Personal Property Tax Franklin County Ohio

Get driving directions to this office. Interest is 10 annually and begins accruing the first day of the month following the due date.

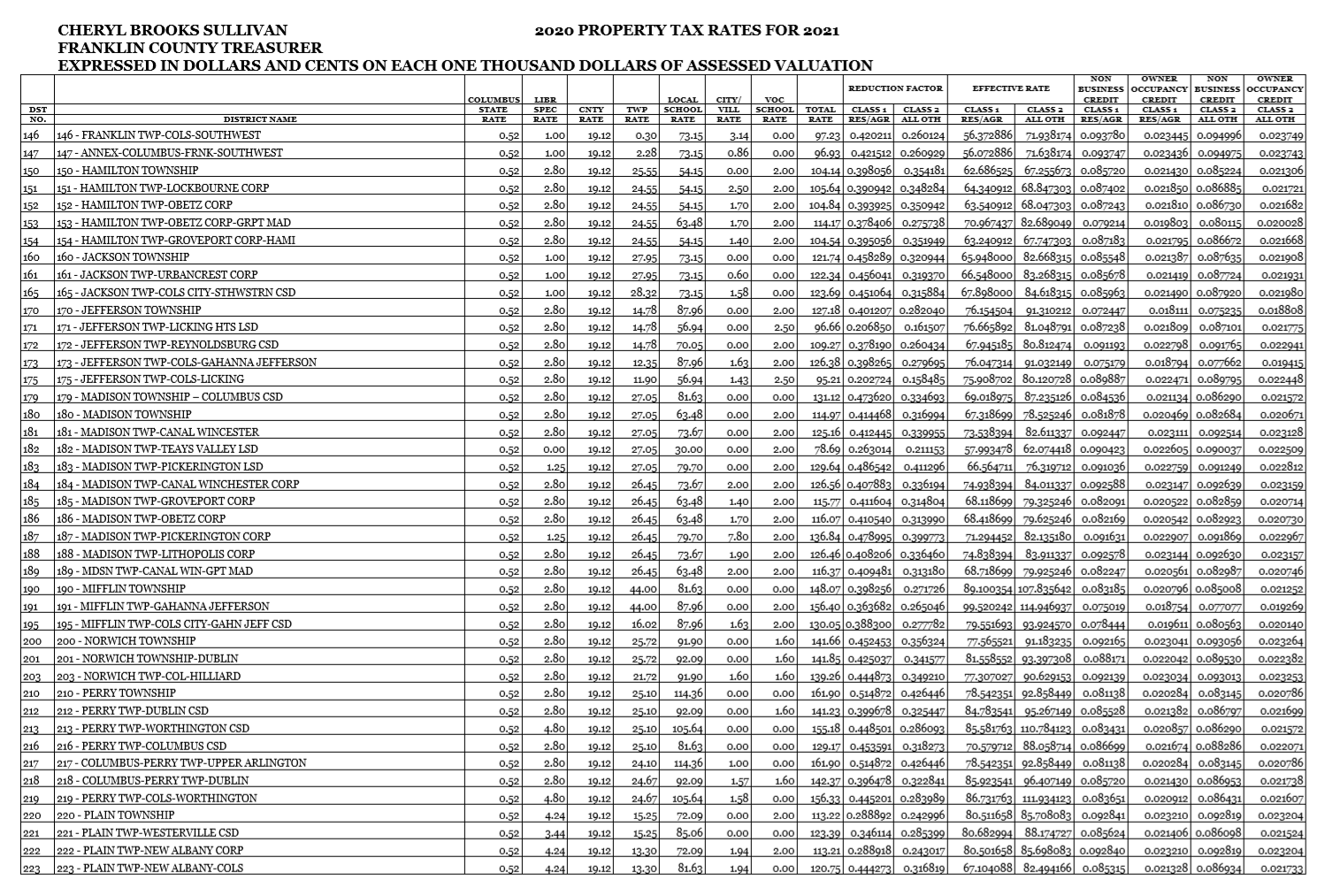

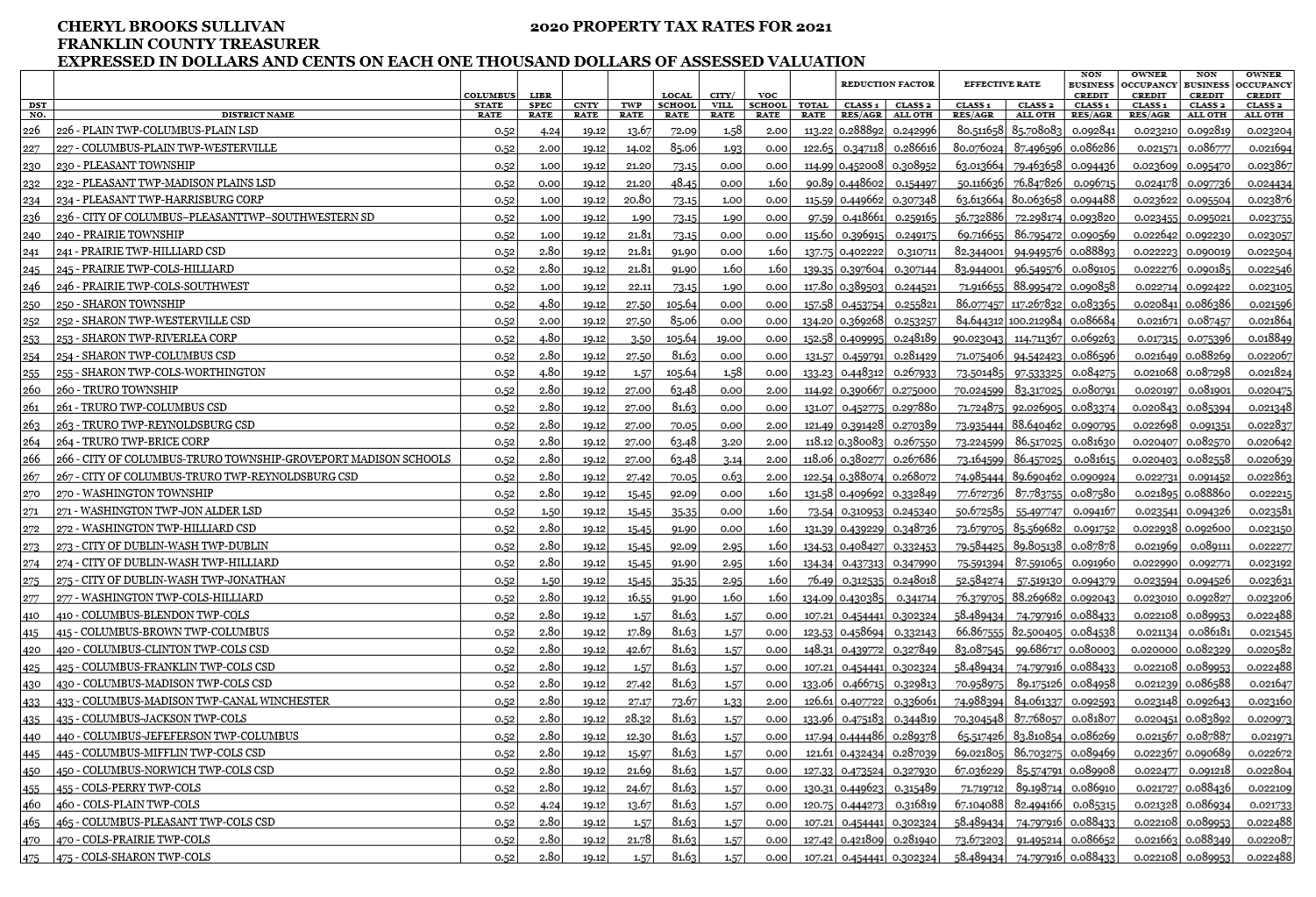

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

The following is a list of the services and duties of the Delinquent Tax Division at the Franklin County Treasurers Office.

Personal property tax franklin county ohio. Search for a Property Search by. The Franklin County Treasurers Office wants to make paying your taxes as easy as possible. Cheryl brooks sullivan.

Please note that the tangible personal property tax has been phased out for general business filers. If you have any questions or need assistance with your city taxes please call the Franklin Income Tax Division at 937-746-9921. However it may take 2-4 business days for processing.

Business personal property owners must research tax laws in order to take advantage of any exemptions for which their property may be eligible. Annual Interest Rate By October 31 of each year the interest rate that will apply to overdue municipal income taxes during the next calendar year will be posted herein as required by Ohio Revised Code Section 71827F. Appealing your property valuation.

The Franklin County Treasurers Office wants to make sure you are receiving all reductions savings and assistance for which you may be entitled. Yearly median tax in Franklin County. PAY TAXES ONLINE To pay your taxes by credit card or eCheck click the button below.

