Property Held In Trust Ontario

However in at least one Ontario case the court allowed a US. It can reduce a familys taxes by shifting income to members in.

The OCLs mandate is to represent the personal and property rights of minors and unborn children.

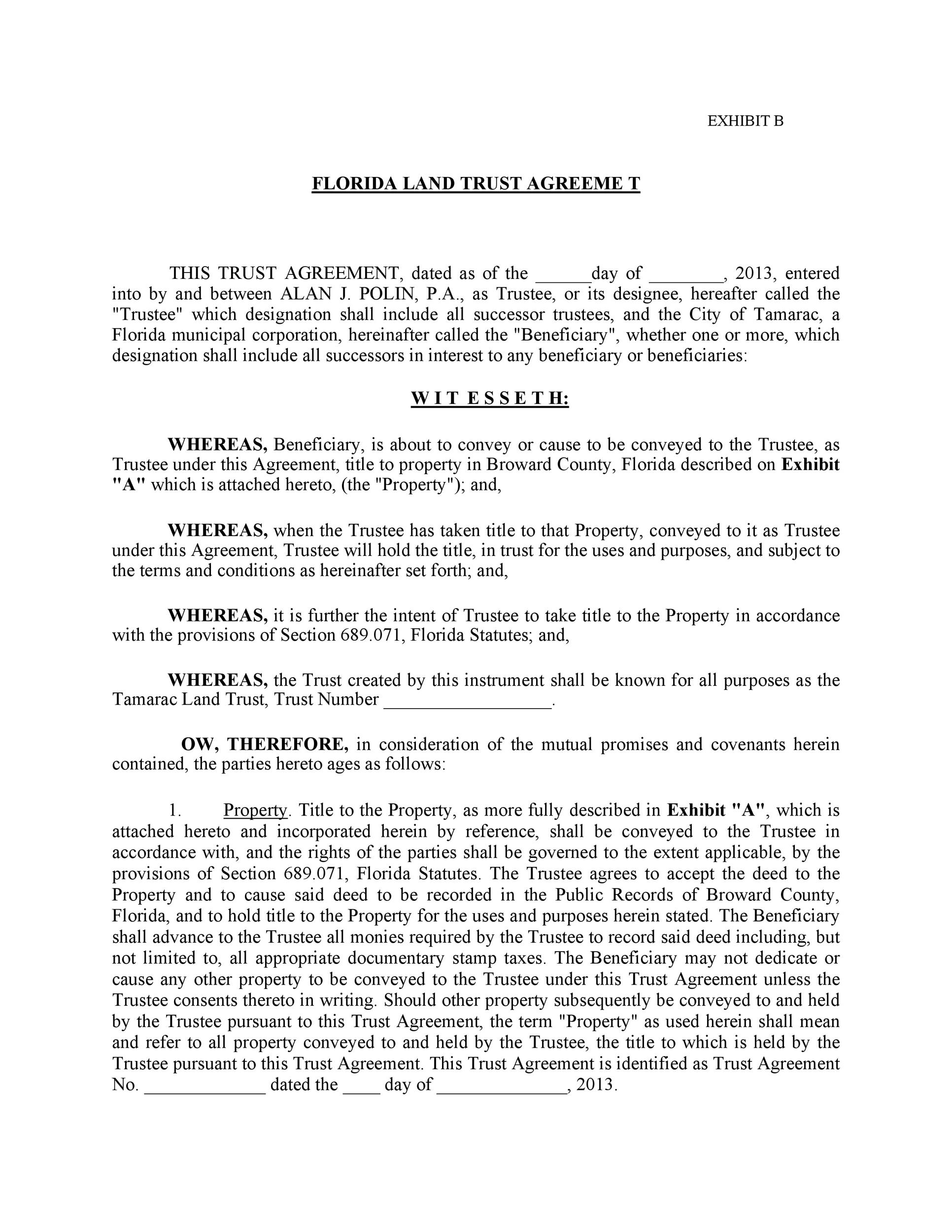

Property held in trust ontario. A trust is a vehicle for holding and passing on the family property. This can include money investments land or buildings. All property held in connection with a PRPP is required to be held in trust by the administrator on behalf of the plan members.

Trust Interests as Property In Ontario the problem arises from the remedial nature of the legislation and the very broad definition of property Subsection 4 1 of the FLA defines property in part as follows. Property rights include estate and trust matters such as challenges to the validity of a will applications to remove trustees and applications to vary the terms of a trust. There are many types of Trust but in the case of a self-declared Trust the settlor and trustee are the same person.

Supplementary documentation must be provided as set out below. Property means any interest present or future vested or contingent in real or personal property and includes. A trustee can be.

This allows the family member to benefit from the property but the property will also be protected from unwise decisions that the family member may make. The settlor trustee and beneficiary. The trustee will then hold that Trust property for the benefit of the beneficiaries.

