Utah Property Tax Exemption Form

To Apply Complete form TC-90CB Renter Refund Application and submit it to the Utah State Tax Commission 210 N 1950 W Salt Lake City UT 84134 by December 31. Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers.

Paradigm Shifting Approaches To Persistent Global Challenges Paradigm Team Development Filing Taxes

Paradigm Shifting Approaches To Persistent Global Challenges Paradigm Team Development Filing Taxes

Exemption of Utah Safety and Emission.

Utah property tax exemption form. For those organizations that already receive the exemption they are required to fill out and return an Annual Statement for Continued Property Tax Exemption each year. The following are exempt from personal property tax. File electronically using Taxpayer Access Point at taputahgov.

The percentage cap is subject to change but. Is not claimed as a personal exemption on someone elses income tax return Provide the following documentation. Tangible personal property with a total aggregate fair market value of 15300 2021 or less per taxpayer within a single county Utah Code 59-2-1115 and Rule R884-24P-68 An item of expensed personal property having an.

Yearly renewal is required for county tax exemption with a deadline of March 1st each year. Utah Income and Losses. There is a statement concerning Utah income taxes on this form.

260 rows Other Taxes. What does this property tax exemption have to do with Utah state income taxes. Non-profit and charitable organizations are eligible to apply to have their real property and personal business property to be exempt from taxation Utah Code 59-2-1101 and Utah State Constitution Article XIII Section 3.

A Utah permanent place-of-residence property tax abatement that uses the VAs percentage-rating for a service-connected disability is available for disabled Veterans or for their un-remarried widows or minor orphans. The primary residential exemption is 45 of your homes fair market value. DISABLED VETERAN PROPERTY TAX ABATEMENT.

Innocent or Injured Spouse. 120 The deadline for filing this application with your county of residence is September 1 Section 1 Claimant Information Claimants last name Claimants first. Refund Amount Up to 1027 of rent can be refunded based on income and a percentage of rent paid.

Purchaser must provide sales tax license number in the header on page 1. Please contact us at 801-297-2200 or taxmasterutahgov for more information. The Veterans disability rating must be at least 10 in order to qualify for this abatement.

Utah Income Taxes Utah State Tax Commission Official income tax website for the State of Utah with information about filing and paying your Utah income taxes and your income tax refund. Enter Tax Line 25. State Tax Refund Included on Federal Form.

State Tax Refund Included on Federal Form. This website is provided for general guidance only. Utah Income Tax Line 22.

59-2-1035 for property in this state that is the primary residence of the property owner or the property owners spouse that claim of a residential exemption creates a rebuttable presumption that the property owner and the property owners. If you receive the primary residential exemption on a property in Utah there is a rebuttable presumption that you are domiciled in Utah. You can find the Organization ID and Pin on the letter that was mailed to you.

Innocent or Injured Spouse. Continued Exemption Application - PDF. Enter Tax Line 25.

Tax returns 1099 W-2 forms andor any other documents to verify the income received for the previous calendar year for which the claimant is requesting the tax relief. All other counties require a signed Residential Property Declaration Form PT-19A or county. Direct Mail I certify I will report and pay the sales tax for direct mail purchases.

Utah Income and Losses. State Tax Deducted on Federal Form. Name Address SSN and Residency.

Utah Income Tax Line 22. To continue your tax exempt status please complete and submit the following form by March 1st. You must notify the seller of cancellation modification or limitation of the exemption you have claimed.

It does not contain all tax laws or rules. State Tax Deducted on Federal Form. You must be able to prove Utah residency and household income to qualify.

Providing their own financial support. Request a paper application via. Info from previous years.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Veteran with a Disability Property Tax Exemption Application UCA 59 -2 1903 and 1904 Form PT-030 Rev. Email taxmasterutahgov or call 801-297-2200 or 1-800-662-4335.

