Can You Apply For Florida Homestead Exemption Online

First-time Homestead Exemption applicants and. Online Homestead Application Service You will need to gather the following information in order to complete this application.

Every Florida resident who has legal or beneficial title in equity to real property in the State of Florida who resides on said real property and in good faith makes the same his or her permanent residence on or before January 1st of the year application is made shall be entitled to the 25000 Homestead Exemption.

Can you apply for florida homestead exemption online. The application for homestead exemption Form DR-501 and other exemption forms are on the Departments forms. Page and on most property appraisers websites. Click here for county property appraiser contact and website information.

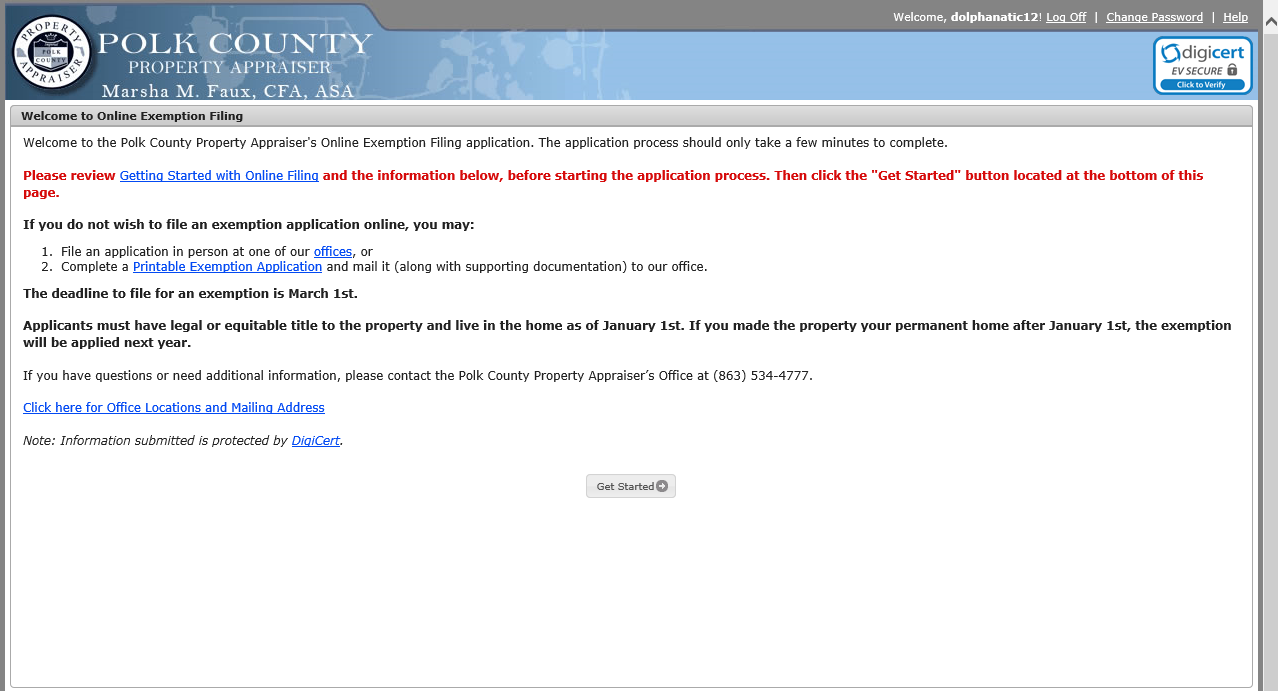

Filing online is SAFE and SECURE. Florida Homestead Exemption Eligibility Requirements. Online Homestead Exemption Application Welcome you are about to E-file for your exemption.

A bankruptcy judge in the Middle District of Florida recently sustained a Chapter 7 trustees objection to a non-Florida resident debtors attempted claim of the Florida homestead exemptionAlthough the debtor had lived in her Florida home for more than 20 years she was not a United States citizen or a permanent resident with a so-called green card. In many cases particularly if you have owned the residence for a while and are applying for the homestead exemption online the Appraisers office will have a record of your ownership of the property. If you would like to file in person our office address is 231 E.

If you are filing for the first time be prepared to answer remainingthese questions. Here is what you need to continue. If you e-file an application you will always receive correspondence via email from our office.

Beginning January 1 2021 if you are applying for a new Homestead Exemption AND you held a Homestead Exemption on a previous property within the last 3 tax-years anywhere in Florida you should also submit a Portability application with your Homestead application. But to qualify for tax exemption you need to apply for Florida homestead exemption status. Floridas constitution provides for a 25000 exemption which is deducted from a propertys assessed value if the owner qualifies.