You can add more property to the trust over time. There are several reasons that you would want to hold a property in living trust. Assets held in.

As the income from trust-held assets is taxable at Canadian trust tax rates living trusts are not as popular in Canada as they are in the US where the income is taxed at your personal income. A bare trustee also commonly referred to as a nominee holds registered title ownership to property for someone else and often this property is land. Reasons for Holding a Property in Trust.

The duty of a bare trustee is to convey legal title to the beneficial owner upon request. As a result a PRPP is generally treated as a trust for tax purposes the administrator is the trustee of that trust the members are the beneficiaries and the trust property is the property held in connection with the plan. A revocable or living trust allows you to maintain full legal control and ownership of the trust including the properties and assets until the time of your death.

The trust also shelters that property from certain unsecured creditors. Because the transfer of ownership is during your lifetime the trust assets do not form part of your estate and are not subject to probate. The decedents portion of the house would pass to a beneficiary outside probate if they formed a revocable living trust and titled their portion of the property in the name of the trust.

If the Decedent Had a Revocable Living Trust. This means you can addremove assets or properties anytime you want change beneficiaries and even dissolve the whole thing should your situation change. The first is to avoid a lengthy probate.

It is uncontroversial to state that interests in real property can be held personally and in trust under Ontario law. A conveyance involving trusts may be submitted for registration as an electronic document or tendered directly to the Land Registrar for processing and registration without preapproval from the Ministry of Finance ministry. For example property could be held in trust for a family member who is not financially competent.

When you establish a living trust also known as an inter vivos trust property ownership is passed immediately to your beneficiaries. In most circumstances where property or an account are left in joint tenancy with one child where there are other children of the parent the Court will presume that the surviving child into whose name title would go at law holds the property on a resulting trust unless that child can rebut the presumption and show that parent intended that child to take the property by right of survivorship to. Property to be held for the benefit of a beneficiary while protecting the property.

Trust company to apply for and receive an Ontario probate certificate where it was necessary to administer Ontario real property owned by the deceased on the basis that the trust company was not attempting to carry on business or hold itself out as an Ontario trust company but the appointed trustee needed to administer a non. The OCL is an office within the Ontario Ministry of the Attorney General. If the in-trust account represents an actual transfer of property to your childgrandchild or other related minor at the time the property is deposited to the account such that you are acting solely as the childs agent or guardian of hisher property the income from the account will be that of the child subject to the application of the.

Basically a trust is a relationship among three parties. Where a trust is involved the trustee or trustees hold legal title to the property that is the object of the trust with the beneficiaries having a beneficial interest. In this case that tenants share would go directly to the beneficiaries named in the trust documents without.

As such it typically serves at least one of two purposes. When dealing with a family loss the last thing they want to deal with is the distribution of property. A trust can be a useful estate planning tool for vacation property owners.

Https Ca Rbcwealthmanagement Com Documents 682561 682577 Living 2bfamily Trusts Pdf 715d7227 C1b8 48e5 948d 9e1b8a9f2b57

Free Trust Agreement Form Printable Real Estate Forms Real Estate Forms Legal Forms Real Estate Contract

Free Trust Agreement Form Printable Real Estate Forms Real Estate Forms Legal Forms Real Estate Contract

Trust Agreement Pdf Templates Jotform

Trust Agreement Pdf Templates Jotform

Https Www Osullivanlaw Com Wp Content Uploads 2020 02 2020 Advisory Estate And Trust Taxation Important Considerations Pdf

Unit 4 Completely And Incompletely Constituted Trusts Studocu

Unit 4 Completely And Incompletely Constituted Trusts Studocu

Living Trust Agreement Template Word Pdf

Living Trust Agreement Template Word Pdf

Deed Of Trust Template 100 Free To Print Save Download

Deed Of Trust Template 100 Free To Print Save Download

Https Www Nortonrosefulbright Com Media Files Nrf Nrfweb Knowledge Pdfs Trust Basics Pdf

