How Can I Check My Property Tax Online In Kolkata

Get details on the new tax deadlines. Your banks ABA routing number from your check Your checking account number.

Pin By Realtyquest On Property In 2020 Property Leaning Tower Of Pisa Commercial Property

Pin By Realtyquest On Property In 2020 Property Leaning Tower Of Pisa Commercial Property

How to pay property tax online.

How can i check my property tax online in kolkata. To see your Economic Impact Payments view or create your online account. However you can read here about how the Kolkata Municipal Corporation corporation calculates House Tax. You can pay your property tax online at Paytm with the help of just a few simple clicks.

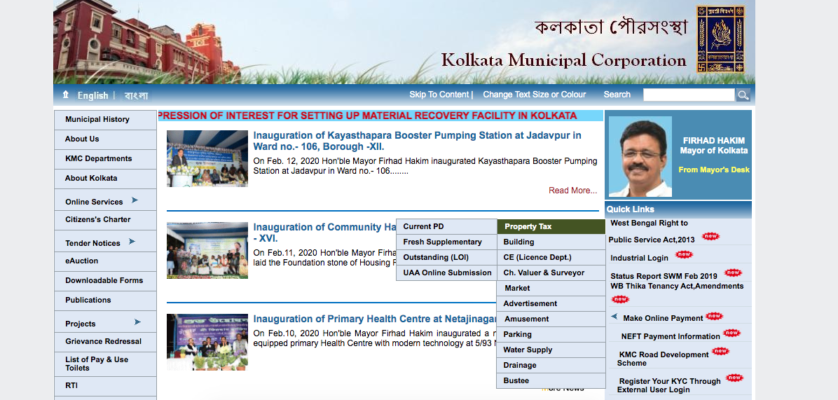

Profession Tax Directorate of Commercial TaxesGovernment of West Bengal. Unit Area Assessment UAA system has commenced from 1st April 2017. Choose assessment-collection from the drop-down menu.

Visit Treasurer and Tax Collector website. The Tax Office accepts e-checks credit cards and debit cards for online payment of property taxes. If you itemize your deductions or are a Yonkers resident see How to report your property tax credits.

Paytm provides you with a very fast and comfortable medium to pay your property tax online. Using the link Taxpayers can calculate their tax online. The systems are updated once every 24 hours.

Letter of Intimation is issued against outstanding tax bills PD orand FS. Fresh bills are also issued after the first assessment of a property LOI. View property tax credit checks.

Login e-District using your User ID and Password. Your actual tax rates. If you want to learn when to expect your School Tax Relief STAR check see STAR Check Delivery Schedule for the most recently updated information for your area.

Also known as the property tax number this number is used for identification purposes for your property. Click Online Services on left menu bar. How to Check Your Refund Status.

FreshSupplementary bills which are issued immediately after a hearing to reflect any changes to the earlier issued bills. Your check number. Assess your property tax on your own.

The payment amount. The deadlines for individuals to file and pay most federal income taxes are extended to May 17 2021. Make Timely Property Tax Payment To Avoid Penalty and Earn Reward.

Click on Apply for Self Assessment and Payment of Property Tax. It stands for Periodic Demand Bills. Here are a few terms that you need to familiarize yourself with when it comes to Kolkata Municipal Corporation Property Tax.

Have your Social Security number filing status and the exact whole dollar amount of your refund ready. The process mirrors paper checks but is done electronically. Property type is residential commercial or industrial.

Use the Wheres My Refund tool or the IRS2Go mobile app to check your refund online. View Your Economic Impact Payment Amounts. Click Make Online Payment which will offer three options Current PD Fresh-Supplementary Outstanding LOI.

JavaScript must be enabled in order for you to use the Site in standard view. Pay your property taxes conveniently and securely using our website. Appealing decisions on your assessed value and subsequent tax bill.

Your telephone number. In property wise option you need to give district sub registrar office Index 2 Property type Search type and TP no or survey number. Your property tax account number.

