Where Do I Pay My Personal Property Tax In Missouri

Any outstanding bills for personal property MUST be paid and the current year Declaration turned in to the assessors office to enroll. Paying Your Taxes Online.

Online No Tax Due System Information

Online No Tax Due System Information

Information and online services regarding your taxes.

Where do i pay my personal property tax in missouri. If playback doesnt begin shortly try restarting your device. You also need to contact the county Assessors office in the county you moved to. How to fill out personal property tax.

You need to contact the county Assessors office in the county you moved from and request to be removed from their Personal Property Assessment roles. The Collectors Office mails tax bills during November. License your vehicle in Cass County.

Find your personal property tax information. You will owe taxes to the county that you lived in on January 1. Pay your taxes online.

You will need your Tax ID number and your PIN number which are found on your statement mailed by the Greene County Collectors office. Louis Mo 63103 Monday Through Friday 8 AM - 5 PM Contact the Collector - Personal Property Tax and Real Estate Tax Department. Credit Card - 24 of the amount paid.

Get information about personal property taxes. You may also make payment at our 24 hour outdoor drop boxes located at the west entrance of the Carthage Courthouse or at the south entrance of the Courts Building located in Joplin. Share This Post With Your Neighbors.

Tap Here for Menu. Collector - Personal Property Tax and Real Estate Tax Department 314 622-4105 1200 Market Room 109 St. We collect over a quarter of a billion dollars each year and distribute the collections to nearly 40 local taxing districts such as schools.

Payments can be made in person at the courthouse in Carthage or the Jasper County Courts Building in Joplin. Use our online portal to Pay Taxes Online. The County Clerk uses their assessed values and the taxing district levies to calculate the tax bills.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. PAY BILL RECEIPTS. Installment Plan Payments You may pay your personal property taxes on a monthly basis.

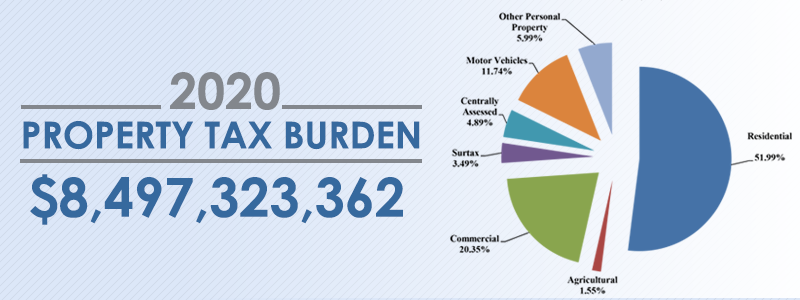

Conversely personal property is taxable in Missouri if it is owned by the spouse of that service member stationed outside the state of Missouri but whose state of legal residence is Missouri even if the property is located outside Missouri provided the residence of the spouse is. The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims. Your paid receipt will be mailed.

Its fast and secure. Paying taxes online takes just a few minutes. The Collectors office then sends out the bills.

Search Personal Property Tax Info. Taxes not paid in full on or before December 31 will accrue interest penalties and fees. Pay your bill online Clay County Missouri Tax.

Pay your Greene County Missouri Real Estate and Personal Property taxes online using this service. Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees. Charges for online payment are as follows.

Missouri Department of Revenue. PAY BILL RECEIPTS. PERSONAL PROPERTY TAXES Clay County Missouri Tax 2017-06-14T125229-0500.

You pay tax on the sale price of the unit less any trade-in or rebate. The Missouri Department of Revenue accepts online payments including extension and estimated tax payments using a credit card or E-Check Electronic Bank Draft. The Personal Property Department collects taxes on all motorized vehicles.

Visa Debit Card - 395. An acknowledgment is issued when your return is received and accepted. Vehicle Licensing in Cass County.

If you need an immediate receipt for license renewal do not pay online. If a tax bill is not received by December 1 contact the Collectors Office at 816-881-3232. E-Check is an easy and secure method allows you to pay your individual income taxes by bank draft.

Do I pay my property taxes if Im protestingappealing. The Assessors office assesses property both real estate and personal property. Personal property installment plans will begin in March of each year.

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Paying Your Taxes Online Jackson County Mo

Paying Your Taxes Online Jackson County Mo

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Https Dor Mo Gov Forms 426 Pdf

Online No Tax Due System Information

Online No Tax Due System Information

Missouri Property Tax Calculator Smartasset

Missouri Property Tax Calculator Smartasset

Missouri Car Registration Everything You Need To Know

Missouri Car Registration Everything You Need To Know

Https Dor Mo Gov Pdf Proptax Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home