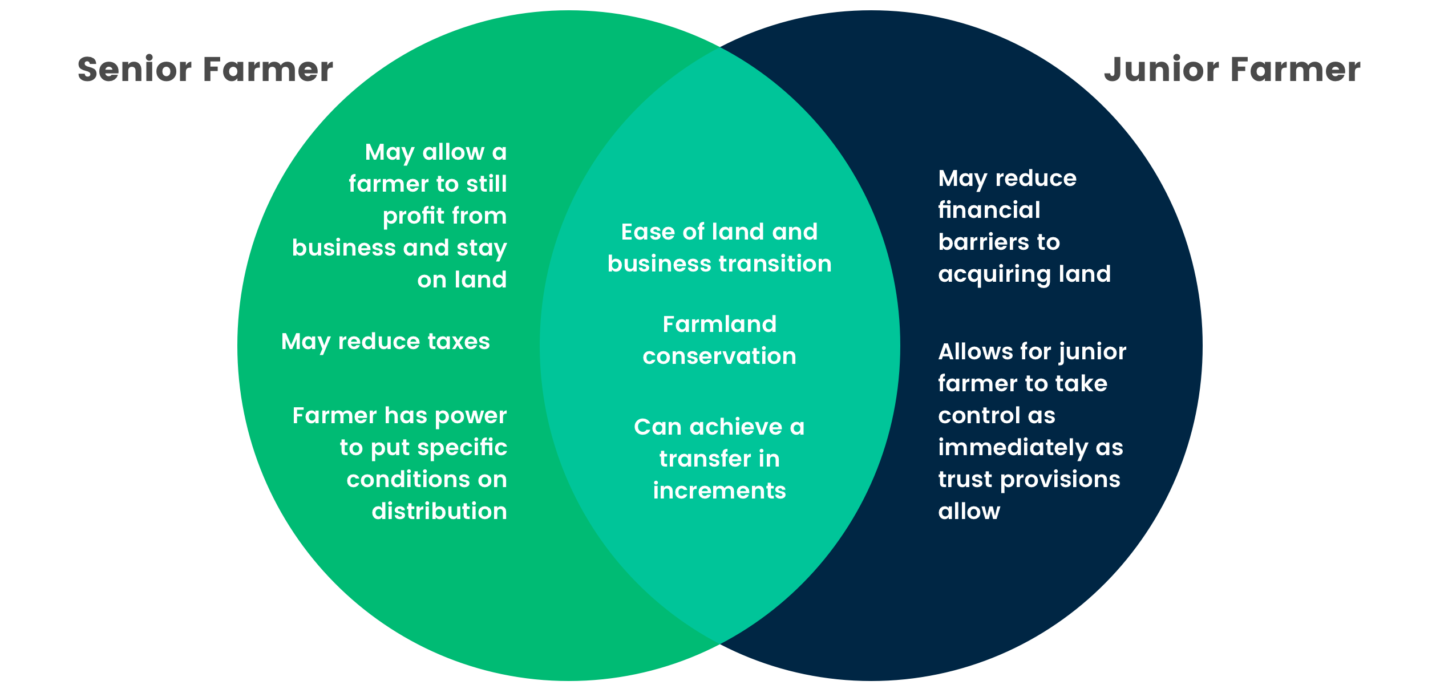

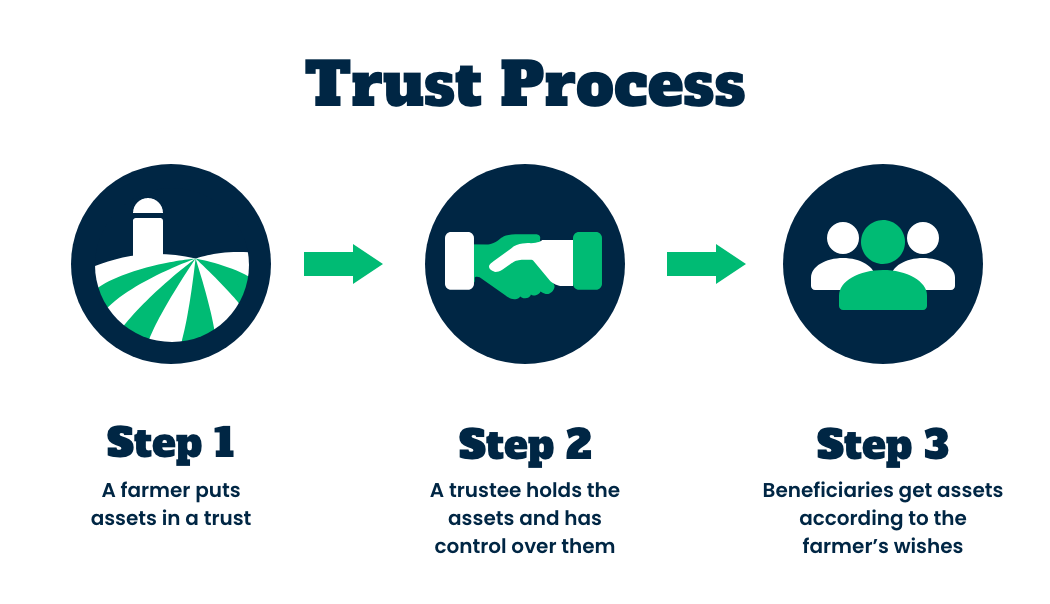

Trusts Farmland Access Legal Toolkit

Trusts Farmland Access Legal Toolkit

Advantages And Disadvantages Of Family Trusts Ioof

Advantages And Disadvantages Of Family Trusts Ioof

Trusts Farmland Access Legal Toolkit

Trusts Farmland Access Legal Toolkit

Land Trusts For Asset Protection And Home Privacy

Land Trusts For Asset Protection And Home Privacy

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home