Requirements For Homestead Exemption In Louisiana

Homestead exemption is doubled to 15000 of a homes assessed value 150000 of market value for property owned by a military veteran having a service-related disability rating of 100 as determined by the US. Spouses and dependents of deceased veterans who meet eligibility requirements may also be eligible for certain programs and services.

Increased Homestead Tax Exemption For Veterans Now A Law Loyd J Bourgeois Llc

Increased Homestead Tax Exemption For Veterans Now A Law Loyd J Bourgeois Llc

Showing a combined Adjusted Gross Income of 100000 or less.

Requirements for homestead exemption in louisiana. If your home is worth 70000 you. To qualify for the Senior Citizens Special Assessment Level Homestead Exemption freeze you must meet both of the following. Person owning a fifty percent 50 interest in property would be entitled to a homestead exemption of 3750 of the propertys assessed value provided such person occupies the home.

LA Homestead Exemption Eligibility Requirements You own and reside at the property in question and are. Requirements for Exemption Homestead is the home or house where a family resides. Disabled military veterans rated with 100 percent unemployability are eligible for a homestead exemption of 150000.

This exemption applies to all homeowners. The Homestead Exemption only applies toward your parish taxes. A homestead may contain one or more lots or tracts of land with the buildings and other appurtenances i.

The exemption applies to all homeowners. Regardless of how many houses are owned no one is entitled to more than one homestead exemption which is a maximum of 7500 of assessed value. This exemption applies to all homeowners.

To apply for Homestead Exemption you will need your drivers license or voters registration that reflects your current address. This exemption does not apply to municipal city taxes. No homestead exemption shall be granted on bond for deed property.

However any homestead exemption granted prior to June 20 2003 on any property. To apply for a Senior Freeze you will need proof of age and your 2019 federal tax returns. Please visit your local Parish Assessors Office to learn more.

Additionally you must meet the income requirement as set forth by the Louisiana legislature. However a person cannot have two homesteads at the same time and a removal from one that gains a new homestead is considered as abandonment of the old. 2 people who have a service-connected disability rating of 50 or more by the United States Department of Veterans Affairs.

General eligibility requirements include military service and Louisiana state residency. In order to qualify for homestead exemption one must own and occupy the house as hisher primary residence. If you change primary residence you must notify the assessor.

This income requirement changes annually. Additional special property tax exemptions are also assessed for some disabled veterans or active duty servicemembers killed in action. Subject to certain limitations homeowners can also protect the full value of their homestead against debts they incurred because of a catastrophic or terminal illness or injury.

Additional eligibility requirements apply. 3 members of the armed forces of the United States or the Louisiana National Guard who owned. If you file for bankruptcy Louisiana law allows owners to exempt up to 35000 of the value of a house or other property covered by the homestead exemption.

The homestead exemption is a tax exemption on the first 75000 of the value of a persons home. You will also need a copy of your recorded cash saledeed. 1 people who are 65 years of age or older.

Specific programs may have additional requirements. The homestead exemption is a tax exemption on the first 75000 of the value of a persons home. You must be 65 years of age or older by the end of the year in which you are applying.

The value of your home is exempt up to 75000 from state and parish property taxes. 2 The homestead exemption shall extend and apply fully to the surviving spouse or a former spouse when the homestead is occupied by the surviving spouse or a former spouse and title to it is in the name of a the surviving spouse as owner of any interest or either or both of the former spouses b the surviving spouse as usufructuary or c a testamentary trust established for the benefit of the surviving spouse and the descendants of the deceased spouse or surviving spouse. Homestead Exemption allows up to 7500 75000 market value to be exempt from paying parish taxes.

Present Constitution provides a special assessment level of residential property receiving the homestead exemption which is owned and occupied by the following person or persons who remain qualified for the special assessment level. The value of your home is exempt up to 75000 from state and parish property taxes. Qualifying Veterans can receive additional tax benefits on their homestead exemption.

The Louisiana Legislature must pass a law and the voters of the entire state must pass the new law at the voting polls before the amount of Homestead Exemption can be increased or decreased. In order to qualify for homestead exemption Louisiana State Law requires that the homeowner must own and occupy the residence by December 31st of the applicable tax year. All of your taxes would be exempted by the Homestead Exemption Law.

Department of Veterans Affairs. Louisianas constitution dictates that only 160 acres and 7500 in property value can be designated as a homestead. Revised Statute 4731 provides that individuals who reside in the state for more than six months are considered residents of the state for the entire year.

The basics of homestead protections in Louisiana are listed below. In addition a temporary absence from Louisiana does not automatically change the taxpayers domicile for income tax purposes. If the homeowner purchases a home in 2009 the homeowner would be eligible for homestead exemption in the 2009 tax year.

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Http Digitalcommons Law Lsu Edu Cgi Viewcontent Cgi Article 5815 Context Lalrev

