Cra Ontario Property Tax And Rent Credit

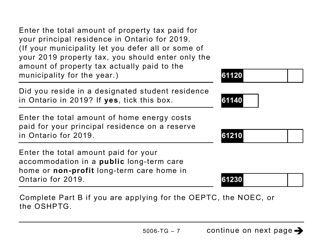

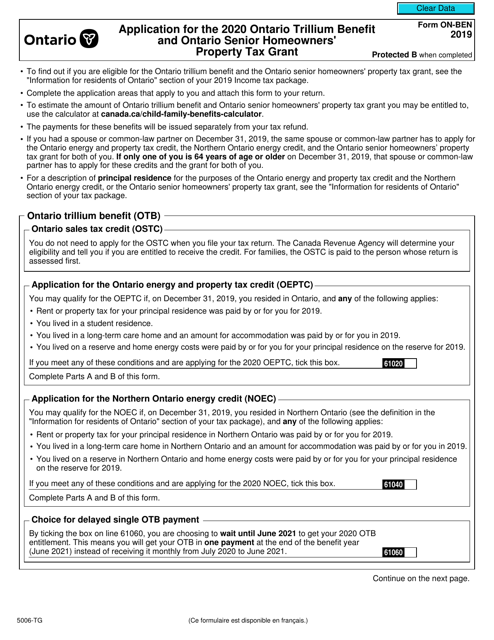

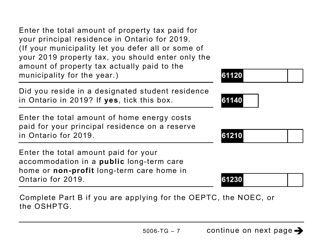

Application for the Ontario Trillium Benefit and the Ontario Senior Homeowners Property Tax Grant form. For example you can deduct property taxes for the land and building where your rental property is situated.

What Is The Ontario Trillium Benefit 2021 Turbotax Canada Tips

What Is The Ontario Trillium Benefit 2021 Turbotax Canada Tips

Accommodation costs for living in a public long-term care home.

Cra ontario property tax and rent credit. Ontario Energy and Property Tax Credit OEPTC You can apply for the Ontario Energy and Property Tax Credit if you have a low to middle-income and you live in Ontario. The Ontario energy and property tax credit OEPTC is designed to help low- to moderate-income Ontario residents with the sales tax on energy and with property taxes. CRA lets you claim municipal taxes from your rental income.

The Ontario energy and property tax credit is a personal tax credit that was implemented to help low- to moderate-income individuals with property taxes and the sales tax on energy. Ontario Energy and Property Tax Credit Rent energy property tax and 3. The basic property tax credit for individuals under age 65 is 250.

The Ontario Energy and Property Tax Credit is a personal tax credit funded by the Province of Ontario and implemented to help individuals with low- to moderate-income with the sales tax on energy as well as their property taxes. How to Qualify for the OEPTC. To qualify you must be living in Ontario at the beginning of the payment month and at least one of the.

This tax credit helps with rent and property taxes paid to your municipal government and is part of the Ontario Trillium Benefit. Province of Manitoba Personal. Manitobas Education Property Tax Credit.

This means you suffered a loss of 2000. The net income for one property is 3000 while the other property yielded a loss of 5000. You may be able to deduct your rental loss from other sources of income but you cannot use CCA to increase or produce a rental loss.

You can apply for the Ontario Energy and Property Tax Credit if you have a low to middle-income and you live in Ontario. Property tax credit amount. Efficient government at its best.

You can claim the Ontario Energy and Property Tax Credit if you lived in Ontario on December 31st and. You apply for the current-year OEPTC on your prior-year income tax and benefit return. People can apply for the credit if eligible for either component.

Even students in residence may be eligible for the credit. The provincial tax on rental income in Ontario for example is 1150. For more information on Manitobas Education Property Tax Credit see the following links.

You cannot claim a property tax credit for more than one Ontario residence such as a house and a cottage for the same period. However these rates arent applicable to all corporations because both the federal and provincial governments offer tax breaks. Northern Energy Credit for taxpayers living in Northern Ontario This benefit does not affect the tax return It is paid out separately just like the GST and CTB credit.

The basic property tax credit for individuals age 65 or older is 625. Ontario Property Tax Credit replaced by Energy and Property Tax Credit which was replaced by OTB based on occupancy cost - property tax paid or 20 of rent paid credit of up to 250 for non-seniors or 625 for seniors plus 10 of occupancy cost. The credit is calculated based on your family income for the year.

An energy component and a property tax component. If you rent real estate or other property including farmland that you own or have use of you will need to report the income to the CRA on Form T776 Statement of Real Estate Rentals which allows you to claim allowable expenses such as advertising insurance and interest on money you borrow to buy or improve the property. One taxman takes money from you the other gives it back.

Rent or property tax for your home. You may qualify for either the Energy Credit portion the Property Tax Credit portion or both. This program combines 1.

