treasurers Office 800 Mount Orab Pike Georgetown OH 45121 937-378-6177 Directions Brown County Building Departments. Persons relying on the information contained herein do so at their own risk.

Jill and her team strive to efficiently and effectively manage the finances of the Brown County government. Brown County Treasurers have traditionally served as the local tax collector. The Recorder is responsible for preserving and protecting the countys land records and related documents.

Jill Hall is your Brown County Auditor. Office Hours - 800 am. However tighter budgets and increasing demands at the local level have changed the duties of the County Treasurer and increased.

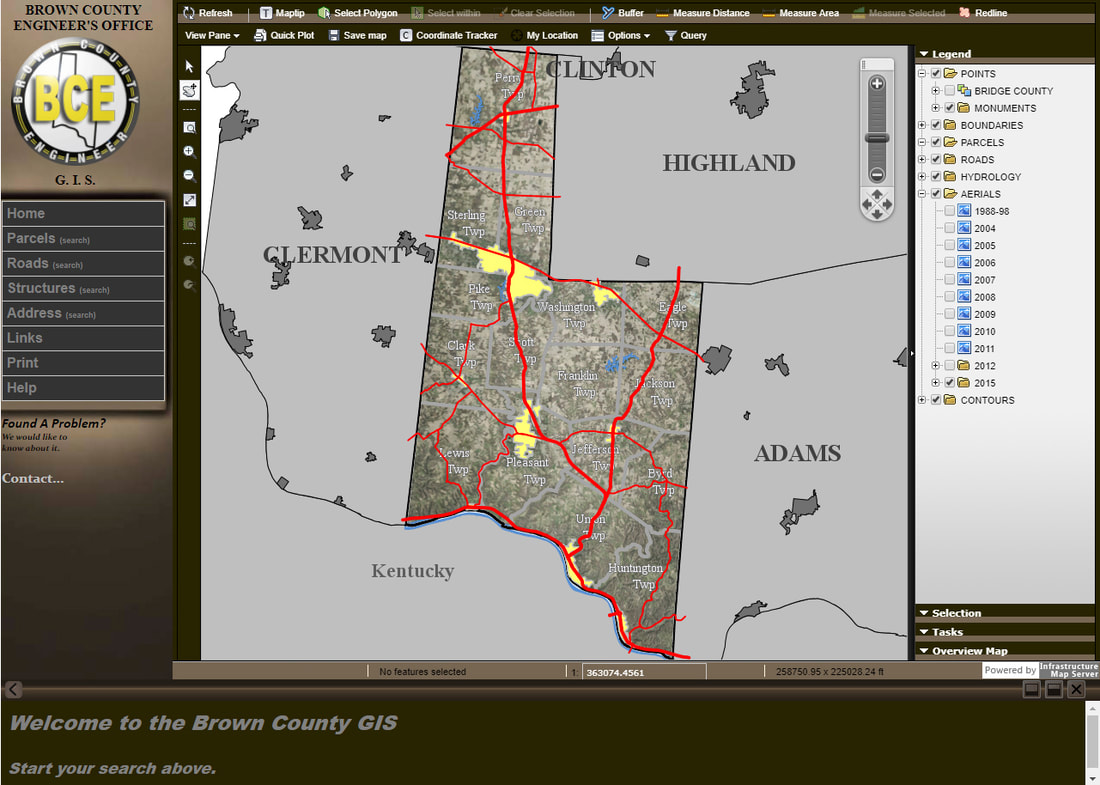

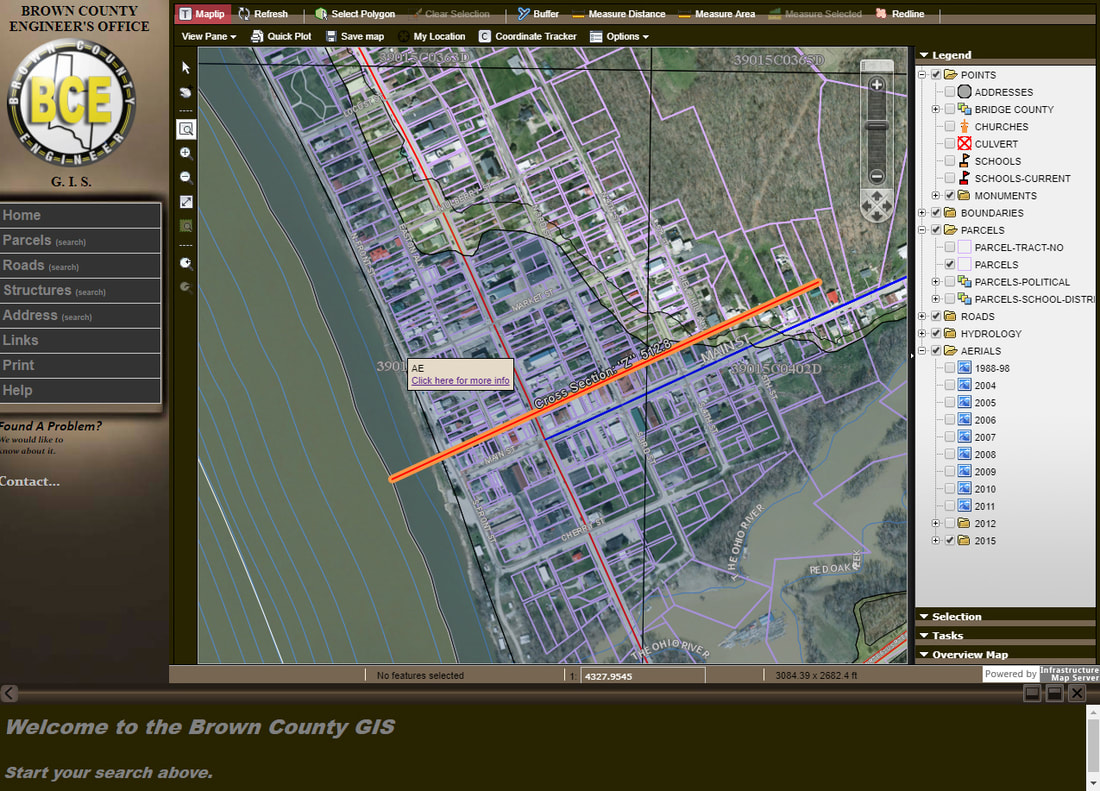

Welcome to the Brown County GIS. The next Triennial Re-AppraisalState evaluation using sales for Brown County is 2021 payable 2022. Click here for the latest information on motor vehicle titling and registration.

BROWN COUNTY TAX MAP25 Veterans BlvdGeorgetown OH 45121937-378-3494Open 800 - 400 Monday - Friday Teresa RenshawMichelle DuncansonMickenzie Scott. Find property records for Brown County The median property tax in Brown County Ohio is 117700 All of the Brown County information on this page has been verified and checked for accuracy. Pursuant to Tex Atty Gen.

Brown County Treasurer Address. Please enable cookies and return to the home page. Real and personal property taxes are collected by the.

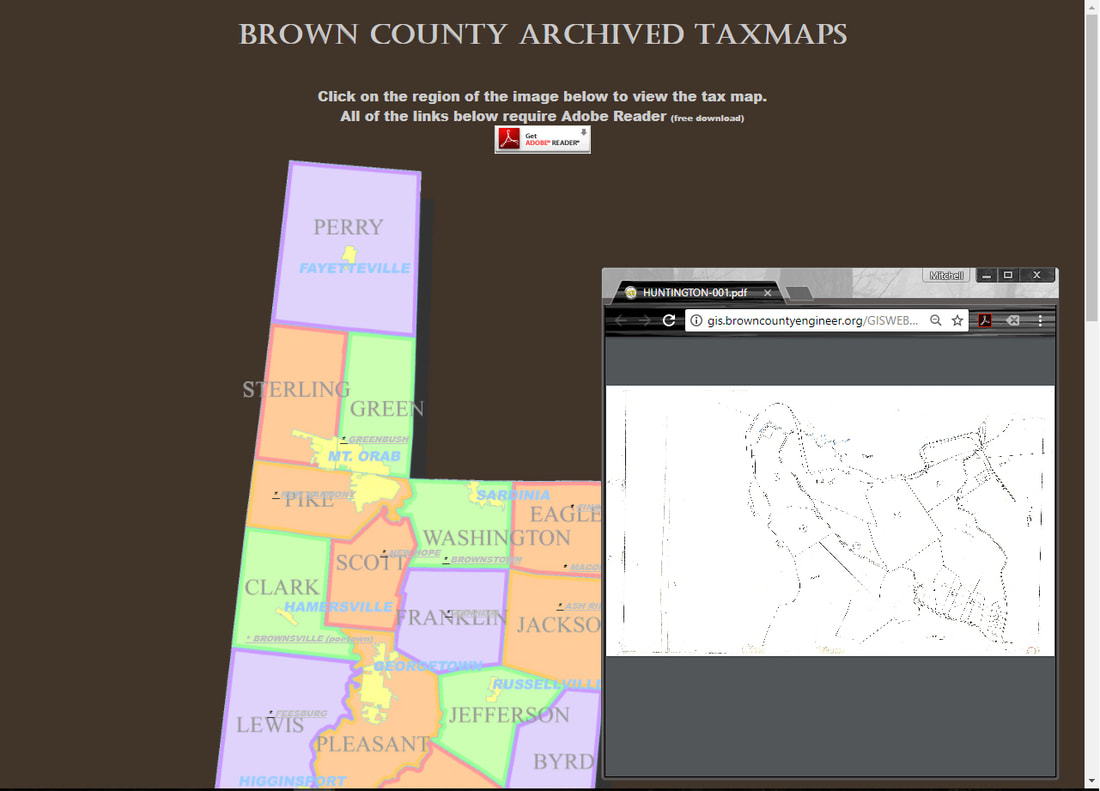

If any of the links or phone numbers provided no longer work. The Brown County Auditor Office is open normal business hours from 730 am to 400 pm Monday through Friday. Ohio law mandates that the County Engineer create and organize the tax maps of his community.

ViewPay Property Taxes Online. Orab Pike Georgetown OH 45121 Phone. Although results of your search will include owner name Brown Countys privacy policy does not allow search by owner name on this free site.

To search our records online please visit our Document Search Site. Search for Brown County property property taxes assessments permit data and sales history by parcel number owner name or address. Renew Your Vehicle Registrations Online.

In-depth Brown County OH Property Tax Information In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Property Tax Records Click this link to view the Brown County Treasurers Property Tax Records Page. These tax maps must be updated on a daily basis to reflect changes in property ownership.

We are constantly adding history to our online index and images. The Treasurer invests unspent revenue in interest-bearing commericial funds that generate added revenue for the county. However you can search by name and other parcel properties using the Register of Deeds system by visiting Brown County offices or by submitting an Open Records Request form.

Start your search above. The purpose of the County Recorder is to keep and maintain land records that are current legible and easily accessible. 8 AM - 4 PM.

The Brown County Recorders Office strives to make as many records available to you as possible online. Suite 171 Georgetown Ohio 45121. These records can include Brown County property tax assessments and assessment challenges appraisals and income taxes.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home