Personal Property Tax Waiver Kansas City Mo

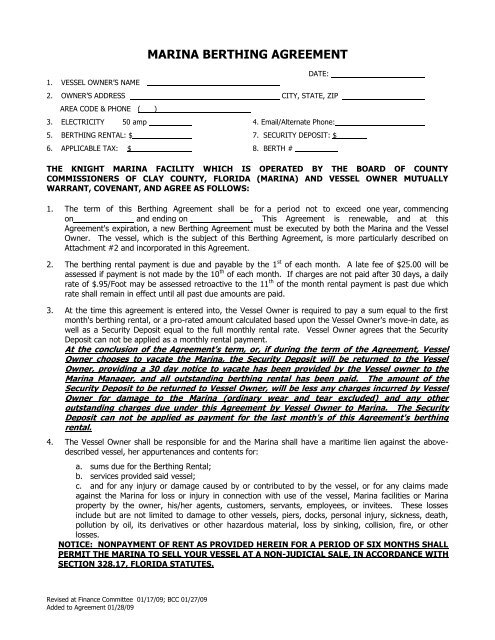

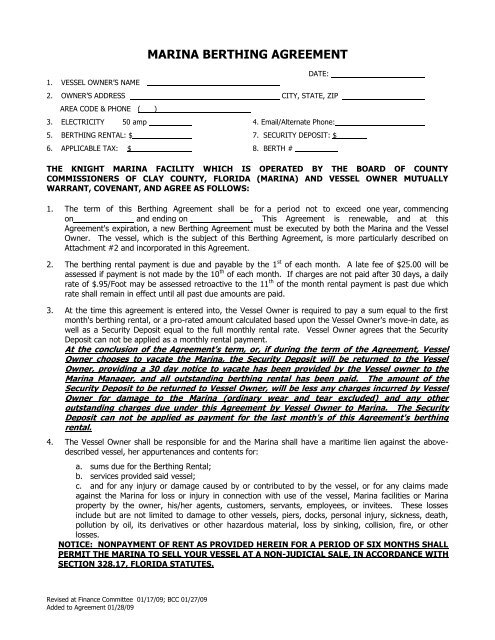

Form RD-109 is a tax return used by a resident individual taxpayer or a non-resident working in Kansas City Missouri to file and pay the earnings tax of one percent. Where Do My Tax Dollars Go.

Clay County Personal Property Tax Waiver Property Walls

Clay County Personal Property Tax Waiver Property Walls

A mill is one dollar in tax for every 1000 in assessed property value.

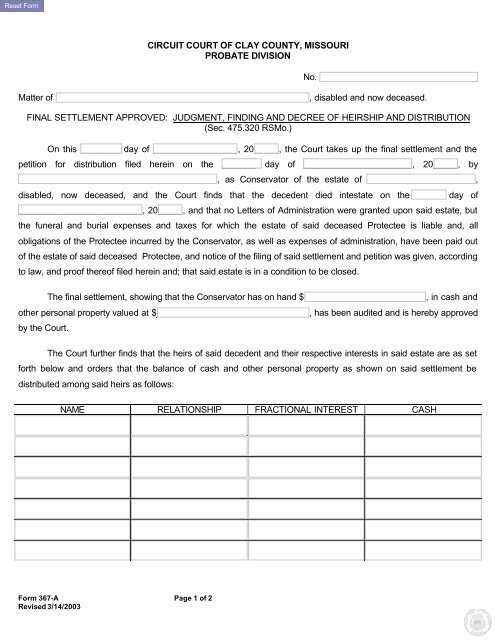

Personal property tax waiver kansas city mo. Jackson County Courthouse 415 E 12th Street Kansas City MO 64106 Phone. To qualify for a tax waiver in Clay County you must meet one of the following requirements. To qualify for a tax waiver in Greene County you must meet one of the following requirements.

Form RD-109 should not be filed if the earnings tax due is fully withheld by the taxpayers employer. In Kansas various types of property are assessed at different rates of their fair market value. For residents of Kansas City real and personal property taxes other than for railroads and utilities are included on the county property tax bill.

If you obtain a 2 year license plate with the State you are still responsible to pay personal property tax each year by December 31 or interest and penalty will be applied to your account. Personal property 33 13 percent. You are new to our state.

Information and online services regarding your taxes. You are a former resident returning to Missouri from another State and no unpaid personal property taxes are due in Greene County or any other Missouri County. Online Chat - available for Personal Property only from 200pm-430pm M-F Excluding County holidays INFORMAL COMMERCIAL REVIEW FORM INFORMAL RESIDENTIAL REVIEW FORM DMV TAX WAIVER LOOKUP PLATTE COUNTY SALES MAP IMPORTANT STATEMENT REGARDING PUBLIC.

So a house which sells for 100000 would be assessed for tax purposes at 11500. Residential property is assessed at 115 of fair market value. You are a former resident returning to Missouri from another State and no unpaid personal property taxes are due in Clay or any other Missouri County.

Tax rate is measured in mills. You will need to contact the assessor in the county of your residence to request the statement or non-assessment and to be added to the assessment roll for the subsequent tax year. The amount of tax you owe is based on the assessed value of the tangible personal property you owned on January one of that year and the levy rates provided by the political subdivisions example school districts city fire district etc in which you reside.

Jackson County Courthouse 415 E 12th Street Kansas City MO 64106 Phone. Jackson County Courthouse 415 E 12th Street Kansas City MO 64106 Phone. Form RD-109 is also used by a resident to request a refund if over withheld.

A waiver or statement of non-assessment is obtained from the county or City of St. What Are Personal Property Taxes. The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims.

Personal Property Tax - A Yearly Tax Personal property tax is paid to Jackson County by December 31 of every year on every vehicle you owned on January 1. What Does an Assessor Do and How Is My Value Determined. How to fill out personal property tax.

You lived in Clay County on January 1st of the previous year but you did not have any personal property titled in your name. Louis assessor if you did not own or possess personal property as of January 1. You are new to our state.

How Do I Fill Out My Online Assessment Form. No separate billing for these taxes comes from the City. Missouri law requires that property be assessed at the following percentages of true value.

PERSONAL PROPERTY TAXES Clay County Missouri Tax 2017-06-14T125229-0500.

Https Dor Mo Gov Forms 426 Pdf

Paid Personal Property Tax Receipt Missouri Property Walls

Paid Personal Property Tax Receipt Missouri Property Walls

How To Get A Sales Tax Certificate Of Exemption In Georgia Startingyourbusiness Com

How To Get A Sales Tax Certificate Of Exemption In Georgia Startingyourbusiness Com

How To Get A Sales Tax Certificate Of Exemption In Virginia Startingyourbusiness Com

How To Get A Sales Tax Certificate Of Exemption In Virginia Startingyourbusiness Com

Paid Personal Property Tax Receipt Missouri Property Walls

Https Www Jacksongov Org Documentcenter View 118 Business Personal Property Tax Exemption 2021 Application Pdf

Download Print Tax Receipt Clay County Missouri Tax

Download Print Tax Receipt Clay County Missouri Tax

How To Use The Property Tax Billing Portal Clay County Missouri Tax

How To Use The Property Tax Billing Portal Clay County Missouri Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

Https Dor Mo Gov Forms Missouri Titling Manual Pdf

Paid Personal Property Tax Receipt Missouri Property Walls

Clay County Personal Property Tax Waiver Property Walls

Clay County Personal Property Tax Waiver Property Walls

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home