Property Tax On Cars Sc

Citizens can pay Vehicle taxes through mail drop box phone or internet. This reduced assessment ratio applies only to personal automobiles personal light trucks and personal motorcycles.

Liberty Sc Homes For Sale And Real Estate In Liberty Sc Realtortlowe Yeahthatgreenville Move To Greenville Keller Will Real Estate Prices Real Estate Estates

Liberty Sc Homes For Sale And Real Estate In Liberty Sc Realtortlowe Yeahthatgreenville Move To Greenville Keller Will Real Estate Prices Real Estate Estates

The Treasurers Office collects current real property taxes personal property taxes and motor vehicle taxes.

Property tax on cars sc. For vehicles that are being rented or leased see see taxation of leases and rentals. As of 500 pm. Counties in South Carolina collect an average of 05 of a propertys assesed fair market value as property tax per year.

You can find these fees further down on the page. Tag for Vehicle 1. South Carolina collects a 5 state sales tax rate on the purchase of all vehicles.

Real and personal property are subject to the tax. Report vehicle tax payments to the South Carolina Department of Motor Vehicles DMV respond to taxpayer inquiries regarding DMV tags. Spartanburg County Treasurer is no longer accepting 2020 real property tax payments.

After payment is processed receipts andor decals with vehicle registration will be mailed within 7 -. In addition to taxes car purchases in South Carolina may be subject to other fees like registration title and plate fees. Please note payments made online may take up to 48 hours to process.

According to Law Code. Select A Search Type. One-Call Response Center 24 Hours 803 929-6000 ombudsmanrichlandcountyscgov.

Search Vehicle Real Estate Other Taxes. Vehicles Real Estate. Lexington County makes no warranty representation or guaranty as to the content sequence accuracy timeliness or completeness of any of the database information provided herein.

In accordance with South Carolina law pursue collection of delinquent property taxes through notification advertisement and auction of delinquent property for collection of taxes penalties and costs. Sales Use taxpayers whose South Carolina tax liability is 15000 or more per filing period must file and pay electronically. File online using MyDORWAY To file by paper use the ST-455 State Sales Use and Maximum Tax Return and ST-593 Schedule of Maximum Tax Allocation.

South Carolina has one of the lowest median property tax rates in the United States with only five states collecting a lower median property tax than South Carolina. In South Carolina Borden has the lowest tax rate at 6 percent whereas Charleston has the highest at 9 percent. After you pay your taxes the plate or registration decal is mailed to the customer from the SCDMV the next working day.

Property tax is administered and collected by local governments with assistance from the SCDOR. SC DMV Form 400 to register for South. Motor vehicle taxes Deduction - Vehicle - High mileage Deduction - Vehicle - Military Legal residence applications Mileage Rate Schedules Not receiving tax bill.

Title 12 Chapter 37 Section 12-37-268 vehicle assessments are determined by guides given to each county by the South Carolina Department of Revenue. An amendment to the South Carolina Constitution Article X Section 1 8 B 1 reduced the assessment ratio on personal motor vehicles including motorcycles from 105 to 6 over six years beginning with the 2002 tax year. 2020 Hampton Street POBox 192 Columbia SC 29201.

March 232020 Spartanburg County will waive all CreditDebit card fees until further notice. Approximately two-thirds of county-levied property taxes are used to support public education. These guides are used to calculate the taxes due in accordance with the mills for the district in which you reside within the county.

Title Application SCDMV Form 400 Statement of Vehicle Operation SCDMV Form TI-006 Out-of-state registration Original paid property tax receipt from your county treasurer South Carolina beginners permit drivers license or. The average effective property tax rate in South Carolina is just 055 with a median annual property tax payment of 980. South Carolina State Rates for 2019.

A personal property tax notice is acquired from the Aiken County Auditors Office. If you have a loan on your automobile you need all of the following. In this state you must pay your personal vehicle property taxes before a license plate can be renewed and a new decal issued.

The online price of items or services purchased through SCGOV the states official Web portal includes funds used to develop maintain enhance and expand. For inquiries regarding real property tax for 2020 and prior please contact. Title dated prior to June 1989 must be signed over on back and be accompanied by a.

Proof of ownership title. The property taxes are due the last day of the month in which the license expires. Be sure to know the current.

Part of the reason taxes are so low is that owner-occupied residences get the benefit of a lower assessment rate than commercial and second residences. Your online payment will be processed by SCGOV a third party working under contract administered by the South Carolina Department of Administrations Division of Technology Operations. You can pay both the vehicle property taxes and renewal fees at the county treasurers office.

The service fee for Hospitality Taxes using SCGOV will also be waived until further notice. This website is a public resource of general information.

