What Documents Do You Need To File For Homestead Exemption In Georgia

You can access the application there and fill it out. The Disabled Veterans Homestead Exemption is available to certain disabled veterans in an amount up to 60000 deducted on the State portion and 85645 from the 40 assessed value of the homestead property.

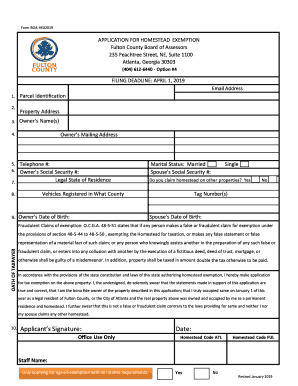

Ga Form Homestead Exemption Fill Out And Sign Printable Pdf Template Signnow

Ga Form Homestead Exemption Fill Out And Sign Printable Pdf Template Signnow

IF in the prior tax year you receiveda.

What documents do you need to file for homestead exemption in georgia. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. Application for Homestead Exemption You can file a homestead exemption application any time of the year with your county tax commissioner or county board of tax assessors but it must be filed by April 1 to be in effect for the current tax year. The State of Georgia offers homestead exemptions to persons that own and occupy their home as a primary residence.

School tax exemption you need not reapply for this higher. Must come into office with proof of age. Several types of homestead exemptions have been enacted to reduce the burden of ad valorem taxation for Georgia homeowners.

An application for homestead exemption can be filed anytime during the year however to be effective it must be filed before the Tax Commissioner of the County. However it is restricted to certain types of serious disabilities requiring proof of disability from the Veterans Administration or from a private. Enter information and click Search.

Print the confirmation page. View the 2020 Homestead Exemption Guide Once granted exemptions are automatically renewed each year as long as the homeowner continually occupies the property under the same ownership. This exemption applies to all ad valorem tax levies.

To learn more about which state exemptions apply to you see Which Exemptions Can You Use in Bankruptcy Homestead Declarations. Once your application. In Georgia the homestead exemption is automatic you dont have to file a homestead declaration in order to claim the homestead exemption in bankruptcy.

No income qualifier. Homestead Exemption removal letter from Tax Official Required if applicants had a previous residence in another countystate and had a Homestead Exemption. Total School Tax Exemption Must be 70 on or before January 1.

Proof of Motor Vehicle registration in Columbia County registration card. The following process is used to apply for all homestead exemptions. Homeowners may qualify for different homestead exemptions from the various taxing jurisdictions including school system cities and Fulton County.

A homestead is defined as a single-family owner-occupied dwelling and the land thereto not exceeding 160 acres. Depending upon which application is completed one or more of the following items shall be required. Valid Georgia Drivers License with current residence address.

Most counties in Georgia still require you to deliver the homestead exemption form directly to the tax commissioners office. This exemption also applies to mobile home owners where the real estate is also owned by the taxpayer. Leave Earnings Statement Required if.

Complete and submit the application. The exemptions apply-to homestead property owned by the taxpayer and occupied as his or her legal residence some exceptions to this rule apply and your Tax Commissioner can explain them to you. Athens-Clarke County offers homestead exemptions that are more beneficial to the taxpayer than the exemptions offered by the state.

Finding the Georgia Homestead Exemption. Homestead exemption plus 2000 plus 30000 on the portion to which school taxes are applied. When applying for homestead exemption please note that you may need to provide a copy of your Warranty Deed book and page proof of residence social security numbers drivers license andor car tag info.

Proof of age required. The local homestead increases the state exemption. An easier method for filing a homestead exemption is Go directly to your local county tax website for an easier way to file homestead exemption.

Verify the information is correct then click the blue Parcel Number box. Documents Required with Homestead Exemption Application. If you reside in Georgia you must use the state exemptions.

Completed Trust Affidavit Required if property is held in a trust. In order to file for homestead exemption the homeowner must be the owner of record and occupy the property as the principal residence. Also if the property is located within city limits the homeowner may be required to file with the city as well.

Must have homestead exemption must have letter certified by a medical doctor as being 100 disabled on or before January 1st of the effective tax year if qualified you will be exempt from school taxes only up to 416400 fair market value or 166560 of assessed value. If you make application for any homestead with income requirements you will be required to submit a copy of your current years Federal Income tax return a copy of your social security benefit statement a copy of any 1099 retirement statements IRA and interest statements.