Gible personal property tax starting with tax year 2006 by gradually reducing the listing percentage or taxable portion of the true value of all tangible personal prop erty. Frequently Asked Questions - Personal Property. 373 South High Street 21st Floor.

The real estate tax collection begins with the assessment of the real estate parcels in Franklin County. John Smith Street Address Ex. PAY TAXES ONLINE.

2017 Franklin County Information Services All. Franklin County has one of the highest median property taxes in the United States and is ranked 252nd of the 3143 counties in order of median. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

Your payment will be considered accepted and paid on the submitted date. Please note you cannot use home equity line of credit checks or money market account to make an online payment. The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues.

If taxable property is discovered purchased or moved into the County and was not on record in time for the regular billing cycle then supplemental bills will be issued. The Franklin County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Franklin County. Personal Property taxes are billed annually with a due date December 5th.

Ohio law requires counties to revalue all real property every six years with an update at the three year midpoint as ordered by the Tax Commissioner of the State of Ohio. The listing percentages are 1875 percent. Franklin County collects on average 167 of a propertys assessed fair market value as property tax.

This is a result of the listing percentage being reduced to zero. The only changes to a propertys value outside of the three year cycle would be due to. The Business Personal Property Department of the Franklin County Tax Assessors Office is responsible for listing and assessing business and professional property for ad valorem taxation.

Personal Property Tax Division 30 E. In addition to collecting taxes for real and personal property the Collector also collects levee railroad and utility taxes along with issuing merchants and manufacturers. The County assumes no responsibility for errors.

Tax Lien Sale Find out about our annual tax lien sale and access. This booklet is published to apprise persons of the manner in which property taxes are levied in Ohio. The Franklin County Collector of Revenue is responsible for the collection and distribution of current and delinquent taxes for the county and 64 other taxing entities within Franklin County.

A 10 penalty is added on December 6th for late payment. Guidelines for Filing Ohio Personal Property Tax Returns. The following provides you with information on property tax payments.

Please reference our Franklin County OLP Portal User Guide. The median property tax in Franklin County Ohio is 2592 per year for a home worth the median value of 155300. Payment Plans Ask how to set up a payment plan to pay delinquent taxes.

If you have any issues or questions contact Customer. Franklin County Assessors Office Services. 614 462 4663 Phone 614 462 5083Fax The Franklin County Tax Assessors Office is located in Columbus Ohio.

123 Main Parcel ID Ex. Broad St 21st Floor z Columbus OH 43215. No annual or new taxpayer returns either form 920 or 945 are required to be filed after 2009.

Should Your Address Determine Access To Aging Services An Analysis Of Senior Tax Levies In Ohio The Center For Community Solutions

Should Your Address Determine Access To Aging Services An Analysis Of Senior Tax Levies In Ohio The Center For Community Solutions

Map Of Franklin Co Ohio Library Of Congress

1909 Tax Bill Floyd County In New Albany In For Mary Snider Floyd County West Baden Springs New Albany

1909 Tax Bill Floyd County In New Albany In For Mary Snider Floyd County West Baden Springs New Albany

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Horse Properties For Sale In Medina County Ohio This Extraordinary Horse Property Is Set Up For The Active Animal Love Horse Property Medina County Property

Horse Properties For Sale In Medina County Ohio This Extraordinary Horse Property Is Set Up For The Active Animal Love Horse Property Medina County Property

Franklin County Ohio Treasurer Payments

Franklin County Ohio Treasurer Payments

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Franklin County Auditor Personal Property Tax

Franklin County Auditor Personal Property Tax

Horse Property For Sale In Clermont County Ohio New Offering This Property Is Being Made Available For Purc Horse Property Horse Facility Equestrian Estate

Horse Property For Sale In Clermont County Ohio New Offering This Property Is Being Made Available For Purc Horse Property Horse Facility Equestrian Estate

Equestrian Estate For Sale In Preble County Ohio This Property Offers A Casual Yet Stylish 9 000 Square Foot Estate W Property Country Estate Horse Property

Equestrian Estate For Sale In Preble County Ohio This Property Offers A Casual Yet Stylish 9 000 Square Foot Estate W Property Country Estate Horse Property

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Kroger Buys Macy S Location At Ua S Kingsdale Kroger Macys Kroger Co

Kroger Buys Macy S Location At Ua S Kingsdale Kroger Macys Kroger Co

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home