Property Held In Revocable Trust

The type of trust and its provisions impact how a trust is treated in a divorce. This can include money investments land or buildings.

Free Living Trust Forms Sample Living Trust Form Template 10 Samples Examples Revocable Living Trust Living Trust Doctors Note Template

Free Living Trust Forms Sample Living Trust Form Template 10 Samples Examples Revocable Living Trust Living Trust Doctors Note Template

Along with mutual funds bank accounts.

:max_bytes(150000):strip_icc()/dotdash_Final_Trust_Aug_2020-01-6b0686cb892a40589605baeeef79a183.jpg)

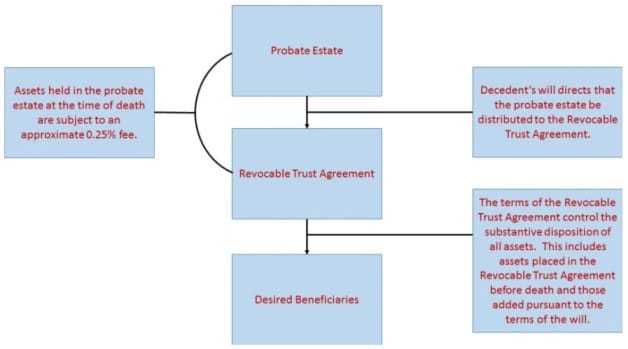

Property held in revocable trust. There are many types of Trust but in the case of a self-declared Trust the settlor and trustee are the same person. The benefit of using an estate-planning attorney rather than doing it alone helps ensure the. That being said a trust can become an issue in a divorce if it was funded with marital property.

However to accommodate the use of inter vivos trusts as an estate planning tool Fannie Mae provides an exception for property held by inter vivos revocable trusts created by credit-qualifying borrowers. You might get pushback from a lender when you try to refinance a property held by a trust. This means that although the home technically belongs to the trust you have the ability to take back the property at any time.

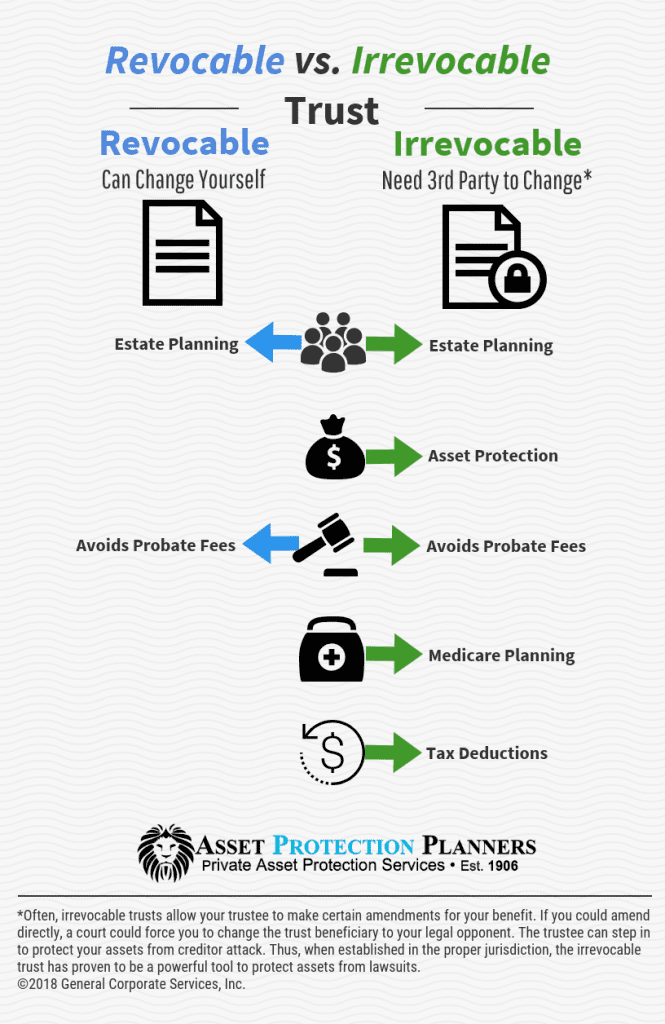

Create a revocable trust with the assistance of an estate-planning attorney in New York. Trusts can be revocable meaning you can make changes to them or irrevocable unable to be changed. Land trusts are a form of revocable trust only used for real property and the main benefit is privacy.

Transfers of real estate into a revocable living trust require recording a new deed in the name of the trust in the locality where the real estate is located. Revocable trusts do not provide protection from US. A revocable trust is a part of estate planning that manages and protects the assets of the grantor as the owner ages.

In addition Fannie Mae normally deems property in which no borrower has an ownership interest as ineligible collateral. 2 A mortgage or other loan against the property shouldnt cause a problem because mortgages follow the property. In a revocable trust you have the right to dissolve the trust at any time.

Property Put in a Revocable Trust Almost any property owned by the grantor can go into a revocable trust including real estate on which there is a mortgage. Home in a Revocable Trust You should put your house in a trust if you want to avoid probate. There is no creditor protection for a property held in a US.

Fiduciary has authority to sell property on such terms as in the opinion of the fiduciary are most advantageous to those interested in the estate. It creates issues with the ownership of your property however. One asset might be a trust which is an estate-planning tool that handles how property is owned during life and distributed after death.

