California Income Tax Due Date 2021

When the due. 2021 first quarter estimated tax payments due for individuals and corporations.

Extended Gstr 9 Due Date Annual Return For Fy 2019 20 Due Date Dating Day

Extended Gstr 9 Due Date Annual Return For Fy 2019 20 Due Date Dating Day

The due date for providing the 2020 Form 1095-B and 2020 Form 1095-C has been extended from February 1 2021 to March 2 2021.

California income tax due date 2021. Most tax refunds associated with e-filed returns are issued within 21 days. The Treasury Department and Internal Revenue Service announced that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15 2021 to May 17 2021. Form 1099-NEC Nonemployee Compensation is used beginning with tax year 2020 to report nonemployee compensation.

Do not include Social Security numbers or any personal or confidential information. 1040-ES PDF Instructions included March 15 2021. Taxpayers should pay their federal income tax due by May 17 2021 to avoid interest and penalties.

2020 fourth quarter estimated tax payments due for individuals. Individual taxpayers can also postpone federal income tax payments for the 2020 tax year due on April 15 2021 to May 17 2021 without penalties and interest regardless of the amount owed. Yes California has postponed the income tax filing due date for individuals those who file forms 540 540 2EZ and 540NR including PIT composite returns for the 2020 tax year from April 15 2021 to May 17 2021.

Important Dates for Income Tax. 540-ES Form PDF 540-ES Instructions. This extension is generally granted.

When the due date falls on a weekend or holiday the deadline to file and pay without penalty is extended to the next business day. Your payment is still due by May 17 2021. The IRS will be providing formal guidance in the coming days.

The due date to file and pay taxes and fees owed to the California Department of Tax and Fee Administration CDTFA originally due between December 15 2020 and April 30 2021 has been extended by three months. Detailed California state income tax rates and brackets are available on this page. Pay the amount you owe by May 15 to avoid penalties and interest.

The extension from April 15 to May 17 will give more time to taxpayers to prepare their tax returns and so to pay the taxes owed. What Is Extended for 2021 On March 17 2021 the IRS officially extended the federal income tax filing deadline from April 15 to May 17. California Tax Deadline 2021.

An extension to file your tax return is not an extension to pay. That means taxpayers who owe money dont need to file a tax return until this date and if they owe money they dont need to make payments until then. The extended deadline is Sept.

The tax filing deadline for California state income tax returns has been extended to May 17 along with the federal tax filing deadline. You must file by October 15 2021. The IRS urges taxpayers who are due a refund to file as soon as possible.

You must estimate and pay the fee by the 15th day of the 6th month of the current tax year. No form is required. Individual taxpayers can also postpone federal income tax payments for the 2020 tax year due on April 15 2021 to May 17 2021 without penalties and interest regardless of the amount owed.

You must file and pay by May 17 2021. Sacramento The Franchise Tax Board FTB today announced that consistent with the Internal Revenue Service it has postponed the state tax filing and payment deadline for individual taxpayers to May 17 2021. Tax Deadline Extension.

The deadline is October 15 2021. California grants you an automatic extension to file your state tax return. This postponement applies to individual taxpayers including individuals who pay self-employment tax.

Individual taxpayers who pay their 2020 taxes in full by May 17 2021 will not be subject to penalties and interest. This relief does not apply to estimated tax payments that are due on April 15 2021. Send us your payment if you are not ready to file your return.

This postponement applies to individual taxpayers including individuals who pay self-employment tax. The deadline for California taxpayers to file their 2020 personal income tax returns and pay their taxes to the federal and state governments has been extended to. Extended due date for 2020 Partnership and LLC Income Tax returns for calendar year filers.

15th day of the 4th month after the close of your tax year.

What Is Casdi Employer Guide To California State Disability Insurance Gusto

What Is Casdi Employer Guide To California State Disability Insurance Gusto

Net Income Definition Example Net Income Economics Lessons High School Income

Net Income Definition Example Net Income Economics Lessons High School Income

California Income Tax Returns Can Be E Filed Now Start Free

California Income Tax Returns Can Be E Filed Now Start Free

This Is A California Form That Can Be Used For Family Law Dissolution Legal Separation Annulment Within Judicial Legal Separation Family Law Divorce Help

This Is A California Form That Can Be Used For Family Law Dissolution Legal Separation Annulment Within Judicial Legal Separation Family Law Divorce Help

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

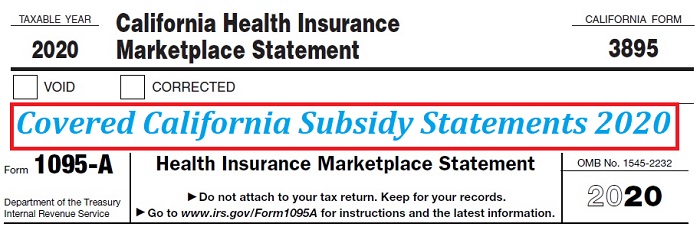

Covered California Ftb 3895 And 1095a Statements 2020

Covered California Ftb 3895 And 1095a Statements 2020

Irs Form 540 California Resident Income Tax Return

Irs Form 540 California Resident Income Tax Return

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

2020 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

2020 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

2020 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

2020 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

E Filing Income Tax Return Through Net Banking Filing Mantra Efiling Of Income Tax Return Login Income Tax Return Income Tax Tax Return

E Filing Income Tax Return Through Net Banking Filing Mantra Efiling Of Income Tax Return Login Income Tax Return Income Tax Tax Return

Pin On Irs Tax Debt Relief Tax Settlement

Pin On Irs Tax Debt Relief Tax Settlement

W8 Form California 8 Five Signs You Re In Love With W8 Form California 8 In 2021 W2 Forms Power Of Attorney Form Business Strategy

W8 Form California 8 Five Signs You Re In Love With W8 Form California 8 In 2021 W2 Forms Power Of Attorney Form Business Strategy

How To File Your Taxes After Working Remotely Trading Stocks And Surviving 2020 In 2021 Tax Remote Work Irs Taxes

How To File Your Taxes After Working Remotely Trading Stocks And Surviving 2020 In 2021 Tax Remote Work Irs Taxes

California State Tax Information Support

California State Tax Information Support

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home