How To Pay Personal Property Tax Missouri

Motorized vehicles boats recreational vehicles owned on January 1st of that year. State statutes require a penalty to be added to your personal property tax bill.

Pay Individual Income Tax Online If you have a balance due pay using your credit card or e-check.

How to pay personal property tax missouri. Your assessment list is due by March 1st of that year. The Collectors office cannot accept payments for the wrong amount. The County Collector is responsible for collecting current and delinquent real estate and personal property taxes for the county.

Please be sure that your payment is postmarked no late than December 31. Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees. The Collectors office then sends out the bills.

Assessment forms for Personal Property tax are mailed by the Assessors office in January and due by March 1st. Any envelope with a December 31st postmark will be considered paid on time. Each year you are required to make a list called an assessment list of all of your taxable personal property and mail or deliver this list to the County Assessors office in the county where you lived on the first day of January.

Pay your taxes online. Personal property tax is collected by the Collector of Revenue each year on tangible property eg. Property taxes are due on property owned or under your control as of January 1.

The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims. This list is due no later than the first of March. The County Clerk uses their assessed values and the taxing district levies to calculate the tax bills.

Tax bills are based on those forms and mailed to residents November 1st. Bills become delinquent as of midnight December 31st. You will need to contact the collector and request a statement of non-assessment.

You may pay personal and real estate taxes with one check but make sure to add them correctly and send the exact amount due. Click Link Account and Pay Property Tax. Enter the required information for your selection.

Information and online services regarding your taxes. If you did not own a vehicle on January 1 then no personal property taxes will be due. Personal property is assessed valued each year by the Assessors Office.

Collections are deposited daily into an interest-bearing account then distributed at the end of each month to the County Treasurer. Its quick convenient and accurate. Get information about personal property taxes.

The Missouri Department of Revenue accepts online payments including extension and estimated tax payments using a credit card or E-Check Electronic Bank Draft. The Collectors Office mails tax bills during November. Vehicle Licensing in Cass County.

Collector of Revenue The Assessors office assesses property both real estate and personal property. License your vehicle in Cass County. File your declaration form with the Assessors Office by April 1st of each year or be subject to a 10 penalty.

If a tax bill is not received by December 1 contact the Collectors Office at 816-881-3232. The Billing History is displayed. For questions regarding your property contact the Assessors Office at 314 622-4171.

E-Check is an easy and secure method allows you to pay your individual income taxes by bank draft. Taxes not paid in full on or before December 31 will accrue interest penalties and fees. You may also make payment at our 24 hour outdoor drop boxes located at the west entrance of the Carthage Courthouse or at the south entrance of the Courts Building located in Joplin.

If you purchase a vehicle after January 1 no taxes will be due on it in the year of purchase. Payments can be made in person at the courthouse in Carthage or the Jasper County Courts Building in Joplin. Find your personal property tax information.

When the linked parcel is displayed click Im Done. Search Personal Property Tax Info. ClayCountyMotax is a joint resource provided and maintained by Lydia McEvoy Clay County Collector and Cathy Rinehart Clay County Assessor.

Additional interest will accrue on all delinquent property taxes on the first day of each month from January to September for every year they are delinquent. From the Dashboard select the account you want a receipt for.

Online No Tax Due System Information

Online No Tax Due System Information

How To Appeal Property Taxes In Missouri Property Tax Appealing Missouri

How To Appeal Property Taxes In Missouri Property Tax Appealing Missouri

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Https Dor Mo Gov Forms 426 Pdf

Https Dor Mo Gov Forms 948 Pdf

Oklahoma State And Local Taxburden Combined Industries Manufacturing Utilities Educational Services And Art Entertainment Types Of Taxes Tax Burden

Oklahoma State And Local Taxburden Combined Industries Manufacturing Utilities Educational Services And Art Entertainment Types Of Taxes Tax Burden

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Paying Your Taxes Online Jackson County Mo

Paying Your Taxes Online Jackson County Mo

New 2016 Tax Incentive Enhancements Mo Tax Accountant Tax Payment Tax Accountant Business Tax

New 2016 Tax Incentive Enhancements Mo Tax Accountant Tax Payment Tax Accountant Business Tax

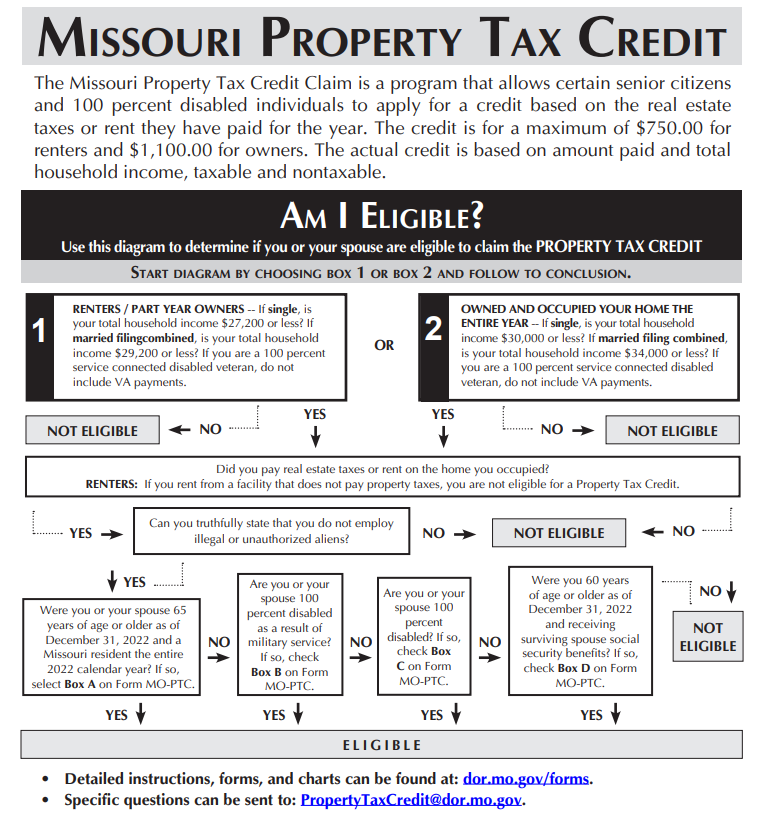

Property Tax Claim Eligibility

Property Tax Claim Eligibility

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home