How Do I Get A Personal Property Tax Receipt St Louis County

CollectorAssessor Drop Box in front of the County Administration Building at 201 N. Please allow 5 business days for.

Filing Your St Louis County Personal Property Tax Declaration Robergtaxsolutions Com

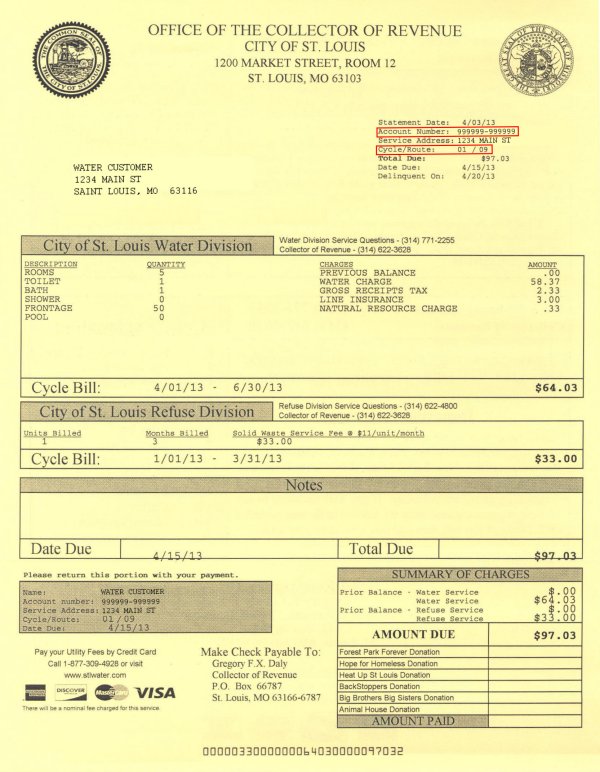

Obtaining a property tax receipt.

How do i get a personal property tax receipt st louis county. Assessments are due March 1. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or using the email form. Please contact us by calling 314 622-4108 or you can send e-mails to.

We look forward to serving you. Louis County Missouri Government ready to serve. To obtain a paper copy of a tax receipt please submit a written request with your name account number address and a 1 statutory fee by check or money order via one of the following methods.

Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees. Contact the Collector - Personal Property Tax and Real Estate Tax Department. Use your account number and access code located on your assessment form and follow the prompts.

The Collectors Office mails tax bills during November. You can pay your current year and past years as well. Pay your personal property taxes online.

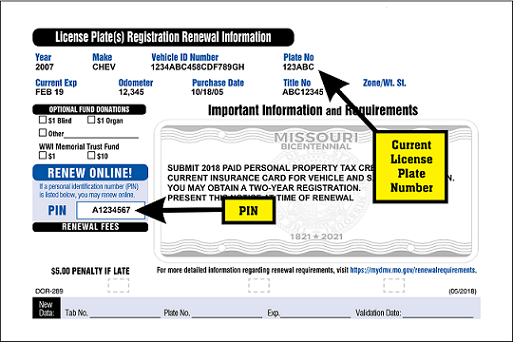

Please note that personal property account numbers begin with the letter. The official Paid Personal Property Tax Receipt needed for license renewal will be mailed from the Collectors Office. You may click on this collectors link to access their contact information.

Obtaining Copies of Tax Receipts. Search by Account Number or Address To declare your personal property declare online by April 1st or download the printable forms. Definition of Tangible Personal Property Every tangible thing being owned or part owned weather animate or inanimate other than money household goods wearing apparel and articles of personal use and adornment as defined by the State Tax.

Place funds in for an inmate in the St. Property Tax Receipts are obtained from the county Collector or City Collector if you live in St. The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 24 billion annually for personal property taxes real estate property taxes railroad taxes utility taxes merchants taxes and manufacturers taxes.

Search for your account by account number address or name and then click on your account to bring up the information. If you do not receive a form by mid-February please contact Personal Property at 636-949-7420 or by email. We are committed to treating every property owner fairly and to providing clear accurate and timely information.

Duplicate personal property tax receipts are available either by mail online at the Saint Louis County Collector of Revenues Office in Clayton or at any of the Saint Louis County Government satellite offices. Its quick and easy. Louis City in which the property is located and taxes paid.

Public Notices April 13. We have staff available Monday - Friday from 800 AM - 500 PM to answer calls and emails regarding your personal property tax needs. Pay your current or past real estate taxes online.

Your feedback was not sent. How can I contact the Collector of Revenues Office about my annual personal property taxes. Monday Through Friday 8 AM - 5 PM.

The Personal Property Department collects taxes on all motorized vehicles. Once your account is displayed you can select the year you are interested in. If a tax bill is not received by December 1 contact the Collectors Office at 816-881-3232.

Find tax payment history vehicles and print a tax receipt or proceed to payment. Second Street in St. Collector - Personal Property Tax and Real Estate Tax Department.

If you did not file a Personal Property Declaration with your local assessor and did not receive a Personal Property bill you will need to file with your. All personal property assessment forms are to be returned to the County Assessor no later than March 1st. Louis County Assessors Office is responsible for accurately classifying and valuing all property in a uniform manner.

Leave this field blank. The charge for a duplicate receipt by mail or at the Collectors office is 100.

