Property Held In Trust For Minor

If you wish you can simply use your will to name a property guardian for your child. A simple bare trust or a more formally constituted trust such as a life interest or discretionary trust.

Templates Last Will And Testament Templates Hunter Last Will And Testament Templates Estate Planning

Templates Last Will And Testament Templates Hunter Last Will And Testament Templates Estate Planning

The property title is registered in the name of for example.

Property held in trust for minor. A child under 18 cannot take legal title to property so there are two ways in which the property can be held. Holding the property on trust also means that the parent is responsible for managing the trust property such as paying the relevant taxes and duties for the benefit of the child. Here are four of the simplest and most useful.

Sometimes a custodial account is established for a minor child under the Uniform Transfer to Minors Act or Uniform Gifts to Minors Act. The account is set up in-trust because the child is under the age of majority and cannot enter into a legal binding contract. The laws requirement that the trust assets must be transferred to the minor when they become 21 years old is a concern and limitation for parents who do not believe that their child or.

Guardianships involve court appointed guardians that manage property for minors. A relatively common form of lifetime gift by parents is to transfer investment eg. They are expensive and are usually used when minor children are orphaned and trusts have not been established for property left to them.

The adult is then responsible for investing for the child and signing the contract on behalf of the child. Under a bare trust another person holds the title to the property as a nominee. Trusts for minors or minors trusts are very specific types of trusts that are used to hold and distribute property or assets to minors.

But if the amount is significant say. For example a parent may wish to create a discretionary trust to provide for the childrens school fees or start building up a fund towards their university education. You serve as grantor or creator of the trust and control all of the assets you place in the trust.

An age 18 to 25 trust is a trust created by a parent or step-parent in their will in which the trust property is held for a child under twenty-five who will become absolutely entitled to. Buy-to-let property into trust for their children. The trustee of the Bhamita Ranchod trust shall be Connor Jenkins.

This clause provides that all property given to the child named in the clause shall be held in trustthat is managed strictly for the benefit of the child by the person named as the trustee until the child turns the age indicated. You can choose someone now to manage any property that your minor or young adult children may someday inherit from you. This simple Trust Agreement contains the type of provisions often found in a revocable living trust for a married person with young adult children and a modest estate.

People understand why minor children and even young adults shouldnt inherit property outright. Living Trust Deed Property Probably the easiest way to put a house in trust for a child is by establishing a revocable living trust and transferring the deed to it. There are lots of ways to structure this arrangement.

If the value of property left to the minor is not significant usually 20000 or less state law may allow an interested adult such as the minors parent or grandparent to request that the minors inheritance be placed in an account established under the states Uniform Transfers to Minors Act UTMA or Uniform Gifts to Minors Act UGMA. The assets are usually held by a trustee. The trust instrument is called a Trust Agreement because a third party is serving as the trustee which mandates that the grantor and the third-party trustee agree on the terms of the trust.

That child has the right to give away the trust assets in the event that he or she dies before 21 that is the child can make his will and state that the trust is to go to his sister for example if he dies before hes 21. When a property is held on trust by the parents for their child any personal creditors of the parents are not entitled to claim the trust property to satisfy any debts owed by the parents to them. They typically provide instructions that the money or property assets will be held in trust until the minor reaches the age of majority.

Someone with more maturity and experience needs. As money property shares jewellery or even household items for the benefit of a person or purpose. An in-trust account is an informal trust so that an adult can invest funds on behalf of a minor.

These are usually established through a bank and a custodian is named to manage the funds. Name a Property Guardian in Your Will. A person who is entitled to benefit from the assets is known as a beneficiary.

In the case of a Minors Trust it is standard practice for the trustee to interact with the. If the in-trust account represents an actual transfer of property to your childgrandchild or other related minor at the time the property is deposited to the account such that you are acting solely as the childs agent or guardian of hisher property the income from the account will be that of the child subject to the application of the. This is usually 21 years old in most cases.

