New Orleans Property Tax Homestead Exemption

The Orleans Parish Assessors Office does not issue tax bills nor collect taxes. Regardless of how many houses are owned no one is entitled to more than one homestead exemption which is a maximum of 7500 of assessed value.

We Are In Crisis Mode Cantrell Administration Would Slash New Orleans Public Library Funding For 20 Years Big Easy Magazine

We Are In Crisis Mode Cantrell Administration Would Slash New Orleans Public Library Funding For 20 Years Big Easy Magazine

52820 Homestead Exemption.

New orleans property tax homestead exemption. The Homestead Exemption and Taxpayers in the New Orleans Area BGR examines the impacts of a proposed increase in Louisianas homestead exemption on taxpayers in Jefferson Orleans St. Search for your Real Estate bill number by visiting the Assessors website or call 504 658-1712. Additional taxes applied to exemption amount.

Any questions about taxes or tax payments should be directed to the New Orleans Bureau of Treasury 504 658-1712 or bureauoftreasurynolagov. Proof of ownership Act of Sale or Warranty Deed. THE HOMESTEAD EXEMPTION Every homeowner in Orleans Parish is able to claim an exemption from property taxes for the first 75000 of value of their domicile or the home they occupy as their primary residence.

NEW ORLEANS REDEVELOPMENT AUTHORITY 1409 ORETHA CASTLE HALEY BL NEW ORLEANS LA 70113 Property Values Land Assessment. New Orleans Assessor Jefferson Parish Assessor. RP-421-n Fill-in RP-421-n-Ins Instructions.

The homestead exemption allows residents to take 75000 off the appraised value of their primary residence when calculating its value for most property taxes in New Orleans. The calculator will automatically apply local tax rates when known or give you the ability to enter your own rate. To pay your property taxes online you will need your tax bill number.

Tammany parishes including how it would shift the property tax burden. Homeowners in Louisiana are eligible for the homestead exemption which can significantly reduce property taxes owed. Proof of ownership recorded Act of Sale or Warranty Deed.

How to File for a Homestead Exemption To file for a Homestead Exemption the applicant must appear in person at the Assessors Office with the exception of Ascension Parish residents and bring the following. Is your property homestead exempt. The Homestead Exemption is permanent for as long as the individual owns and resides at that property in Orleans Parish.

Back to Top How to file for a Homestead Exemption To claim a Homestead Exemption all owners who occupy the property must appear in person at the Assessors Office and present the following. If the overpayment was due to a duplicate payment the homeowner should contact the Treasury office at 504 658-1712 or bureauoftreasurynolagov for a refund application. Application for Real Property Tax Exemption for Capital Improvements to Residential Buildings in Certain Towns Town of Evans Erie County RP-421-m Fill-in RP-421-m-Ins Instructions Application for Real Property Tax Exemption for Certain New or Substantially Rehabilitated Multiple Dwellings.

Use this Louisiana property tax calculator to estimate your annual property tax payment. The homestead exemption applies to owner-occupied primary residences and reduces assessed value by 7500. If you change primary residence you must notify the assessor.

The homestead exemption is permanent as long as the homeowner continues to own and permanently reside at that location. In order to qualify for homestead exemption one must own and occupy the house as hisher primary residence. 37W106901 View Property Information Property Location 1600 N CLAIBORNE AV Legal Description.

Property Tax Exemption and Assessment Administration 1999 Unfair Assessments Excessive Exemptions in New Orleans 2005 The Nonprofit Margin 2011 Its Time for ommon Sense on Nonprofit Exemptions 2016 Letter to Legislature proposing constitutional changes 2017. If the overpayment was due to a homestead exemption or reduction of assessment a refund application will be mailed to the property address. Please be advised that the due date for 2021 property taxes has been extended to February 282021.

Thus the net assessed taxable value for the home in the above example would be just 2500. If you need your Business Personal Property Tax number call. The homestead exemption allows that the first 7500 of assessed value on an owner occupied home will be exempt from property taxation.