Https Stlouiscountymo Gov St Louis County Government County Council Council Journals Journal Of The County Council 12082020

Https Stlouiscountymo Gov St Louis County Departments Public Health Environmental Services Waste And Recycling Regulations And Licensing Waste Hauling Licensing 2021 Waste Hauling Application

Look For Property Tax Bills In Mail You Can Avoid Lines By Paying Online St Louis Call Newspapers

Look For Property Tax Bills In Mail You Can Avoid Lines By Paying Online St Louis Call Newspapers

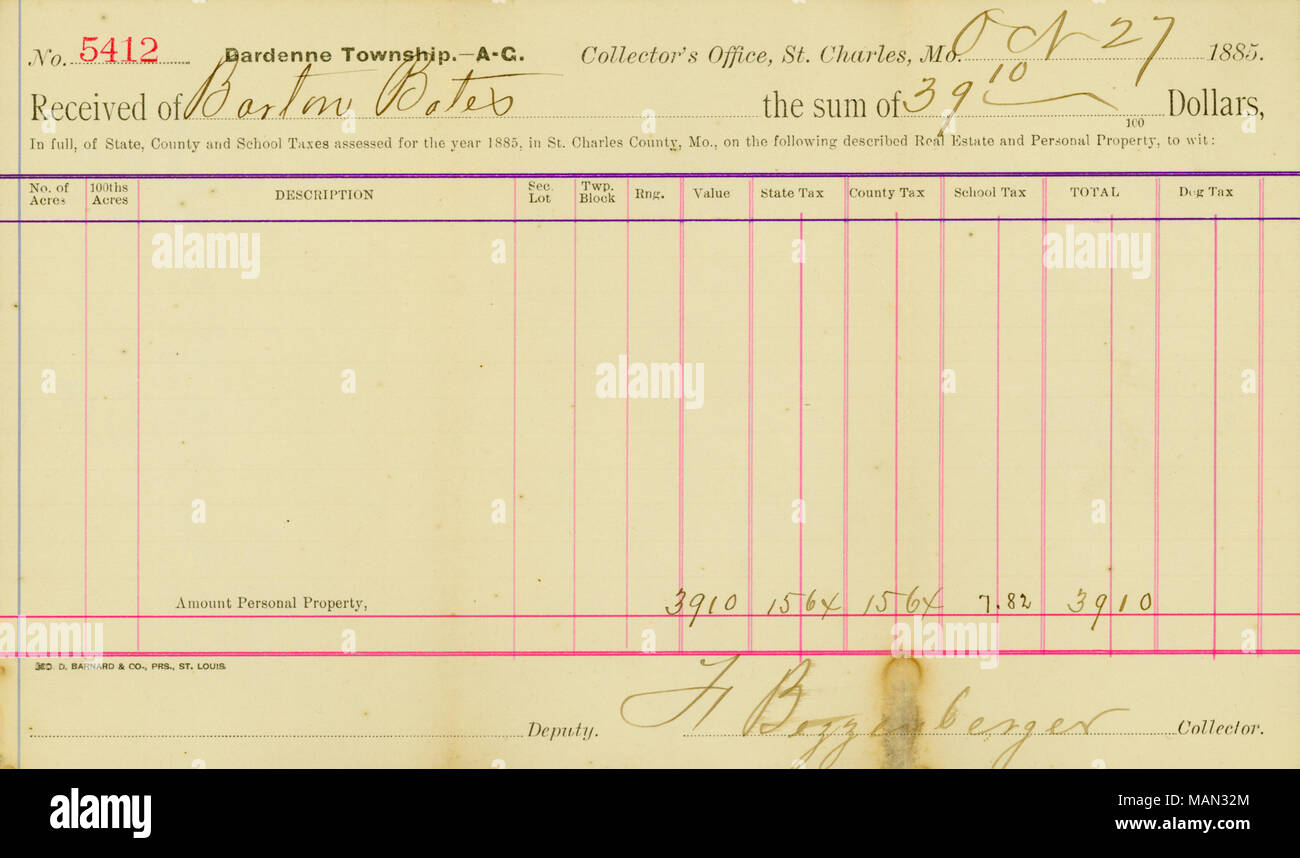

Personal Property Tax Receipt St Charles Missouri Property Walls

Personal Property Receipt St Louis County Property Walls

Personal Property Receipt St Louis County Property Walls

Personal Property Receipt St Louis County Property Walls

Personal Property Receipt St Louis County Property Walls

Msd To Start Multi Million West St Louis County Project Politics Stltoday Com

Msd To Start Multi Million West St Louis County Project Politics Stltoday Com

Personal Property Tax Receipt St Charles Missouri Property Walls

Personal Property Tax Receipt St Charles Missouri Property Walls

Personal Property Receipt St Louis County Property Walls

Personal Property Receipt St Louis County Property Walls

Print Tax Receipts St Louis County Website

Print Tax Receipts St Louis County Website

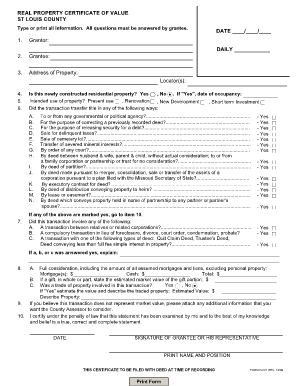

St Louis County Certificate Of Value Fill Online Printable Fillable Blank Pdffiller

St Louis County Certificate Of Value Fill Online Printable Fillable Blank Pdffiller

Collector Of Revenue St Louis County Website

Collector Of Revenue St Louis County Website

Https Stlouiscountymo Gov St Louis County Departments Administration Performance Management And Budget 2021 Recommended Budget Recommended Business Plan

Collector Of Revenue St Louis County Website

Collector Of Revenue St Louis County Website

Personal Property Receipt St Louis County Property Walls

Personal Property Receipt St Louis County Property Walls

Collector Of Revenue St Louis County Website

Collector Of Revenue St Louis County Website

New Resident Checklist Collector Of Revenue City Of St Louis Missouri

New Resident Checklist Collector Of Revenue City Of St Louis Missouri

Https Stlouiscountymo Gov St Louis County Departments Revenue Collector Of Revenue Partial Tax Payments Brochure

Labels: personal

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home