Custodianships are created under the Uniform Gift to Minors Act UGMA and the Uniform Transfer to Minors Act UTMA. Joe Bloggs as bare trustee for Samantha Bloggs.

What Happens To A Family Trust If The Trustee Dies Linda Alexander Law

What Happens To A Family Trust If The Trustee Dies Linda Alexander Law

Abuse Involving Misappropriation Of Trust Funds By Trustee Course 6

Abuse Involving Misappropriation Of Trust Funds By Trustee Course 6

Freebie Alert Parent S Free E Guide Planning Guide For Parents Click The Link Here To Dow Estate Planning Planning Guide Estate Planning Attorney

Freebie Alert Parent S Free E Guide Planning Guide For Parents Click The Link Here To Dow Estate Planning Planning Guide Estate Planning Attorney

Trust Agreement Pdf Templates Jotform

Trust Agreement Pdf Templates Jotform

/living-trust-documents-483615849-5c7bd28146e0fb0001edc855.jpg) Should You Gift Assets Through An Utma Or Trust Fund

Should You Gift Assets Through An Utma Or Trust Fund

Free Living Trust Free To Print Save Download

Free Living Trust Free To Print Save Download

We Are So Excited To Announce That We Are Now Seeing Clients In Our Westlake Office Contact Us Today To Set Up Estate Planning Revocable Living Trust Moorpark

We Are So Excited To Announce That We Are Now Seeing Clients In Our Westlake Office Contact Us Today To Set Up Estate Planning Revocable Living Trust Moorpark