Fulton County Homeowners Encouraged To Take Advantage Of Homestead Exemptions For Property Tax Relief Fulton County Government Mdash Nextdoor Nextdoor

Fulton County Homeowners Encouraged To Take Advantage Of Homestead Exemptions For Property Tax Relief Fulton County Government Mdash Nextdoor Nextdoor

Apply For Georgia Homestead Exemption Grant Park Atlanta Real Estate Grant Park Homes For Sale

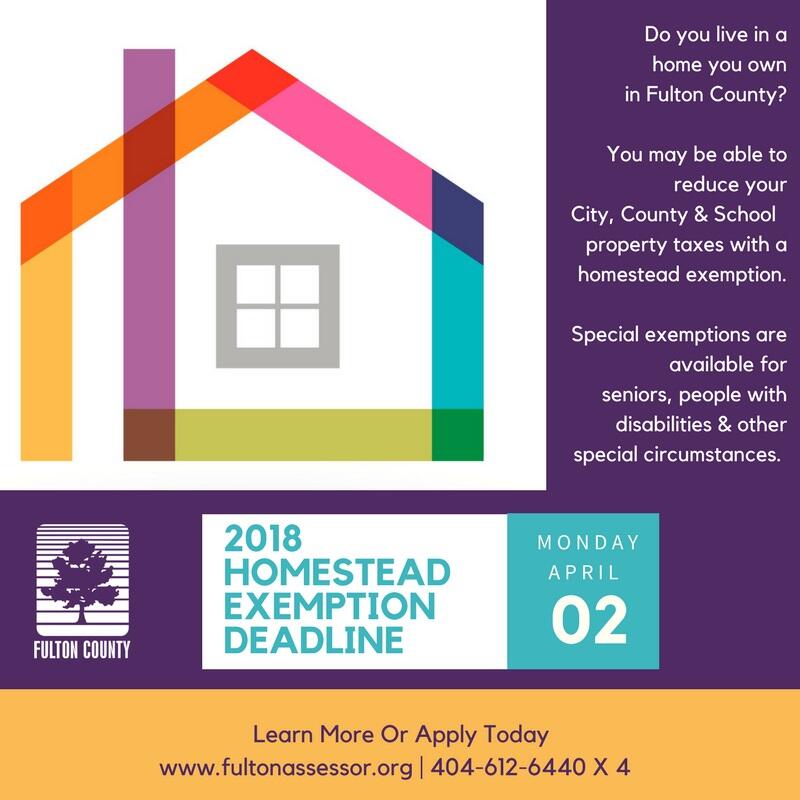

Ga Application For Cobb County Homestead Exemptions 2020 2021 Fill Out Tax Template Online Us Legal Forms

Ga Application For Cobb County Homestead Exemptions 2020 2021 Fill Out Tax Template Online Us Legal Forms

