Property Held In Trust Divorce

Therefore others most commonly children and loved ones can inherit after the surviving spouses death. That being said a trust can become an issue in a divorce if it was funded with marital property.

Lucille Ball And Desi Arnaz Trust Document Original Declaration Of Trust Signed By Desi Arnaz And Lucille Ball The 8 5 X Lucille Ball Lucille Famous Couples

Lucille Ball And Desi Arnaz Trust Document Original Declaration Of Trust Signed By Desi Arnaz And Lucille Ball The 8 5 X Lucille Ball Lucille Famous Couples

If marital property is placed in an irrevocable trust that trust cannot be changed and the assets in it cannot be removed and divided in the divorce.

Property held in trust divorce. If your Irrevocable Trust is the legitimate title holder legal owner of the property such third party property held by the Irrevocable Trust is not a marital asset therefore not subject to the equitable division of property by the divorcing spouses. They can arise in many circumstances and in divorce proceedings when spouses are unable to agree how their assets should be divided and how their housing and other needs are to be met the Court may have to decide how a trust should be treated. During the marriage this trust paid for certain expenses such as real estate taxes on the marital residence and when the couple divorced the husband Mark petitioned the court to have the.

Trusts can be used for asset protection gifting tax sheltering protection from creditors and more. The trust assets remain in the trust until after the death of the grantor when they are distributed to the beneficiaries in accordance with the trusts. A trustee can be.

A trust fund also just called a trust is a legal entity that. If you skip this important step your property may not go to the rightful inheritor after you pass and your beneficiaries will need to comply with the choice a probate court selects. The trust holds them to be transferred to your beneficiaries after your death and divorce does not change that.

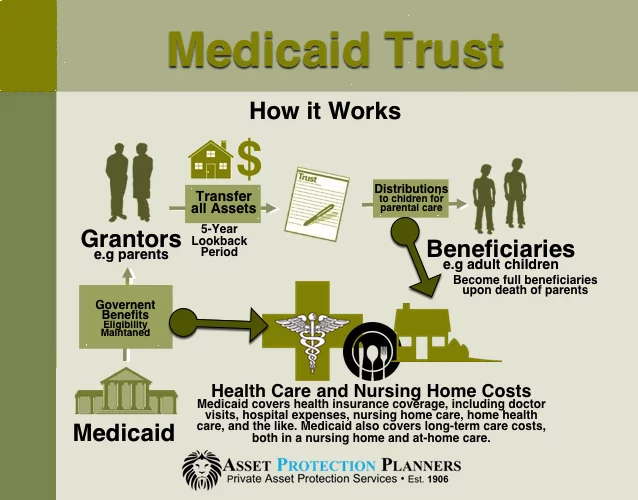

Financial trusts are one of the most complicated aspects of property division during divorce. Trust assets are not subject to probate increased tax liability and in this case claims from an ex-spouse during divorce proceedings. Part of your trust may be marital property.

2In other words if a creator has full access to the trust property so too will a creditor thereby allowing a. Marital property is subject to equitable distribution or division in a divorce. The trustee will then hold that Trust property for the benefit of the beneficiaries.

When you go through a divorce you must analyze all of your assets including property held in trust or corpus. Property Division in a Divorce Affects Property Held in Trust. You can take the property back into your ownership or the court can order this done prior to issuing a divorce judgment.

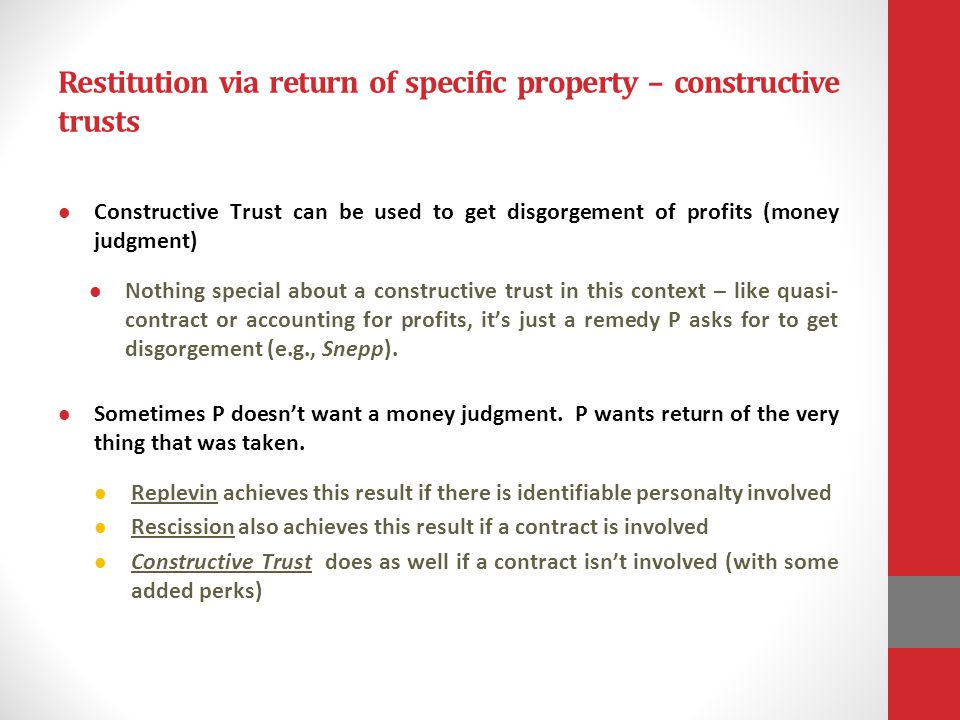

If a spouse established a revocable trust and funded it with assets that were marital property regardless of whos name is on the title then it would be considered marital property. When analyzing a trust in divorce an essential question to be answered is whether the trust is marital or separate property. If the trust is revocable you can undo it.

Your ex-spouse was once in a marriage with you not the trust. There are many types of Trust but in the case of a self-declared Trust the settlor and trustee are the same person. A trust is a relationship where the property is held by one party for the benefit of the other.

When it comes to a property settlement having a trust fund can make for a sticky financial situation. A claim against the property in your trust is like an ex-spouse claiming half of your neighbors real estate during your divorce. This is a trust you put in your will so that the surviving spouse can continue living in your property but the deceaseds share of the property is kept separate.

When you leave assets in a trust youll need to retitle them in the name for putting property in a trust. This can include money investments land or buildings. Although the Courts reasoning in Jones differed slightly from Rosenblum 32 the Court still affirmed the result in Rosenblumthat an interest in a discretionary distribution from a trust is not a property interest33 Arguably Jones also can be read more expansively to hold that only a vested remainder interest fully distributable at some point in time is property subject to allocation by a court.

Assets held in a revocable trust will be included in the creators estate at death because the creator can revoke or amend a revocable trust and will have complete access to the trust assets until death. Divorce forces spouses to consider every asset that can be counted as part of their union. In California which is a community property state a beneficiarys interest in a trust created by a third party is considered separate property and not subject to division in a divorce proceeding.

Mey the New Jersey Supreme Court held that a beneficiary spouses interest in a trust does not constitute property that is legally and beneficially acquired unless the beneficiary has acquired unimpaired control and totally free use and enjoyment of the trust assets. Trusts In divorce proceedings are an increasingly common issue in family law cases. However while the trust is considered separate property and not subject to division the California Probate Code provides if the trustee decides.

Read more »

:max_bytes(150000):strip_icc()/dotdash_Final_Trust_Aug_2020-01-6b0686cb892a40589605baeeef79a183.jpg)