How S Your Property Vested It Matters As Much As Your Will Or Trust Deeds Com

How S Your Property Vested It Matters As Much As Your Will Or Trust Deeds Com

Free Kansas Revocable Living Trust Form Pdf Word Eforms

Free Kansas Revocable Living Trust Form Pdf Word Eforms

Joint And Mutual Will Will And Testament Last Will And Testament Joint

Joint And Mutual Will Will And Testament Last Will And Testament Joint

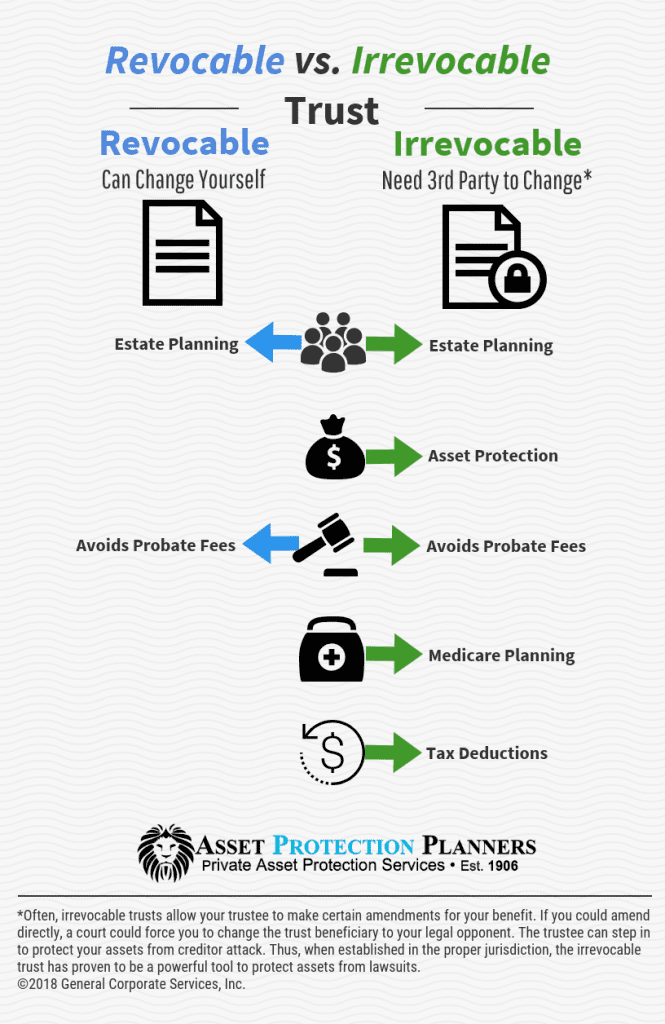

What Is An Irrevocable Trust How Does It Work Free Video Explains

What Is An Irrevocable Trust How Does It Work Free Video Explains

Http Www Hackardlaw Com Blog 2017 01 Ca Probate 850 Heggstad Petition Sacramento County Shtml Probate Elder Abuse Sacramento County

Http Www Hackardlaw Com Blog 2017 01 Ca Probate 850 Heggstad Petition Sacramento County Shtml Probate Elder Abuse Sacramento County

Land Trusts For Asset Protection And Home Privacy

Land Trusts For Asset Protection And Home Privacy

Free Kansas Revocable Living Trust Form Pdf Word Eforms

Free Kansas Revocable Living Trust Form Pdf Word Eforms

Holding Real Estate In A Trust Or An Llc Deeds Com

Holding Real Estate In A Trust Or An Llc Deeds Com

How To Prepare Will Trust Legal Papers On Mercari Book Show Power Of Attorney How To Stay Healthy

How To Prepare Will Trust Legal Papers On Mercari Book Show Power Of Attorney How To Stay Healthy

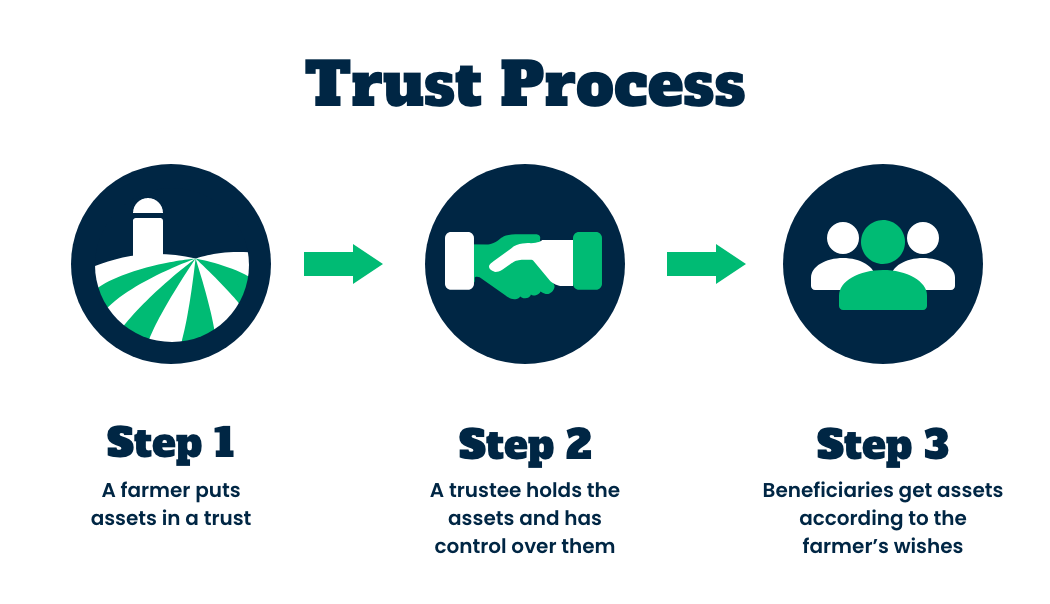

Trusts Farmland Access Legal Toolkit

Trusts Farmland Access Legal Toolkit

Free Trust Agreement Form Printable Real Estate Forms Real Estate Forms Legal Forms Real Estate Contract

Free Trust Agreement Form Printable Real Estate Forms Real Estate Forms Legal Forms Real Estate Contract

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home