Https Www Bgr Org Wp Content Uploads Summarydecember1999 Pdf

Orleans Parish Homestead Exemption Information And Where To File

Orleans Parish Homestead Exemption Information And Where To File

Giarrusso What Comes Next For The Property Tax Assessments And Appeals Mid City Messenger

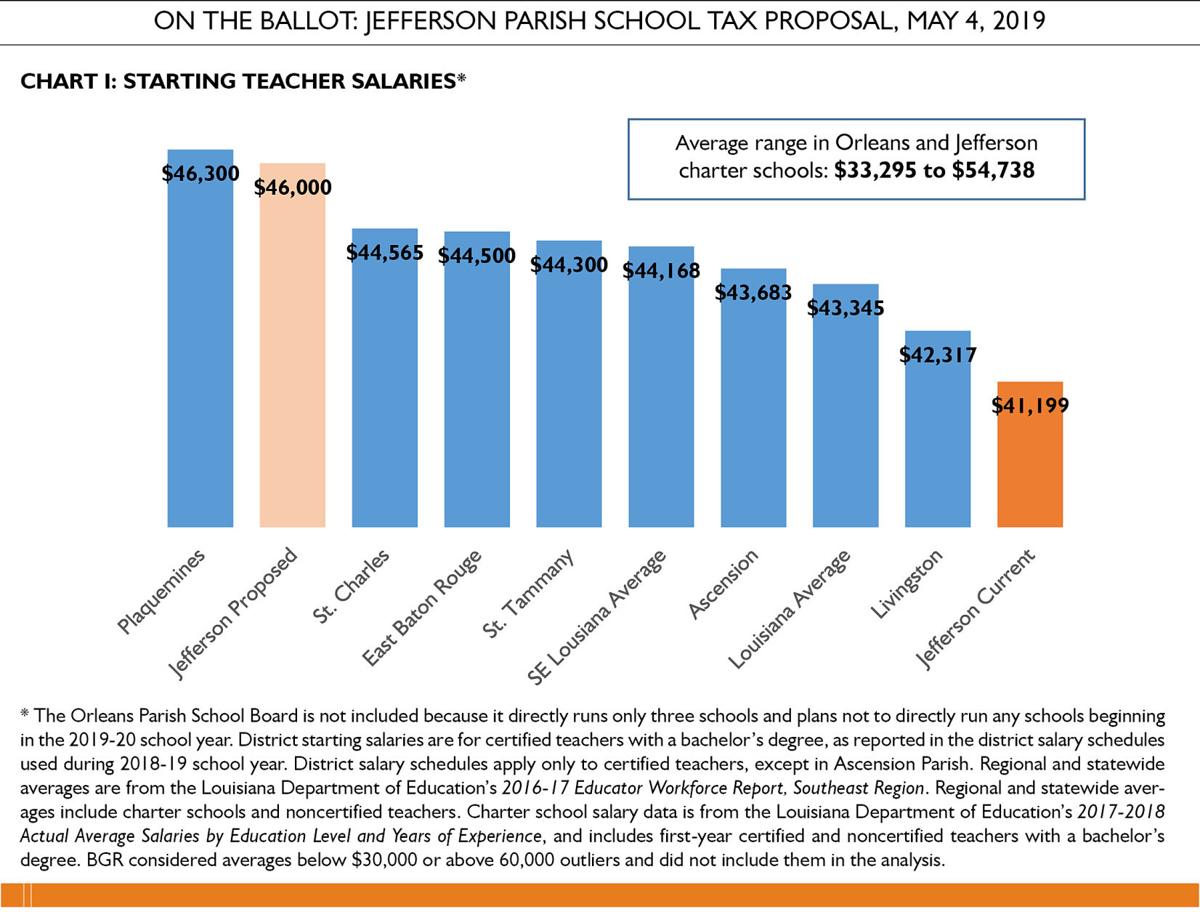

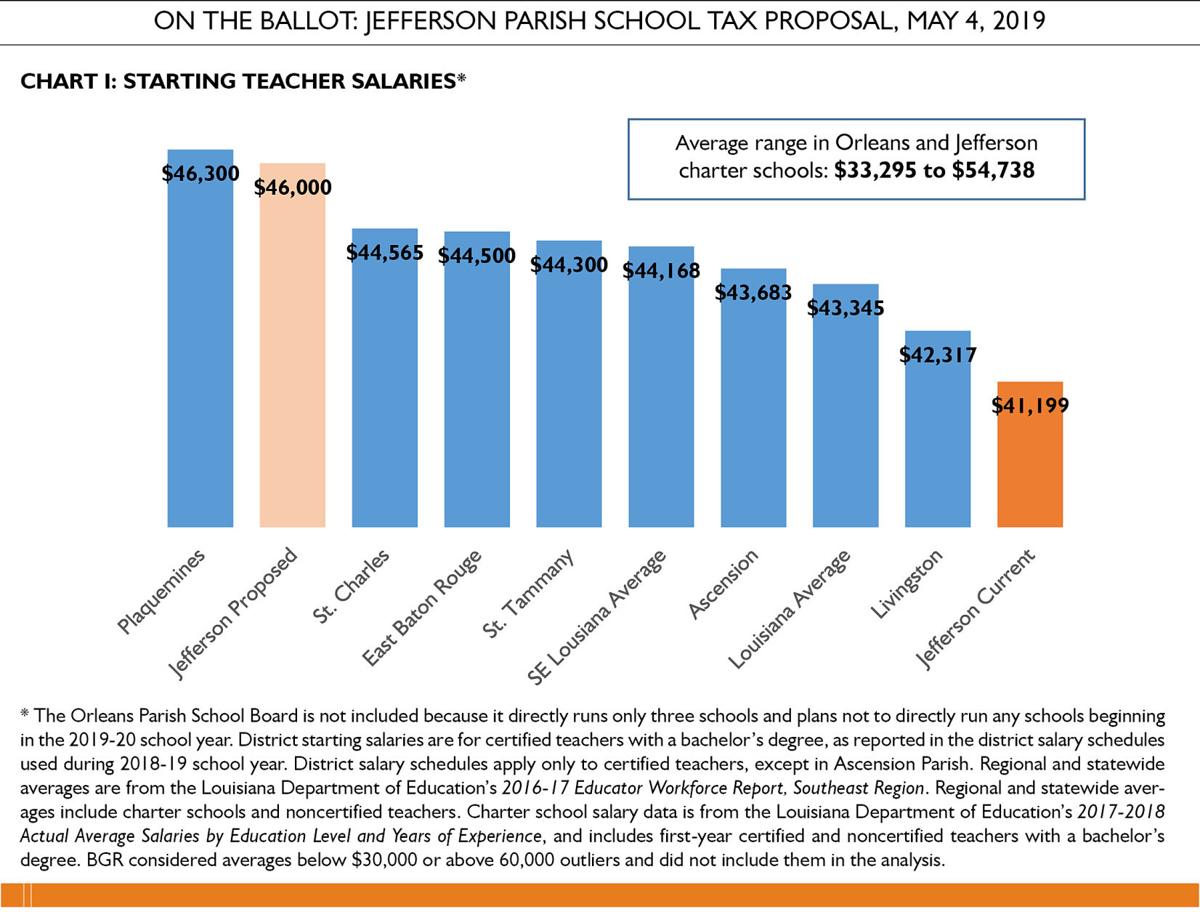

Jefferson Parish Backs Tax For Teacher Pay Raises News Nola Com

Jefferson Parish Backs Tax For Teacher Pay Raises News Nola Com

If You Want To Contest Your New Orleans Property Assessment The Deadline Is Right Around The Corner News Nola Com

If You Want To Contest Your New Orleans Property Assessment The Deadline Is Right Around The Corner News Nola Com

