Missouri Property Tax Credit Income Limit

The credit is for a maximum of 75000 for renters and 110000 for owners. Any charitable organization which is exempt from federal income tax and whose Missouri unrelated business taxable income if any would be subject to the state income tax imposed under chapter 143 RSMo.

Https Www Lincolninst Edu Sites Default Files Gwipp Upload Sources Missouri 2012 Mo Property Tax Credit Claim Faq By Department Of Revenue Webaccess 2013 Apr 25 Pdf

Domestic violence shelter tax credit If you donate 100 or more in cash stock bonds real property or other marketable securities to a qualified domestic violence shelter and are subject to Missouri income tax you may be able to take a tax credit for.

Missouri property tax credit income limit. To qualify as a homeowner. Household Income for the Property Tax Refund Minnesota Department of Revenue COVID-19 Penalty Relief. The Missouri Property Tax Credit Claim is a program that allows certain senior citizens and 100 percent disabled individuals to apply for a credit based on the real estate taxes or rent they have paid for the year.

To qualify for the credit as a renter income must be. The minimum number of units a development must have to qualify for LIHTC is. Missouri allows for a property tax credit for certain senior citizens and 100 disabled individuals for a portion of what was paid in real estate taxes or rent that was paid throughout the tax year.

The maximum amount of the credit for renters is 750 and 1100 for home owners that pay real estate taxes. Once approved the credit can be used each year for 10 years and is allocated to developers who may then sell it to raise equity to construct or acquire and. For renters or part year owners.

The Rent Income Limit Calculator will calculate IRC Section 42i3A low-income housing tax credit LIHTC rent and income limits for every Missouri county and metropolitan statistical area MSA It is. You may ask us to cancel or reduce filing or payment penalties if you have a reasonable cause or are negatively affected by the COVID. The Missouri Property Tax Credit also referred to as circuit breaker is a tax credit available to qualified older andor disabled adults.

Property Tax Credit April 12th 2013 The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disable individuals for a portion of. A 2016 claim must be filed by April 15 2020 or a refund will not be issued. Income limits and Maximum rent levels can be determined by accessing Novogradac Company LLPs Rent Income Limit Calculator.

Owned and Occupied your home the entire year. About 94000 or over half of recipients were renters. 27500 or less if single or 29500 or less if married.

3 40 percent of the total number of units affordable to persons from a range of 20 percent to 80 percent of the area median income so long as the average unit designation averages no. Eligibility for the Circuit Breaker Property Tax Credit. The actual credit is based on amount paid and total.

1 2019 Individual Income Tax Return and Property Tax Credit ClaimPension Exemption - Short Form Form MO-1040P 19335010001 19335010001 You may contribute to. If married filing combined your total household income must be 34000 or less. Age or disability paid property tax and.

Renters or homeowners can apply so long as property tax. Low Income Housing Tax Credit LIHTC Compliance This program provides federal and state tax credits to investors in affordable housing through an annual competitive application process. The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year.

The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. The credit is for a maximum of 750 for renters and 1100 for owners who owned and occupied their home. The MTSP Income Limits are used to determine qualification levels as well as set maximum rental rates for projects funded with tax credits authorized under section 42 of the Internal Revenue Code the Code and projects financed with tax exempt housing bonds issued to provide qualified residential rental development under section 142 of the Code.

The actual credit is based on the amount of real estate taxes or rent paid and total household income taxable. An individual subject to the state income tax imposed in Chapter 143 RSMo. In state fiscal year 2018 tax year 2017 Missouris circuit breaker property tax credit helped 178518 seniors Missourians living with disabilities.

For tax years beginning on or after January 1 2017 the Illinois Property Tax Credit is not allowed if a taxpayers federal Adjusted Gross Income AGI exceeds 500000 for returns with a federal filing status of married filing jointly or 250000 for all other returns. The credit is for a maximum of 750 for renters and 1100 for owners who owned and occupied their home. If single your total household income must be 30000 or less.

Your household income affects whether you qualify and how much you can receive for the Property Tax Refund. Total household income for single filers must be 27500 or.

Fha Loan With 1099 Income Fha Lenders

Fha Loan With 1099 Income Fha Lenders

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

Mobile Austin Notary Austin Tx Accounting Notary Limited Company

Mobile Austin Notary Austin Tx Accounting Notary Limited Company

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

Irs Clarifies How To Calculate Income Limits For Lihtc Average Income Set Aside Eye On Housing

Irs Clarifies How To Calculate Income Limits For Lihtc Average Income Set Aside Eye On Housing

Feather Network Internet Scams Hunger Games San Antonio Tx

Feather Network Internet Scams Hunger Games San Antonio Tx

Https Dor Mo Gov Forms Mo 1040 20fillable 20calculating 2019 Pdf

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg) What Tax Breaks Are Afforded To A Qualifying Widow

What Tax Breaks Are Afforded To A Qualifying Widow

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg) Are Social Security Benefits Taxable After Age 62

Are Social Security Benefits Taxable After Age 62

Https Dor Mo Gov Forms 4711 2018 Pdf

Https Dor Mo Gov Forms Mo 1040 20instructions 2019 Pdf

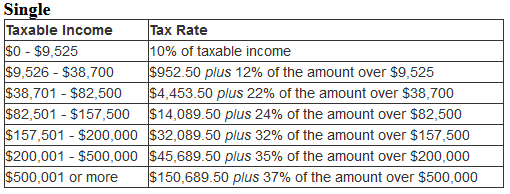

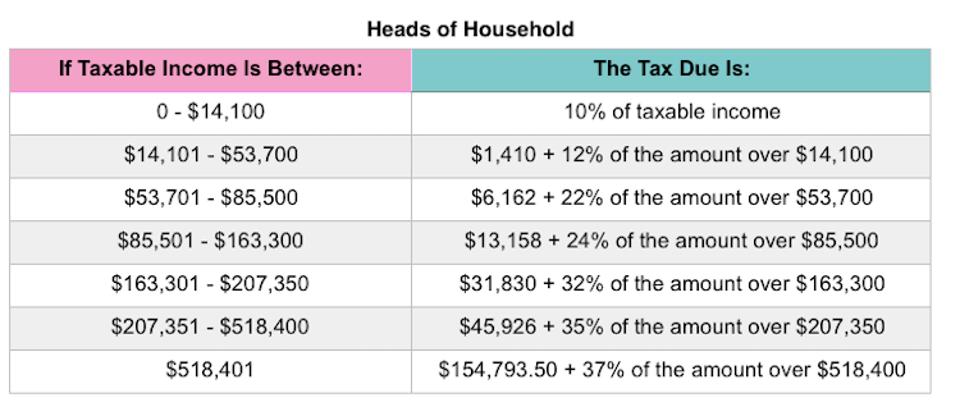

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Tncpa

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Tncpa

Irs Clarifies How To Calculate Income Limits For Lihtc Average Income Set Aside Eye On Housing

Irs Clarifies How To Calculate Income Limits For Lihtc Average Income Set Aside Eye On Housing

Https Dor Mo Gov Pdf Proptax Pdf

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg) What Tax Breaks Are Afforded To A Qualifying Widow

What Tax Breaks Are Afforded To A Qualifying Widow

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home