Are Property Taxes In Ohio Paid In Arrears

Real estate property taxes are actually billed and assessed one year in arrears. Paying real estate taxes in arrears is a concept that many states initiated during the Depression when many could not afford to pay their property taxes when actually incurred.

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

For example a typical property tax year runs from January 1 to December 31.

Are property taxes in ohio paid in arrears. Ohio real estate taxes may be paid in two semi annual installments. To help first-time home buyers understand how these figures are. Property taxes are fees paid to state county and various local authorities that in turn fund local schools road upkeep and watersewer line maintenance to name a few municipal services they cover.

This is also known as arrears. It is an easy way to set aside money on a monthly basis for the payment of your next real estate tax bill. Because of the payment in arrears phenomenon the taxpayer is in effect paying taxes based on a non-current valuation of their property.

The departments Tax Equalization Division helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work of local county auditors. Buyers and sellers are occasionally confused by the difference between the tax year and the due date on those taxes. Can taxes be paid in advance.

The County Treasurer collects real estate taxes for the previous year during the current year. This usually occurs because although property taxes are spoken of as being paid in arrears in reality they are paid partially in arrears and partially in advance. But these costs can vary based on where you live and when you close.

Because of the payment in arrears phenomenon the taxpayer is in effect paying taxes based on a non- current valuation of their property. 10 penalty on the total unpaid 2020 real estate tax. Ohio real estate taxes may be paid in two semi annual installments.

Property taxes can differ significantly depending on your region. 5 penalty on the total unpaid 2020 real estate tax. If you do not redeem or repay the late taxes and fees within five years of their due date the tax collector may sell your property at public auction to obtain payment.

When an individual pays property taxes in arrears they are essentially paying a tax bill for the current year in the closing months of the year. Postal service postmark by the due date reflected on the semi-annual tax bill. This is because taxes are six months in arrears in Ohio.

The real property tax is Ohios oldest tax. Some tax agencies allow residents to pay property taxes in arrears in installments. Our Budget Payment Program allows you to make monthly prepayments on your semi-annual tax bill.

Taxes are billed in arrears and can only be paid once they are assessed by the County Auditors office. July 10 2021 - July 19 2021. 2 Interest assessment on unpaid prior years delinquent real estate taxes.

Residents may then receive two bills during the following year one in May and one in. 1 Interest assessment on unpaid real. The tax is paid in arrears which means the homeowner pays.

East Palestine OH located in Columbiana County for example pays an average tax rate of 1189 and 2973 in annual property taxes which differs from the state average. Simply put individuals are paying property taxes for a defined duration of time at the end of that time period. Or to express it another way typically in Montgomery County and parts of Greene County the purchasers will be paying a prorated share of taxes for a time period that they did not live in the property.

Each month the payment remains unpaid you also incur a redemption fee of 15 percent. Payments must be received in the Treasurers office or contain a US. Semi-annual taxes are typically due in February and August.

The state of Ohio has an average tax rate of 3883 and pays 1553 in annual property taxes. The court will enter a judgment and order the home sold at auction to satisfy the tax debt. However you may set up a Budget Payment with our office.

Because Ohio real estate taxes may be paid in two six-month installments they are said to be six months in arrears. For example if the tax year runs from January through December the due date on those taxes may fall in October which. Taxes are never required to.

If your Ohio property taxes are overdue instead of selling the tax lien the county treasurer may start a foreclosure against you in court. 10 penalty on the unpaid current half tax. Municipalities and counties levy property tax to raise money for local infrastructure as well as schools and other public services.

It has been an ad valorem tax meaning based on value since 1825. Taxes are considered current if the most recent bill is paid.

The Story Of Why Real Estate Taxes Are Paid In Arrears And How Property Tax Prorations Work Chicago Real Estate Closing Blog

The Story Of Why Real Estate Taxes Are Paid In Arrears And How Property Tax Prorations Work Chicago Real Estate Closing Blog

Https Www Columbus Gov Workarea Downloadasset Aspx Id 2147512517

The Story Of Why Real Estate Taxes Are Paid In Arrears And How Property Tax Prorations Work Chicago Real Estate Closing Blog

The Story Of Why Real Estate Taxes Are Paid In Arrears And How Property Tax Prorations Work Chicago Real Estate Closing Blog

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Property Tax Prorations Case Escrow

Property Tax Prorations Case Escrow

Details Of The Contract Are Crucial In A Pleasant Real Estate Closing Ohio Ag Net Ohio S Country Journal

Details Of The Contract Are Crucial In A Pleasant Real Estate Closing Ohio Ag Net Ohio S Country Journal

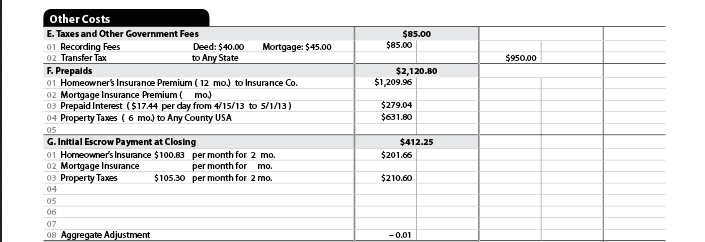

Escrows Prepaids At Closing What You Should Know U S Mortgage Calculator

Escrows Prepaids At Closing What You Should Know U S Mortgage Calculator

Understanding 2017 Ohio Property Taxes Cincinnati Real Estate Cincinnati Homes For Sale By Kathy Koops

Understanding 2017 Ohio Property Taxes Cincinnati Real Estate Cincinnati Homes For Sale By Kathy Koops

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Your Guide To Prorated Taxes In A Real Estate Transaction

Your Guide To Prorated Taxes In A Real Estate Transaction

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Understanding Tax Prorations Hancock Mcgill Bleau

Understanding Tax Prorations Hancock Mcgill Bleau

How To Buy Real Estate By Paying The Back Taxes Millionacres

How To Buy Real Estate By Paying The Back Taxes Millionacres

Several Ohio Counties Extend Real Estate Tax Due Date

Several Ohio Counties Extend Real Estate Tax Due Date

Delinquent Tax Collection Campbell County Attorney

Delinquent Tax Collection Campbell County Attorney

Equipment Lease Agreement Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Formats Lik Lease Agreement Legal Forms Templates

Equipment Lease Agreement Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Formats Lik Lease Agreement Legal Forms Templates

Deducting Property Taxes H R Block

Deducting Property Taxes H R Block

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home