Personal Property Tax Waiver Kansas City Missouri

Agricultural property may include farm machinery and attachments grains and livestock. No separate billing for these taxes comes from the City.

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

No fee is charged for a certificate of non-assessment.

Personal property tax waiver kansas city missouri. So a house which sells for 100000 would be assessed for tax purposes at 11500. A waiver or statement of non-assessment is obtained from the county or City of St. Louis assessor if you did not own or possess personal property as of January 1.

To qualify for a tax waiver in Clay County you must meet one of the following requirements. Missouri law requires that property be assessed at the following. This certificate is used in lieu of a paid personal property tax receipt when registering a vehicle or renewing license plates.

For residents of Kansas City real and personal property taxes other than for railroads and utilities are included on the county property tax bill. In Kansas various types of property are assessed at different rates of their fair market value. Motorized vehicles boats recreational vehicles owned on January 1st of that year.

Personal property tax is collected by the Collector of Revenue each year on tangible property eg. You will need to contact the assessor in the county of your residence to request the statement or non-assessment and to be added to the assessment roll for the subsequent tax year. The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims.

Jackson County Courthouse 415 E 12th Street Kansas City MO 64106 Phone. Personal property is assessed valued each year by the Assessors Office. You lived in Clay County on January 1st of the previous year but you did not have any personal property titled in your name.

Information and online services regarding your taxes. Jackson County Courthouse 415 E 12th Street Kansas City MO 64106 Phone. Determining What You Need for Personal Property.

Your assessment list is due by March 1st of that year. Personal Property Tax - A Yearly Tax Personal property tax is paid to Jackson County by December 31 of. Missouri Sales Tax - A One-Time Tax Sales Tax is paid to the State usually at the Department of Motor Vehicles when the vehicle is first purchased.

The amount of tax you owe is based on the assessed value of the tangible personal property you owned on January one of that year and the levy rates provided by the political subdivisions example school districts city fire district etc in which you reside. Online Chat - available for Personal Property only from 200pm-430pm M-F Excluding County holidays INFORMAL COMMERCIAL REVIEW FORM INFORMAL RESIDENTIAL REVIEW FORM DMV TAX WAIVER LOOKUP PLATTE COUNTY SALES MAP IMPORTANT STATEMENT REGARDING PUBLIC. You are new to our state.

Missouri vehicle sales tax and County personal property tax are 2 different types of tax. Per Missouri Revised Statute 137122 property is placed in service when it is ready and available for a specific use whether in a business activity an income-producing activity a tax-exempt activity or a personal activity. No Tax Obligations A non-assessment is issued to a county resident when they had no personal property tax obligation to any county in Missouri for the prior years.

You are a former resident returning to Missouri from another State and no unpaid personal property taxes are due in Clay or any other Missouri County. Jackson County Courthouse 415 E 12th Street Kansas City MO 64106 Phone. Take the 11500 times the amount of the mill levy to calculate how much tax is owed.

Residential property is assessed at 115 of fair market value. Even if the property is not being used the property is in service when it is ready and available for its specific use. State statutes require a penalty to be added to your personal property tax bill.

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

Paid Personal Property Tax Receipt Missouri Property Walls

Https Dor Mo Gov Forms Missouri Titling Manual Pdf

Https Wordpressstorageaccount Blob Core Windows Net Wp Media Wp Content Uploads Sites 535 2018 01 Ccr Tax Exemption Pdf

Paid Personal Property Tax Receipt Missouri Property Walls

Https Www Jacksongov Org Documentcenter View 118 Business Personal Property Tax Exemption 2021 Application Pdf

