How To Find My Property Taxes Paid

Weve redesigned the page to provide easy access to content and tools for property owners local officials and real estate professionals. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax.

Pin By Dayane On The Intelligent Investor Property Tax Closing Costs Down Payment

Pin By Dayane On The Intelligent Investor Property Tax Closing Costs Down Payment

Pay-by-Phone IVR 1-866-257-2055.

How to find my property taxes paid. When using this method to make a payment you will be provided a confirmation number. Delinquent tax refers to a tax that is unpaid after the payment due date. 123 Main Parcel ID Ex.

Go to your city or county tax assessors website and look for a link to Property search or Property Tax records. The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. Welcome to our new Real Property landing page.

Approximately two-thirds of county-levied property taxes are used to support public education. You can also learn how to earn interest towards your future taxes. CREDITDEBIT CARD CONVENIENCE FEES APPLY.

Box 71063 Charlotte NC 28272 -1063 Write bill number on check or money order DO NOT MAIL CASH. WITHOUT Tax Bill Coupon Stub. John Smith Street Address Ex.

Find out how to pay your taxes online. Review your bank or credit card records if you paid the propertyreal estate tax yourself. In order to use Easy File you must be assigned a PIN to initially access your account.

Online payments are available for most counties. Mecklenburg County Tax Collector PO. Contact Your Assessors Office For Detailed Property Tax Information.

Search for a Property Search by. While youre here enter your email address in the Subscribe box to sign up for our Tax Tips for. Be sure to pay before then to avoid late penalties.

Want to avoid paying a 10 late penalty. Your own records the county assessors office your mortgage tax documentation or on the property tax. The tax is paid by individuals corporations partnerships etc.

The statewide property tax deadline is October 15. The County assumes no responsibility for errors in the information and does not guarantee that the. Please include your Property ID or property address on your check or.

Property tax payment details are available in one of four ways. Keep this number with your tax records. While we can provide estimates of your property assessment and property tax burden each county has a unique and often complicated method for calculating actual property tax due and a wide variety of details about your property are taken into account.

Budget Pay Program Learn how to pay your current taxes on a monthly basis to help you budget your money. WITH Tax Bill Coupon Stub. You can contact your lender to find out when they typically.

Your Receipt Numbers When paying by e-check once your account is registered and you initially enter your receipt number you. Mecklenburg County Tax Collector PO. Your Receipts With an account you will always have access to your past transactions and can review previous payment amounts and dates.

Please visit this page for more information. Easy File allows individuals to file and pay their Columbus Annual Income Tax Returns IR-25 via credit card debit card or electronic check. You can pay using a debit or credit card online by visiting ACI Payments Inc.

If you have an active City tax account you may request a PIN by sending an email to email protected. The Clark County Treasurer provides an online payment portal for you to pay your property taxes. This payment method charges your credit card Discover Visa MasterCard or American Express.

Enclose your check or money order payable to Jefferson County Sheriffs Office along with your tax bill payment stub or copy of your tax bill. Register to Receive Certified Tax Statements by email Property Tax Payments can be made at all locations by cash check and most major credit cards. Pay By Mail.

Although determining your property taxes may seem as simple as multiplying the value of your property by the millage rate it. Box 31457 Charlotte NC 28231-1457 Write bill number on check or money order DO NOT MAIL CASH. At that time the state government imposed a half-mil property tax which is equivalent to 050 per 1000 of taxable property value.

The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible. Who own property within the state. In Person at the counter Property Tax Payment Fees.

Scroll down to select the content youre looking for regarding local property tax and assessment administration. If you pay your property tax with your mortgage you can only deduct it after your lender has paid the tax on your behalf. At CheckFreePay Locations There is a large agent network of nearly 25000 locations so you can find a convenient and secure location to.

Municipalities levy a tax on property situated within the limits of the municipality for services provided by the municipality.

25 Illinois Counties With The Highest Median Property Taxes Property Tax Illinois Property

25 Illinois Counties With The Highest Median Property Taxes Property Tax Illinois Property

Property Taxes By State Property Tax Estate Tax Tax Payment

Property Taxes By State Property Tax Estate Tax Tax Payment

Title Tip The Property Tax Cycle Can Be A Vicious One Candysdirt Com Property Tax Cycle Tips

Title Tip The Property Tax Cycle Can Be A Vicious One Candysdirt Com Property Tax Cycle Tips

Property Tax Online Payment How To Pay Mcd House Tax Delhi Property Tax Online Payment Tax Payment

Property Tax Online Payment How To Pay Mcd House Tax Delhi Property Tax Online Payment Tax Payment

Homes For Sale Real Estate Listings In Usa Property Tax Real Estate Buying Investment Property

Homes For Sale Real Estate Listings In Usa Property Tax Real Estate Buying Investment Property

Which States Have The Lowest Property Taxes Property Tax History Lessons Historical Maps

Which States Have The Lowest Property Taxes Property Tax History Lessons Historical Maps

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

Deducting Property Taxes H R Block

Deducting Property Taxes H R Block

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

How To Calculate Real Estate Property Taxes Appeal Your Assessment Property Tax Estate Tax Real Estate

How To Calculate Real Estate Property Taxes Appeal Your Assessment Property Tax Estate Tax Real Estate

Entrepreneurshiptipoftheday Pay Taxes Tax Refund Tax Time Small Business Accounting

Entrepreneurshiptipoftheday Pay Taxes Tax Refund Tax Time Small Business Accounting

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

10 Essential Tax Questions For Homeowners Tax Questions This Or That Questions Homeowner

10 Essential Tax Questions For Homeowners Tax Questions This Or That Questions Homeowner

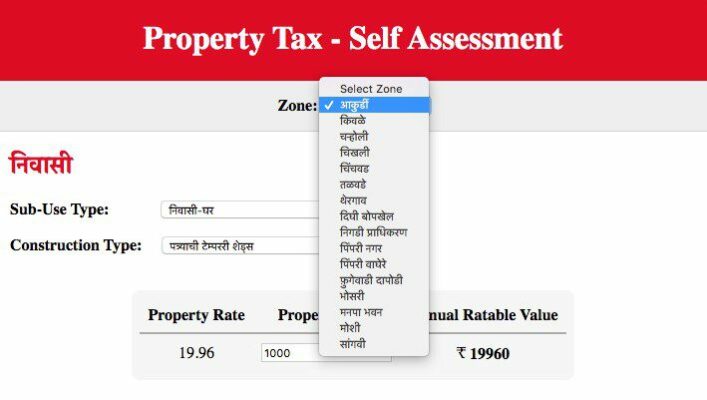

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

How Are My Property Taxes Calculated Understanding How Your Property Taxes Are Calculated Can Often Feel Like Property Tax Mortgage Marketing Mortgage Payoff

How Are My Property Taxes Calculated Understanding How Your Property Taxes Are Calculated Can Often Feel Like Property Tax Mortgage Marketing Mortgage Payoff

How To Pay Property Taxes Through An Escrow Account Property Tax Escrow Tax Help

How To Pay Property Taxes Through An Escrow Account Property Tax Escrow Tax Help

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home