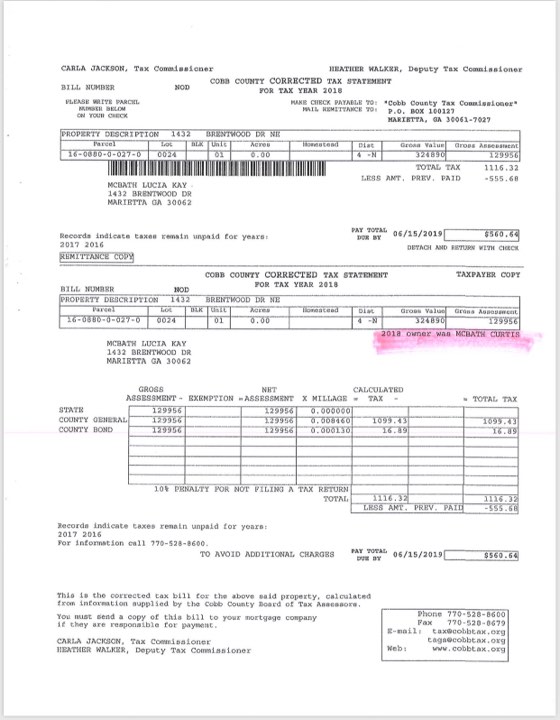

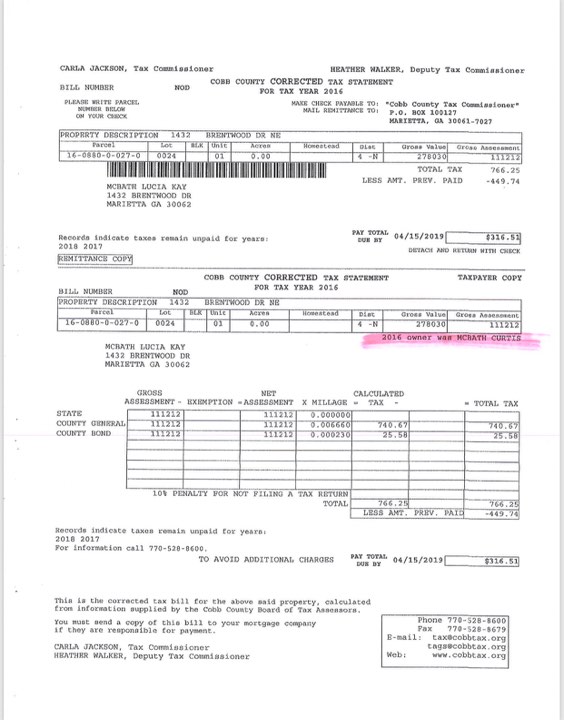

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

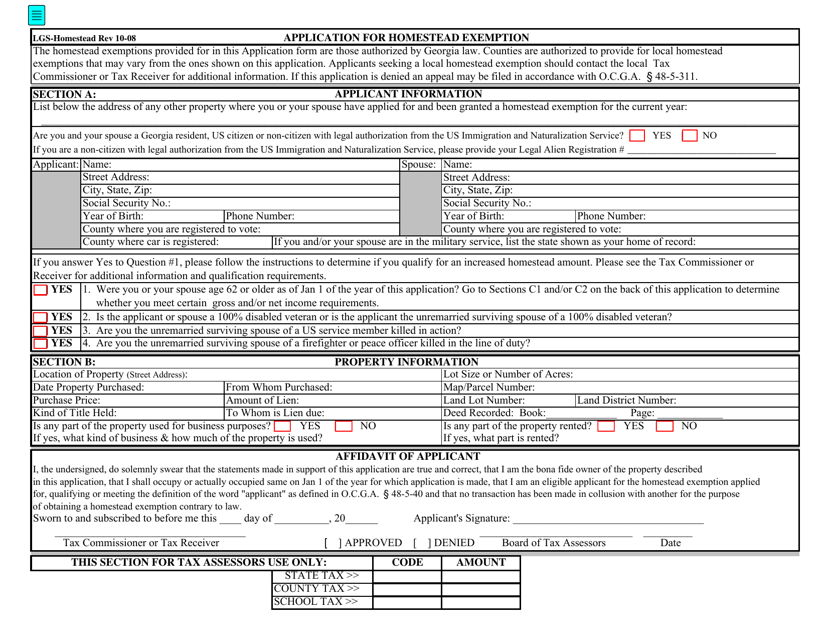

Georgia United States Lgs Homestead Application For Homestead Exemption Download Fillable Pdf Templateroller

Georgia United States Lgs Homestead Application For Homestead Exemption Download Fillable Pdf Templateroller

Homestead Exemption 2020 Information South Fulton Ga

Georgia United States Lgs Homestead Application For Homestead Exemption Download Fillable Pdf Templateroller

Georgia United States Lgs Homestead Application For Homestead Exemption Download Fillable Pdf Templateroller

