Property Held In Irrevocable Trust

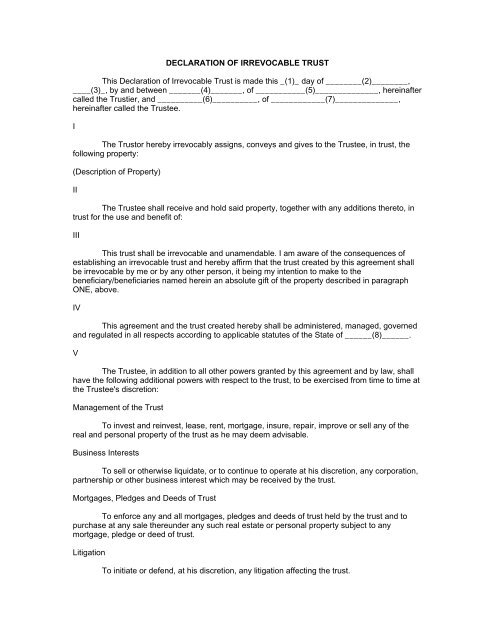

Assets in an irrevocable trust are not owned in your name and therefore are not part of the probated estate. An irrevocable trust is a grantor trust when the trust continues to use the grantors tax identification number.

If propety is in the Trust only the Trustee can sell it and the money from the sale will stay in the trust you wont be able to remove the sale proceeds from the Trust.

Property held in irrevocable trust. Property back into trust for the benefit of desired persons. Theyll take care of everything for you so you dont have to worry about doing it yourself. The trust assets will carry over the.

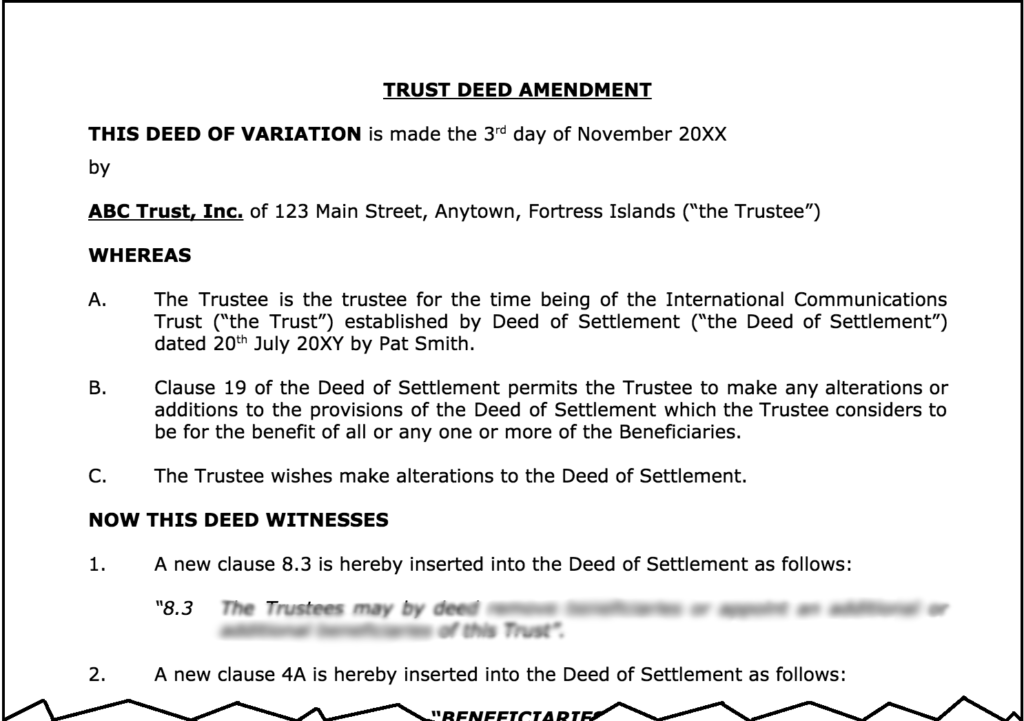

With each method the plan is to intentionally cause selected assets of an irrevocable trust to become subject to the estate tax of a decedent whose taxable estate is under 5000000 and whose estate could absorb the trust assets in. An Irrevocable Trust. Irrevocable trusts are set in stone the minute you sign them and the owner is not the trustee meaning you give up control to a true third party.