You can deduct property taxes you incurred for your rental property for the period it was available for rent. Ontario Sales Tax 2. The Ontario Energy and Property Tax Credit is one of the three credits that make up the Ontario Trillium Benefit.

2020 Ontario energy and property tax credit OEPTC calculation sheets Your OEPTC entitlement is calculated on a monthly basis. However for all the monthly payments from July 2020 to June 2021 you must use your marital status on December 31 2019. For more information go to Vacant land and Construction soft costs.

The setup of your corporation will determine the corporate tax rate and the tax credits. This tax credit helps with rent and property taxes paid to your. You or someone on your behalf paid.

CRA Information for Residents of Manitoba. One taxman takes money from you the other gives it back. As an Ontario resident you can claim your property taxes through the Ontario energy and property tax credit OEPTC by completing the ON-BEN.

This credit has two components. Residents of Manitoba who pay rent may be able to receive a credit of up to 20 of rent payments or 700 whichever is less. For example you own two rental properties.

Home energy costs for.

Statistics Canada Property Taxes

Statistics Canada Property Taxes

Solved How Can I Enter The Property Tax

Solved How Can I Enter The Property Tax

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

Property Taxes And Water Sewer Bills

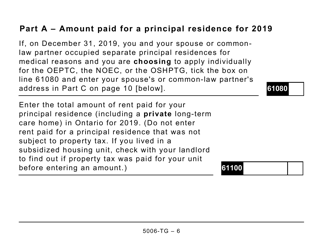

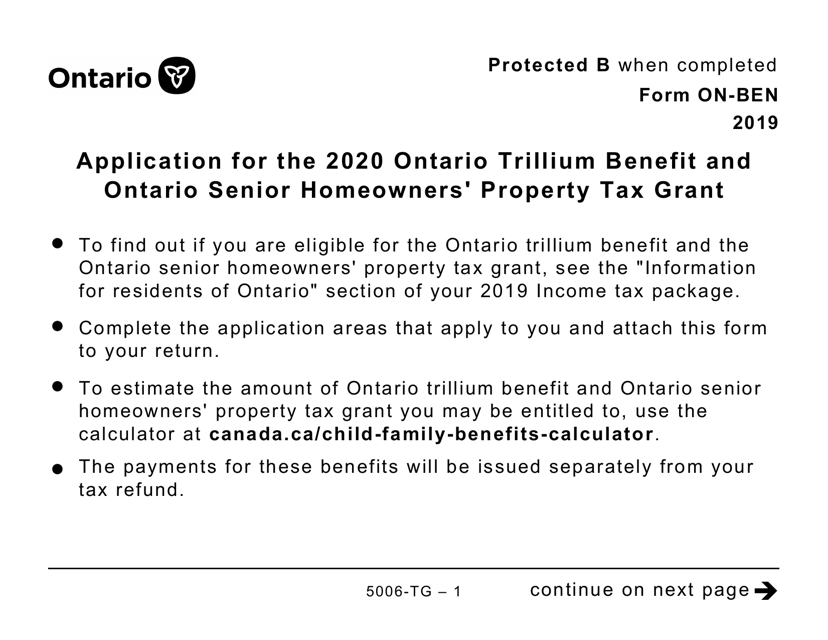

Form On Ben 5006 Tg Download Fillable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant 2019 Canada Templateroller

Form On Ben 5006 Tg Download Fillable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant 2019 Canada Templateroller

Form On Ben 5006 Tg Download Printable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant Large Print 2019 Canada Templateroller

Form On Ben 5006 Tg Download Printable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant Large Print 2019 Canada Templateroller

Ontario Senior Homeowners Property Tax Grant Qualifications Canadian Budget Binder

Ontario Senior Homeowners Property Tax Grant Qualifications Canadian Budget Binder

Solved Claimed Property Tax Doesn T Show Up In Box 61120

Solved Claimed Property Tax Doesn T Show Up In Box 61120

What Motor Vehicle Expenses Can You Claim On Income Tax In Canada Income Tax Motor Car Tax Prep

What Motor Vehicle Expenses Can You Claim On Income Tax In Canada Income Tax Motor Car Tax Prep

Form On Ben 5006 Tg Download Printable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant Large Print 2019 Canada Templateroller

Form On Ben 5006 Tg Download Printable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant Large Print 2019 Canada Templateroller

Form On Ben 5006 Tg Download Printable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant Large Print 2019 Canada Templateroller

Form On Ben 5006 Tg Download Printable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant Large Print 2019 Canada Templateroller

Solved Claimed Property Tax Doesn T Show Up In Box 61120

Solved Claimed Property Tax Doesn T Show Up In Box 61120

Property Taxes And Water Sewer Bills

Ontario Energy And Property Tax Credit 2021 Show Me The Green

Rent To Own Homes In Mississauga Rent To Own Homes Rent House Rental

Rent To Own Homes In Mississauga Rent To Own Homes Rent House Rental

Form On Ben 5006 Tg Download Printable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant Large Print 2019 Canada Templateroller

Form On Ben 5006 Tg Download Printable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant Large Print 2019 Canada Templateroller

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home