Paid Personal Property Tax Receipt Missouri Property Walls

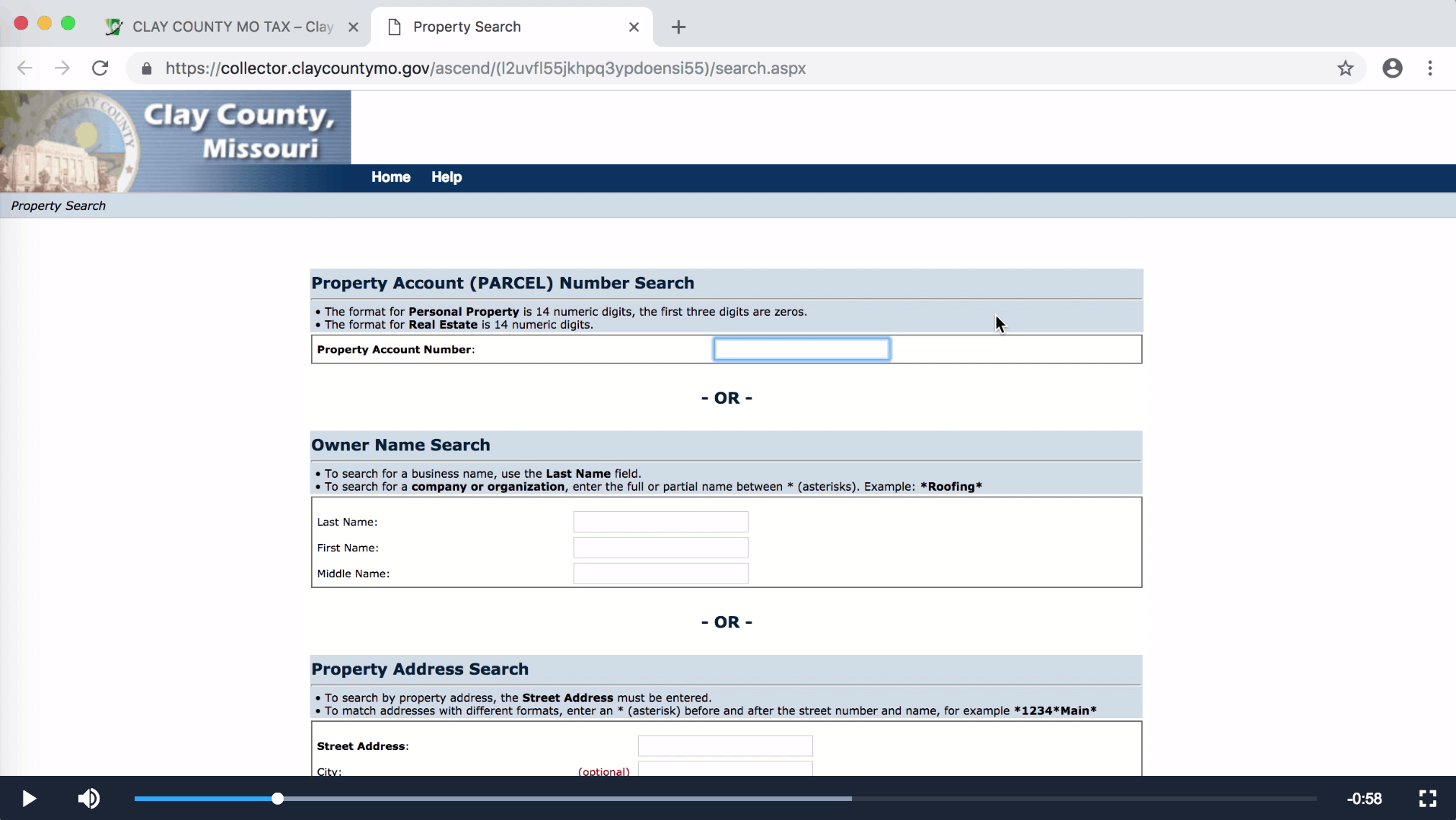

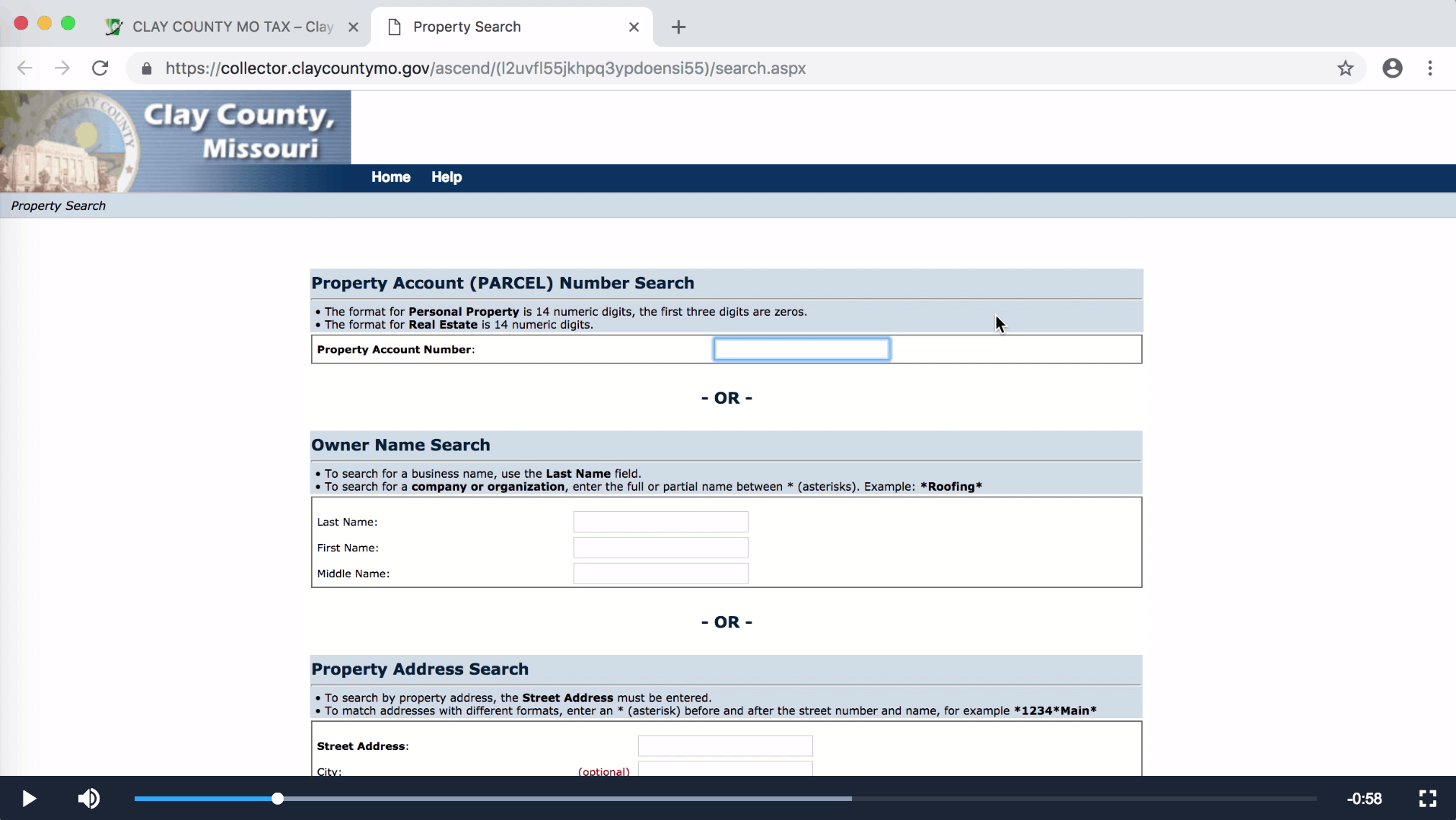

How To Use The Property Tax Billing Portal Clay County Missouri Tax

How To Use The Property Tax Billing Portal Clay County Missouri Tax

Https Dor Mo Gov Forms 426 Pdf

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

How To Get A Sales Tax Certificate Of Exemption In Virginia Startingyourbusiness Com

How To Get A Sales Tax Certificate Of Exemption In Virginia Startingyourbusiness Com

