Personal Property Tax In Nevada

Tax rates in Nevada are expressed in dollars per 100 in assessed value. Assessed value is computed by multiplying the taxable value by 35 rounded to the nearest 1.

Claims For Primary Residential Tax Caps Due June 30 Las Vegas Real Estate Property Tax Public Information

Claims For Primary Residential Tax Caps Due June 30 Las Vegas Real Estate Property Tax Public Information

The Nevada County Treasurer Tax Collectors Office can only pursue collection of the tax from the Assessee.

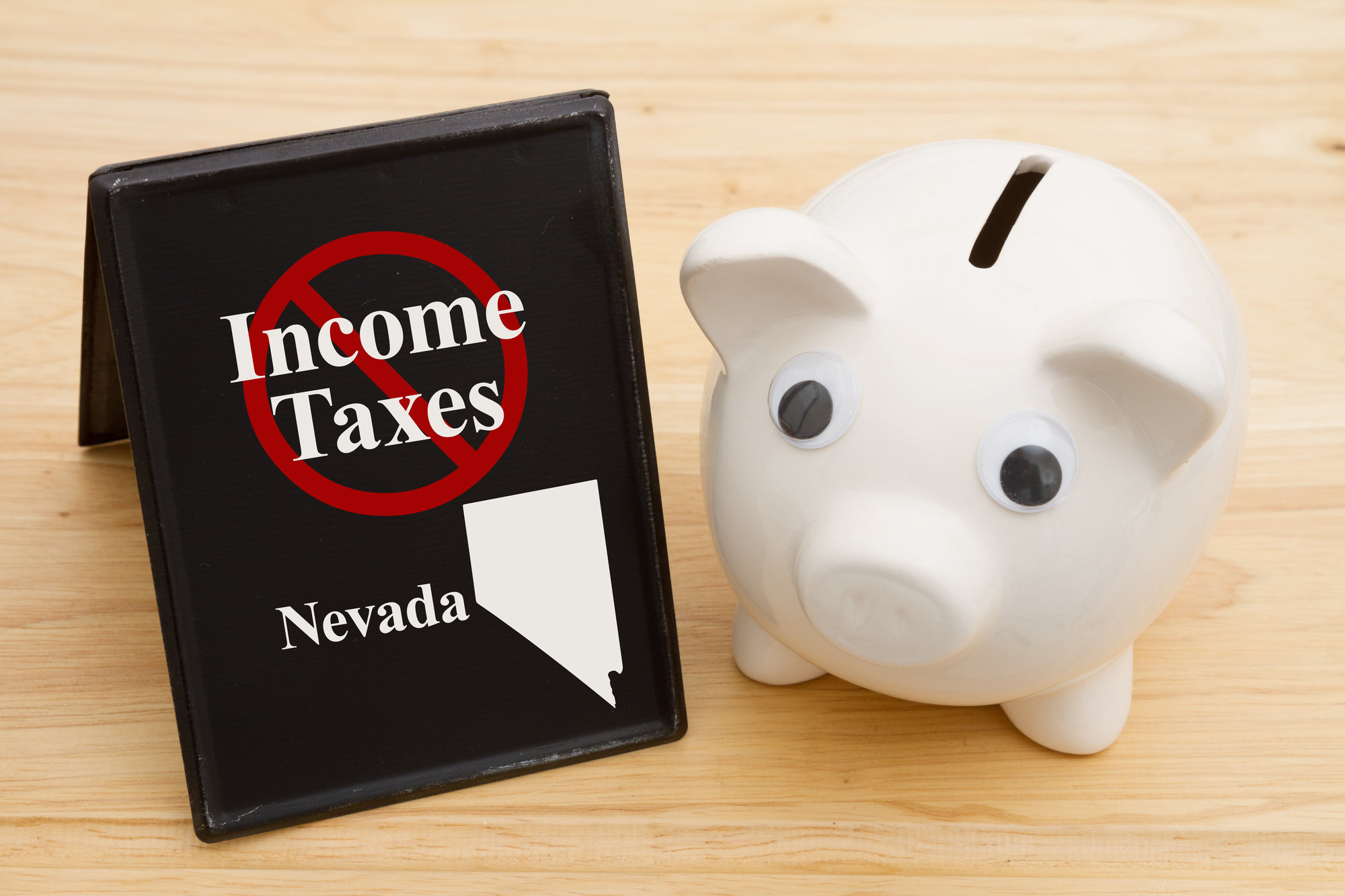

Personal property tax in nevada. Thus if your tax rate is 325 and your assessed value is 40000 your total annual tax is 1300. Nevada is one of seven states that do not collect a personal income tax. However revenue lost to Nevada by not having a personal income tax may be made up through other state-level taxes such as the Nevada sales tax and the Nevada property tax.

Counties cities school districts special districts such as fire protection districts etc. The tax rate varies by district. An exemption may be applied to real property tax and personal property tax which includes business personal property and manufactured housing.

Assessed value is computed by multiplying the taxable value by 35 rounded to. Counties in Nevada collect an average of 084 of a propertys assesed fair market value as property tax per year. Penalties If not paid in full a 10 delinquent penalty will be added on September 1st or on the first business day of the second month following the Enrollment Date.

