What Is Personal Property Tax Used For

Its possible that youll use more than one dwelling unit as a residence during the year. Personal use property is used for personal enjoyment as opposed to business or investment purposes.

A Property Inventory Template Is The Record Of A Rental Property And All Its Contents The Schedule Of Condition Is Personal Property Excel Templates Templates

A Property Inventory Template Is The Record Of A Rental Property And All Its Contents The Schedule Of Condition Is Personal Property Excel Templates Templates

The tax rate for real and personal property is the same.

What is personal property tax used for. However the IRS requires you to satisfy certain requirements regardless of how your government classifies the tax. Personal-use property When you sell personal-use property such as cars and boats in most cases you do not end up with a capital gain. However if these items are used in a business property tax applies.

Most personal property owned by individuals is exempt. These may include personally-owned cars. Although there are exceptions personal property usually can be removed without causing damage to either the real estate from.

If you end up paying personal property taxes to your local government the IRS allows you to claim a deduction for it on your federal tax return. Personal property taxes also known as property taxes are a form of taxation on what is termed personal property. 14 days or 10 of the total days you rent it to others at a fair rental price.

Personal property used in a business such as equipment furniture and supplies is also subject to personal property tax. If you use personal property in a business or have taxable personal property you must complete a personal property tax listing form by April 30 each year. Intangible personal property Household goods Most automobiles trucks and other licensed vehicles Inventory that is for sale as part of your business 25000 TPP Exemption If you file your TPP return by April 1 you will be eligible for a property tax exemption of up to 25000 of assessed value.

What is considered personal property for local property tax purposes. Examples of tangible personal property are computers furniture tools machinery signs equipment leasehold improvements supplies and leased equipment. A personal property tax is imposed by state or local tax authorities based on the value of an item of qualifying property.

May 18 2015 by. If the property is held in a QEAA the IRS will accept the qualification of property as either replacement property or relinquished property and the treatment of an EAT as the beneficial owner of the property for federal income tax purposes. Tangible property includes movable man-made objects that have a physical form and can be seen and touched.

As a result you may end up with a loss. For example household goods and personal effects are not subject to property tax. To claim the deduction the tax must only apply to personal property you own be based on its value and be charged on an annual basis.

Most commonly property tax is a real estate ad-valorem tax which can be considered a. Taxable personal property includes property used for commercial industrial and agricultural purposes. Tangible personal property is everything other than real estate that is used in a business or rental property.

Individuals can deduct personal property taxes paid during the year as an itemized deduction on Schedule A of their federal tax returns at least up to a point. Property taxes pay for road construction and maintenance local governments staff salaries and municipal public service employees such as police firefighters and the local public works. Property tax is a tax paid on property owned by an individual or other legal entity such as a corporation.

Personal property tax does not apply to business inventories or intangible. The tax is imposed on movable property such as automobiles or boats and its assessed annually. Some may not know that property tax also applies to personal property.

The tax is levied by the jurisdiction where the property is located and it includes tangible property that is not real property. Personal property is defined as any movable property that is not attached to a. A personal property tax is a levy imposed on a persons property.

Its also called an ad valorem tax. Youre considered to use a dwelling unit as a residence if you use it for personal purposes during the tax year for more than the greater of. This is because this type of property usually does not increase in value over the years.

196183 FS What If I Dont File. Personal property generally includes tangible items that are not firmly attached to land or buildings and are not specially designed for or of such a size and bulk to be considered part of the real estate. Personal property is considered to be movable and not permanently attached to real estate.