The exemption results in approximately a 500 - 1000 property tax savings to Florida residents. Other personal exemptions such as widows. When you purchase a home and want to qualify for an exemption you may file online or in person at one of our offices.

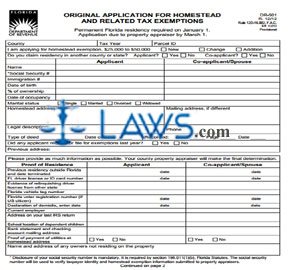

To qualify for the Florida homestead exemption on your 2019 taxes you must have filed this paperwork by March 1 2019. Title and residency as of January 1 determine your qualification for homestead exemption. The form you have to complete is DR-501.

Click this link to find your county property appraiser on this website. You have three options for completing and submitting it. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

Submit all homestead exemption applications Form DR501 and other required documentation to your county property appraiser. Homestead Exemption Application can now be made Online. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607.

Property owners with Homestead Exemption and an accumulated SOH Cap can apply to transfer or Port the SOH Cap value up to 500000 to a new homestead property. If you hold the title in trust you may be required to furnish a Certificate of Trust as well. Complete the form online and select the states e-file option.

You may also file by mail by downloading the application from the website. You must make a new application every time you establish a new residence. However we encourage you to use our online service for filing homestead and other exemptions.

Our office is open to the public. This application is known as the Transfer of Homestead Assessment Difference and the annual deadline to file for this benefit and any other property tax exemption is March 1st. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

The exemption on your property when you purchased it is not yours and is not transferable to you. This secure server uses 128-bit encryption to maintain your privacy. The following applications may also be filed on-line with the homestead exemption application.

Forsyth Street Suite 260 Jacksonville Florida 32202. Homestead Exemption Application can also be made by mail. 3 Oversee property tax administration involving 109.

Homestead Property Tax Exemption. 80 of all new homeowners file online in less than 15 minutes. Prior to January 1 2021 the timeframe extended only two tax years.

You may file anytime during the year but before the states deadline of March 1 for the tax year in which you wish to qualify.

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

How To File For The Homestead Tax Exemption Property Tax Tallahassee

How To File For The Homestead Tax Exemption Property Tax Tallahassee

Free Form Dr 501 Originial Application For Homestead And Related Tax Exemptions Free Legal Forms Laws Com

Free Form Dr 501 Originial Application For Homestead And Related Tax Exemptions Free Legal Forms Laws Com

Florida Homestead Exemption Why You Need An Attorney Realty Times

Florida Homestead Exemption Why You Need An Attorney Realty Times

How To Apply For A Homestead Exemption In Florida 15 Steps

How To Apply For A Homestead Exemption In Florida 15 Steps

Florida Homestead Exemptions Emerald Coast Title Services

Florida Homestead Exemptions Emerald Coast Title Services

Florida Homestead Exemption Chrisluis Com

Florida Homestead Exemption Chrisluis Com

How To Apply For A Homestead Exemption In Florida 15 Steps

How To Apply For A Homestead Exemption In Florida 15 Steps

How Do I Register For Florida Homestead Tax Exemption

How Do I Register For Florida Homestead Tax Exemption

Florida Property Taxes Your Guide To Filing For Homestead Exemption

Florida Property Taxes Your Guide To Filing For Homestead Exemption

Fl Dr 501 2021 Fill Out Tax Template Online Us Legal Forms

Fl Dr 501 2021 Fill Out Tax Template Online Us Legal Forms

How To Apply For A Homestead Exemption In Florida 15 Steps

How To Apply For A Homestead Exemption In Florida 15 Steps

Have You Filed For Your Florida Homestead Exemption Yet Stern Realty Team Blog

Have You Filed For Your Florida Homestead Exemption Yet Stern Realty Team Blog

Filing An Exemption Application Online

Filing An Exemption Application Online

What Is The Florida Homestead Exemption

What Is The Florida Homestead Exemption

Don T Forgot To Apply For Your Homestead Exemption In Florida

Don T Forgot To Apply For Your Homestead Exemption In Florida

How To File For Florida Homestead Exemption Florida Agency Network

How To File For Florida Homestead Exemption Florida Agency Network

File For Homestead Exemption In Alachua County Fl

File For Homestead Exemption In Alachua County Fl

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home