Once you and your financial advisor or attorney draft a final version an. If a spouse established a revocable trust and funded it with assets that were marital property regardless of whos name is on the title then it would. When youre going to sell a property held in a trust youll want to have someone who can guide you through the whole process.

While the assets are removed from the estate for estate tax purposes the grantor continues to be liable for the trusts income taxes. The biggest advantage is avoiding estate taxes. Irrevocable trusts pass the legal ownership of the trust including the assets and properties to a trustee.

I am a Massachusetts attorney and answer questions based on Massachusetts law. Irrevocable trusts are separate legal entities and so transferring your home to an irrevocable trust makes it impossible for you to claim the exclusion on. An Irrevocable Trust has beneficiaries who have rights to the Trust property.

Very often a parent or grandparent will create an Irrevocable Trust. In New York an individual cannot protect assets from creditors by creating either a revocable trust or an irrevocable trust for his or her benefit. Self-Settled Revocable and Irrevocable Trusts.

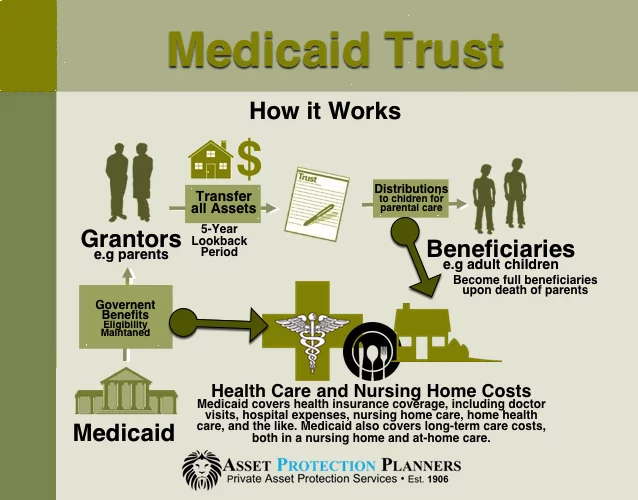

It also puts the management of the trust on someone elses shoulders which may be needed in the case of incapacity as you near your final days. WHEREAS the Grantor desires to create an irrevocable trust of the property described in Schedule A hereto together with such monies securities and other assets as the Trustees hereafter may hold or acquire hereunder said property monies securities and other assets. An irrevocable trust is commonly created to remove assets from the grantor so they are not counted in determining whether the grantor qualifies for Medicaid payment of long-term care.

If a trust is irrevocable you cant remove property from it. Liens and Living Trusts A lien is a legal claim that is placed on real or personal property to secure the payment of a debt. New York law provides that where a creator retains the right to revoke the trust he or she remains the absolute owner of the property so far as the.

The other method is to spring the Delaware Tax Trap. The cost basis of assets when used in the context of a trust means the value of assets held by the trust as calculated for tax purposes as of a certain triggering event Trust assets can include a wide variety of property such as real property automobiles art jewelry and investment portfolios. In addition retaining a life estate may make the transfer of the house into an irrevocable trust more palatable to your father because although he gives up control over the house his consent will be required to sell the house.

That is not true. Depending on the type of trust and other assets held in the trust you might ask your tax adviser if there is a provision in the tax code that could aid you in the sale if you have other gains. It is a common misconception about Irrevocable Trusts that no distributions can be made from the trust.

Land trusts are a form of revocable trust only used for real property and the main benefit is privacy. An irrevocable trust works just like it sounds. If you have a title company on your side youll get the best price for your home.

A trust is a relationship where the property is held by one party for the benefit of the other. As long as he is alive your father will have an interest in the house. For assets held in irrevocable trusts the basis depends on whether the trust is deemed a grantor trust.

Liens are governed by state law. That being said a trust can become an issue in a divorce if it was funded with marital property. An irrevocable trust can protect your assets against Medicaid estate recovery.

When you or your spouse if they are part of the trust pass away any assets put into an irrevocable trust are not included in the estate for the calculation of Medicaid recovery the estate tax or probate.

.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Trust_Aug_2020-01-6b0686cb892a40589605baeeef79a183.jpg)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home