Property Tax Deduction Paid By Someone Else

Divide line 2 by 366. To make matters worse if you pay the property tax your mother in law cant take the.

Stress Free Organizing For Tax Day Above Beyond Tax Payment Tax Deductions Tax Deadline

Stress Free Organizing For Tax Day Above Beyond Tax Payment Tax Deductions Tax Deadline

Filers who have a head of household status get a deduction of 18650.

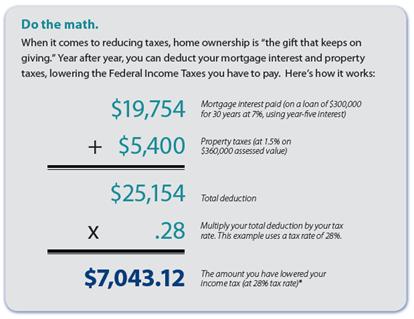

Property tax deduction paid by someone else. You can deduct property tax payments that you make directly to the taxing authority as well as payments made into an escrow account that are included in your mortgage payments Your mortgage lender would remit. The amount you can deduct is 2500 or the amount you paid whichever is less. Add a comment 7.

If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill. Please view the Turbo Tax FAQ below for more information on claiming itemized deductions. The daughter in the Tax Court case was also allowed to claim an itemized deduction for 5508 of local real estate taxes that were paid by the mother plus some taxes that the daughter paid.

Can I claim the property tax if theyre in someone elses name. You have an equitable interest in the property and can deduct the Real estate tax you pay. In other words you cant take the standard deduction and deduct your property taxes.

June 4 2019 1225 PM. Tax you paid for someone else Dan Williams Sep 14 10 at 1904. If you and your partner contribute equally to the expenses you can each take 50 percent of the deduction.

Instead they are imposed against the property. Enter the number of days in the property tax year that you owned the property. Enter the total real estate taxes for the real property tax year.

Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property. 1 the taxpayer must actually pay the tax and 2 the tax must be imposed against the taxpayer. Multiply line 1 by line 3.

If I pay someone elses property taxes can I use it as a deduction on my income tax return. According to the court the test for claiming a deduction is two-fold. Enter it on Schedule A Form 1040 line 5b.

This deduction cannot be claimed if you are married but dont file jointly or if you or your spouse are claimed as a dependent on someone elses return. Property Taxes Paid Through Escrow. Often however dividing the deductions will result in the highest total tax because neither partner will have enough to itemize.

In order to claim a deduction for her property taxes you must be the person responsible for paying them. They would also go onto schedule a as an itemized deduction. You can also deduct the mortgage interest you pay.

Property taxes are rarely imposed against individuals. If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your personal. For the 2020 tax year the standard deduction is 12400 for single filers and 24800 for joint filers.

Active 4 years 8 months ago. If you co-own a property but arent named on the deed have your ownership interest clearly defined in a written contract. The deduction amount also increases slightly each year to keep up with inflation.

Ask Question Asked 10 years 7 months ago. If you pay someone elses mortgage debt for them you can never deduct the mortgage interest unless you are indebted as. For jointly owned property you are entitled to deduct the actual amount of interest or taxes that you paid.

This is your deduction. For 2019 you can deduct up to 10000 5000 for married filing separately of. For example 2500 paid in property taxes.

In fact the IRS and most states allow property taxes paid by homeowners to be deducted when they file their tax returns.

Read more »