If a property owner or a property owners spouse claims a residential exemption under Utah Code Ann. Name Address SSN and Residency. Some counties may require an Application for Residential Property Exemption Form PT-23 or county equivalent to receive the exemption.

PDF Forms Instructions. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

Application For Hospital Sales Tax Exemption Illinois Tax Exemption Informative

Application For Hospital Sales Tax Exemption Illinois Tax Exemption Informative

Find 990 Series Forms And Annual Filing Requirements For Tax Exempt Organizations Irs Gov Filing Taxes Internal Revenue Service

Find 990 Series Forms And Annual Filing Requirements For Tax Exempt Organizations Irs Gov Filing Taxes Internal Revenue Service

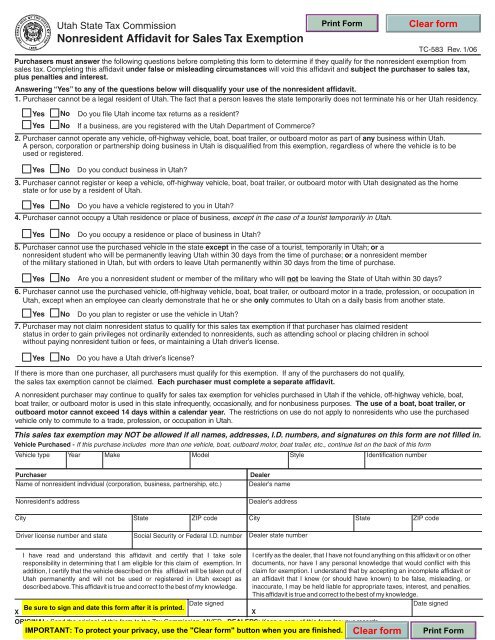

Utah Nonresident Affidavit For Sales Tax Exemption Tc 583

Utah Nonresident Affidavit For Sales Tax Exemption Tc 583

How To Get A Sales Tax Exemption Certificate In Utah

How To Get A Sales Tax Exemption Certificate In Utah

Https Propertytax Utah Gov Form Pt 021 Pdf

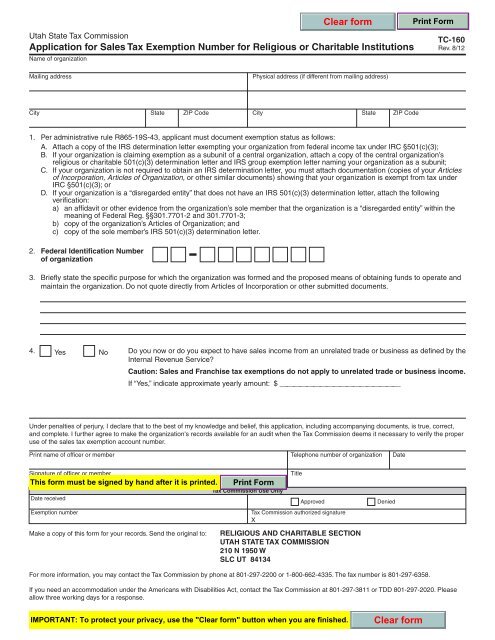

Form Tc 160 Application For Sales Tax Exemption Utah State Tax

Form Tc 160 Application For Sales Tax Exemption Utah State Tax

Sales Tax Changes In Your State For Property Management Software Rentec Blogengage Sales Tax Property Management Tax Software

Sales Tax Changes In Your State For Property Management Software Rentec Blogengage Sales Tax Property Management Tax Software