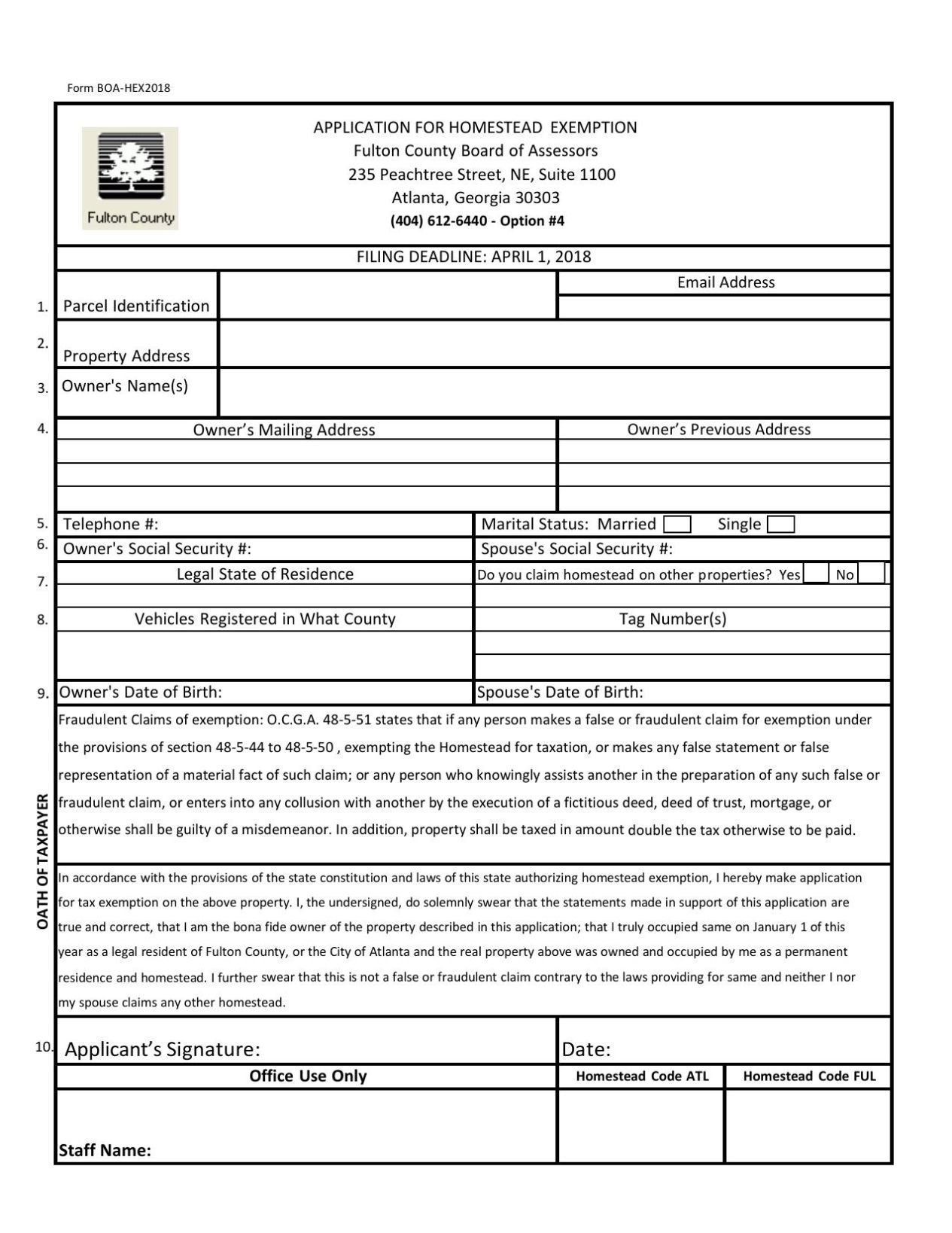

Fulton County 2018 Homestead Exemption Application Neighbornewsonline Com Suburban Atlanta S Local News Source Mdjonline Com

Fulton County 2018 Homestead Exemption Application Neighbornewsonline Com Suburban Atlanta S Local News Source Mdjonline Com

Https Www Deeds Com Forms Supplemental 1513784683sf32664 Pdf

Https Www Augustaga Gov Documentcenter View 6473 Homestead Exemption Explanation

Https Atl703 Connect Globalwolfweb Com Getfile Aspx Id 592929

Https Fultoncountyga Gov Media Departments Board Of Assessors 2020 Fulton County Homestead Exemption Guide Ashx

Dekalb County Homestead Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Dekalb County Homestead Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Http Images Kw Com Docs 1 4 9 149519 1232575907351 2008 Guide To Filing Homestead Exemption Pdf

Don T Forget To Apply For Your Homestead Exemption In 2019

Don T Forget To Apply For Your Homestead Exemption In 2019

How To Apply For Homestead Exemption In Georgia Growatlantahomes Com

How To Apply For Homestead Exemption In Georgia Growatlantahomes Com

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

Homestead Exemption Welcome To Rockdale County Georgia

Homestead Exemption Welcome To Rockdale County Georgia

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home