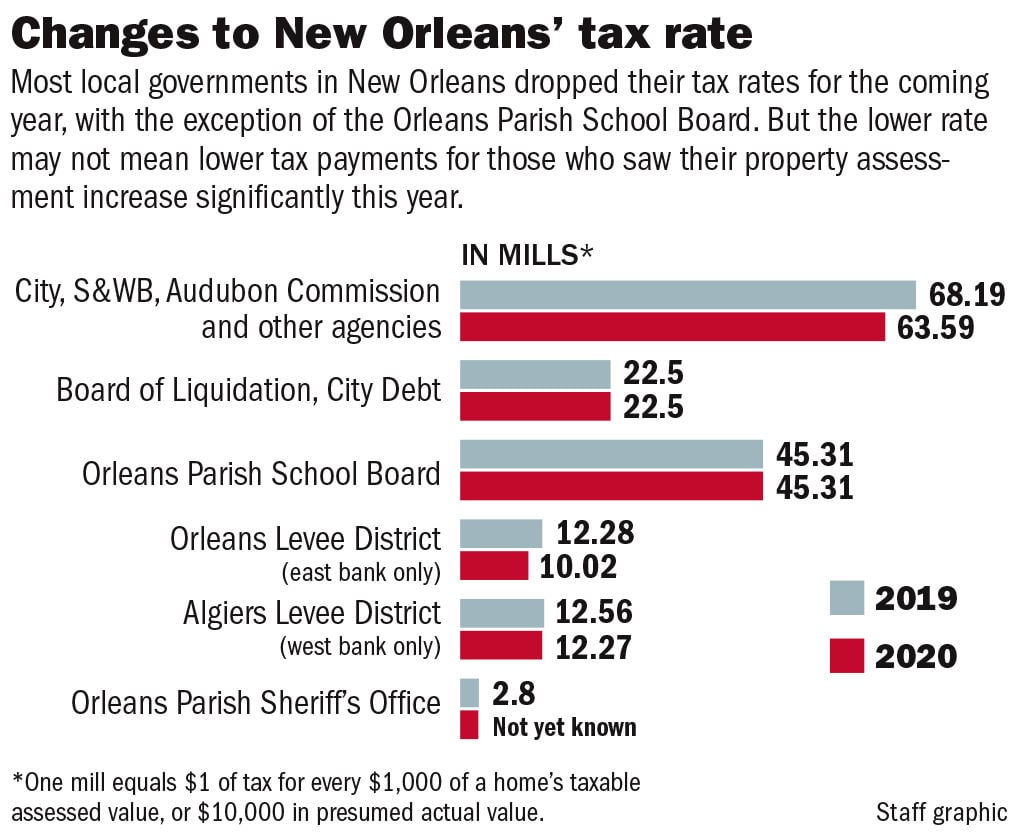

Taxes In New Orleans All But Set Property Owners Can Expect A Slight Dip In Rates Local Politics Nola Com

Taxes In New Orleans All But Set Property Owners Can Expect A Slight Dip In Rates Local Politics Nola Com

Property Taxes On Your Condo In New Orleans When Do You Pay And How Much

Property Taxes On Your Condo In New Orleans When Do You Pay And How Much

Policywatch Revisiting Assessment Issues In New Orleans

Policywatch Revisiting Assessment Issues In New Orleans

Taxes In New Orleans All But Set Property Owners Can Expect A Slight Dip In Rates Local Politics Nola Com

Taxes In New Orleans All But Set Property Owners Can Expect A Slight Dip In Rates Local Politics Nola Com

Orleans Parish Assessor S Office

Orleans Parish Assessor S Office

Orleans Parish Assessor S Office Reopening With Restrictions

Orleans Parish Assessor S Office Reopening With Restrictions

Policywatch Revisiting Assessment Issues In New Orleans

Policywatch Revisiting Assessment Issues In New Orleans

Homestead Exemptions In Orleans Parish What You Need To Know Homestead Title

Homestead Exemptions In Orleans Parish What You Need To Know Homestead Title

How To Apply For Your Homestead Exemption Witry Collective New Orleans Real Estate

How To Apply For Your Homestead Exemption Witry Collective New Orleans Real Estate

Homestead Exemption In New Orleans La How To File

Homestead Exemption In New Orleans La How To File

Http Qpublic Net La Orleans Docs Home Exemp Flyer Pdf

Paying For Street Maintenance In New Orleans

Paying For Street Maintenance In New Orleans

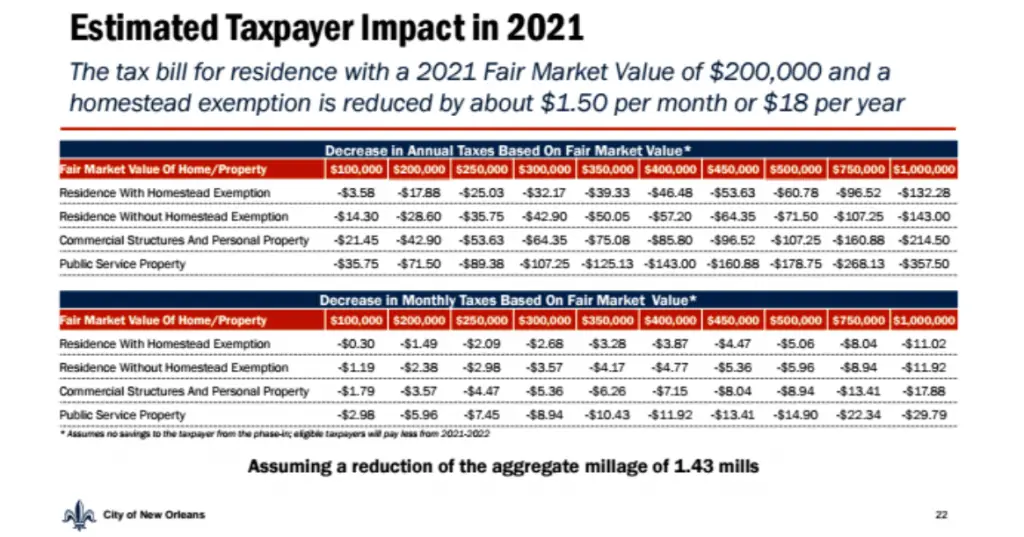

Tiny Dip In New Orleans Property Tax Rate Set For Next Year After Debt Payments Decrease Local Politics Nola Com

Tiny Dip In New Orleans Property Tax Rate Set For Next Year After Debt Payments Decrease Local Politics Nola Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home