The Nevada Tax Commission may exempt from taxation that personal property for which the annual taxes would be less than the cost of collecting those taxes. All property that is not defined or taxed as real estate or real property is considered to be personal property. Rate Range of Taxes.

The Nevada Legislature NRS 361 provides for property tax exemptions to individuals who meet certain criteria. In Nevada property taxes are based on assessed value In the case of business personal property tax a taxable value is arrived at by reducing the original or acquisition cost by depreciation factors mentioned above. If such an exemption is provided the Nevada Tax Commission shall annually determine the average cost of collecting property taxes in this state which must be used in determining the applicability of the exemption.

In Nevada property taxes are based on assessed value In the case of business personal property tax a taxable value is arrived at by reducing the original or acquisition cost by depreciation factors described above. Personal property is taxable whether it is owned leased rented loaned or otherwise made available to the business. Personal Property tax is regulated by the Nevada Revised Statutes NRS chapter 361.

Nevada Property Tax Rates. You may find this information in Property Tax Rates for Nevada Local Governments commonly called the Redbook. NOTICE TO TAXPAYERS OF DOUGLAS COUNTY NEVADA The fourth installment of the 2020-2021 property tax is due and payable on March 1 2021.

Nevada is ranked number twenty four out of the fifty states in order of the average amount of property taxes collected. There are numerous tax districts within every Nevada county. The Clark County Treasurer provides an online payment portal for you to pay your property taxes.

Taxable personal property includes all property used in conjunction with a business manufactured homes aircraft aircraft hangars and billboards. Residential Rental Property - The total property tax bill is limited to a maximum 3 percent increase over the prior year if the rent charged is equal to or less than the final fair market rents as published by HUD. Prior to the budget hearings the County will publish a newspaper ad which identifies any.

5 rows Nevada State Taxes. 2017-2018 Personal Property NRS 361_068 NOD REVISED. Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes.

The taxation of business personal property has been in effect since Nevada became a state in 1864. 2019-2020 Personal Property Manual Final. The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000.

Sales Tax Rate Range. 2017-2018 Personal Property Manual Final 20160628 rev 20161114. Property Tax Rates Tammi Davis Washoe County Treasurer HOW THE TAX RATE IS DETERMINED The property tax rates are proposed in April of each year based on the budgets prepared by the various local governments.

Owner-Occupied Single Family Residences - The total property tax bill is limited to a maximum 3 percent increase over the prior year. 2018-2019 Personal Property Manual Final 05082017. 2018-2019 Personal Property Manual NOD 20170508.

Nevada Revised Statutes Chapter 360-361 provide for the taxation of all property unless specifically exempted by law. Please visit this page for more information.

Nevada Vs California Taxes Explained Retire Better Now

Nevada Vs California Taxes Explained Retire Better Now

Celebrate Tax Day With 9 Of Our Favorite Tax Maps Property Tax Tax Day Filing Taxes

Celebrate Tax Day With 9 Of Our Favorite Tax Maps Property Tax Tax Day Filing Taxes

Chart 3 Illinois State And Local Tax Burden Vs Major Industry Fy 2016 Jpg Burden Tax Educational Service

Chart 3 Illinois State And Local Tax Burden Vs Major Industry Fy 2016 Jpg Burden Tax Educational Service

Https Tax Nv Gov Localgovt Policypub Active Publications Elements And Applications 2013 Nevada Property Tax Elements And Application

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Property Taxes Are Not Uniform And Equal In Nevada

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Pin By Fastincnow On Apply Seller S Permit Business Tax Business Sales Tax

Pin By Fastincnow On Apply Seller S Permit Business Tax Business Sales Tax

Wayfair And Your State Sales Tax Obligations In 2021 Business Structure Sales Tax Tax

Wayfair And Your State Sales Tax Obligations In 2021 Business Structure Sales Tax Tax

Basic Lease Agreement Template Awesome Month To Month Lease Agreement Rental Agreement Templates Lease Agreement Lease Agreement Free Printable

Basic Lease Agreement Template Awesome Month To Month Lease Agreement Rental Agreement Templates Lease Agreement Lease Agreement Free Printable

Chart 2 Louisiana State And Local Tax Burden By Type Of Tax Fy 1950 To 2016 Jpg Types Of Taxes Tax Burden

Chart 2 Louisiana State And Local Tax Burden By Type Of Tax Fy 1950 To 2016 Jpg Types Of Taxes Tax Burden

Property Taxes In America Property Tax Business Tax Tax

Property Taxes In America Property Tax Business Tax Tax

Sample Printable Nevada Sellers Real Property Disclosure Form Form Real Estate Forms Legal Forms Real Estate Contract

Sample Printable Nevada Sellers Real Property Disclosure Form Form Real Estate Forms Legal Forms Real Estate Contract

Nevada Property Tax Calculator Smartasset

Nevada Property Tax Calculator Smartasset

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

Http Tax Nv Gov Uploadedfiles Taxnvgov Content Taxlibrary Leases And Subleases Of Tangible Personal Property Pdf

Chart 2 Indiana Tax Burden By Type Of Tax Fy 1950 To 2015 Jpg Types Of Taxes Low Taxes Burden

Chart 2 Indiana Tax Burden By Type Of Tax Fy 1950 To 2015 Jpg Types Of Taxes Low Taxes Burden

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home