Washington State Agricultural Property Tax Exemption

Agriculture tax guide Latest news for farmers and the farming industry This guide helps farmers and those who sell goods or services to farmers understand how state taxes apply to Washingtons agricultural industry. Property valued at less than five hundred dollars Exceptions.

How To Use A Small Farm For Tax Write Offs Tax Write Offs Small Farm Tax

How To Use A Small Farm For Tax Write Offs Tax Write Offs Small Farm Tax

Crop production data and calculation of 2021 agricultural assessment.

Washington state agricultural property tax exemption. BO taxes apply to their retail sales and to any manufacturing of agricultural products. Obtain information about properties owned by cemeteries and non-profit organizations that may apply for property tax exemption. Discover why properties owned by taxing districts are exempt from property taxes.

Find out if you qualify for a property tax deferral. It is measured on the value of products gross proceeds of sale or gross income of the business. The Washington State Legislature recognizes that it is in the best interest of the state and its citizens to maintain preserve and conserve adequate open space lands for the production of food fiber and forest crops.

On your behalf the Department of Revenue pays the deferred property taxes. Special benefit assessments for farm and agricultural land or timberland Assessments due on land withdrawn or changed as amended by 2014 c 137. You dont necessarily have to do the work yourself to claim the.

To support the development and preservation of farm and agricultural lands the legislature created a property tax deferral program designed to help taxpayers who wish to produce agricultural products for commercial purposes. Senior Citizens Or People with Disabilities. There are six primary programs.

This means there are no deductions from the. The Washington Association of County Officials is proposing a change in agricultural property tax exemption that violates the intent of state law and threatens the viability of. For example you could allow a nearby farmer to harvest hay on acres youre not using or rent your land to a farmer.

Current Use - Farm Agricultural Land Open Space Designated Forest Land. Cemeteries churches parsonages convents and. Agricultural producers are exempt from business and occupation BO taxes on the growing producing and harvesting of agricultural products and on the wholesale sale of agricultural products.

But unlike the exemption program this program is not a reduction of your taxes. Washington State Law Provides limited property tax relief to specific classes of individuals andor types of property. Depending on your states rules one way to execute this tax strategy is to offer use of your land to a local farmer.

2021 Agricultural Assessment Values per Acre. Tribal property exemption Application. Property Tax Fact Sheets Contact your county assessors office.

Business and Occupation BO Tax The state Business and Occupation BO tax is based on your gross business income. Property Tax Classification as Farm and Agricultural Land An owner may apply for his or her farm to be valued based. When the property changes ownership the amount of the postponed taxes plus interest each year becomes a lien in favor of the State until the total amount is repaid.

Agricultural assessment information Agricultural assessments. FDA incorporated flexibility into the Produce Safety Rule through extended compliance dates and exemptions to help minimize the economic and resource burden on small and very small farms. Exemptions are based on farm sales products and markets where farms are selling their produce.

RP-483-a Fill-in Instructions on form. Tangible real property but no more than 2000 acres of any single property owner which is devoted to bona fide agricultural purposes shall be assessed for ad valorem taxation purposes at 75 percent of the value which other tangible real property is assessed. State Board of Real Property Tax Services.

Application for Tax Exemption of Agricultural and Horticultural Buildings and Structures. The farm property must consist of at least 50 percent or more of the total estates adjusted gross value total gross estate less any mortgages or indebtedness on such farm property. This program may reduce property taxes for qualifying owners of rural vacant land that is part of an agricultural homestead that is or was enrolled in Green Acres.

Deferral of Taxes for Homeowners with Limited Income. Senior Citizen or Disabled Persons Exemption Deferral Program. Application for Tax Exemption of Farm Silos Farm Feed Grain Storage Bins Commodity Sheds Bulk Milk Tanks and Coolers and Manure Storage and Handling Facilities.

Washingtons BO tax is calculated on the gross income from activities. Property may be exempt in part if a portion of the property does not meet the requirements for the exemption. Application for Property Tax Exemption Chapter 8436 Revised Code of Washington Exclusive Use Required To qualify property must be exclusively used to conduct the exempt activity.

However agricultural-related activities like. How agricultural assessment values are determined. RP-483-b Fill-in RP-483-b-Ins Instructions.

Agricultural machinery and equipment is exempt from the state property tax. Special benefit assessments for farm and agricultural land or timberland Application of exemption to rights and interests preventing nonagricultural or nonforest uses. Property subject to taxation.