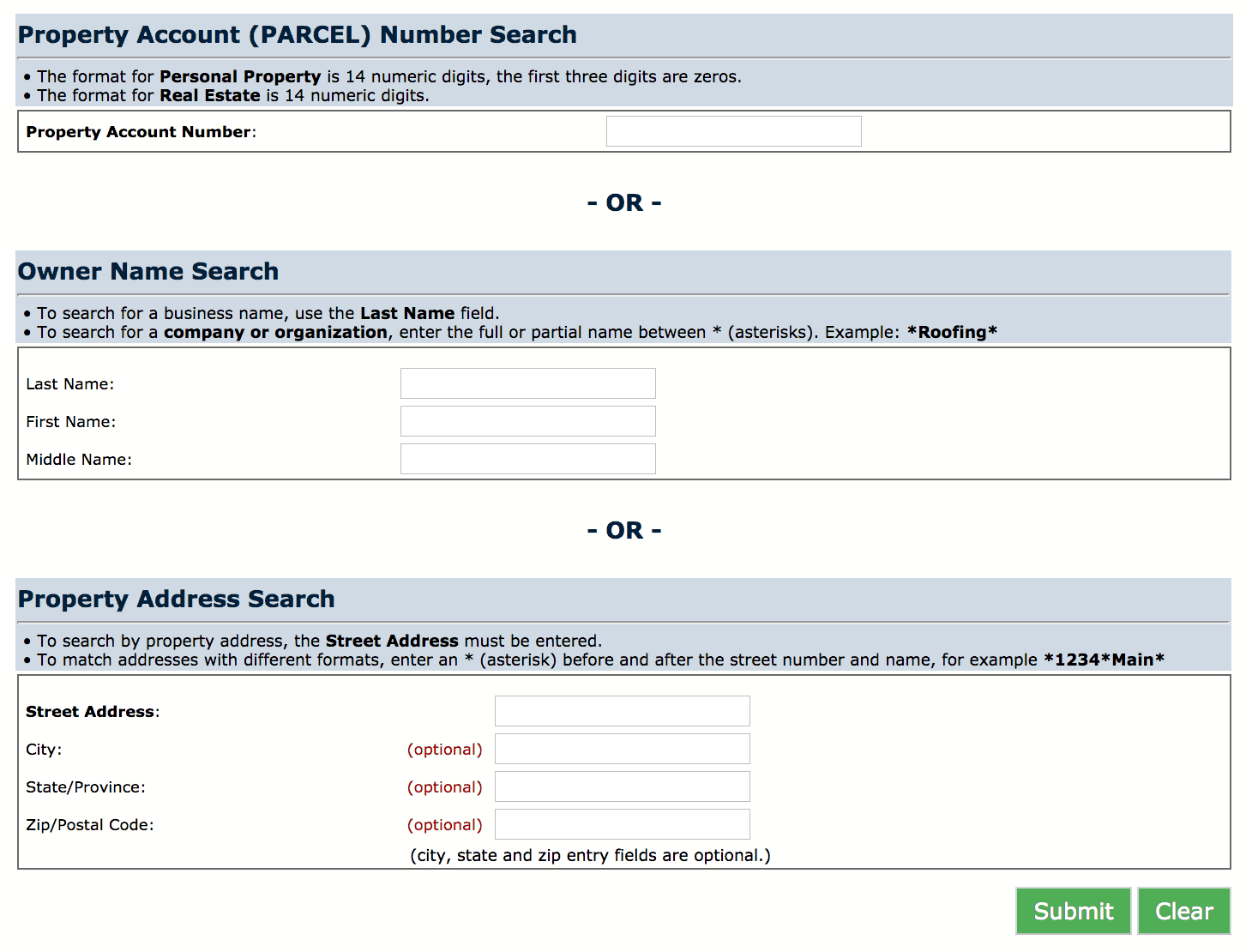

Download Print Tax Receipt Clay County Missouri Tax

Download Print Tax Receipt Clay County Missouri Tax

Chapter 100 Sales Tax Exemption Personal Property Department Of Economic Development

Chapter 100 Sales Tax Exemption Personal Property Department Of Economic Development

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home