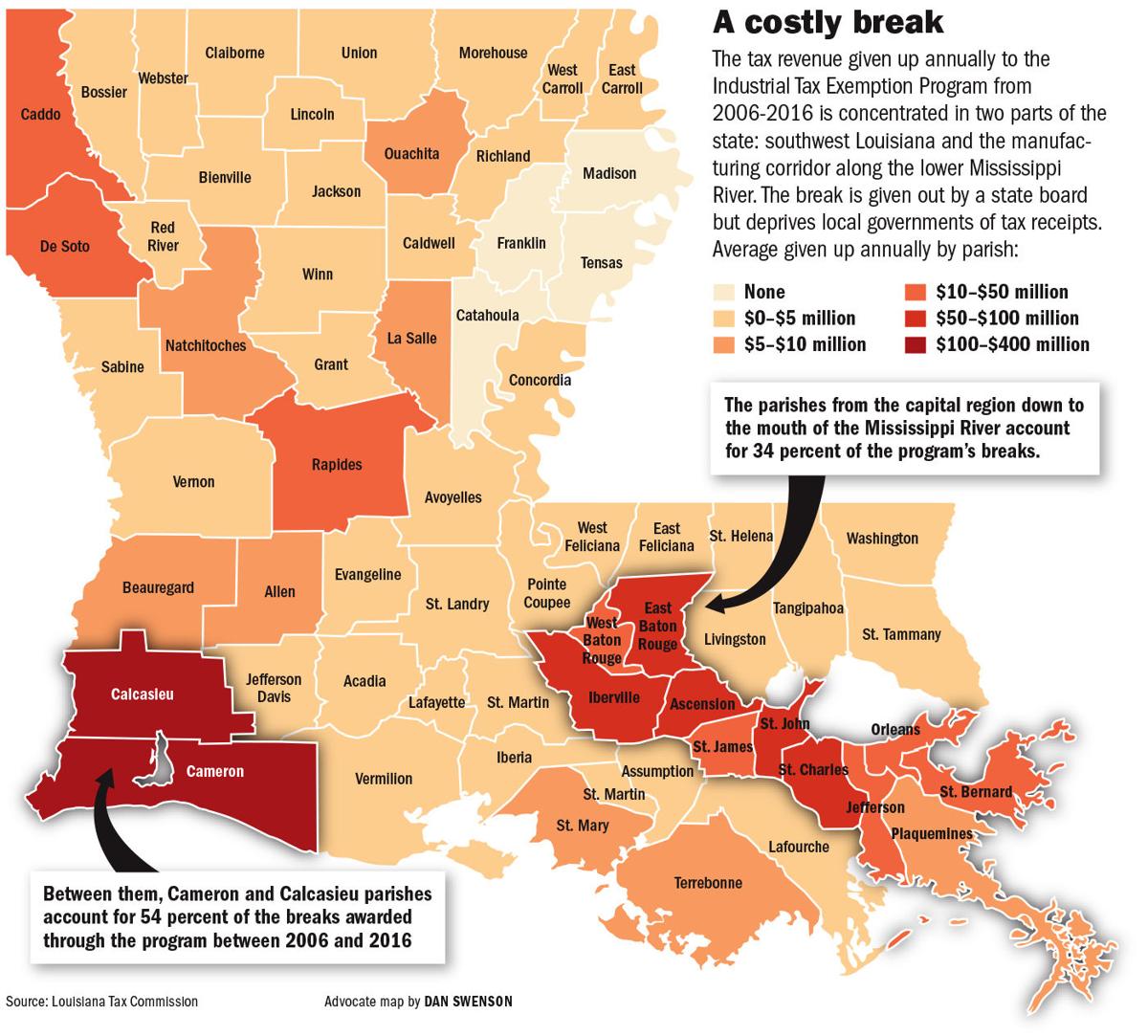

Jeff Sadow Louisiana Property Tax Policy Needs Bigger Reforms Jeff Sadow Theadvocate Com

Jeff Sadow Louisiana Property Tax Policy Needs Bigger Reforms Jeff Sadow Theadvocate Com

Louisiana Amendment 6 Homestead Exemption Special Assessment Income Limit Arklatexhomepage

Louisiana Amendment 6 Homestead Exemption Special Assessment Income Limit Arklatexhomepage

Brproud Nonpartisan Group Breaks Down Proposed Amendments To Louisiana Constitution

Brproud Nonpartisan Group Breaks Down Proposed Amendments To Louisiana Constitution

Homestead Exemption Louisiana Fill Online Printable Fillable Blank Pdffiller

Homestead Exemption Louisiana Fill Online Printable Fillable Blank Pdffiller

Bankruptcy Exemptions See If You Qualify In Louisiana The Cook Law Firm Aplc

Bankruptcy Exemptions See If You Qualify In Louisiana The Cook Law Firm Aplc

Voters Say Yes To Increasing Homestead Exemption Special Assessment Level

Voters Say Yes To Increasing Homestead Exemption Special Assessment Level

Federal State Meat Programs Department Of Agriculture And Forestrydepartment Of Agriculture And Forestry

Https Www Acadiaassessor Org Wp Content Uploads 2019 05 Special Assessment Freeze Notice 20206 Pdf

Orleans Parish Homestead Exemption Information And Where To File

Orleans Parish Homestead Exemption Information And Where To File

Https Www Jstor Org Stable 42879579

Https Www Latax State La Us Frontpagedocuments Rr2020 20pp Pdf

Louisiana Tax Commission Lax In Oversight Of Assessors Auditor Says Local Politics Nola Com

Louisiana Tax Commission Lax In Oversight Of Assessors Auditor Says Local Politics Nola Com

Home Mortgage Information When And Why Should You File A Homestead Exemption

Home Mortgage Information When And Why Should You File A Homestead Exemption

Homestead Exemptions In Bankruptcy After The Bankruptcy Abuse Prevention And Consumer Protection Act Of 2005 Bapcpa Everycrsreport Com

Homestead Exemptions In Bankruptcy After The Bankruptcy Abuse Prevention And Consumer Protection Act Of 2005 Bapcpa Everycrsreport Com

Http House Louisiana Gov Slg Pdf Chapter 203 20part 20d 20 20local 20government 20finance Pdf

Http Qpublic Net La Orleans Docs Home Exemp Flyer Pdf

Everything About Louisiana Property Tax Exemption Top Tips

Everything About Louisiana Property Tax Exemption Top Tips

Labels: exemption, property, requirements

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home