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

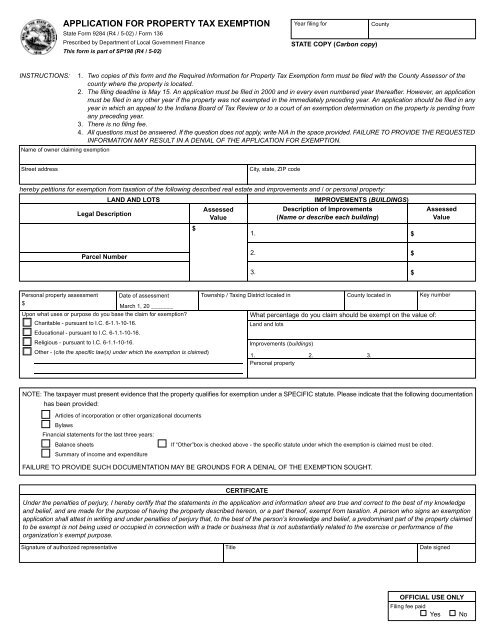

Form 136 Application For Property Tax Exemption

Form 136 Application For Property Tax Exemption

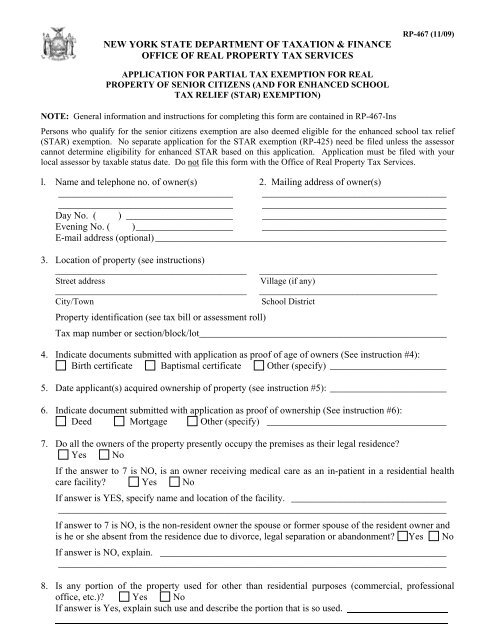

Application For Partial Tax Exemption For Real Property Of Senior

Application For Partial Tax Exemption For Real Property Of Senior

How To Get A Sales Tax Certificate Of Exemption In Virginia Startingyourbusiness Com

How To Get A Sales Tax Certificate Of Exemption In Virginia Startingyourbusiness Com

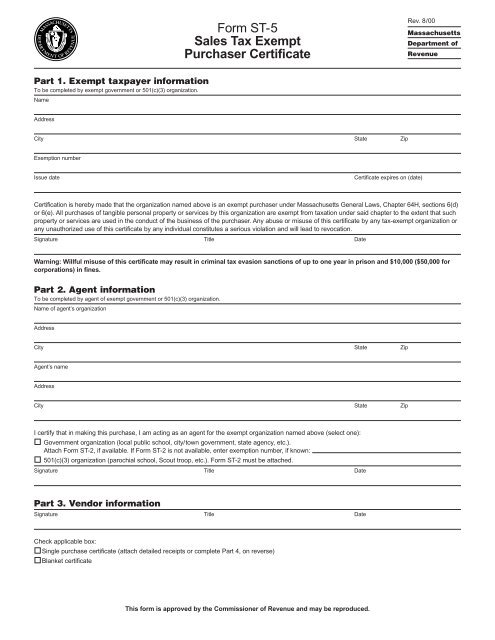

Sales Tax Exempt Form St 5 Grossman Marketing Group

Sales Tax Exempt Form St 5 Grossman Marketing Group

Inherit Law In Utah 7 Things You Should Know Gary Buys Houses Estate Planning Inheritance Tax Avoid Foreclosure

Inherit Law In Utah 7 Things You Should Know Gary Buys Houses Estate Planning Inheritance Tax Avoid Foreclosure

Https Propertytax Utah Gov Form Pt 020 Pdf

Https Www Titleadvantage Com Mdocs Homeowners 20prop 20tax 20exemption 20all Pdf

Louisiana Amendment 6 Homestead Exemption Special Assessment Income Limit Arklatexhomepage

Louisiana Amendment 6 Homestead Exemption Special Assessment Income Limit Arklatexhomepage

Https Propertytax Utah Gov Media Residential Exemption Faq Pdf

Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home