So just PaytmKaro and leave all the hassles for property tax online payment to us. You can also check the status of your one-time coronavirus stimulus check. Property tax assessment is now made easier in Kolkata Municipal area.

1 day agoThe Kolkata Municipal Corporation online property tax calculator link has been shared on this page. Every year valuation of the properties is done and the property tax amount is decided for the year. Periodic Demand bills which are issued annually based on the last decided valuation of the property FS Bill.

To pay by e-Check you must have the following information. In search type you need to select option such as survey number TP number block number etc. Upon successfully logging in please select under the Head Line Department NKDA Payment of Property tax at NKDA.

This is the fastest and easiest way to track your refund. FREE eCheck electronic check is a digital version of the paper check. You can call the IRS to check on the status of your.

Taxpayers are requested to make early payment against the bill for the current year 2017-18 as sent to respective address and know the property tax under the.

Kmc Property Tax Online Payment Procedure Calculation Payment Centers And Latest News

Kmc Property Tax Online Payment Procedure Calculation Payment Centers And Latest News

How To Pay Property Tax Online In Kolkata

How To Pay Property Tax Online In Kolkata

An Unbiased View Of Looking For An Internet Based Mlm Business Solution That In 2020 Mlm Business Business Solutions Mlm

An Unbiased View Of Looking For An Internet Based Mlm Business Solution That In 2020 Mlm Business Business Solutions Mlm

S K Singh Associates Is Dynamic Concern Providing Legal Services To Their Clients I E Intellectual Propert Legal Services Corporate Law Secretarial Services

S K Singh Associates Is Dynamic Concern Providing Legal Services To Their Clients I E Intellectual Propert Legal Services Corporate Law Secretarial Services

Kmc Property Tax Paying Property Tax Online In Kolkata

Kmc Property Tax Paying Property Tax Online In Kolkata

Earn Good Returns While Saving Tax By Investing In L T Tax Advantage Fund Mutuals Funds Investing Fund

Earn Good Returns While Saving Tax By Investing In L T Tax Advantage Fund Mutuals Funds Investing Fund

Kolkata Smart Cities Graphic Download Google Search Smart City City Mission

Kolkata Smart Cities Graphic Download Google Search Smart City City Mission

How To Pay Property Tax In Kolkata Online Step By Step Guide For Kmc

How To Pay Property Tax In Kolkata Online Step By Step Guide For Kmc

How To Pay Property Tax In Kolkata Online Step By Step Guide For Kmc

How To Pay Property Tax In Kolkata Online Step By Step Guide For Kmc

Online Kolkata Municipal Corporation Property Tax Kolkata Property Tax Kolkata Real Estate Kolkata Commonfloor Articles

Kmc Property Tax Online Payment Procedure Calculation Payment Centers And Latest News

Kmc Property Tax Online Payment Procedure Calculation Payment Centers And Latest News

Pin By Realtyquest On Kolkata Properties In 2020 Property House Styles Mansions

Pin By Realtyquest On Kolkata Properties In 2020 Property House Styles Mansions

How To Pay Property Tax Online In Kolkata

Online Kolkata Municipal Corporation Property Tax Kolkata Property Tax Kolkata Real Estate Kolkata Commonfloor Articles

Science City Auditorium City Auditorium West Bengal

Science City Auditorium City Auditorium West Bengal

Income Tax Return Form 8 Pakistan Why Is Income Tax Return Form 8 Pakistan So Famous Income Tax Income Tax Return Tax Forms

Income Tax Return Form 8 Pakistan Why Is Income Tax Return Form 8 Pakistan So Famous Income Tax Income Tax Return Tax Forms

How To Pay Property Tax Online In Kolkata

Tax Exemption Steps For Getting An 80g Certificate Tax Accounting Books Tax Exemption Tax

Tax Exemption Steps For Getting An 80g Certificate Tax Accounting Books Tax Exemption Tax

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home