If you qualify an agricultural tax exemption could knock thousands off your property tax bill. The Washington open space designation provides a reduction in annual property taxes for land used for commercial agricultural purposes. Public certain public-private and tribal property exempt.

In order for real property to qualify for the farm deduction additional requirements must be met.

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

High Angle View Of Green Fields Steptoe Butte Palouse Washington State Usa C Superstock Alamy Palouse Steptoe Green Fields

High Angle View Of Green Fields Steptoe Butte Palouse Washington State Usa C Superstock Alamy Palouse Steptoe Green Fields

Realtymonks One Stop Real Estate Blog Debt Relief Programs Tax Rules Investing

Realtymonks One Stop Real Estate Blog Debt Relief Programs Tax Rules Investing

Valuing The Family Farm For Property Tax Purposes Straight Talk Law Blog

Valuing The Family Farm For Property Tax Purposes Straight Talk Law Blog

Taxation Of Social Security Benefits Mn House Research

Taxation Of Social Security Benefits Mn House Research

800 Square Mile Texas Ranch For Sale All Yours For 725 Million Texas Ranch Ranches For Sale Ranch

800 Square Mile Texas Ranch For Sale All Yours For 725 Million Texas Ranch Ranches For Sale Ranch

Pin By Jim Pettyjohn On Farm Life Up Early Farmer Agriculture History Of India

Pin By Jim Pettyjohn On Farm Life Up Early Farmer Agriculture History Of India

Wa State Cannabis Tax Revenue What You Need To Know Gleam Law

Wa State Cannabis Tax Revenue What You Need To Know Gleam Law

Change Proposed In Ag Land Property Taxes Dairy Capitalpress Com

Change Proposed In Ag Land Property Taxes Dairy Capitalpress Com

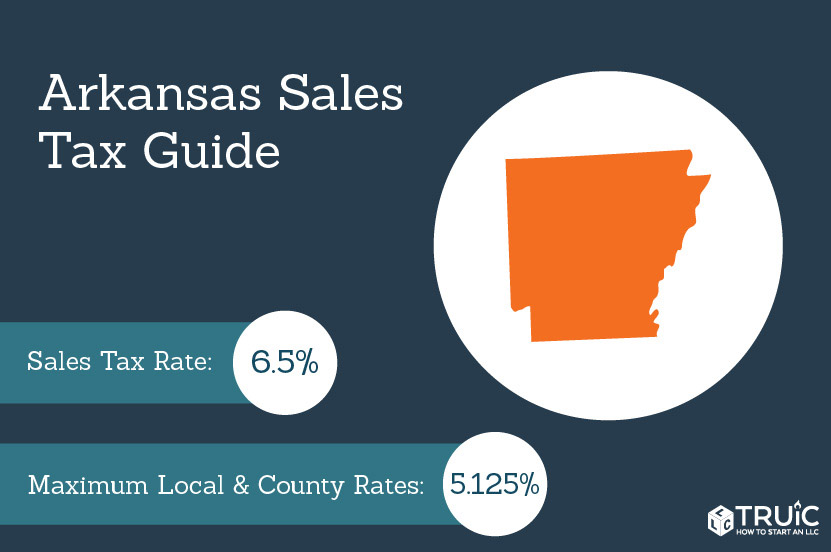

Arkansas Sales Tax Small Business Guide How To Start An Llc

Arkansas Sales Tax Small Business Guide How To Start An Llc

Horse Property For Sale In Coryell County Texas This 3 Acre Ranch Is Ideal For Horse Owners Or Anyone Interested I In 2021 Horse Property Horse Boarding Horse Ranch

Horse Property For Sale In Coryell County Texas This 3 Acre Ranch Is Ideal For Horse Owners Or Anyone Interested I In 2021 Horse Property Horse Boarding Horse Ranch

Equestrian Estate For Sale In Broward County Florida Equestrian Lifestyle In Southwest Ranches At Its Finest Bea Maine House Estate Homes Equestrian Estate

Equestrian Estate For Sale In Broward County Florida Equestrian Lifestyle In Southwest Ranches At Its Finest Bea Maine House Estate Homes Equestrian Estate

The Property Tax Annual Cycle In Washington State Myticor

The Property Tax Annual Cycle In Washington State Myticor

Laws Rules Washington Department Of Revenue

Laws Rules Washington Department Of Revenue

A History Of Washington State S Tax Code All In For Washington

A History Of Washington State S Tax Code All In For Washington

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

Taxes And Incentives Economic Alliance Snohomish County

Taxes And Incentives Economic Alliance Snohomish County

Labels: property, state, washington

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home