Restrictions on Revocable Trusts The central difficulty that is present when you attempt to refinance property placed inside of a revocable trust is the fact that according to the legal definition. But if you the trustee are granted the power to encumber the property take out a mortgage within the trust you should be able to negotiate the refinance. A trust is a relationship where the property is held by one party for the benefit of the other.

With a revocable living trust where the grantor retains the present right to possess and live on the property the property will retain both the 25000 exemption and the SOH cap. Actually it does not make one bit of difference whether the trust sells the property and distributes net gain or distributes the property in-kind and the beneficiary sells the property. If its a typical revocable trust also called a living trust whoever set it up called the grantor trustor or settlor is deemed to be the owner as long as that person is alive.

If you dissolve the trust then you must file a new deed at the county courthouse that lists you rather than the trust as the property owner. The trustee will then hold that Trust property for the benefit of the beneficiaries. Your attorney can review your trust to determine if it is drafted to allow you this right.

The trust can be amended or revoked as the grantor desires and is included in. You can modify dissolve or rescind a revocable type and it saves your beneficiaries the lengthy process and cost of probate. Selling a house held in revocable trust after death Carl wrote.

Exception Real property held in a revocable trust is not probate property and the ExecutorAdministrator has no power to sell such property. If a spouse established a revocable trust and funded it with assets that were marital property regardless of whos name is on the title then it would be considered marital property. Estate tax to the grantor but certain planning can be included to reduce or defer this tax where a surviving spouse is inheriting the trust property.

Holding Real Estate In A Trust Or An Llc Deeds Com

Holding Real Estate In A Trust Or An Llc Deeds Com

Assignment Of Promissory Note Template Sample Notes Template Promissory Note Revocable Trust

Assignment Of Promissory Note Template Sample Notes Template Promissory Note Revocable Trust

Suze Orman S Must Have Documents Suze Orman Revocable Trust Personal Finance Budget

Suze Orman S Must Have Documents Suze Orman Revocable Trust Personal Finance Budget

Https Www Elgacu Com Assets Files Trust Faqs Pdf

.png) Can I Refinance A Property That S Held In A Living Trust

Can I Refinance A Property That S Held In A Living Trust

Trust Lawyer Near Me Trust Attorney In Los Angeles Ca Trust Lawyer Revocable Trust Trust

Trust Lawyer Near Me Trust Attorney In Los Angeles Ca Trust Lawyer Revocable Trust Trust

Owning A Home In A Revocable Living Trust Tarleton Law Firm

Owning A Home In A Revocable Living Trust Tarleton Law Firm

Revocable Living Trusts Bluffton Attorney Avoid Probate

Revocable Living Trusts Bluffton Attorney Avoid Probate

Revocable Vs Irrevocable Trusts Advantages And Disadvantages

Revocable Vs Irrevocable Trusts Advantages And Disadvantages

Reverse Family Tree Template Family Tree Template Revocable Living Trust Estate Planning

Reverse Family Tree Template Family Tree Template Revocable Living Trust Estate Planning

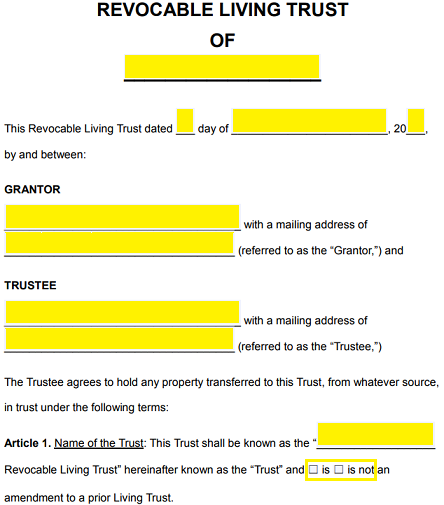

Free Revocable Living Trust Forms Pdf Word Eforms

Free Revocable Living Trust Forms Pdf Word Eforms

Free Living Trust Free To Print Save Download

Free Living Trust Free To Print Save Download

Learn The Differences Between Revocable And Irrevocable Living Trusts Revocable Living Trust Living Trust Revocable Trust

Learn The Differences Between Revocable And Irrevocable Living Trusts Revocable Living Trust Living Trust Revocable Trust

Free Indiana Revocable Living Trust Form Pdf Word Eforms Free Fillable Forms Revocable Living Trust Living Trust Revocable Trust

Free Indiana Revocable Living Trust Form Pdf Word Eforms Free Fillable Forms Revocable Living Trust Living Trust Revocable Trust

Revocable Trust How To Create A Real Estate Revocable Trust Download This Real Estate Revocable Trust Template Now Revocable Trust Templates Living Trust

Revocable Trust How To Create A Real Estate Revocable Trust Download This Real Estate Revocable Trust Template Now Revocable Trust Templates Living Trust

Printable Revocable Trust Template Revocable Trust Simplest Form Legal Forms

Printable Revocable Trust Template Revocable Trust Simplest Form Legal Forms

Free Revocable Living Trust Forms Pdf Word Eforms

Free Revocable Living Trust Forms Pdf Word Eforms

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home