Family Auto Of Anderson Used Trucks Car Loans Anderson Sc

Family Auto Of Anderson Used Trucks Car Loans Anderson Sc

2018 Property Tax Rates Mecklenburg Union Counties Property Tax Union County Mecklenburg County

2018 Property Tax Rates Mecklenburg Union Counties Property Tax Union County Mecklenburg County

Get Your Car Cleaned For Less Myrtle Beach Myrtle Beach Sc Murrells Inlet

Get Your Car Cleaned For Less Myrtle Beach Myrtle Beach Sc Murrells Inlet

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Downtown Columbia Early 1960 S South Carolina Columbia Landmarks

Downtown Columbia Early 1960 S South Carolina Columbia Landmarks

Easyknock South Carolina Property Tax Rate A Complete Guide

Easyknock South Carolina Property Tax Rate A Complete Guide

While You Are Taking Care Of Property Inspections And Securing Financing Our Agents Will Be Working Behind The Sc This Or That Questions Finance Property Tax

While You Are Taking Care Of Property Inspections And Securing Financing Our Agents Will Be Working Behind The Sc This Or That Questions Finance Property Tax

Closing Costs Calculator Retirement Calculator Student Loan Calculator Budget Calculator

Closing Costs Calculator Retirement Calculator Student Loan Calculator Budget Calculator

Understanding Taxes When Buying A Myrtle Beach Home Myrtle Beach Homes Carolina Forest Homes

Understanding Taxes When Buying A Myrtle Beach Home Myrtle Beach Homes Carolina Forest Homes

Vr Spirit Nights At Cavrn Virtual Reality Spirit Night Myrtle Beach How To Raise Money

Vr Spirit Nights At Cavrn Virtual Reality Spirit Night Myrtle Beach How To Raise Money

Greenville County Courthouse Greenville Sc House Styles Courthouse Greenville

Greenville County Courthouse Greenville Sc House Styles Courthouse Greenville

South Carolina Sales Tax On Cars Everything You Need To Know

South Carolina Sales Tax On Cars Everything You Need To Know

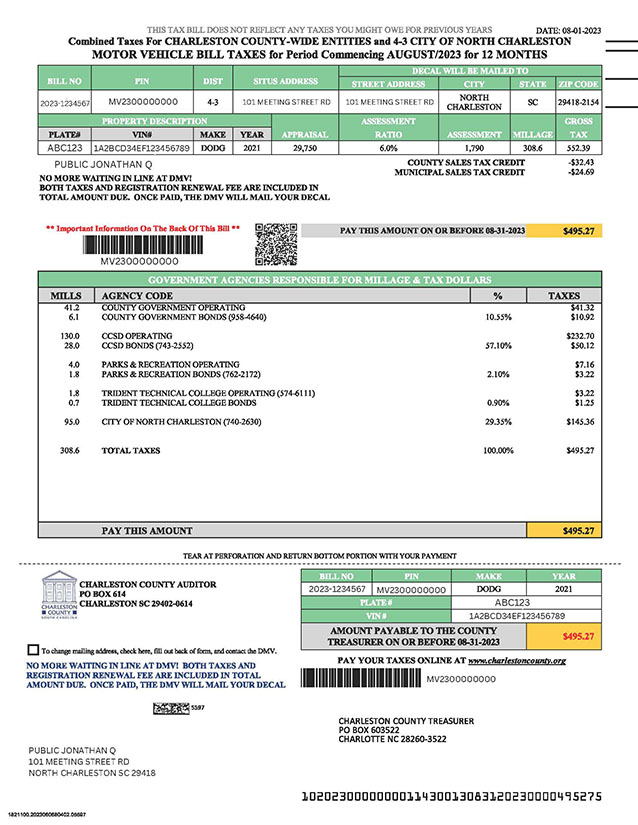

Sample Motor Vehicle Tax Bill Charleston County Government

Sample Motor Vehicle Tax Bill Charleston County Government

Property Tax Get The Tricks For Lowering The Bill Property Tax Tax Consulting Estate Tax

Property Tax Get The Tricks For Lowering The Bill Property Tax Tax Consulting Estate Tax

Virginia Sales Tax On Cars Everything You Need To Know

Virginia Sales Tax On Cars Everything You Need To Know

New Year Will Means New Carolina Addresses And Taxes For Some Nc Sc Border Residents Moving Van Vintage Trucks Moving Truck

New Year Will Means New Carolina Addresses And Taxes For Some Nc Sc Border Residents Moving Van Vintage Trucks Moving Truck

Cheap Car Insurance Quotes For Chevrolet Silverado In South Carolina Sc Compare Quotes Cheap Car Insurance Quotes Insurance Quotes

Cheap Car Insurance Quotes For Chevrolet Silverado In South Carolina Sc Compare Quotes Cheap Car Insurance Quotes Insurance Quotes

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home