Selling Property Held In Living Trust

Title held in the trust does not in any way diminish Fannie Maes rights as a creditor including the right to have full title to the property vested in Fannie Mae should foreclosure proceedings have to be initiated to cure a default under the terms of the mortgage. A Trustee has the authority to sell property held in a revocable trust No Court issued Letters of Trusteeship No Court approval of Letters of Trusteeship Attorney should obtain copy of trust agreement to verify if the trustee has the power to sell property out of the trust Attorney should obtain a copy of all amendments to.

The first and most common approach is to sell the property directly from the trust.

Selling property held in living trust. I am a Massachusetts attorney and answer questions based on Massachusetts law. The money from the sale will go into the trust and then will either be disbursed to you and your brother or not depending on what the trust says or what you and your brother decide. It is imperative to consult an elder law attorney when transferring or selling property that is held in an irrevocable trust or otherwise part of an asset protection plan.

For many people a revocable trust also known as a living trust or an inter vivos trust is their best option. A living trust also called an inter vivos or revocable trust originates by creating a trust agreement. If propety is in the Trust only the Trustee can sell it and the money from the sale will stay in the trust you wont be able to remove the sale proceeds from the Trust.

A second approach used mostly when an institution requests it is to transfer the property out of the trust and back to you. Mary is not doing well in 2013. During their lifetime the grantor or maker of the trust may use both real and personal property belonging to the trust while designating themselves as trustee.

Theyll take care of everything for you so you dont have to worry about doing it yourself. You can still sell property after you transfer it into a living trust. Another option is for the trustee to transfer title of the property to your own name so that you can sell the property yourself.

The beneficiary will be. This means that the trust will convey ownership of the property to the subsequent buyer. After the grantors passing the successor trustee assumes the trustees duties and must transfer documents to themselves so they.

When youre going to sell a property held in a trust youll want to have someone who can guide you through the whole process. Allocated to the Bypass Trust aka the Credit Shelter Trust or the Decedents Trust. The title insurance policy ensures full title protection to Fannie Mae.

Depending on the type of trust and other assets held in the trust you might ask your tax adviser if there is a provision in the tax code that could aid you in the sale if you have other gains. If a trust is irrevocable you cant remove property from it. The Bypass Trust is now worth 3500000 - and Marys estate is 1000000 because it had the house.

In general to get the benefits of the exclusion you need to have owned your home for at least two out of the five years prior to the date of sale and you have to have lived in the property as. One method is for the trustee to conduct the sale of the property and the proceeds will become assets of the trust. Selling real property from a trust or estate is very different from selling your own home.

When you sell the property youll be selling it through the trust. In this case the trustee of the trust most likely you as trustee is the seller. And all of Marys property ends up in the Survivors Trust.

If you have a title company on your side youll get the best price for your home. As a trustee or executor you are constrained by your authority and ultimately beholden to the beneficiaries of the trust or estate and should not act without taking their interest into consideration. This can be difficult because a trust is taxed differently than in individual is and it usually results in the trust paying more in taxes than the individual would if the individual sold it after inheritance.

Transfer to An Irrevocable Trust Marie and her daughter Connie consult an elder law attorney for asset protection purposes in. While they are alive they can control the assets in the trust including removing. Sell You must remove the property and then sell it in your name Taxes The trust wont impact a home residence home sale exclusion or mortgage interest deduction but it may trigger a reassessment of property taxes depending on where you live Insurance The transfer may impact your title and homeowners insurance.

Selling The Home With Trustee. A sale of an inherited house can be accomplished in two ways. Actually it does not make one bit of difference whether the trust sells the property and distributes net gain or distributes the property in-kind and the beneficiary sells the property.

Equestrian Estate For Sale In Taos County New Mexico The Stewardship Of This Working Farm Has Been Impeccable 17 9 Saltwater Pool New Mexico Horse Property

Equestrian Estate For Sale In Taos County New Mexico The Stewardship Of This Working Farm Has Been Impeccable 17 9 Saltwater Pool New Mexico Horse Property