10 Ways To Lower Your Property Taxes Property Tax Tax Property

10 Ways To Lower Your Property Taxes Property Tax Tax Property

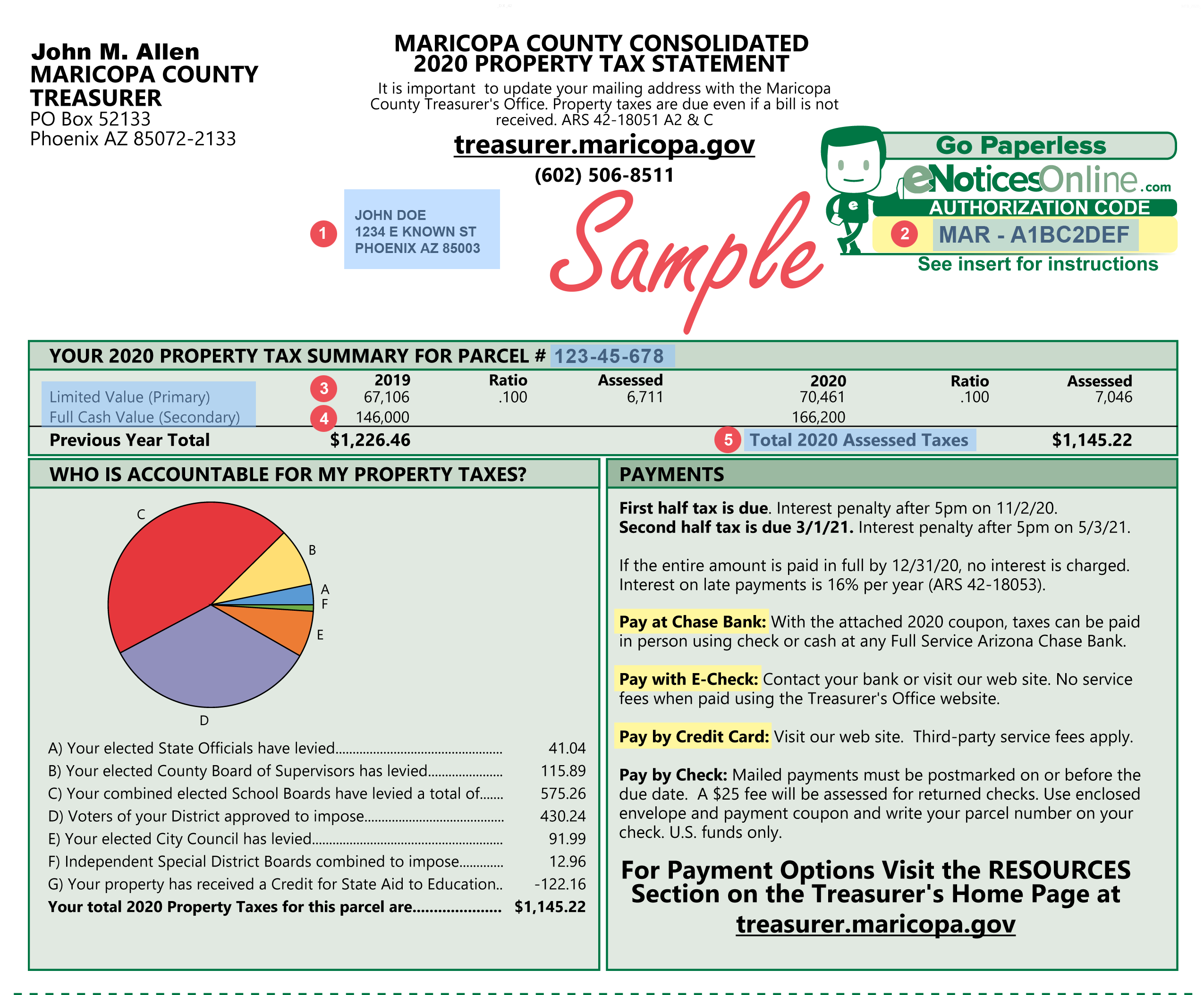

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Here Is A Worksheet On Taxes We Live In California So I Used The Taxes That Apply To Us I Also Used A Minimum Amount Of Income Tax Income Tax

Here Is A Worksheet On Taxes We Live In California So I Used The Taxes That Apply To Us I Also Used A Minimum Amount Of Income Tax Income Tax

Personal Financial Literacy Identifying Taxes Teks 5 10a Personal Financial Literacy Financial Literacy Economics Lessons

Personal Financial Literacy Identifying Taxes Teks 5 10a Personal Financial Literacy Financial Literacy Economics Lessons

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Real Estate Real Estate Advice

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Real Estate Real Estate Advice

Terms Used In Budget What Is Direct Tax Intraday Trading Stock Options Trading Budgeting

Terms Used In Budget What Is Direct Tax Intraday Trading Stock Options Trading Budgeting

1231 1245 And 1250 Property Used In A Trade Or Business Investing Infographic Investment Quotes Investing

1231 1245 And 1250 Property Used In A Trade Or Business Investing Infographic Investment Quotes Investing

2018 Tax Laws That Affect Real Estate We Will Guide You Through The Sales Process Consult Your Cpa For Det Investment Property Estate Tax Real Estate

2018 Tax Laws That Affect Real Estate We Will Guide You Through The Sales Process Consult Your Cpa For Det Investment Property Estate Tax Real Estate

Teks 5 10a Taxes Personal Financial Literacy With Projects Personal Financial Literacy Financial Literacy Literacy

Teks 5 10a Taxes Personal Financial Literacy With Projects Personal Financial Literacy Financial Literacy Literacy

Taxes From A To Z 2015 M Is For Municipal Bonds Property Tax Business Tax Personal Property

Taxes From A To Z 2015 M Is For Municipal Bonds Property Tax Business Tax Personal Property

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Deducting Property Taxes H R Block

Deducting Property Taxes H R Block

Personal Property Taxes Definition Bankrate Com

Personal Property Taxes Definition Bankrate Com

Ucc Financing Statement For A Coop In Nyc Hauseit Finance Nyc Statement

Ucc Financing Statement For A Coop In Nyc Hauseit Finance Nyc Statement

Understanding Depreciation For Real Estate Investing Morris Invest Real Estate Investing Investing Real Estate Advice

Understanding Depreciation For Real Estate Investing Morris Invest Real Estate Investing Investing Real Estate Advice

Encourage Your Clients In Cook County To Appeal Their Property Tax Assessment Before The Deadline Township Deadlines Below Northfield Township Is Open Fo

Encourage Your Clients In Cook County To Appeal Their Property Tax Assessment Before The Deadline Township Deadlines Below Northfield Township Is Open Fo

1968 Winchester Massachusetts Real Estate Personal Property Tax List Directory Personal Property Property Real Estate Property Tax

1968 Winchester Massachusetts Real Estate Personal Property Tax List Directory Personal Property Property Real Estate Property Tax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home