Here S Why You Would Put Your House In A Trust Clever Real Estate

Here S Why You Would Put Your House In A Trust Clever Real Estate

Revocable Living Trust Form Living Trust Revocable Living Trust Revocable Trust

Revocable Living Trust Form Living Trust Revocable Living Trust Revocable Trust

4 Documents You Must Have To Protect Your Assets Living Trust You Must Asset

4 Documents You Must Have To Protect Your Assets Living Trust You Must Asset

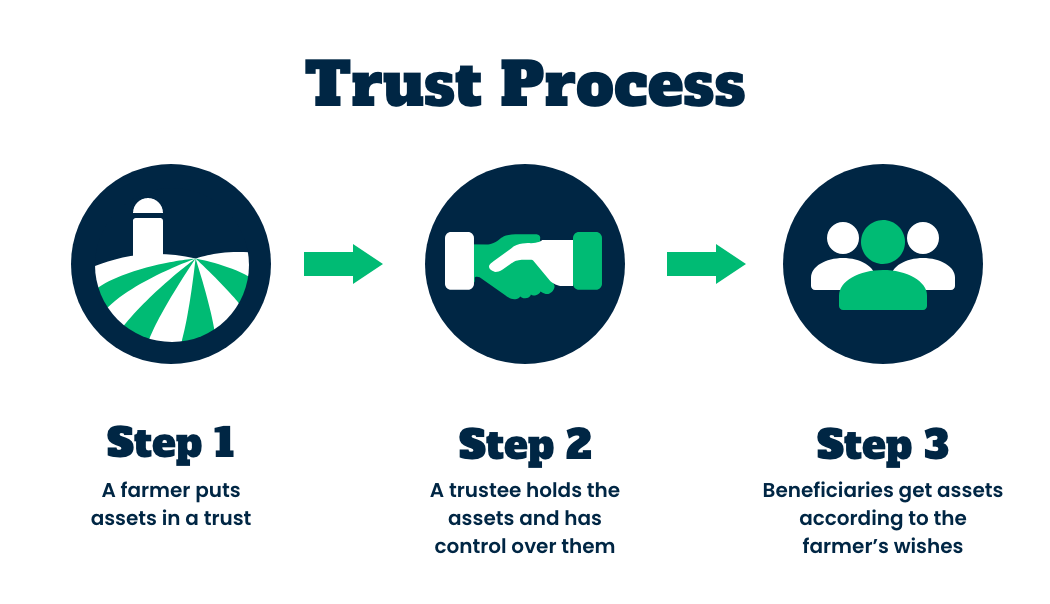

Trusts Farmland Access Legal Toolkit

Trusts Farmland Access Legal Toolkit

What Is A Step Up In Basis Cost Basis Of Inherited Assets

What Is A Step Up In Basis Cost Basis Of Inherited Assets

Tipoftheweek Is A Glossary Of Real Estate Terms Home Buyers Should Know A Lot Of Buyers Have Questions About Wh Real Estate Terms Home Buying How To Find Out

Tipoftheweek Is A Glossary Of Real Estate Terms Home Buyers Should Know A Lot Of Buyers Have Questions About Wh Real Estate Terms Home Buying How To Find Out

Free Trust Agreement Form Printable Real Estate Forms Franchise Agreement Real Estate Forms Agreement

Free Trust Agreement Form Printable Real Estate Forms Franchise Agreement Real Estate Forms Agreement

Account Suspended Real Estate Infographic Buying First Home Selling Real Estate

Account Suspended Real Estate Infographic Buying First Home Selling Real Estate

How To Sell A Property Held In A Revocable Trust

Printable Revocable Trust Template Revocable Trust Simplest Form Legal Forms

Printable Revocable Trust Template Revocable Trust Simplest Form Legal Forms

How To Sell A Property Held In A Revocable Trust

Sell Your Home Senior Living My Silver Age Aging In Place Older Adults Real Estate Tips

Sell Your Home Senior Living My Silver Age Aging In Place Older Adults Real Estate Tips

Installment Sale To An Idgt To Reduce Estate Taxes

Installment Sale To An Idgt To Reduce Estate Taxes

Real Estate Purchase Agreement Property Sale Free Printable Legal Form Pdf Format Purchase Agreement Real Estate Contract Real Estate Forms

Real Estate Purchase Agreement Property Sale Free Printable Legal Form Pdf Format Purchase Agreement Real Estate Contract Real Estate Forms

Michael Jennifer Themccartyteam Twitter First Time Home Buyers Real Estate Client Real Estate Tips

Michael Jennifer Themccartyteam Twitter First Time Home Buyers Real Estate Client Real Estate Tips

Do I Need A Living Trust Estate Planning Guide

Do I Need A Living Trust Estate Planning Guide

First Time Home Buyer Vocab Cheat Sheet With The Top 10 Terms Used During The Home Buying Process Receive A Fre Home Buying First Home Buyer Buying First Home

First Time Home Buyer Vocab Cheat Sheet With The Top 10 Terms Used During The Home Buying Process Receive A Fre Home Buying First Home Buyer Buying First Home

:max_bytes(150000):strip_icc()/dotdash_Final_Trust_Aug_2020-01-6b0686cb892a40589605baeeef79a183.jpg)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home